Join Our Telegram channel to stay up to date on breaking news coverage

Navigating Market Challenges: Ethereum’s Outlook Ahead

This Ethereum price forecast looks at how Ethereum’s price will change in 2023. Different factors like blockchain shifts, increased funding, regulatory improvements, and alternative technologies will be discussed. Graphs and charts will keep our audience engaged.

In 2021, Ethereum’s price moved up and down a lot. With its performance, it could have reached over $5,000 after starting at around $600. During the first quarter of 2022, Terra collapsed, resulting in the bear takeover.

The cryptocurrency Ethereum has a reputation for being less volatile than other cryptocurrencies. In May 2022, Ethereum led the crypto market with $4,380. As a result of China’s crackdown on cryptocurrencies, Ethereum’s price fell to $1,700, where it stabilized.

Bitcoin and Ethereum Approaching 9-Month High: Positive Signs for the Future

Ethereum’s momentum increased in the year’s second half despite the financial industry’s war. NFTs and DeFi are thriving, and cryptos’ not going anywhere. Ethereum has shown substantial gains despite increased crackdowns. Prices will hit lows in 2023 and quickly recover.

Ethereum’s performance is closely tied to Bitcoin’s, as both are nearing 9-month highs. The Ethereum 2.0 project has been developing since September 2022 and looks promising despite some setbacks.

Market Sentiment and Ethereum Prices: The Link You Need to Know

In recent years, cryptocurrency sentiment has played a significant role in influencing Ethereum prices. Ethereum tends to increase in value when the market is optimistic and down when it’s negative.

Ethereum has earned the nickname “average indicator” for the overall crypto market because of this pattern. Investor appetite and the crackdown on cryptocurrencies in 2021 determine market sentiment.

Ethereum hasn’t been directly targeted in the war on cryptos, but the general negative sentiment has occasionally affected its price. Furthermore, high gas fees have moderately affected Ethereum’s price. London Hard-Fork aims to fix this issue, but it’s still unclear how successful it will be in attracting long-term projects.

Ethereum’s Growth Shines Amid Global Challenges in Cryptocurrency Market

The coronavirus pandemic hurt the global economy, but the cryptocurrency market, including Ethereum, grew. The crypto market value rose from $750 billion to $2.9 trillion, and Ethereum’s market cap rose from $83 billion to $572 billion.

Crypto markets, including DeFi and GameFi/meme coins, have been volatile. However, Ethereum has been less volatile than these sectors. Because of this, Ethereum is known as the “market average indicator,” surpassing Bitcoin in terms of stability.

As a result, Ethereum has become a favorite among conservative investors looking for a more secure option.

During the pandemic, much cash poured into the financial markets, which fueled the crypto market. As central banks tighten their monetary policies, this trend will slow down in 2022.

DeFi’s Dominance: The Catalyst Behind Ethereum’s Surging Success

Decentralized finance (DeFi) is on the rise, thanks to the crypto market going mainstream. Global uncertainty has fueled the rapid expansion of DeFi despite attempts to stop it. Over $78 billion worth of capital has been deployed in various DeFi protocols.

DeFi relies heavily on Ethereum’s network, so this growth has greatly benefited Ethereum. A flourishing DeFi sector has boosted Ethereum’s ecosystem. Miners and speculators are attracted to cryptocurrencies, driving the market growth.

Ethereum 2.0: Transforming DeFi and Addressing Scalability Challenges

To address the limitations of its Layer 1 blockchain network, Ethereum is transitioning to Ethereum 2.0. DeFi transactions, while experiencing volume fluctuations, have contributed to scalability issues. In Ethereum 2.0, there’s a shift to the Power of Stake (PoS) consensus algorithm and sharding for Layer 2 payment channels.

Ethereum becomes more suitable for everyday retail transactions by improving transaction speed and scalability. While Ethereum 2.0 progresses, it’ll take a while to fully function. Ethereum’s scaling roadmap, including the graph protocol, is supposed to solve the network’s scaling problems.

Ethereum Statistics

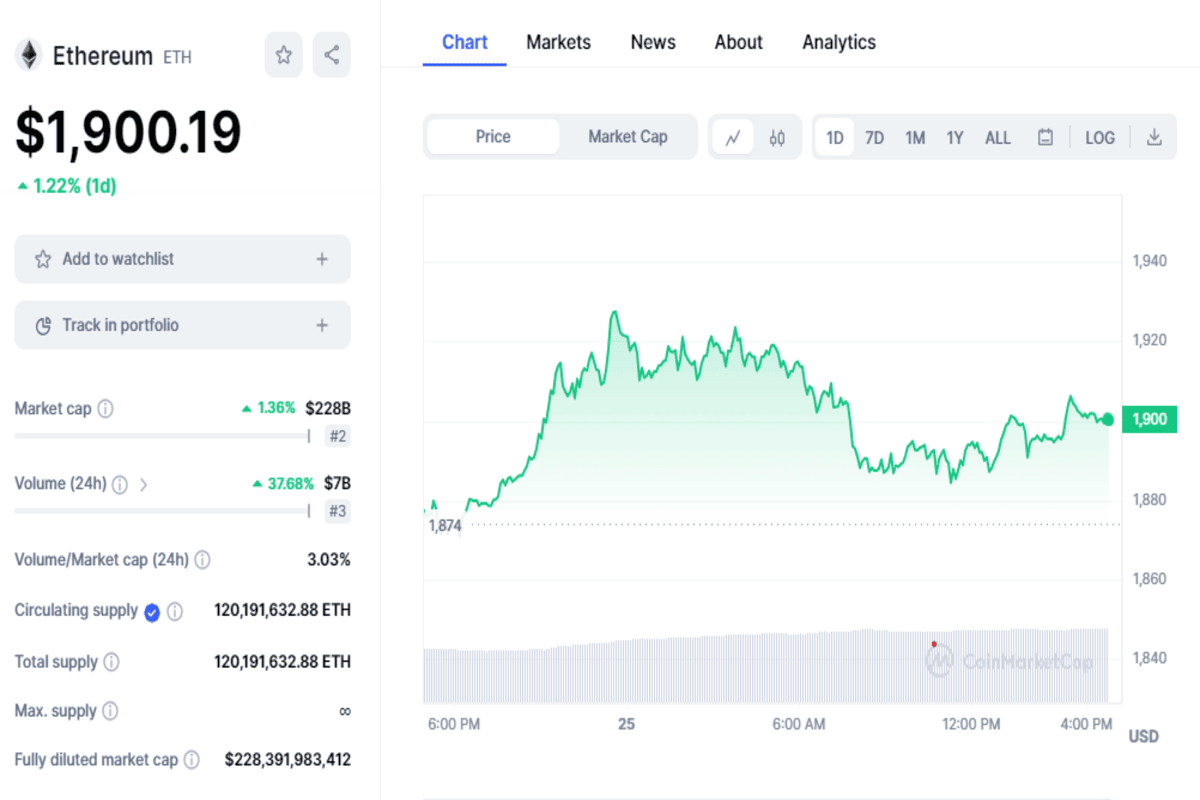

Ethereum (ETH) is currently priced at $1900 USD; its trading volume in the past 24 hours is $7 billion USD. The ETH to USD price is updated in real-time. Ethereum is up 1.22% in the last 24 hours. It’s ranked #2 on CoinMarketCap, with a market cap of $228 billion. ETH has a circulating supply of 120,191,632.88 coins and a maximum supply of 120,191,632.88 coins.

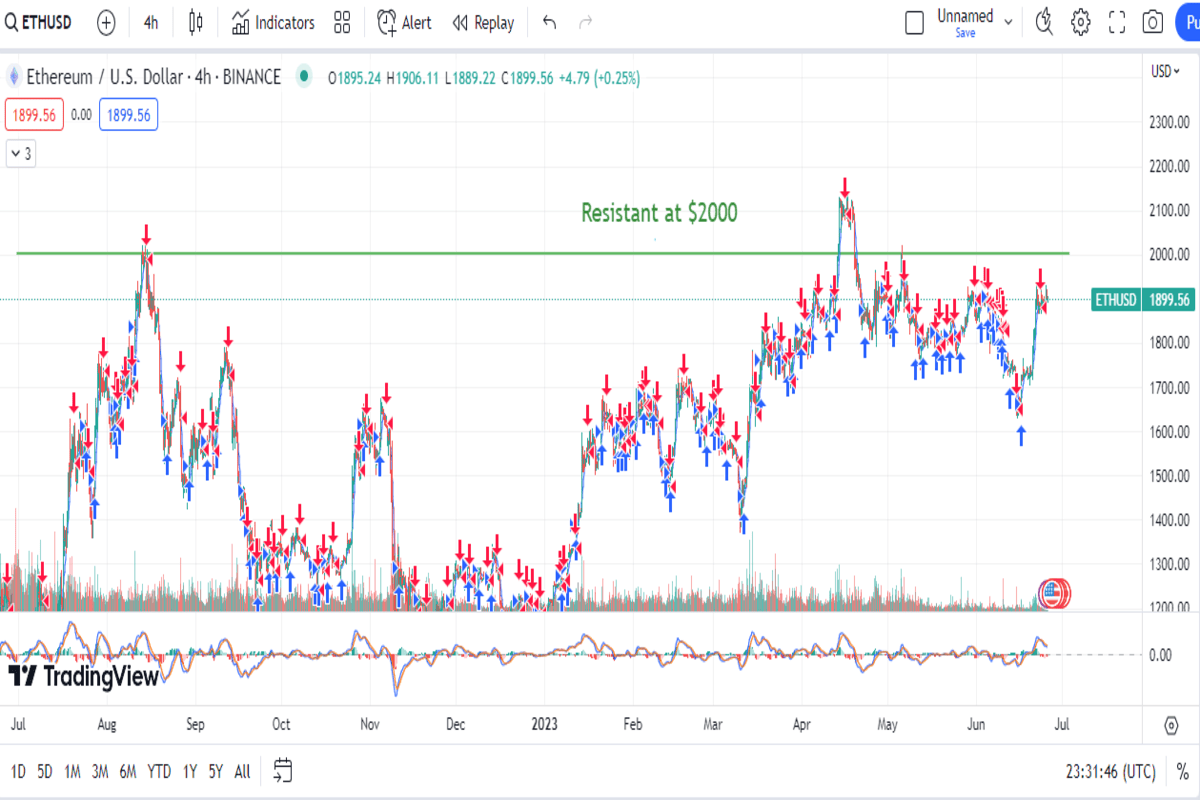

MACD Signals Point to Upward Trajectory for Ethereum Price

The Shapella upgrade helped Ethereum hold above $2,100 on Sunday. The price must close above this level daily to maintain an advantage over bearish moves.

Moving Average Convergence Divergence (MACD) signals an upward move for Ethereum.

The resistance at $2,000 is everyone’s focus right now. A break above this level could push Ethereum’s price to $2,400 or even higher.

Many investors are excited about the start of a bull market. During upward trends in the market, FOMO often creates momentum.

Will Ethereum Investors Witness a $5,000 Price Surge in 2023?

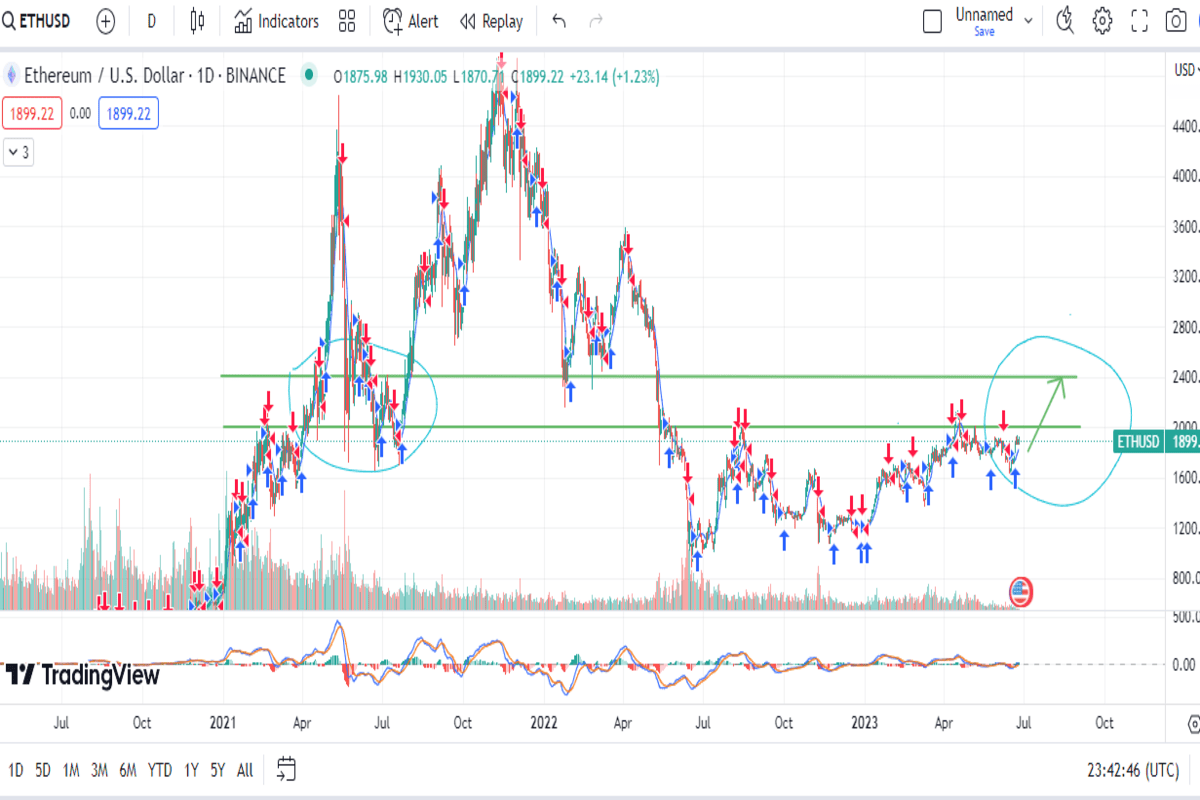

Ethereum’s price has been performing well this year, and it’s looking good. A break above $2,000 confirmed that a bull market is here.

The price of Bitcoin, Ethereum’s older sibling, has also surged, with the potential to hit $38,000 soon. When it comes to market momentum, Ethereum tends to follow Bitcoin.

For Ethereum’s price to reach $5,000, several things must happen. Ether needs to keep support at $2,000.

Although Shapella has upgraded, allowing stakers to withdraw tokens and rewards, there’s no guarantee. It’s essential for large investors to keep holding Ethereum and for demand to remain high. Regulatory developments will also influence Ethereum’s future in the industry.

Ecoterra: Eco-Friendly Crypto Project Raises $5.12M in Token Presale

Good news! Ecoterra is an innovative crypto project that cares about the environment. Ecoterra uses blockchain technology to encourage recycling and offset carbon emissions.

Recycling gets rewarded with $ECOTERRA, the company’s cryptocurrency. Reverse vending machines (RVMs) are available in countries with R2E apps. Ecoterra lets individuals and businesses offset their carbon footprints easily. On Ecoterra’s marketplace, businesses can buy recycled goods with $ECOTERRA or other cryptocurrencies.

Businesses and individuals can track their environmental impact with Ecoterra’s Impact Trackable Profile, powered by transparent blockchain technology. Companies that care about the environment will love this feature.

Ecoterra’s platform also adds value to $ECOTERRA. Members of $ECOTERRA get VIP access to real-world events and educational programs. Staking their tokens also earns them passive income, so they have another reason to hold on.

$ECOTERRA has a total supply of two billion tokens, 50% of which are allocated to presale investors. Tokens will be used for ecosystem liquidity, listings and marketing, corporate adoption, and team development.

Green Web3 experts recognize $ECOTERRA’s potential. Analysts predict a 100x increase by 2023. Once $ECOTERRA is listed on cryptocurrency exchanges, Crypto Bury believes its value will double, and analysts expect substantial growth.

Join Our Telegram channel to stay up to date on breaking news coverage