Join Our Telegram channel to stay up to date on breaking news coverage

Analysts are advising investors to consider “buying the dip” in the altcoin market, as a technical pattern on the weekly chart indicates a potential bullish reversal. This pattern appears after a lengthy accumulation phase, suggesting that prices may soon rise. Consequently, this might be one of the final chances to acquire altcoins at lower prices before a market upswing occurs.

Additionally, increased trading volumes for cryptocurrencies like WIF, PEPE, SOL, and FTM reflect growing investor interest during these price dips. However, profit-taking and caution have led to temporary decreases in market capitalization as investors evaluate their risks. This analysis focuses on some of the best cryptocurrencies to invest in right now.

Best Cryptocurrencies to Invest in Right Now

Aave has recently linked its algorithmic stablecoin with Chainlink’s Cross-Chain Interoperability Protocol (CCIP), aimed to simplify the cross-chain transfer of the GHO stablecoin. Meanwhile, Memebet has raised more than $525,000 in its presale, generating significant interest among investors. Additionally, the proposed partnership between Injective and Fetch.AI has garnered attention within the crypto community.

1. Aave (AAVE)

Aave has recently integrated its algorithmic stablecoin, GHO, with Chainlink’s Cross-Chain Interoperability Protocol (CCIP). This partnership aims to facilitate easier, cross-chain movement of the GHO stablecoin, which is pegged to the US dollar. Since its launch, GHO has shown promising traction, accumulating $31.2 million in bridged volume.

This makes GHO the second-largest asset by volume on Chainlink’s CCIP, underscoring its early adoption and potential growth in the stablecoin market. The GHO launch aligns with Aave’s goal of enhancing cross-chain liquidity and improving stability for the stablecoin’s ecosystem.

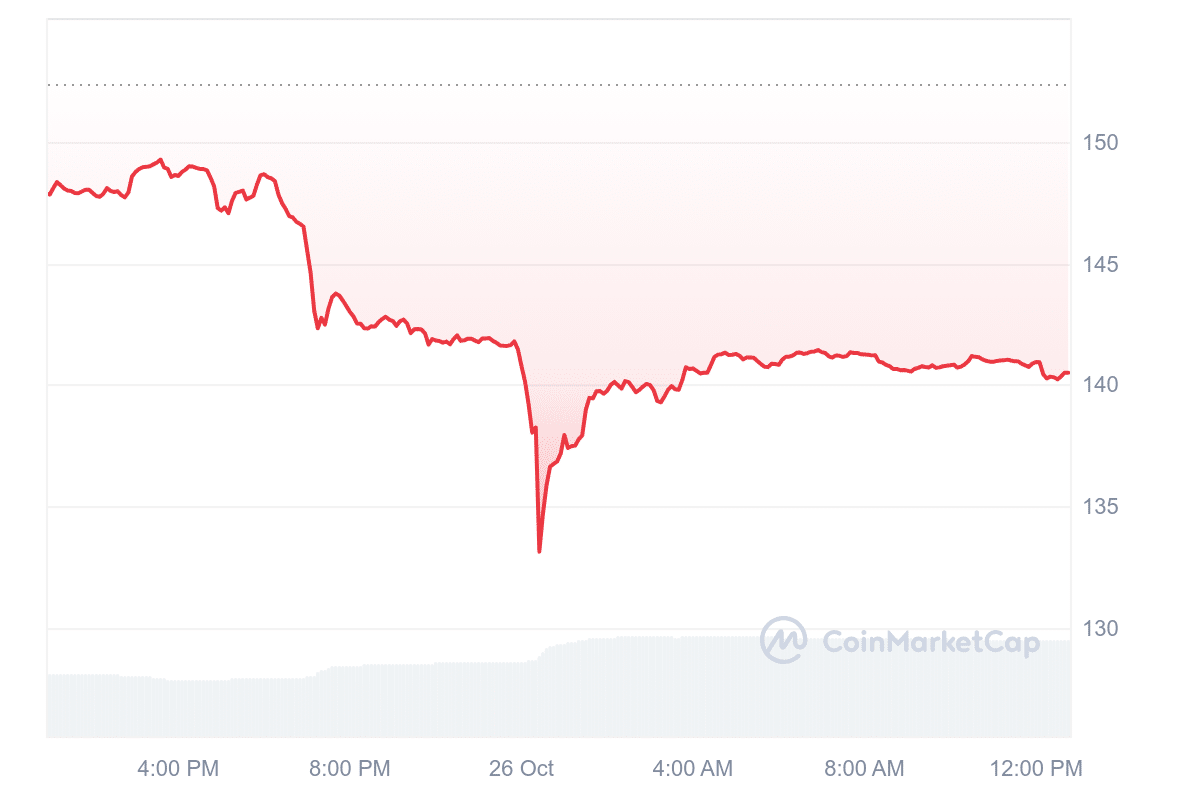

Currently, the AAVE token trades at $139.78, marking a 5.97% decline. However, the token’s trading volume has surged 72.75% to $182.99 million in a single day, which indicates an increase in market activity. The Relative Strength Index is 49.29, a neutral position that suggests neither oversold nor overbought conditions.

GHO is now available as a fee token for bridging any token via @Chainlink CCIP, offering users a simpler way to transfer GHO across supported networks. pic.twitter.com/DKhbaxtDdG

— Aave Labs (@aave) October 21, 2024

This neutrality in the RSI reflects that AAVE’s price could see potential movement in either direction. With this backdrop, a slight dip could precede a potential breakout if buying momentum increases.

Meanwhile, exchange reserves for AAVE tokens have risen by 0.55% to 2.6578 million. An increase in exchange reserves typically signals that more tokens are being held on exchanges, which often leads to heightened selling pressure. If this trend persists, it may hinder any upward price movement for AAVE in the near term.

2. Cronos (CRO)

Cronos (CRO) is a blockchain built to support Crypto.com’s ecosystem, focusing on payment, trading, and financial services. By enhancing its utility, Cronos seeks to create a smoother experience for users, especially within the Crypto.com platform.

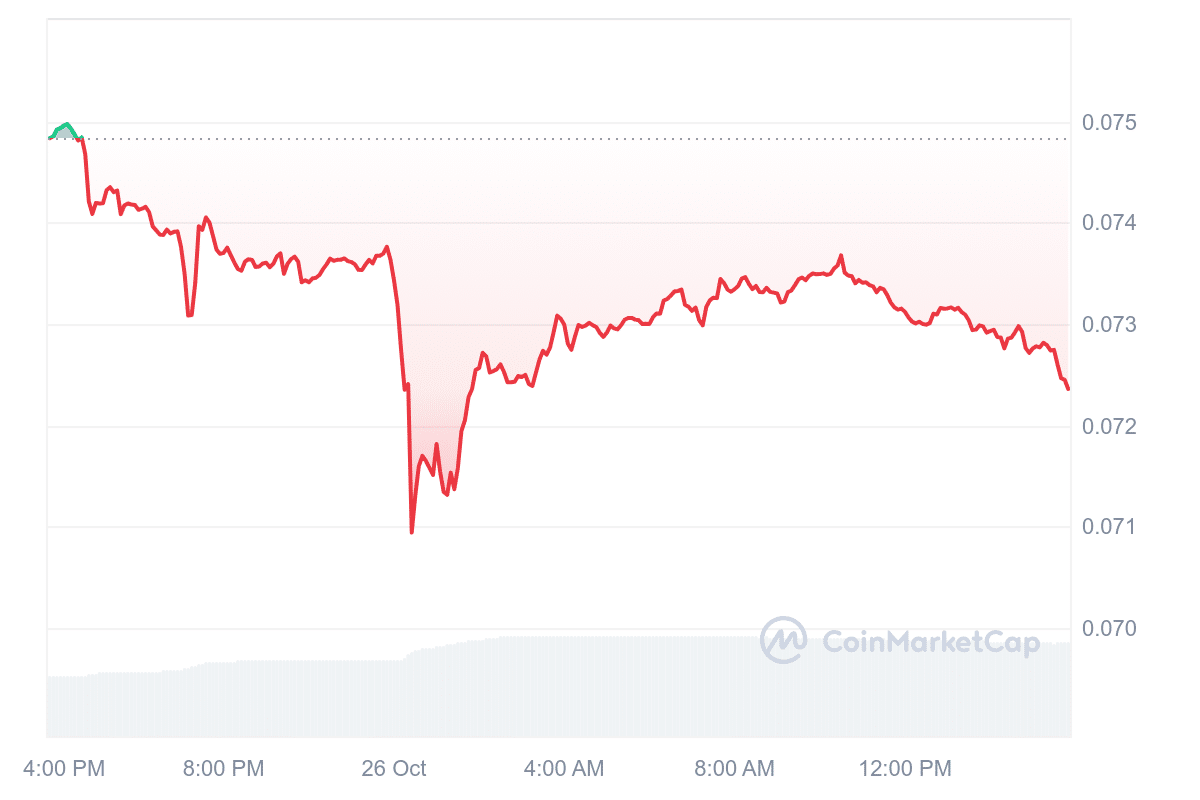

At press time, the price of CRO is $0.07234, reflecting a 3.32% intraday decrease. Market capitalization has also dropped by the same rate, landing at around $1.92 billion. However, trading activity has surged, with a 54.32% increase in volume, reaching $7.71 million.

This uptick in volume may indicate growing interest or heightened market activity despite the recent price drop. Furthermore, Cronos has a fully diluted valuation (FDV) of $2.17 billion, and its volume-to-market cap ratio is 0.4109%, suggesting moderate trading interest in relation to its market size.

Pyth, a leading oracle protocol on #Cronos EVM and zkEVM, announces Redemption Rate Feeds (RRF) that track the rewards accumulated by yield-bearing tokens. $CDCETH, on Cronos EVM chain, is one of the few leading projects integrated for the inauguration of this feature! https://t.co/0Bh3fYUZjS

— Cronos (@cronos_chain) October 26, 2024

Recent price movements show minor fluctuations, with a low of $0.0722 and a high of $0.07333, indicating some short-term volatility. Meanwhile, the CoinMarketCap community sentiment remains generally positive, with 85% of voters expressing optimism about Cronos. This optimism suggests confidence in Cronos’s goals and potential, even with recent price shifts.

3. Injective (INJ)

The proposed collaboration between Injective and Fetch.AI, a blockchain AI protocol, has drawn attention within the crypto community. A crypto analyst from the Altcoin Buzz podcast thinks this partnership could give Injective a short-term boost, potentially pushing the price up.

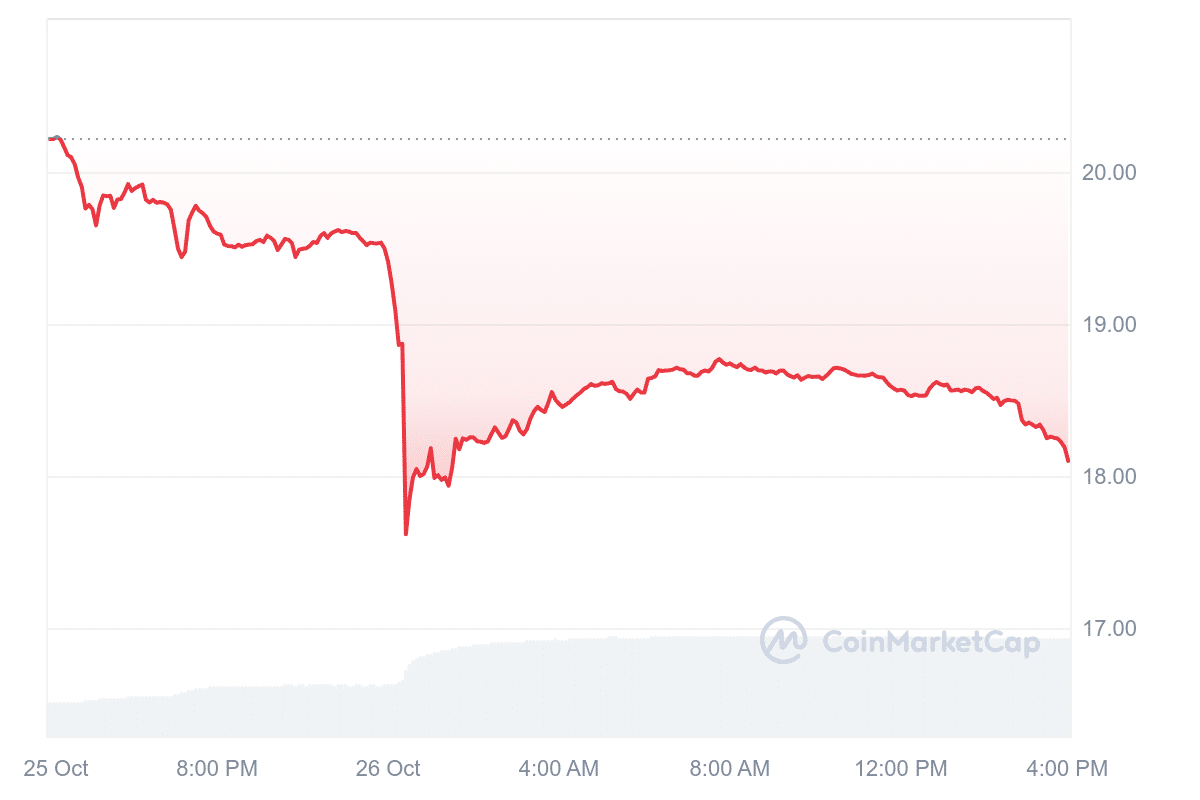

At the time of writing, the INJ token’s price dropped to $18.08, down 10.60% over 24 hours, with its market cap also down by 10.63%. Trading volume has surged by 174.33% to $140.87 million within the same period, possibly due to investor reactions to the price dip.

Injective’s fully diluted valuation (FDV) is near $1.81 billion, and its volume-to-market cap ratio sits at 7.68%, indicating high trading activity relative to its market size. Price movement has been volatile, with INJ dropping from around $20 to $18 recently.

The official on-chain governance proposal to integrate Fetch and Injective is now live 🔥

100% of participants have voted Yes so far, marking one of the highest approval rates in history.$ASI + $INJ incoming 👀 https://t.co/ZdkNlnAhEF

— Injective 🥷 (@injective) October 24, 2024

Meanwhile, market sentiment remains largely optimistic. This reflects positive expectations from the majority, despite recent fluctuations, likely driven by excitement surrounding the potential Fetch.AI partnership.

4. Memebet (MEMEBET)

Memebet has attracted over $525,000 in its presale, drawing interest from crypto investors with its MEMEBET token. The casino, based on Telegram, is aimed at crypto and meme coin enthusiasts, blending traditional sports betting with popular meme coins like Pepe, Dogecoin, Shiba Inu, and Bonk for placing bets.

Using blockchain technology, Memebet aims to ensure faster transactions than traditional banking. Users only need a cryptocurrency wallet to access the platform, avoiding KYC verification and account setup. This setup offers a simpler and more private experience for users.

MEMEBET tokens currently cost $0.0261, and players can use meme coins to place bets on games, slots, and sports options within the casino. As the presale nears its next funding milestone, the token price may soon increase, adding urgency for interested investors.

To encourage betting, Memebet has allocated 400 million MEMEBET tokens for airdrops, rewarding users based on their activity. Higher-stakes bettors stand to benefit most, though regular users also have future opportunities for these airdrops. Memebet’s mix of meme coins and crypto betting creates a unique niche, appealing to those interested in both Web3 and decentralized gaming.

5. Solana (SOL)

Solana is an open-source blockchain project aimed at providing decentralized finance (DeFi) solutions through a permissionless network. Solana’s standout feature is its rapid transaction processing capabilities.

The blockchain employs a hybrid protocol that optimizes validation times for transactions and smart contract executions, significantly enhancing its speed and scalability. These efficiencies have attracted interest from institutional players, positioning Solana as a prominent blockchain for high-speed applications within the crypto market.

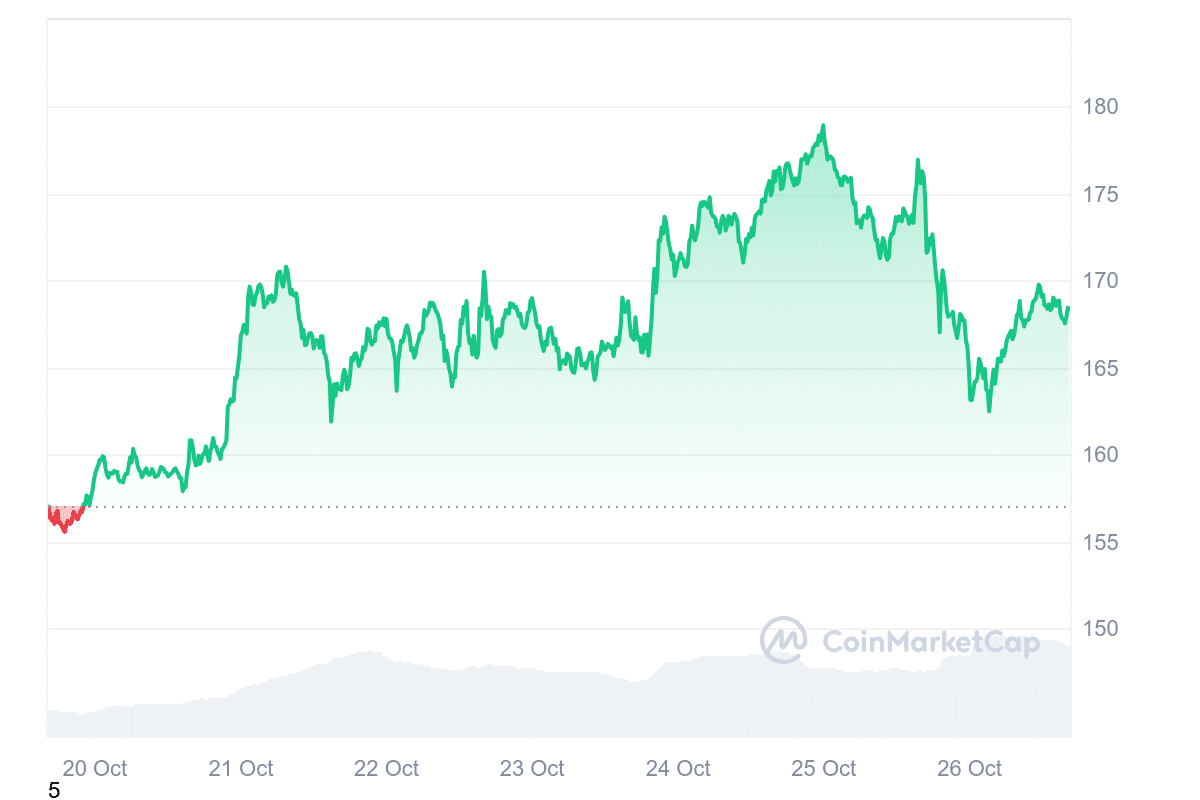

Currently, SOL is valued at $168.24, marking a 7.17% increase over the past week. Its market cap is $79.11 billion, down 4.55% despite heightened trading interest. Notably, the past 24 hours saw a trading volume of $4.63 billion, a 38.48% increase, indicating strong recent engagement with the token.

It’s a beautiful day to read the State of Solana: Breakpoint Edition ☀️

– $3.8B stablecoins issued on the network.

– $173M capital raised by founders, Q3’24.

– 78 DePIN products built on Solana.Check out the full report — share your favorite takeaways!https://t.co/iQtXZRp5oc

— Solana (@solana) October 22, 2024

Overall sentiment within the community remains positive, reflecting general optimism despite some fluctuations in Solana’s market cap. Solana’s volume-to-market cap ratio of 5.90% signals high trading activity relative to its market size.

Out of a total supply of 587.26 million SOL tokens, around 470.20 million are currently circulating. Price trends indicate a gradual upward trajectory, recently nearing $180 before stabilizing at the current $168 range.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage