Join Our Telegram channel to stay up to date on breaking news coverage

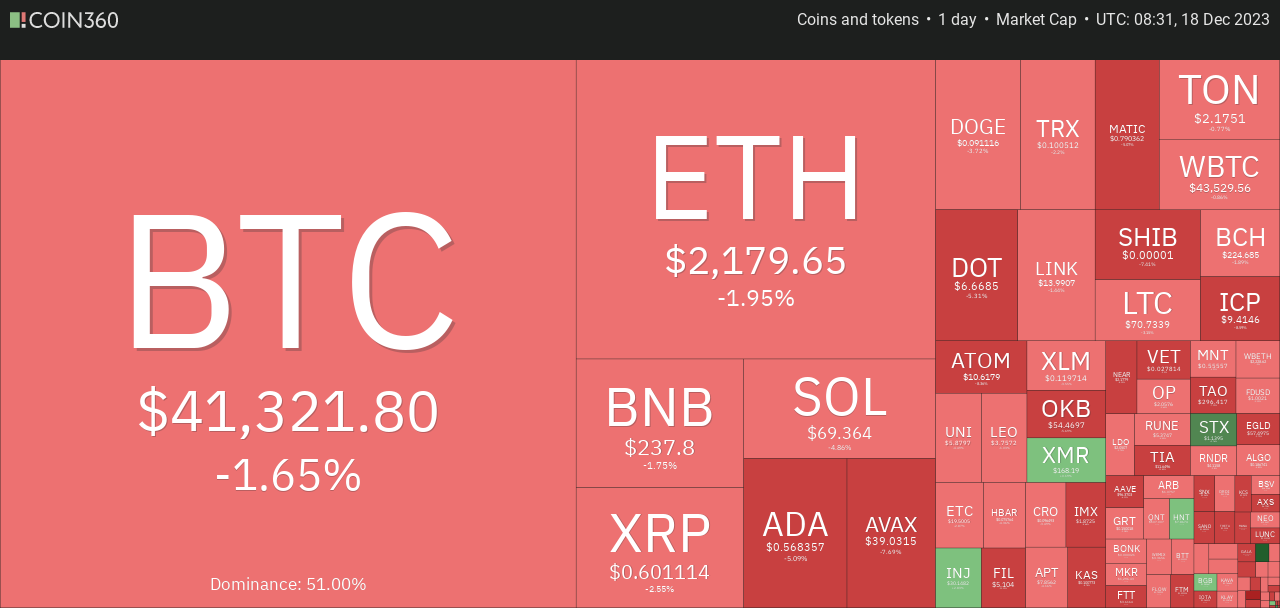

In the last 24 hours, the global cryptocurrency market has experienced a slight dip. The market cap currently rests at $1.55 trillion, marking a 1.99% decrease over the last 24 hours. However, trading activity surged significantly, with the total market volume reaching $51.07 billion, signifying a notable 12.54% increase within the same period.

In decentralized finance, the volume has reached $6.8 billion, constituting 13.32% of the 24-hour crypto market volume. Remarkably, stablecoins continue to hold substantial dominance, accounting for $45.67 billion, making up 89.43% of the total crypto market’s 24-hour volume.

Bitcoin’s dominance in the crypto market is currently measured at 51.74%, reflecting a marginal increase of 0.10% compared to the previous day. Nevertheless, premium assets retain their positions as the next cryptocurrencies to explode.

Meanwhile, FTX Trading Ltd., the crypto firm embroiled in a bankruptcy case due to fraudulent activities, has unveiled a new proposal to return significant sums to customers and creditors. However, the plan raises critical unanswered queries, leaving room for potential disputes in the final phase of the bankruptcy case.

The proposed reorganization plan needs more clarity on crucial aspects, such as the potential revival of FTX’s defunct crypto exchange, the methodology for evaluating the value of specific digital tokens, and the anticipated repayment ratios for creditors. The proposal’s release initiates a pivotal stage that may see stakeholders engaging in discussions and negotiations over the unresolved aspects of the plan.

Next Cryptocurrency To Explode

The fate of FTX Trading Ltd. and the resolution of its bankruptcy case remain contingent upon the resolution of these crucial questions, which could significantly impact the compensation and future operations of the embattled crypto firm.

1. Helium (HNT)

Helium (HNT) has exhibited a remarkable surge, standing out amidst the struggles of major cryptocurrencies like Bitcoin and Ethereum. HNT soared to $7, marking a three-day upward trend and a staggering 400% surge from its October lows, elevating its market cap to over $976 million.

The rally extends beyond HNT; Helium’s ecosystem coins have substantially increased. Helium Mobile (MOBILE) surged by over 58%, reaching a market cap of $189 million, while Helium IOT (IOT) soared by 27%, valued at $46 million.

Several driving forces contribute to Helium’s impressive performance. The first is the ecosystem synergy. The current surge mirrors Solana’s ecosystem tokens’ performance, with SOL and Bonk witnessing remarkable gains and buoying platforms like Raydium, Orca, and Solend.

Analysts also foresee a bright future for Decentralized Public Infrastructure (DePin) platforms in 2024, with Helium as a major player boasting over 100,000 paying customers.

Helium’s rally aligns with an “everything rally” following the recent Fed decision. U.S. equities near all-time highs and record-breaking gold prices fuel a sense of FOMO among crypto investors.

Technical analysis suggests a robust rally for HNT, with indicators such as moving averages, the Relative Strength Index (RSI) in overbought territory, and the Average Directional Index (ADX) surpassing 60, signaling strong bullish momentum. Anticipation mounts for a potential push towards the $10 resistance level in the coming weeks.

📱The Helium Wallet v2.5.0 Update (Android & iOS)

The Helium Wallet v2.5.0 release adds several new features for the Helium community:

▶ Allow users to self-onboard Hotspots when Makers do not have enough Data Credits

▶ Better handling of token conversion for location… pic.twitter.com/QWL29G3POp— Helium🎈 (@helium) December 15, 2023

The broader market impact is evident, with lesser-known cryptocurrencies like Bonk and Memecoin (MEME) experiencing significant surges as investors seize the momentum.

As Helium’s HNT and its ecosystem tokens continue their impressive surge, fueled by ecosystem strength, market sentiment, and technical indicators, the crypto market braces for heightened volatility and potential further gains in the short term.

2. Stacks (STX)

Stacks (STX) has experienced a notable surge of 13.17% today, reaching a selling price of $1.16. This surge in value is attributed to the ongoing airdrop, prompting a significant influx of investors into the network.

The Stacks STX airdrop isn’t merely about acquiring free cryptocurrency tokens. It presents an opportunity to engage in a governance token initiative, allowing participants to guide the project’s evolution. The distribution of Stacks STX goes beyond offering complimentary crypto; it offers a chance for active involvement in a governance token initiative, contributing to the project’s advancement.

By staying informed and actively engaged, participants can maximize the benefits of this airdrop and similar opportunities. Moreover, active participation in decentralized finance amplifies one’s influence within the ecosystem.

The Next Era For Bitcoin 🟧 pic.twitter.com/ZLXQy5ykig

— stacks.btc (@Stacks) December 17, 2023

However, it’s crucial to emphasize the importance of being well-informed and ensuring security in cryptocurrencies. Maintaining vigilance and staying updated on developments will be paramount for individuals engaging in this airdrop and navigating other crypto-related opportunities.

3. TG.Casino (TGC)

TG.Casino (TGC) has secured over $4.3 million in funding as its Telegram-based crypto casino continues to gain traction, witnessing over $45 million in wagers placed on the platform. With the presale heading for a sellout, the project is gathering substantial momentum.

The platform has reported total deposits exceeding $4.5 million, including contributions to the casino, live events, and sportsbook. The player count approaches 3,000, while the Telegram channel subscribers have surged past the 11,000 milestone.

TG.Casino offers 40% of its 100 million TGC token supply in the presale. The token’s price incrementally rises by $0.005 every five days until reaching the hard cap of $5 million. With three days until the next price increase, the current TGC token price stands at $0.19, with the presale now over 80% complete.

Positioned as the next GameFi crypto set to soar, TG.Casino has several advantages over competitors like Rollbit, offering fee-free passive income from staking and a user-friendly onboarding experience via Telegram and crypto-funded wallets.

We have raised more than $4.3 million in the $TGC presale💎

Steadily on our way to $5 million!

Can we get it done this week? pic.twitter.com/ifI0ZOe4eU

— TG Casino (@TGCasino_) December 18, 2023

Presale buyers can immediately stake their acquired tokens, earning a generous 158% (APY) and gaining exclusive benefits on the platform. Additionally, exclusive NFTs and rewards await presale buyers after launch, with enticing perks for high-roller presale investors.

As the presale approaches its hard cap goal of $5 million, the fundraising rate accelerates, drawing significant interest from whale buyers seeking a stake in the project’s success.

TG.Casino stands out among Telegram-based casinos by securing a Curaçao gambling license, ensuring a secure environment for investors and players. The project’s verification by Assure DeFi, including a rigorous KYC certification process completed in November and a thorough, smart contract audit by security firm Coinsult, further bolstered its credibility and security measures.

The project’s commitment to robust security measures and regulatory compliance positions TG.Casino is an enticing opportunity for investors and players in the burgeoning world of crypto gaming and gambling.

Visit TG.Casino.

4. Injective (INJ)

The price of INJ also surged today by over 7%. It has positioned itself as one of the prominent gainers in the market and the next cryptocurrency to explode.

Trading within a range of $16.059 to $18.490, the Injective token underwent a phase where bullish momentum subsided, leading to a brief pullback. Subsequently, it remained confined between $14.147 and $18.490 for over three weeks, experiencing consistent volatility.

Amidst this range-bound movement, INJ displayed fluctuations before eventually breaking out. Witnessing a surge of over 49%, it reached $27.574 after a brief period of consolidation between $18.490 and $20.615. Following a minor correction, strong support around $23.826 facilitated a rebound, propelling the token to break multiple resistance levels, marking a remarkable 34% increase within a day.

The bulls have maintained INJ’s trading within a tight range of $29.785 to $31.893 after a rejection at $34.750. Technical analysis using the Moving Average Convergence Divergence (MACD) indicator indicates a diminishing selling pressure reflected in the declining red histogram. Moreover, the averages hint at a potential bullish convergence, signaling the likelihood of significant price action shortly.

✈️Injective transactions: Up Only

💳Injective active wallets: Up Only

🧱Injective blocks produced: Up Only

🏷️Injective fees: Near 0— Injective 🥷 (@injective) December 18, 2023

A breakthrough above the $31.893 resistance level is anticipated to provide momentum for INJ, setting the stage for a test of the $34.750 resistance level this week. Sustained stability at this level could further propel the token towards its upper resistance at $37.5.

On the contrary, a trend reversal leading to a failure to hold above the $29.785 support might see a test of the lower support at $27.574. Continued bearish dominance could result in a further downturn, targeting the critical support level at $23.826 in the foreseeable future.

As INJ navigates this volatile phase, the market’s reaction at key resistance and support levels will likely determine its trajectory, presenting bullish and bearish scenarios for investors to monitor closely.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage