Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin is showing strong signs of recovery, stabilizing above $86,000 and edging Arthur Hayes, former CEO of BitMEX, has been making waves in the crypto space with his bold predictions for Bitcoin’s future. He foresees BTC reaching $110,000 before pulling back to around $76,500, largely due to increasing market liquidity driven by the Federal Reserve’s anticipated policy shifts. Hayes remains highly bullish, even projecting a long-term target of $250,000 as inflation and monetary easing fuel demand.

Notably, this market momentum isn’t limited to Bitcoin—tokens across various asset classes are also surging, particularly cost-effective options. Investors are eyeing the best cheap cryptocurrencies to buy under 1 dollar as these low-cost assets gain traction alongside the broader crypto rally. With liquidity expanding, the stage is set for potential new highs in digital assets.

5 Best Cheap Cryptocurrencies to Buy Under 1 Dollar

Safe stands out as a premier Web3 ownership layer, safeguarding assets worth over $100 billion. At present, L3 is valued at $0.1254, marking a 26.89% surge in the past day. Meanwhile, BLAST is trading at $0.003757, reflecting a 15.36% gain over the last week. Solaxy plays a crucial role in optimizing Solana’s network by alleviating congestion while preserving its key advantages.

Additionally, the Gravity ecosystem has experienced significant expansion in recent months. On the regulatory front, Paul Atkins, former SEC commissioner and Trump’s pick for financial oversight, emphasized that crypto regulation remains a primary concern during a recent hearing.

1. Safe (SAFE)

Safe is a leading Web3 ownership layer, securing over $100 billion in assets. It includes Safe{Core}, a full-stack account abstraction infrastructure, and Safe{Wallet}, the industry-standard multi-signature solution. The project aims to transform every Ethereum account into a smart account, enabling innovations in AI, Staking, Gaming, SocialFi, DeFi, and Payments with gasless transactions, biometric logins, onramps, and recovery features.

Currently, Safe supports an extensive ecosystem of 200+ projects across 15+ networks, including major names like Gnosis Pay and Worldcoin. Its Safe{Wallet} is trusted by influential figures like Vitalik Buterin and Punk6529, as well as companies like Shopify and Reddit, for securing digital assets and high-value NFTs.

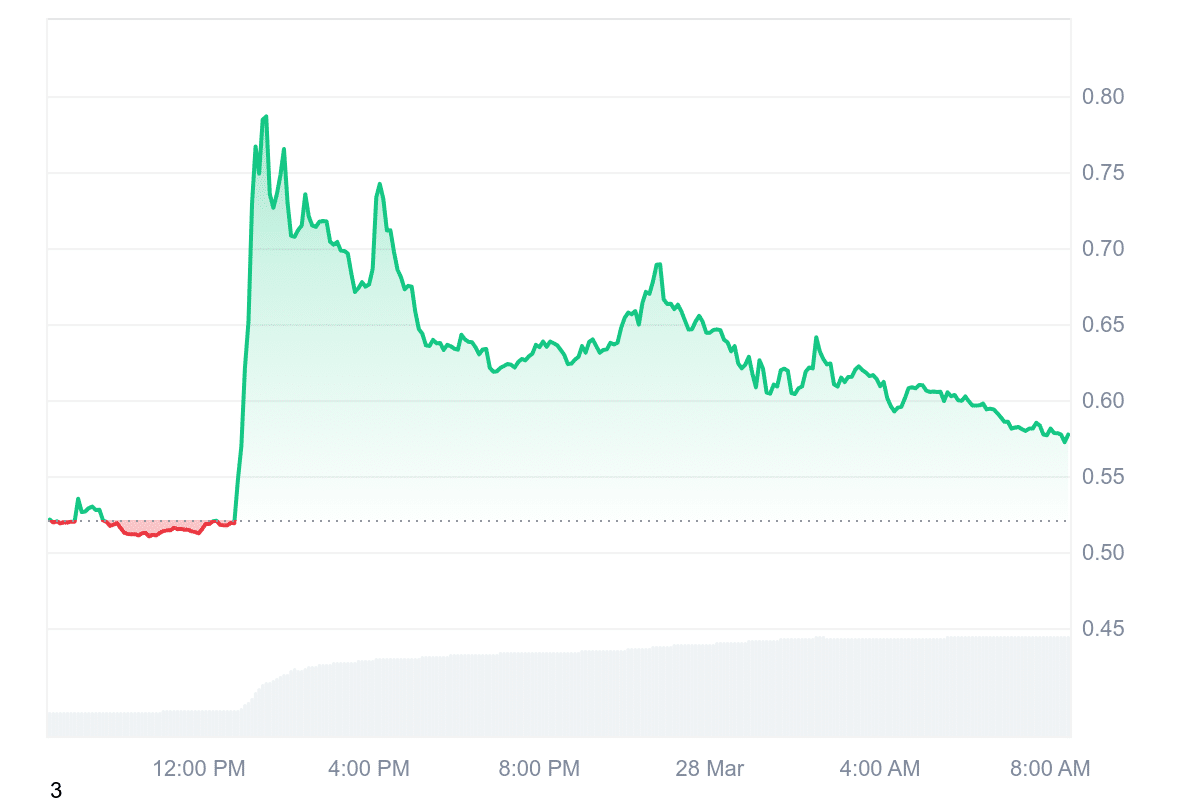

Safe (SAFE) is priced at $0.5772, reflecting a 10.75% daily increase. Its market cap is $304.42M, and 24-hour trading volume is $465.32M. The token is currently 4,637.80% above its 200-day simple moving average, indicating strong upward momentum.

Analysts predict SAFE’s price will continue to rise, potentially reaching $1.97 in March 2025, $2.74 in April 2025, and $2.15 in May 2025, offering potential ROIs of 239.37%, 371.35%, and 270.05%, respectively. With consistent growth, high liquidity, and increasing adoption, Safe presents a promising opportunity for long-term investors looking to capitalize on Web3’s expansion.

2. Layer3 (L3)

Layer3 (L3) is an omnichain distribution and identity network designed to redefine how value is distributed and identities are managed across multiple blockchains. By enabling ecosystems to reward users for participation directly, Layer3 fosters a permissionless and trustless environment where contributions fuel network growth. Its approach creates a virtuous flywheel, reinforcing a robust distribution system while incentivizing deeper engagement within Web3.

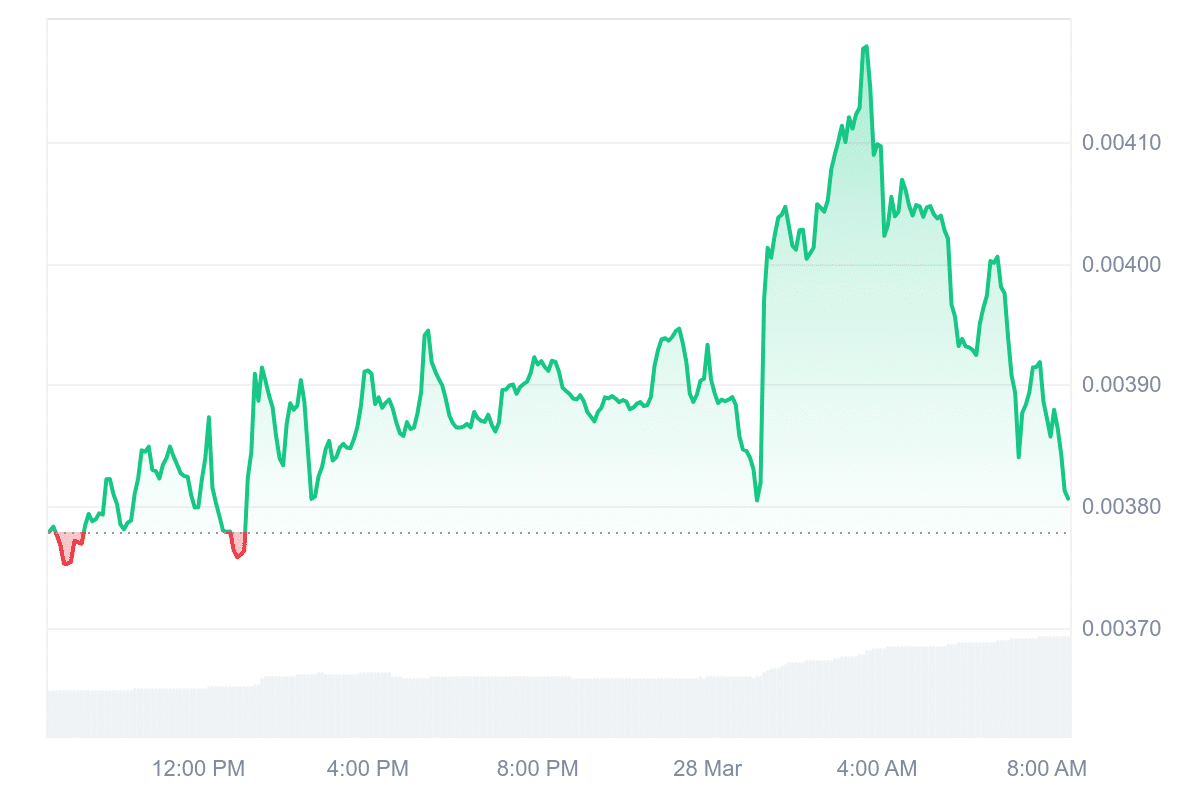

Currently, L3 is priced at $0.1254, reflecting a 26.89% daily increase. It has a market cap of $46.62M and a 24-hour trading volume of $31.02M. The token has demonstrated high liquidity and 60% green days in the last 30 days, showing positive market momentum. The Fear & Greed Index sits at 44 (Fear), indicating some caution among traders but also potential for substantial upside.

Layer3 has secured an allocation of BOB tokens for Launchpad participants.

The campaign will also be extended by two additional weeks, giving you more time to participate and earn.

Don’t miss out: https://t.co/OGhFT6oxTg pic.twitter.com/EslmPaBrIE

— Layer3 (@layer3xyz) March 27, 2025

Analysts predict L3’s price could rise significantly in the coming months. By March 2025, it is expected to reach a high of $0.4503, reflecting a 258.60% potential ROI. The trend is projected to continue into April 2025, with prices reaching $0.6245, marking a 397.33% increase from current levels. With its strong market performance, growing adoption, and bullish outlook, Layer3 presents an attractive investment opportunity for those looking to capitalize on blockchain’s evolving ecosystem.

3. Blast (BLAST)

Blast (BLAST) is an Ethereum Layer 2 (L2) solution that stands out by offering native yield for ETH and stablecoins. Unlike traditional L2 networks, which provide zero default interest rates, Blast automatically distributes yield generated from ETH staking and real-world asset (RWA) protocols back to its users.

This unique approach allows users to earn 4% on ETH and 5% on stablecoins. Thus, this makes the protocol an attractive choice for DeFi participants looking for passive income without additional steps.

ICYMI

The Blast App Store is now LIVE!

The App Store is currently whitelist only. Next up, we’ll enable permissionless app launches.

More buttons coming. pic.twitter.com/LnEfa3bVon

— Blast (@blast) March 19, 2025

Currently, BLAST is trading at $0.003757, reflecting a 15.36% increase over the past week. With a market cap of $101.26M and a 24-hour trading volume of $29.29M, Blast maintains high liquidity relative to its size. It is also trading 1,782.85% above its 200-day simple moving average (SMA) of $0.000201, indicating strong bullish momentum.

4. Solaxy ($SOLX)

Solana has faced significant congestion issues in recent months due to a surge in meme coin trading. Tokens like Trump and Millennia have overwhelmed the blockchain, leading to slower transaction speeds. This has frustrated users who rely on Solana’s typically fast and efficient infrastructure.

Wallets such as Phantom have struggled with the weight of these transactions. Some users have experienced delays of up to 30 minutes—an unusual setback for a blockchain known for near-instant finality. To address this issue, a new Layer 2 (L2) scaling solution called Solaxy has emerged.

Solaxy enhances Solana’s performance by reducing congestion while maintaining the network’s core benefits. It leverages Solana’s proof-of-stake (PoS) consensus and robust Layer 1 infrastructure to support high-transaction decentralized applications (dApps). Its roll-up technology processes transactions off-chain, bundling them into optimized batches for on-chain validation. This improves efficiency while lowering fees.

Solaxy is ideal for high-frequency dApps, including meme coin platforms, gaming ecosystems, and low-latency financial applications. Additionally, its Ethereum bridge will enable seamless asset transfers between Solana and Ethereum, boosting liquidity and interoperability.

🔥 Solaxy Dev Update 🔥

We're excited to share some significant updates focused on boosting TPS and data throughout:

🛸 Soft Confirmations 🛸

• Integrated a new sequencer implementation from the Sovereign SDK.

• Enjoy faster confirmations as transactions are quickly… pic.twitter.com/IrhpmhqUUQ

— SOLAXY (@SOLAXYTOKEN) March 26, 2025

Solaxy also offers staking rewards with an estimated APY of 145%. Staked tokens can be withdrawn seven days after the Token Generation Event (TGE), while staking rewards are available immediately. With over $28 million raised in its presale, Solaxy aims to be a key solution for Solana’s scalability.

5. Gravity (G)

Gravity (G) is the native utility token for both Gravity and the Galxe ecosystem. It plays a crucial role in powering transactions, securing the network through staking, and facilitating governance decisions. As the gas token, G is essential for transactions within these ecosystems. It helps incentivize growth, governance participation, and payments across multiple applications.

The Gravity ecosystem has seen remarkable growth in recent months. Since December 2024, G stakers have increased by 122%, rising from 33,226 to 73,810. This surge reflects growing confidence in the platform’s potential.

The team has also launched Grevm 2.0, the Gravity L1 Devnet, and .G domains through Space ID. These innovations expand its Web3 infrastructure and enhance user experience. Additionally, Gravity introduced a rewards hub, providing further incentives for user engagement.

Gravity cannot be stopped 🌀@MessariCrypto breaks down the recent $G staking surge, 51K+ .g domain owners @SpaceIDProtocol, Grevm 2.0, L1 Devnet, and more. Read the latest updates below: https://t.co/49HbYkJYT9

— Gravity (@GravityChain) March 27, 2025

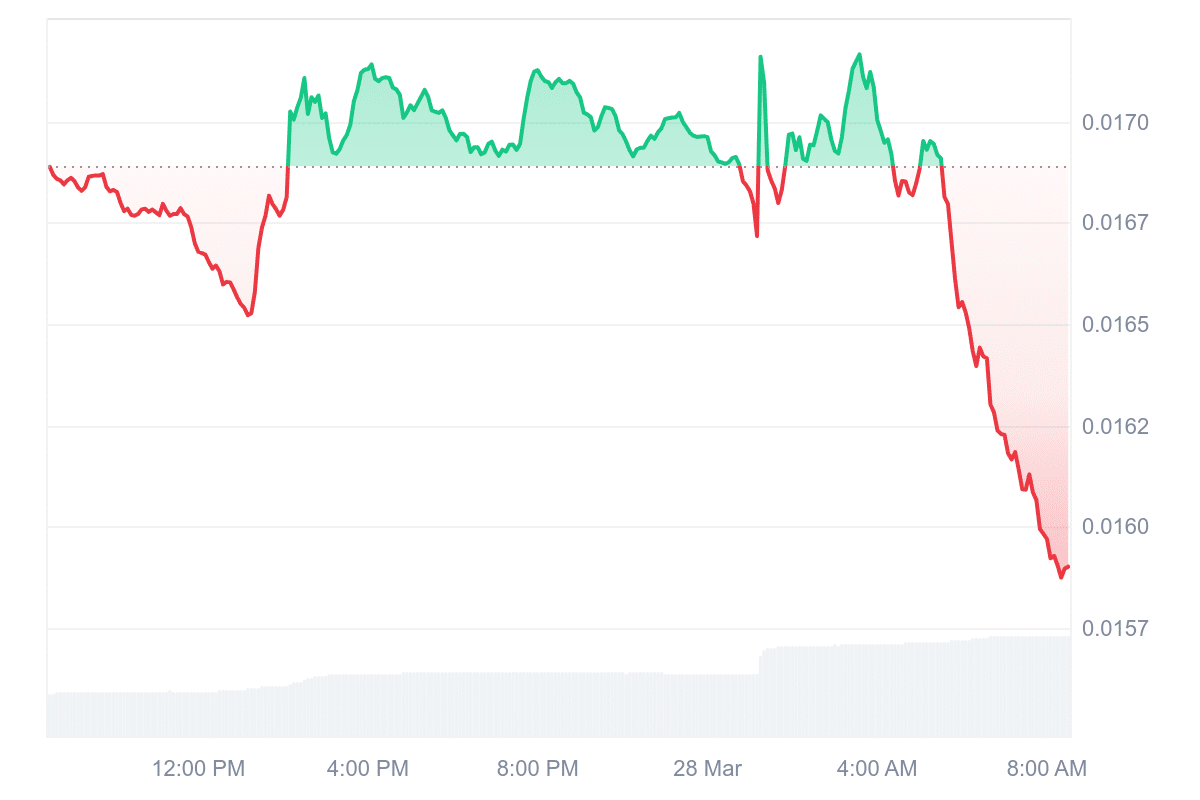

Currently, G trades at $0.01586, reflecting a 3.28% increase over the past seven days. Market analysts predict strong performance in April 2025. They forecast potential growth of 400.69%, with prices reaching as high as $0.079742. If these projections hold, Gravity could present a profitable opportunity for investors looking to benefit from its expanding ecosystem and increasing adoption.

Learn More

Join Our Telegram channel to stay up to date on breaking news coverage