Join Our Telegram channel to stay up to date on breaking news coverage

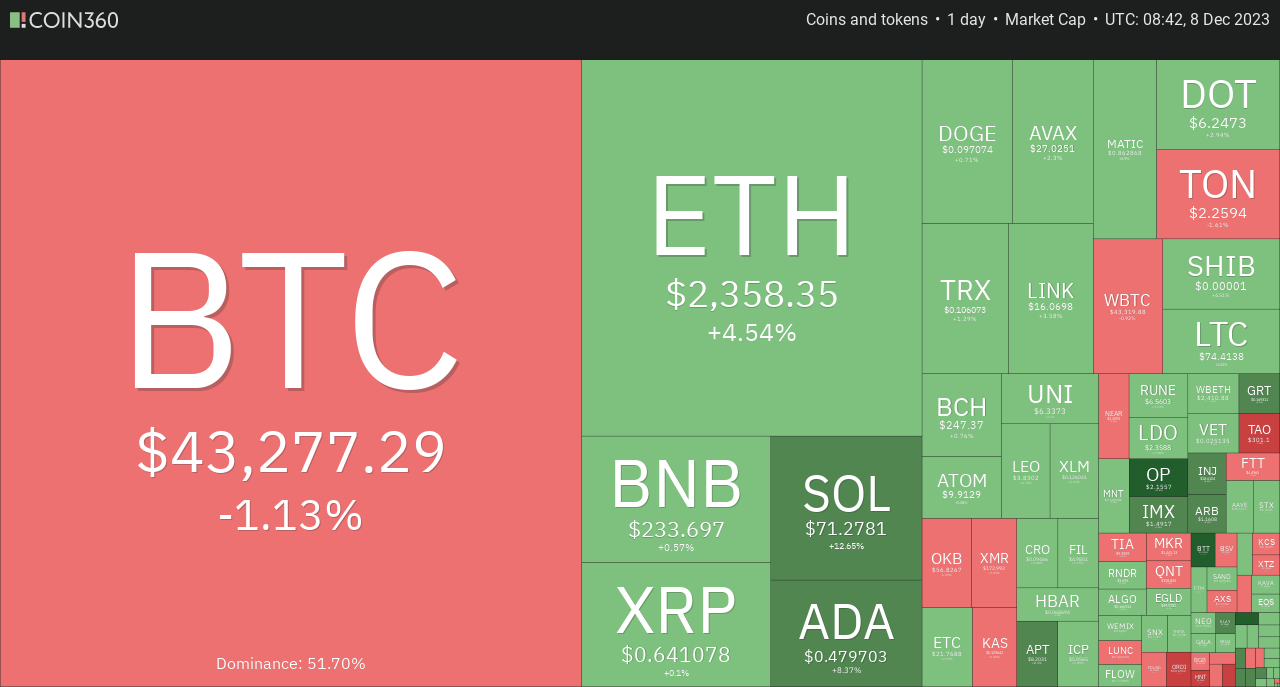

Again, the global cryptocurrency market made more gains on Friday after Thursday’s impressive gains. The market’s capitalization has consequently risen to $1.62 trillion. The latest gains mark a 0.85% increase in value over the past 24 hours. However, this growth contrasts with a notable decline in the overall trading activity within the crypto sphere.

It turns out that the crypto market’s trading volume amounted to $74.31 billion, reflecting an increase of 8.07% from Wednesday’s trade. Notably, the decentralized finance sector contributed $7.98 billion to this volume. This sector of the market, thus, secured 10.74% of the entire crypto market’s daily trading activity. Stablecoins, on the other hand, maintained a dominant position, accounting for $65.8 billion in trading volume, constituting a substantial 88.55% share of the total market activity over the same period.

The market’s resilience in capitalization, despite the reduced trading volume, suggests a consolidation of assets and a potential shift towards more stable crypto assets like stablecoins amid market uncertainties. Experts anticipate continued monitoring of Bitcoin’s dominance and the evolving dynamics of trading volumes across various crypto sectors in the coming days.

Meanwhile, industry executives have revealed that talks between the U.S. securities regulator and asset managers vying to launch Bitcoin exchange-traded funds (ETFs) have progressed to intricate technical discussions, indicating potential approval from the agency in the pipeline.

Thirteen prominent firms, including Grayscale Investments, BlackRock, Invesco, and ARK Investments, have submitted applications to the Securities and Exchange Commission (SEC) seeking approval for ETFs that would mirror the price movements of bitcoin.

Next Cryptocurrency to Explode

Introducing a spot Bitcoin ETF would signify a monumental moment for the industry, granting cautious investors access to the world’s largest cryptocurrency through the tightly regulated stock market. Anticipation for such a product is high, with initial demand projected to reach as much as $3 billion within the first few days of its launch.

1. JITO (JTO)

After an eventful week for Bitcoin, traders shifted their focus to the obvious next cryptocurrency to explode. JTO is the new governance token from Jito, a Solana-based staking project. It is currently experiencing a staggering 85.46% surge upon its Thursday launch.

Introduced at 11 am ET, Jito’s JTO token witnessed rapid uptake, with around 30% of the airdrop claimed within just 45 minutes. Notably, none of the top 14 addresses claiming the token, ranked by size, had initiated any sales during this period.

In a departure from the norm, eligible recipients have an extended 18-month window to collect their assets, a notably prolonged claim period compared to the typical 30 to 90-day windows for airdropped tokens.

At the time of this report, JTO boasted a market capitalization of approximately $337,98 million. It was at the top of the gainers’ list on CoinMarketCap on Friday.

So you claimed your $JTO, but now what?

We built a DeFi Guide that can help you figure it out!https://t.co/Gx5pYgjl9o pic.twitter.com/IUB52O9ML7

— Jito (@jito_sol) December 7, 2023

The decentralized exchange Aevo experienced severe disruptions following a surge in futures market activity coinciding with the token’s airdrop. Coinbase and Binance also disclosed their intentions to list the JTO token.

JTO’s launch aligns with the ongoing rise of altcoins throughout this year. Solana’s native token (SOL) has seen a remarkable 550% surge year-to-date. It is also one of the tokens drawing investors’ attention at this period.

2. Optimism (OP)

While many altcoins saw steady gains over the past few weeks, Optimism’s price lingered below a critical resistance level for almost seven months. It displayed no clear signs of a breakthrough.

Having traded beneath the $1.86 resistance mark for nearly seven months, the token began to experience a breakout in the past two days. Multiple higher lows formed below $1.86 on Wednesday, suggesting that OP was on the verge of a breakout.

A substantial shift where the $1.86 hurdle transforms into a supportive platform confirmed this breakout scenario. Once realized, Optimism’s price has ascended by 25.24% and is selling at $2.18 at the time of this report. Above this milestone lie two pivotal levels to be tested at $2.29 and $2.58.

Retesting the $2.58 level could yield a 38% surge, likely marking a consolidation point for OP before its next potential move.

An opportunity for devs using OP Goerli and Base Goerli, courtesy of @BuildonCircle. https://t.co/zRuCOqaIY0

— Optimism (@Optimism) December 7, 2023

Indicators like the Relative Strength Index (RSI) and the Awesome Oscillator (AO) support this optimistic outlook, both of which have reset to their respective mean levels of 50 and 0. This reset indicates a revival in momentum, presenting an opportunity for OP bulls to resume their upward journey.

However, investors should remain cautious regarding a potential reversal if the RSI and AO shift below their mean levels. Such a move could signal a shift from bullish to bearish momentum.

3. TG.Casino (TGC)

The TG.Casino presale has successfully amassed over $3.6 million within ten weeks and is on track to reach its hard cap of $5 million. As time dwindles, the opportunity to secure TGC, the next cryptocurrency to explode at a discounted price, is rapidly closing.

TGC, an ERC-20 token, can be purchased by linking an Ethereum-compatible wallet to the presale website, facilitating ETH and USDT payments. The platform offers an immediate staking mechanism for presale buyers, currently presenting a 170% annual percentage yield, subject to decrease as more tokens are staked.

Recent announcements from the TG.Casino team on X revealed impressive statistics: over 2,450 active players engaging with the casino, collectively wagering a total surpassing $38 million, and net deposits exceeding $3.7 million with the successful presale of the TGC token, TG.Casino is silently making waves in the industry due to its unparalleled user experience.

We're just in a league of our own😤 pic.twitter.com/X9J2UbUAeJ

— TG Casino (@TGCasino_) December 8, 2023

TG.Casino is a Telegram-native casino, enabling users to access it directly through the Telegram application, facilitating faster and more user-friendly betting. Furthermore, the casino’s accessibility to Telegram’s one billion users allows unrestricted gambling globally, courtesy of Telegram’s end-to-end encryption. The platform maintains a KYC-free environment, enabling users to initiate gameplay simply by connecting their wallets.

In addition, TG.Casino offers an extensive array of gambling options, including hundreds of games and sportsbook events powered by leading gaming providers such as Amatic, Evolution, and Hacksaw.

These facets collectively contribute to an unparalleled user experience and significantly underpin its initial success. Augmenting its value-driven utility is a robust set of tokenomics meticulously designed to boost demand and restrict supply.

TGC holders receive various benefits, including free rewards, a 25% cashback on losses, access to exclusive games and rooms, a 169% staking APY, up to a 200% rakeback bonus, and other perks.

The project integrates a buyback mechanism, using some of the casino’s revenue to repurchase TGC tokens from the open market. It plans to burn 40% of tokens and allocate 60% to staking rewards, creating a deflationary effect on TGC while bolstering demand and rewarding holders in alignment with the platform’s success.

Visit TG.Casino.

4. Shiba Inu (SHIB)

Shiba Inu is another token going through a lot of dynamics, but it falls among the next cryptocurrency to explode. According to Etherscan’s analysis, a significant transfer of Shiba Inu tokens involved the movement of more than 355.6 billion SHIB tokens to an undisclosed wallet address.

This transaction garnered attention due to its notable impact on volume. According to CoinMarketCap’s volume metric, SHIB witnessed a substantial surge, surpassing $316 million in trading volume today.

Further scrutiny of volume trends in recent months highlighted this as the highest SHIB volume seen in a considerable span. The chart exhibited a resemblance to a volume spike observed back in August.

Recent updates indicated a volume of approximately $439 million, marking a decrease of over 40% within the past 24 hours, as per CoinMarketCap data.

Examining Shiba Inu Exchange Netflow data on CryptoQuant provided insights into the direction of the recent token transfer. As of December 6th, the chart displayed a negative exchange flow, indicating a larger outflow of SHIB tokens from exchanges.

👏 Massive congrats to @ShytoshiKusama one of the visionaries behind our ecosystem! Shy has catapulted $SHIB into the limelight and is now recognised on CoinDesk’s #MostInfluential2023. His vision is shaping the future of crypto 🚀 Show him some love in the comments #SHIBARMY https://t.co/qBnS6Jjtl3

— Shib (@Shibtoken) December 8, 2023

The Exchange Netflow registered around 970 million on that date, suggesting that the observed transfer, which coincided with the surge in volume, involved tokens moving out of exchanges.

However, the situation has since evolved, and the current update reveals a reversal in this trend. The Exchange Netflow has turned positive, noting around 163 million in inflows. It’s crucial to note that the direction of SHIB’s flow also notably impacts the price trend.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage