Join Our Telegram channel to stay up to date on breaking news coverage

A recently released report from Santiment revealed a significant accumulation trend among wallets holding between 10,000 to 100 million Curve Finance (CRV) tokens.

This new revelation may have the potential to amplify the already existing buying pressure for CRV, thereby contributing to its upward trajectory, analysts state.

Whales Now Hold 41% of the Total Token Supply

CRV whales, who have historically held a significant portion of the tokens, have capitalized on the recent price dip to increase their CRV holdings even further. In a mere span of a few weeks, their collective ownership has surged from 33% to an impressive 41% of the total supply.

Despite a considerable price drop since February, with CRV plummeting from around $1.2 to the current $0.58 range marked by intermittent fluctuations, major token holders remained unfazed. Santiment’s report sheds light on the intriguing dynamics of this unusual activity.

While it might raise concerns of undue whale control, it’s worth noting the positive aspect of robust development activity on CRV’s GitHub repository. An average of 10-14 substantial GitHub submissions per day indicates a healthy level of engagement.

As of the present, CRV’s market capitalization exceeds $505 million, with approximately 10% of this figure being traded within the last 24 hours. CRV functions as the native token for the Curve DAO, a prominent governance system in the current crypto landscape. Facilitated by the Ethereum-based creation tool Aragon, the DAO interconnects multiple smart contracts, which collectively manage users’ deposited liquidity.

Therefore, it becomes apparent that although there might be a temporary pause in buying activity, ongoing support from the community will play a pivotal role in driving the continued expansion of the native token and the broader ecosystem.

Price May Dump in the Upcoming Weeks

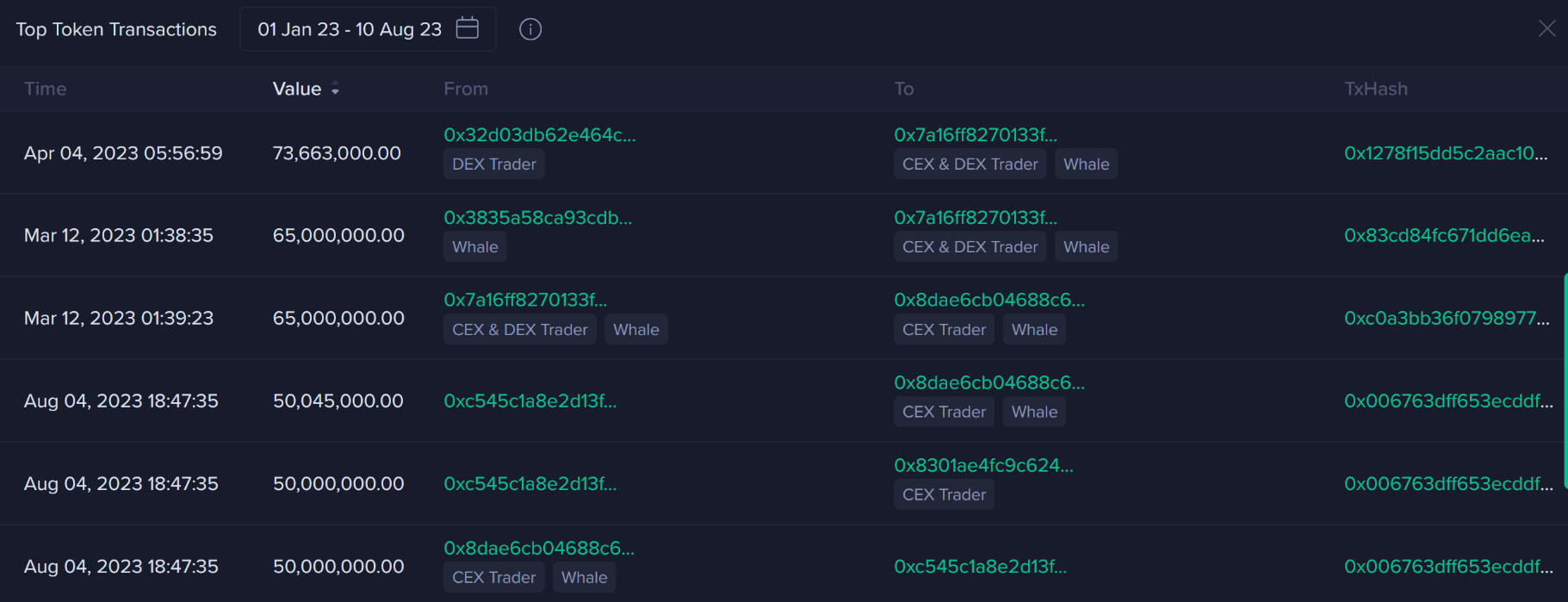

The accumulation of the CRV token by whales might not bode well for the ecosystem, as highlighted in the report. Santiment cautioned that the potential for CRV dumping remains a concern, especially given the recent attention drawn to news and ongoing activities within the blockchain. In fact, over the past week, there were five substantial transactions totalling more than $10 million.

Notably, two of these transactions occurred between exchange addresses, a signal that further dumping might be on the horizon. Curve Finance has been mired in controversy, particularly since Michael Egorov’s involvement in securing a $100 million stablecoin loan using CRV tokens as collateral, which has led to legal actions against the project’s founder. While the repercussions of this event have already impacted CRV’s price, developments like this accumulation by whales could potentially contribute to additional price drops in the future.

Major Transactions were Made in August

Santiment also reported a noteworthy observation regarding the recent token transactions on Curve. Surprisingly, three out of the six most significant token transactions made throughout 2023 took place on August 4th, all synchronously.

Intriguingly, two of these five transactions were conducted between exchange addresses, hinting at the possibility of some selling pressure creeping in, despite the optimism conveyed by the previous chart trends.

In fact, this is not the first time in recent weeks that Curve found itself grappling with considerable selling pressure following a disconcerting revelation. An announcement from the team in July had emerged indicating a vulnerability within the ecosystem, with potential consequences for over $100 million worth of cryptocurrency. This unsettling situation was attributed to a “re-entrancy” bug embedded in Vyper, a pivotal programming language powering certain components of the Curve system.

A number of stablepools (alETH/msETH/pETH) using Vyper 0.2.15 have been exploited as a result of a malfunctioning reentrancy lock. We are assessing the situation and will update the community as things develop.

Other pools are safe. https://t.co/eWy2d3cDDj

— Curve Finance (@CurveFinance) July 30, 2023

Regrettably, this bug had already been exploited by malicious hackers, leading to the compromise of a substantial amount of funds. The network, however, swiftly swung into action to address and rectify the issue. Despite these efforts, the broader community voiced their apprehensions, manifesting through numerous comments and posts across various social media platforms.

The incident, coupled with the recent revelation of whale activity has surely served as a stark reminder for investors of the project to be mindful and updated about their investments as much as they can in this ongoing bear market.

Related News

- Curve DAO Receives $5 Million Funding From Binance Labs

- Curve Stablecoin Exchange Hit by $50 Million Cyber Attack Due to Vyper Vulnerability

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage