Join Our Telegram channel to stay up to date on breaking news coverage

Aave (AAVE) price could have a not-so-good second quarter despite its remarkable performance during the first quarter. The insight comes after market intelligence platform Messari published a report concerning the overall performance of Aave in Q1 2023.

AAVE Q1 Performance Overview

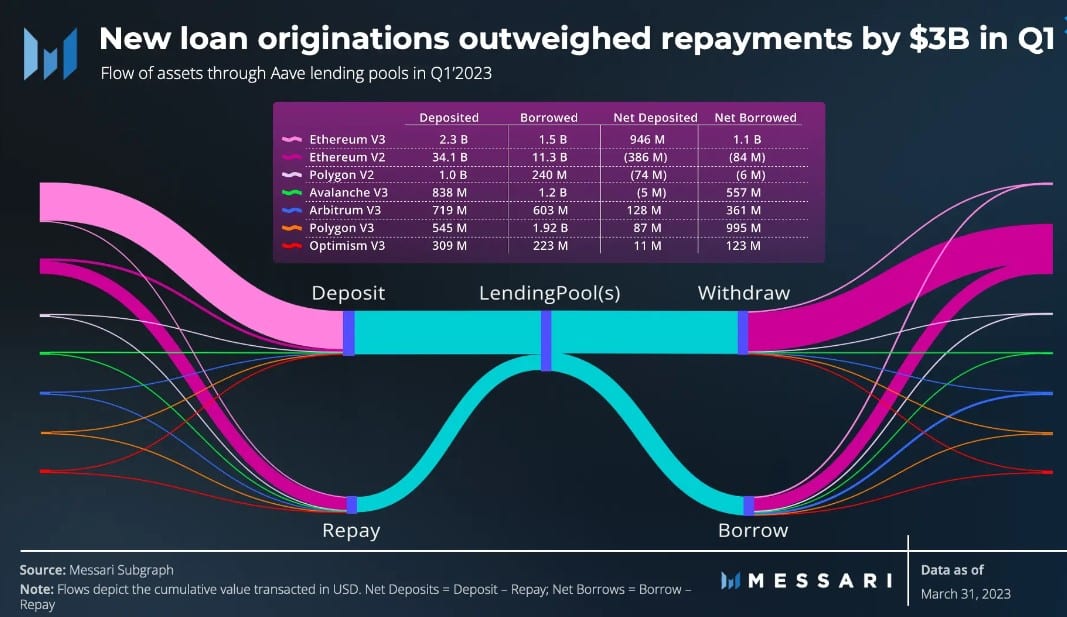

In the report, Messari details the most significant updates in the Aave protocol, citing the launch of Aave v3 on Ethereum (ETH). Post-launch, the new market surpassed $1 billion in value deposited and closed the quarter with $350 million in outstanding loans.

.@PortKey256's State of @aaveaave Q1 23' report ⬇️

+Value supplied on Aave increased 40% QoQ

+Launched V3 market on @Ethereum & @arbitrum — Arbitrum deployment saw 305% growth in outstanding loans

+V3 Governance & GHO Initial Parameters releasedFREE report 🔗 in next tweet👇 pic.twitter.com/2ZRqvTgslp

— Messari (@MessariCrypto) April 24, 2023

Further adding weight to the above information, the asset flows for the Arbitrum deployment increased by a significant margin. This caused outstanding loans to increase from $21 million to $83 million, marking an uptick of around 305%.

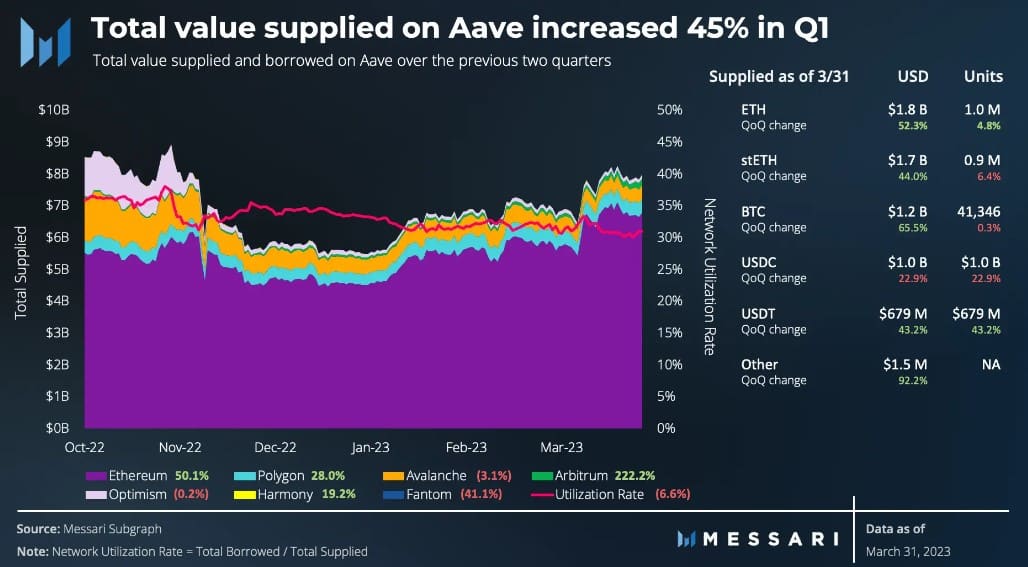

The report also reveals the Aave protocol’s performance on network value metrics, noting that the value supplied on Aave soared by 45% in the first quarter. The upscale took place amid increasing regulatory pressure. Moreover, with the network’s market share of deposits increasing from 42% to 50%, Ethereum and its staking derivatives remained the primary collateral source on the Aave protocol.

On revenue metrics, Aave’s interest revenues during the first quarter were on course to be within 1% of the fourth quarter (Q4) earnings. Nevertheless, things did not go as planned following the USDC de-pegging incident. After three days of growing activity, the decentralized autonomous organization (DAO) earned $305,000 in interest income.

Aave Protocol Not At Its Best

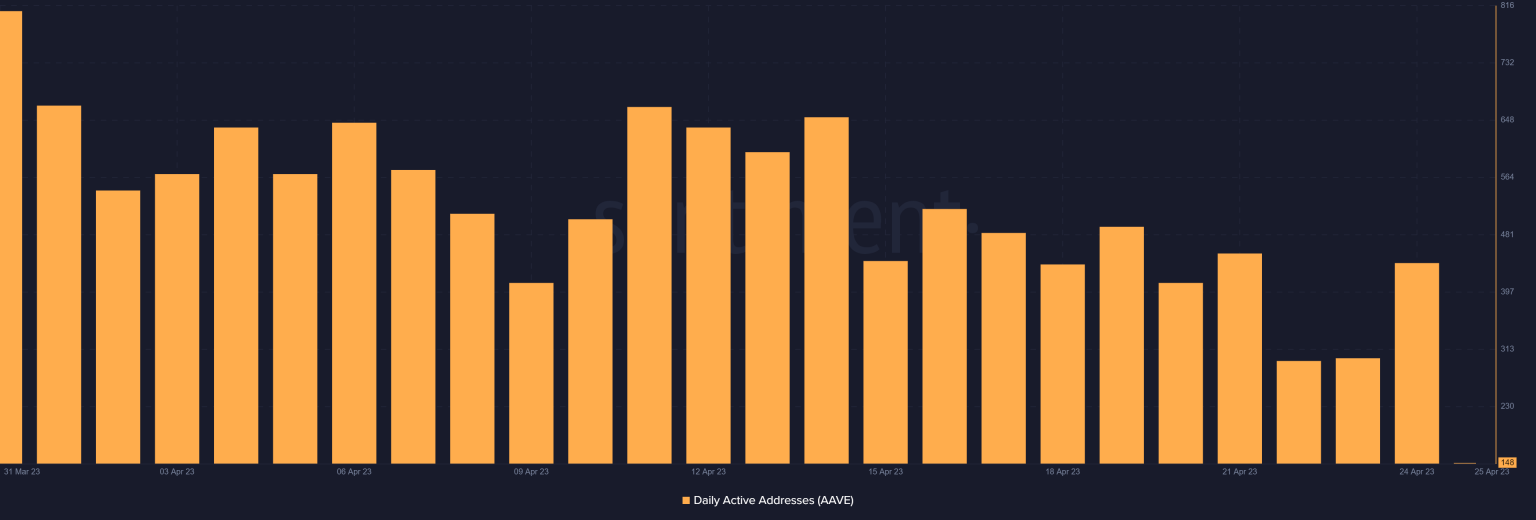

Not everything is in favor of the Aave protocol as of the time of this writing, considering the network’s usage recorded a stark decline in Q1. For example, its daily active users plunged 34% in the last quarter, a worrying outcome. Nevertheless, the most notable drops occurred on Optimism V3, which recorded a 59% reduction. Polygon V3 also fared badly, with a 50% drop.

It is worth mentioning that a similar trend extended into Q2, with Santiment data showing that Aave’s daily active addresses have been on a steady decline since the onset of April 2023.

State Of The Protocol In Q2 Of 2023

A look into the second quarter of the Aave protocol in 2023 shows that the first few weeks of Q2 have not been very attractive to the protocol. Several on-chain metrics support this thesis.

For starters, the weighted sentiment for the AAVE token remains fairly low, indicating that the dominating sentiment in the market is negative. Moreover, the altcoin’s Market Value to Realized Value (MVRV) Ratio also dropped by a significant margin. Notably, this is attributed to the price action the altcoin displayed.

Investor Interest In The AAVE Token Could Be Diminishing

The supply held by top addresses has declined considerably over the last few days, an outcome that is concerning as it suggests whales are losing trust in the token. Moreover, looking at the seven-day average, net deposits on exchanges were high compared to the seven-day average, suggesting a rise in overall seller momentum.

Conversely, the total amount of token holders have soared, with AAVE exchanging hands for $73.72 at the time of writing. Notably, this is down 10% in the last week and down 7% in the last fortnight.

Join Our Telegram channel to stay up to date on breaking news coverage