Join Our Telegram channel to stay up to date on breaking news coverage

The ongoing decline in the stablecoin market continues to persist, marking the 14th consecutive month of contraction and raising concerns about the outflow of capital from the cryptocurrency market.

In May, the value of stablecoins experienced a notable decrease, reaching its lowest level since September 2021. These figures were in a report by CCData, a digital asset data firm, where it mentioned the downward trend has persisted since March 2022.

Persistent Decline in Stablecoin Market Raises Concerns of Capital Outflow from Digital Assets

Stablecoins, a subset of cryptocurrencies, are designed to maintain a stable value by pegging themselves to external assets, predominantly the U.S. dollar.

Stablecoins are important for enabling cryptocurrency trading and connecting traditional government-issued currencies with blockchain-based markets. However, the decreasing stablecoin market has raised concerns among analysts, as it indicates a drop in liquidity within the crypto ecosystem.

Tom Dunleavy, a macro analyst, believes that “Stablecoins are the liquidity of the crypto ecosystem. The more liquidity, the more ability for investment and speculation,”

Despite the growing number of applications, the continuous reduction in stablecoin market capitalisation suggests that the crypto market is still grappling with the challenges of a long-lasting bear market.

Major financial institutions, such as JPMorgan and Goldman Sachs, have also highlighted the impact of the shrinking stablecoin market on cryptocurrency prices. JPMorgan’s report states that a sustained recovery in cryptocurrency prices is unlikely until the stablecoin market stabilizes.

Goldman Sachs sees the shrinking stablecoin market as a type of tightening in the crypto market, suggesting that there is less money available for trading and borrowing.

In addition to the decline in market capitalization, trading with stablecoins on centralized exchanges has also experienced a significant slump.

According to CCData’s report, trading volume with stablecoins plummeted by 40.6% this month, reaching its lowest monthly volume since December 2022. This decline in trading activity coincides with the stagnation of major crypto assets, which have struggled to break key support and resistance levels.

Amidst this overall market contraction, one stablecoin, TrueUSD (TUSD), has defied the trend and experienced growth in trading volume. TUSD’s trading volume has surged to $29 billion this month, surpassing struggling competitors like USDC and BUSD.

This remarkable performance can be attributed to Binance, the world’s leading crypto exchange, which has actively promoted TUSD by waiving trading fees for buying and selling Bitcoin with the stablecoin.

J.P. Morgan Analyst Expresses Concerns Over Crypto Market Recovery Amid Shrinking Stablecoin Ecosystem

In a recent correspondence to clients, J.P. Morgan analyst Nikolaos Panigirtzoglou shared apprehensions regarding the long-term viability of progress in the crypto market this year, emphasizing the need to address the declining stablecoin ecosystem.

Despite the notable 61% rise in Bitcoin and the 50% surge in Ethereum thus far, both digital currencies continue to remain considerably lower than their peak in November 2021, primarily attributed to increased regulatory scrutiny and high-profile bankruptcy cases.

Panigirtzoglou emphasized the significance of stablecoins, which are tied to reserve assets, as they serve as the equivalent of cash within the crypto ecosystem. These stablecoins, such as Tether and USD Coin, enable traders to transact in various cryptocurrencies without relying on traditional fiat currencies.

The J.P. Morgan analyst considered a bunch of factors to be responsible for the decline in the stablecoin market, including the regulatory crackdown on crypto in the United States, disruptions in banking networks supporting the crypto ecosystem, and the repercussions of the FTX collapse in the previous year.

Panigirtzoglou highlighted that the market capitalization of major stablecoins has decreased by nearly $60 billion since reaching a peak of $186 billion in May 2022, with a significant portion of the decline attributable to the Terra ecosystem collapse. Despite this, stablecoins have gained popularity rapidly, considering their market share was less than $30 billion at the beginning of 2021 and only around $5 billion at the start of 2020.

The expansion of the stablecoins, according to the note, serves as an indicator of the flow of money between the crypto ecosystem and traditional fiat currencies. Cryptocurrencies and stablecoins are interconnected in this regard.

Panigirtzoglou also raised concerns about the composition of stablecoin reserves, which increasingly consist of Treasury securities. In the event of a U.S. technical default, maintaining the pegs of stablecoins could become a significant challenge. Such a scenario could have far-reaching implications for the entire crypto ecosystem, as stablecoins play a vital role in facilitating trading, decentralized finance, and serving as collateral.

Panigirtzoglou’s analysis suggests that the stability and growth of the crypto market are closely tied to the stability of the stablecoin universe, making it essential to address the ongoing decline in stablecoin market capitalization.

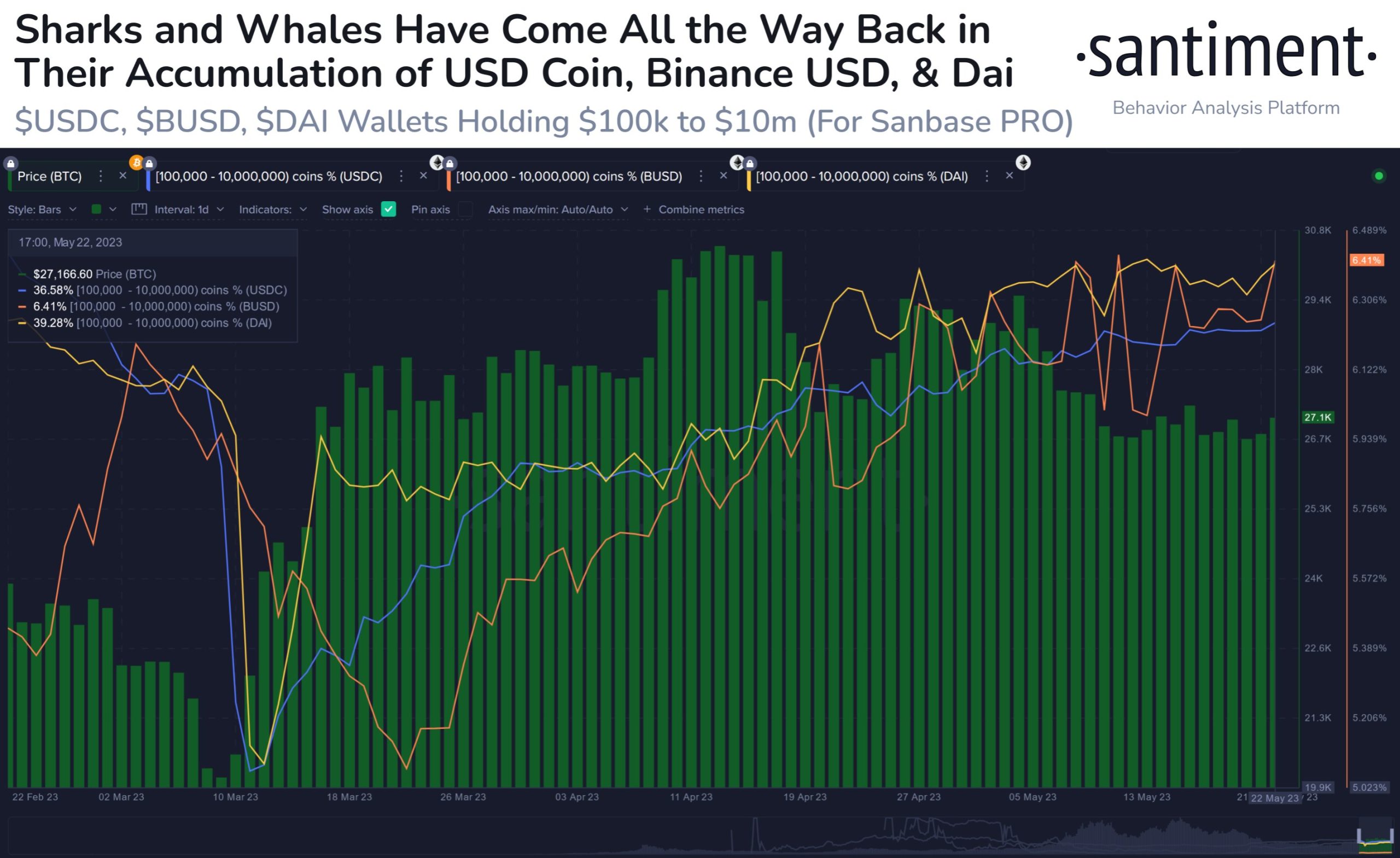

Sharks and Whales Accumulating Stablecoins – Bullish for Bitcoin?

A significant development has been observed in the cryptocurrency market, where sharks and whales are actively augmenting their holdings of major stablecoins such as USD Coin (USDC), Dai (DAI), and Binance USD (BUSD).

This insight comes from Santiment, an on-chain analytics firm that analyzed the “Supply Distribution” metric. This metric reveals the percentage of a cryptocurrency circulating supply held by different wallet groups.

One group of wallets that stands out is those holding between 100,000 and 10 million coins. Since these stablecoins are tied to the US dollar, this range translates to holdings worth $100,000 to $10 million. Considering the significant value involved, it’s likely that these wallets belong to the major investors known as sharks and whales.

The influence of these investor groups should not be underestimated, as their ability to transact large quantities of coins simultaneously can have a significant impact on the market.

Typically, investors turn to stablecoins to mitigate the volatility associated with assets like Bitcoin. Therefore, the accumulation of stablecoins by these major investors suggests a recent shift away from other assets in search of stability and predictability.

These investors may convert stablecoins back into volatile assets like Bitcoin when they see favourable market conditions. The accumulated reserves of stablecoins held by sharks and whales could be a catalyst for injecting capital into the Bitcoin market, making it an interesting trend to watch.

Related Articles

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage