Join Our Telegram channel to stay up to date on breaking news coverage

Exploring the world of altcoins offers potential gains for investors seeking promising investment opportunities beyond the big industry players. However, discovering the best altcoins to invest in right now requires time and effort. Therefore, Insidebitcoins explores the standout coins poised for growth and potential in the current market climate.

5 Best Altcoins to Invest in Right Now

CleanSpark Inc., a US Bitcoin miner, recently disclosed a strategic agreement to acquire up to 160,000 miners by the end of 2024. This move signifies a substantial expansion plan for their mining operations.

As outlined in the announcement, CleanSpark has already secured the purchase of 60,000 Bitmain S21 units at $16.10 per terahash, totaling $193.2 million. Anticipated to arrive between April and June 2024, these acquired miners constitute a significant investment in bolstering their mining infrastructure.

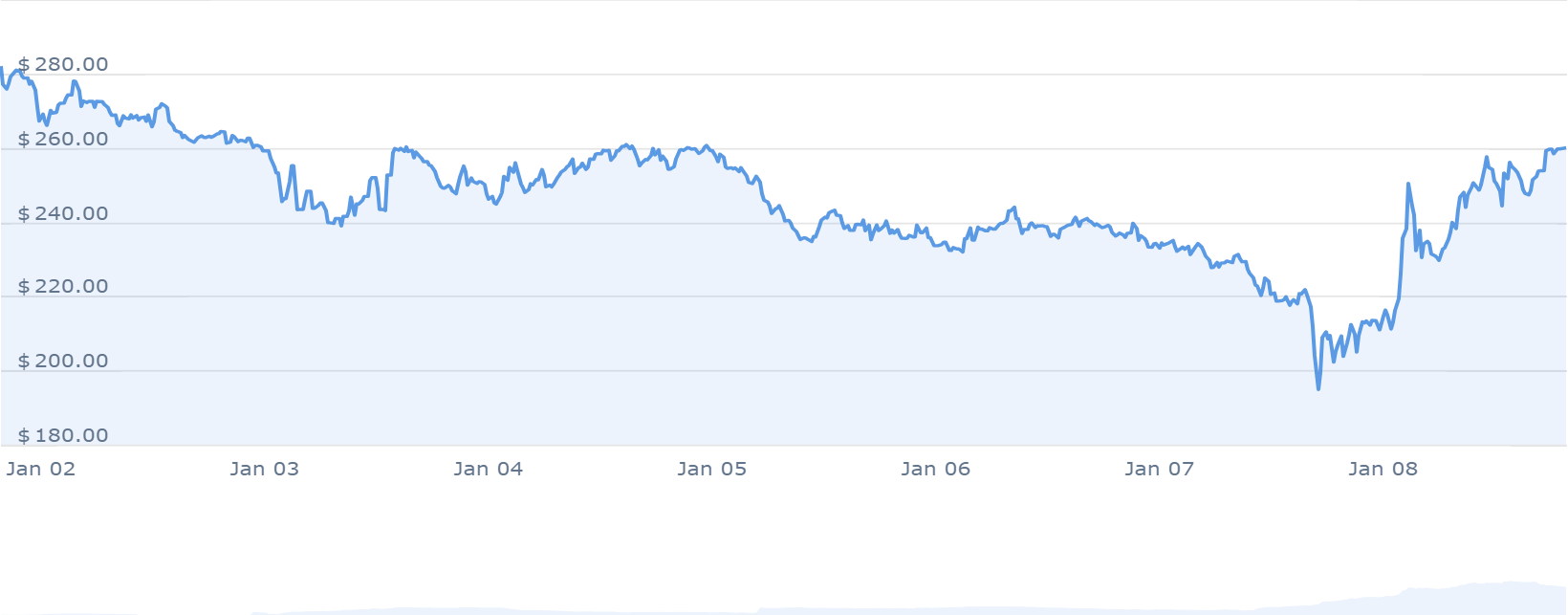

1. Bittensor (TAO)

Nansen’s 2024 forecast envisions a pivotal role for artificial intelligence (AI) in shaping future possibilities in technology. While there were reservations around AI and blockchain integration, promising use cases are surfacing, hinting at potential advancements.

As such, tokens linked to AI projects, like Bittensor (TAO), continue gaining momentum. Despite bearish market conditions since early 2023, AI project tokens have shown resilience. This indicates strong belief and momentum in the convergence of AI and blockchain.

AI agents are emerging as crucial components in the AI sector. These agents can handle transactions, securely manage assets, and exchange user value. Therefore, it suggests a future where AI agents could become primary users in the blockchain landscape.

Bittensor’s price history shows significant fluctuations, hitting its peak at $394.91 on Dec 14, 2023. Meanwhile, it hit its lowest point at $31.74 on May 14, 2023. Since its all-time high, the lowest recorded price stood at $193.77 (cycle low). In contrast, the highest price since the last cycle low hit $260.44 (cycle high). Presently, sentiment leans bearish for Bittensor’s price prediction, but the Fear & Greed Index marks 76 (Extreme Greed).

Furthermore, TAO holds a circulating supply of 6.01 million TAO out of a maximum supply of 21.00 million TAO. In addition, it keeps the #3 position in the AI Crypto sector by market cap. Key highlights include trading above the 200-day simple moving average and hovering near the cycle high. This indicates a positive market position for Bittensor within the AI and blockchain sphere.

2. Astar (ASTR)

The imminent launch of dApp Staking v3 is anticipated to bring significant changes for developers and stakers. This, in turn, necessitates increased engagement for maximizing rewards. Users can claim their current rewards to prepare for the impending upgrade. Astar’s price is $0.146550 with a 24-hour trading volume of $ 293.83M. Moreover, it boasts a market cap of $ 803.89M, wielding a market dominance of 0.05%.

Over the last 24 hours, Astar has seen an 18.71% increase in price. Market sentiment regarding Astar’s price prediction leans towards a bullish outlook. This sentiment aligns with the Fear & Greed Index reading 76, signifying Extreme Greed. Astar’s circulating supply stands at 5.49B ASTR out of a maximum supply of 7.00B ASTR. Notably, the current yearly supply inflation rate is at 44.57%, leading to the creation of 1.69B ASTR last year.

The dApp Staking v3 launch is coming soon!

This update will have profound affects for both builders and stakers, and require more active participation to obtain the highest rewards.

You can prepare for the upgrade to v3 by claiming your current rewards:https://t.co/Dg8DrbDglC

— Astar Network (@AstarNetwork) January 5, 2024

ATSR hit a 257% price increase last year, outperforming 85% of the top 100 crypto assets within the same timeframe. Furthermore, Astar is trading above its 200-day simple moving average. Plus, it has seen 19 positive trading days out of the last 30, marking a 63% positive streak. The project’s liquidity is notably robust, as inferred from its market capitalization.

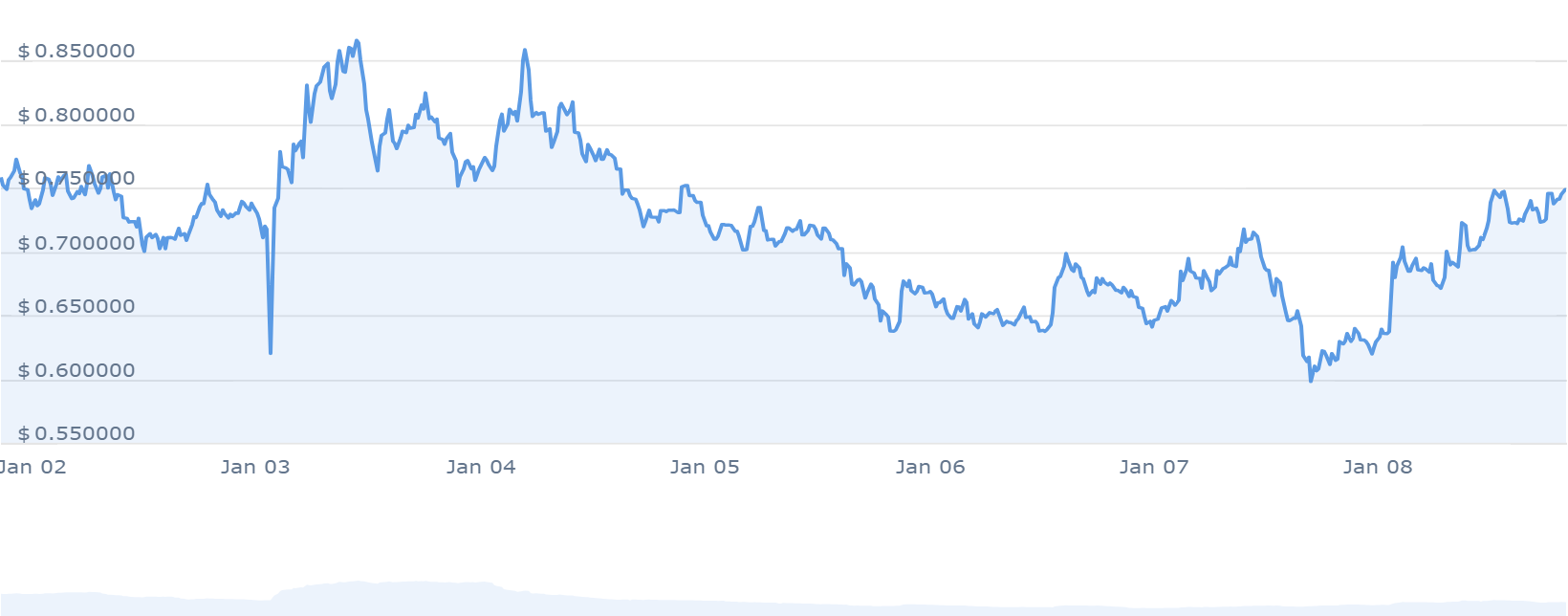

3. Sei (SEI)

Sei v2 is positioned as a pioneering parallelized EVM blockchain, aiming to introduce a significant update from Sei Labs. This proposed update seeks to integrate a backward-compatible Ethereum execution environment into Sei’s core binary.

By adopting Sei’s advanced twin-turbo consensus mechanism and optimistic parallelization capabilities, the update aims to maintain full compatibility with Sei’s existing wasm environment. This strategic approach enables Ethereum or Layer 2 applications to deploy on Sei, leveraging its purported speed and throughput. Additionally, users can interact with Sei using familiar tools like Metamask.

Market sentiment currently leans toward bullish predictions for Sei. Meanwhile, the Fear & Greed Index reports a value of 76 (indicating Extreme Greed). Sei’s circulating supply stands at 2.30 billion SEI out of a maximum supply of 10.00 billion SEI.

"Sei's journey has been marked by a series of strategic advancements, positioning it as a unique player in the world of Layer 1 (L1) blockchains.

With Sei v2, it has taken a monumental step forward, reflecting a deep understanding of the current needs and future directions of… https://t.co/V4LVgyg6gZ

— Sei 🔴💨 (@SeiNetwork) January 8, 2024

Moreover, it holds the #11 position in the Proof-of-Stake Coins sector and #26 in the Layer 1 sector concerning market cap. Over the past 30 days, SEI has seen 17 green days, accounting for 57% of the period. In addition, its trading activity is nearing a cycle high. Moreover, Sei demonstrates high liquidity based on its market capitalization.

4. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix offers a novel cloud mining approach employing tokenization to address common concerns in third-party cloud mining platforms. Their primary aim is to provide a secure and transparent environment within a decentralized framework for individuals interested in Bitcoin (BTC) mining.

With substantial attention, Bitcoin Minetrix has attracted over 400,000 BTCMTX tokens. The platform offers an initial annual percentage yield (APY) of 103,225%, subject to change with increased token staking. During the presale phase, Bitcoin Minetrix raised over $7,886,974 by offering BTCMTX tokens at $0.011 per token.

#BitcoinMinetrix reaches another noteworthy milestone! 🎖️

Surpassing $7,800,000. pic.twitter.com/61vRZDus2v

— Bitcoinminetrix (@bitcoinminetrix) January 8, 2024

Investors acquired 70% of the total token supply, set at 2.8 billion BTCMTX, using Ethereum (ETH) or Tether (USDT), with a minimum investment of $10. The token distribution strategy notably focuses on strengthening mining infrastructure and fostering platform growth.

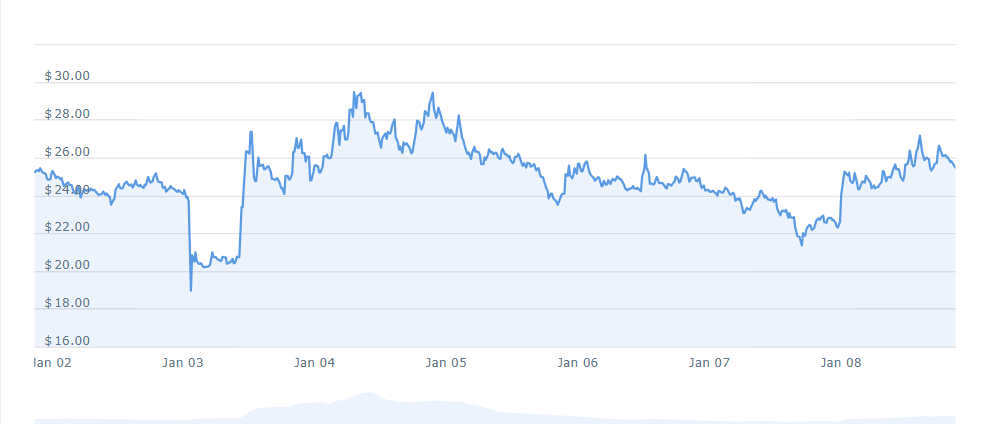

5. Moonriver (MOVR)

Moonriver’s recent performance and key metrics depict a notable trajectory within the crypto space. Over the past year, it has showcased a substantial 288% price surge, outperforming 87% of the top 100 cryptocurrencies. It demonstrates stability in its upward movement above its 200-day simple moving average.

Furthermore, the current circulating supply is 8.72 million MOVR out of a maximum supply of 10.55 million MOVR. Notably, the yearly inflation rate is 51.70%, creating 2.97 million MOVR in the past year. This higher inflation rate could influence its market dynamics.

With robust liquidity, indicated by its market cap, Moonriver’s fundamentals appear strong. However, projections and forecasts often depend on various factors, particularly collaboration announcements with other networks. Such collaborations could propel the maximum price level of MOVR to exceed $21.88 by 2024.

Moreover, a bullish market trend envisages an average price estimate of around $19.82 for the Moonriver Coin by 2024. Conversely, should the crypto market face a downturn, the minimum projected value for MOVR in 2024 could dip to $18.58.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage