Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price is up 5% in the last seven days and a fraction of a percent in the past 24 hours to trade for $71,290 as of 02:19 a.m. EST.

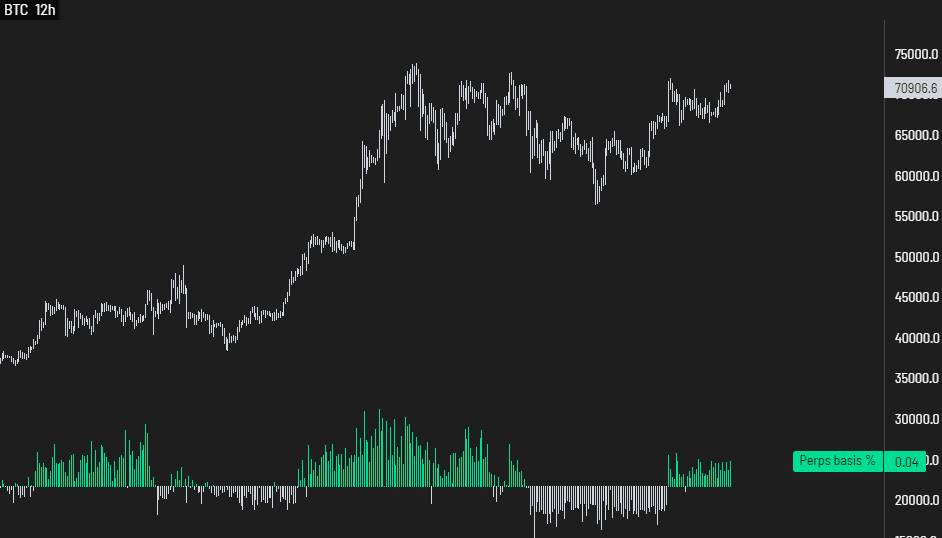

This show of strength above the $70k psychological level is inspiring optimism across markets. Data shows that BTC has a slight perpetual premium, which means that the BTC price in the perpetual futures market is slightly higher than the spot market price.

For the layperson, perpetual contracts are derivative products that track the underlying asset’s price closely, but trade at a premium or discount compared to the spot market.

A slight premium in the perpetual market may indicate bullish sentiment or demand for BTC among traders. It could suggest that traders are willing to pay a little extra to have exposure to Bitcoin through these derivative contracts, anticipating potential price increases.

The reading of the Fear & Greed Index reinforces this bullish sentiment. It’s shifted to “extreme greed” today, indicating strong bullish sentiment.

Bitcoin Price Holds Above $70K As Sentiment Reads ‘Extreme Greed’

The Fear and Greed Index helps to analyze the sentiment in the Bitcoin and crypto market. It identifies the extent to which the market is becoming overly fearful or overly greedy. During times of extreme fear, Bitcoin is cheap or undervalued, presenting a good buying opportunity.

The reverse is true, such that an extremely greedy reading would mean the Bitcoin price is too high above its intrinsic value. While some traders see this as a good time to sell, others say traders are too excited about the prices rising a lot further in the future.

With this, @DaanCrypto, a trader and investor, observed that BTC open interest has surged $2.02 billion in three days.

#Bitcoin Quite the run up in Open Interest over the past 3 days.

A +$2.2B increase which is about ~12% of total open interest.

Price went up +5.5% during this time so there's definitely a lot of additional positioning going on as price tries to move higher.

Volatility likely. pic.twitter.com/YuJN24TwAW

— Daan Crypto Trades (@DaanCrypto) June 5, 2024

Open interest indicates the sum of all open long and short positions for an asset. BitLab Academy director Kelly Kellam highlighted that a ‘whipsaw’ may be in the works, referring to a sudden correction. “The open interest ticking up as the positive premium persists (everyone going Leveraged Long) is a recipe for a small correction & BTC health check,” he said.

I am SUPER #BULLISH on #Bitcoin. (Caution here for whipsaw) heres why:

The open interest ticking up as the positive premium persists (everyone going Leveraged Long) is a recipe for a small correction & #BTC health check.

You can also see on the Liquidation levels from… pic.twitter.com/bXIhK6oEFb

— KellyKellam (@Kellykellam) June 5, 2024

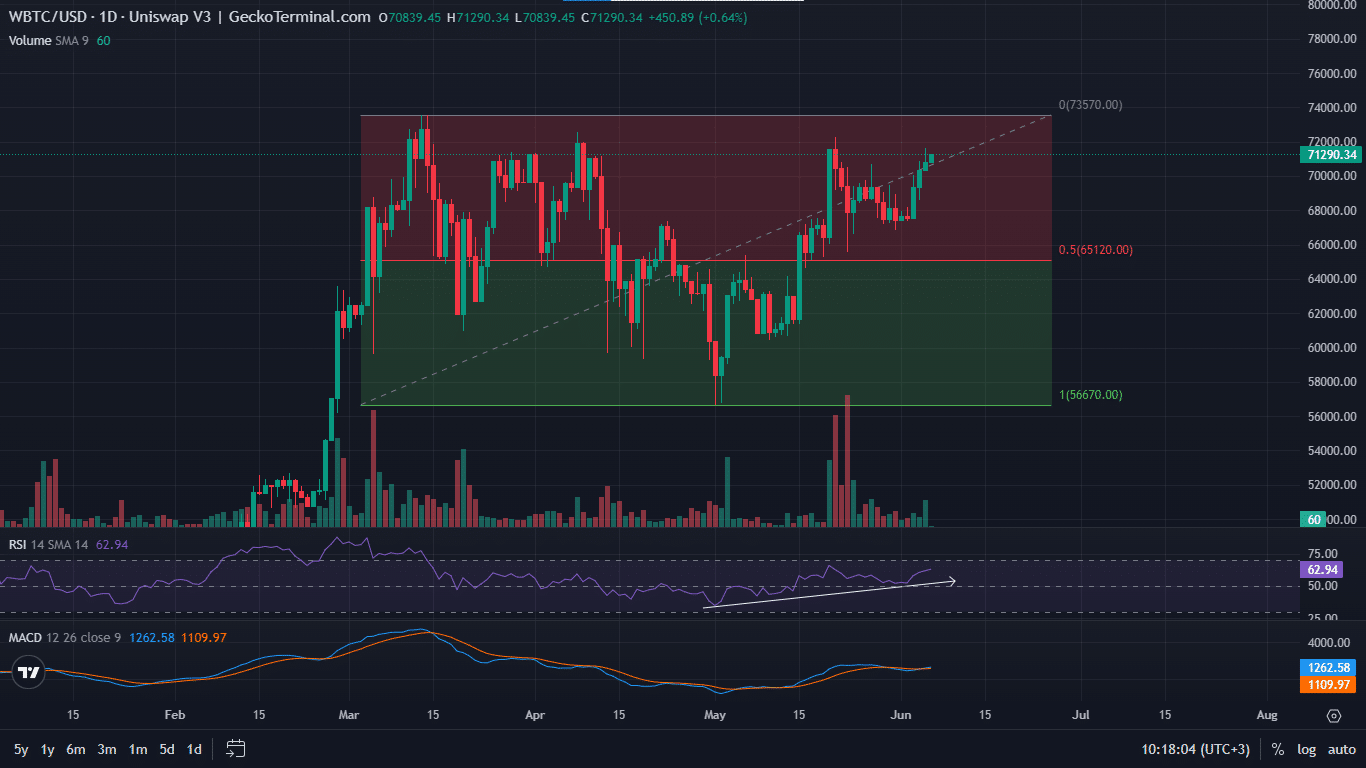

Bitcoin Price Prediction

The Bitcoin price is trading with a bullish bias recording a sustained series of higher lows. As it winds around the trendline of the Fibonacci indicator, however, this diagonal line is borderline support and resistance, depending on how traders play their hand.

A stable close above this threshold would open the expanse for more gains, setting the tone for a further upside. This could see the Bitcoin price reclaim the $73,570 peak, or in a highly bullish case, extend to reclaim the $73,777 all-time high. The highly ambitious case could see the Bitcoin price record a new peak above the $74,000 threshold.

The higher lows on the Relative Strength Index (RSI) point to growing bullish sentiment in the BTC market. The RSI position above the mean level of 50 is also bullish, reinforced by the position of the Moving Average Convergence Divergence (MACD) above its signal line.

Notably, the crossover of the MACD above its signal line is also bullish. It means that the short-term moving average is above the long-term moving average. This typically indicates a bullish momentum in the market. The spikes in the nodes of the volume profile also accentuate this supposition.

GeckoTerminal: BTC/USD 1-day chart

On the other hand, if the trendline holds as resistance and seller momentum plunges the Bitcoin price below it, the downtrend could extend. Nevertheless, only a slip below the 50% Fibonacci placeholder of $65,120 would be concerning, potentially triggering panic selling.

For the bullish thesis to be invalidated, however, the bulls must manage a candlestick close below $56,670. This lower low, relative to the bottom of the May 1 trading session, would signify a change in market structure.

Meanwhile, the 99BTC presale is going ballistic with funds raised now at almost $2 million for this learn-to-earn crypto.

Experts such as Oscar Ramos say it is the best presale to buy now with 100X potential.

A Promising Alternative To Bitcoin

99BTC is the native cryptocurrency for the 99Bitcoins ecosystem, a long-established educational platform that’s pioneering a new Learn-to-Earn rewards model.

#Bitcoin ($BTC) and #Ethereum ($ETH) ETFs are projected to grow to a $450 billion market, according to @BernsteinPWM recent report.

Over the next two years, they expect over $100 billion in flows into #CryptoETFs. 🤯 #99Bitcoins #DEFI #Crypto #RWA pic.twitter.com/waGI2cWzQX

— 99Bitcoins (@99BitcoinsHQ) June 5, 2024

Promising a groundbreaking earn-as-you-learn experience for users of the website, the project incentivizes learning through a unique mix of gamification and a leaderboard reward system.

This ensures users feel like their learning is bearing tangible benefits as they earn crypto while learning about crypto.

Another huge attraction for investors is the token’s staking mechanism, which offers an annual return of 859%.

Join the community of users who realize tangible benefits from learning when you buy 99BTC tokens in the presale for $0.00108. This price tag will only hold for another five days before an increase so buy soon if the project appeals.

Visit and buy 99Bitcoins here.

Also Read:

- 99Bitcoins Price Prediction – $99BTC Profit Potential in 2024

- 99Bitcoins Launches New Learn-to-Earn Airdrop Presale – TodayTrader Video Review

- Best Penny Crypto Investments: Top Picks for Explosive Growth in 2024!

Join Our Telegram channel to stay up to date on breaking news coverage