Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price is down around 1% in the last 24 hours to trade for $37,077 as of 5:20 AM EST.

Trading volume is up 11% amid surging BTC inflows as investors continue to anticipate exchange-traded fund (ETF) approvals.

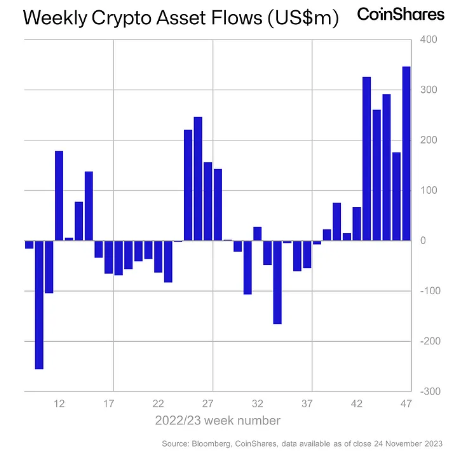

Based on data by CoinShares, digital asset investment products saw inflows totaling $346m last week. This marked the largest weekly inflows in a nine-consecutive week run.

For Bitcoin, inflows totaled $312 million last week, with short-sellers actively capitulating. This brought year-to-date inflows to just over $1.5 billion, marking the largest run since the bull market that began in late 2021.

CoinShares attributes the surge to anticipation for spot BTC ETF approvals in the US, with the combination of price surges and inflows pushing up total assets under management (AUM) to $45.3bn. Notably, this is the highest AUM in more than 1.5 years.

Up to 87% of these total inflows were attributed to Canada and Germany, with the US continuously recording low participation, with only $30 million in inflows last week. CoinShares believes this is because investors have shifted attention to waiting for the ETF launch.

Bitcoin Price Prognosis As BTC Holders Anticipate Spot BTC ETF Approvals

Bitcoin price remains bullish despite consolidation under the $38,008 resistance level. The trajectory of the Exponential Moving Averages (EMAs), tilting north, shows this is the path with the least resistance.

Also, with the Relative Strength Index (RSI) still above the 50 level and the Awesome Oscillator (AO) in the positive zone, the odds continue to favor the bulls.

Therefore, increased buying pressure above current levels could see Bitcoin price shatter the $38,008 resistance level, potentially extending north to test the $38,414 range high. In a highly bullish case, Bitcoin price could hit the enviable $40,000 psychological level. Such a move would constitute a 7% climb above current levels.

On the other hand, if profit-taking abounds over buying momentum, Bitcoin’s price could be extended to test the $35,487 support. Further south, the fall could send BTC to the support confluence between the 50-day EMA and the horizontal line at $33,912.

However, Bitcoin price must record a daily candlestick close below $31,480 to invalidate the bullish thesis. This is critical support, marking the barricade for multiple equal highs. A break and close below it could send BTC to the depths of the 100- and 200-day EMA at $30,225 and $29,374, respectively.

In a dire case, Bitcoin’s price could extend the cliff to collect buy-side liquidity under the $25,133 support level. Such a move would constitute a 30% fall below current levels.

Notice the RSI is inclined south despite its position above the 50 level, suggesting momentum is falling. The AO histogram bars are also edging towards the midline, pointing to the bears actively gaining ground. This adds credence to the bearish thesis.

With Bitcoin price eyeing the $40,000 psychological level, forward-thinking investors are already front-running spot Bitcoin ETFs with the Bitcoin ETF Token project.

The #BTCETF #Token stands as more than a typical #DigitalCurrency; it's a forward-thinking initiative shaping the future of #Bitcoin ETFs. 🌟

Leveraging #Ethereum, #BitcoinETF foresees and embraces this forthcoming evolution, presenting exclusive advantages to its user base. pic.twitter.com/inReCyJ3Ax

— BTCETF_Token (@BTCETF_Token) November 28, 2023

Promising Alternative To Bitcoin

Bitcoin ETF Token presents the most promising alternative to Bitcoin, rewarding investors even as investors continue to anticipate spot Bitcoin ETF approvals. It is among the five best crypto ICOs to buy in 2023, with experts anticipating 10X growth potential at launch.

Featuring among the five best crypto ICOs with high upside potential now is the time to buy BTCETF in the presale with the price at a discounted $0.006. Presale collections have reached $1.910 million as of 6:30 AM EST.

Busy weekend in #Crypto!🚀 @VivekGRamaswamy plans to make #Bitcoin a key topic in the upcoming Republican debates. @KyberNetwork recovers $4.67M from exploit and #GBTC's discount hits a two-year low. #BitcoinETF has also reached another great milestone, raising over $1.8M! pic.twitter.com/yuG72U2fmT

— BTCETF_Token (@BTCETF_Token) November 27, 2023

The project acknowledges how spot Bjtcoin ETFs have influenced the market, noting that “community excitement for a spot Bitcoin ETF drove the largest net inflows into crypto funds this year.”

Community excitement for a spot #BitcoinETF drove the largest net inflows into #Crypto funds this year.$BTC dominates, while $ETH sees a sentiment turnaround.

🚀 How do you think the anticipation for a #Bitcoin #ETF launch is affecting the crypto market's dynamics? 🤔

— BTCETF_Token (@BTCETF_Token) November 27, 2023

With stage six already in session, the project advertises a 5% burn tax for every transaction, intended to reduce the supply of BTCETF tokens in the market.

#BitcoinETF incorporates a 5% burn tax on every transaction, leading to a gradual reduction in the #Token supply as time progresses.

The plan is to burn 25% of the tokens as specific milestones are achieved aiming to alleviate selling pressure. 🚀 pic.twitter.com/odZwrPDn0D

— BTCETF_Token (@BTCETF_Token) November 27, 2023

The project aims to burn 25% of the tokens as specific milestones are achieved to prevent selling pressure. With leading multinationals such as BlackRock reinforcing the imminent arrival of Bitcoin ETFs, the BTCETF token puts you on the stage for when regulatory approvals finally come in.

Once approved, these ETFs are expected to rake billions of dollars into the crypto world.

🌐Leading multinationals like @BlackRock reinforce the imminent arrival of #Bitcoin ETFs, setting the stage for regulatory approvals.

Once approved, these #ETFs might pour billions into the #Crypto world.

What do you think will happen when the first #BitcoinETF is approved?🌎 pic.twitter.com/vUZ4RGtd5w

— BTCETF_Token (@BTCETF_Token) November 25, 2023

Do not be left behind once all this euphoria finally materializes. Visit the Bitcoin ETF Token website to buy BTCETF in the presale here.

Also Read:

- How To Buy Bitcoin ETF Token – BTCETF Presale Review

- No BS Crypto Reviews Top ICOs to Invest in Before the Next Bull Run

- 5 Best Crypto ICOs To Buy In 2023 – Next Altcoins Set To Explode

- Top 3 New Crypto ICOs To Buy Right Now – Altcoins With High Upside Potential

- Cilinix Crypto Provides Update on New Bitcoin ETF-Inspired Crypto ICO – Should You Still Buy $BTCETF?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage