Join Our Telegram channel to stay up to date on breaking news coverage

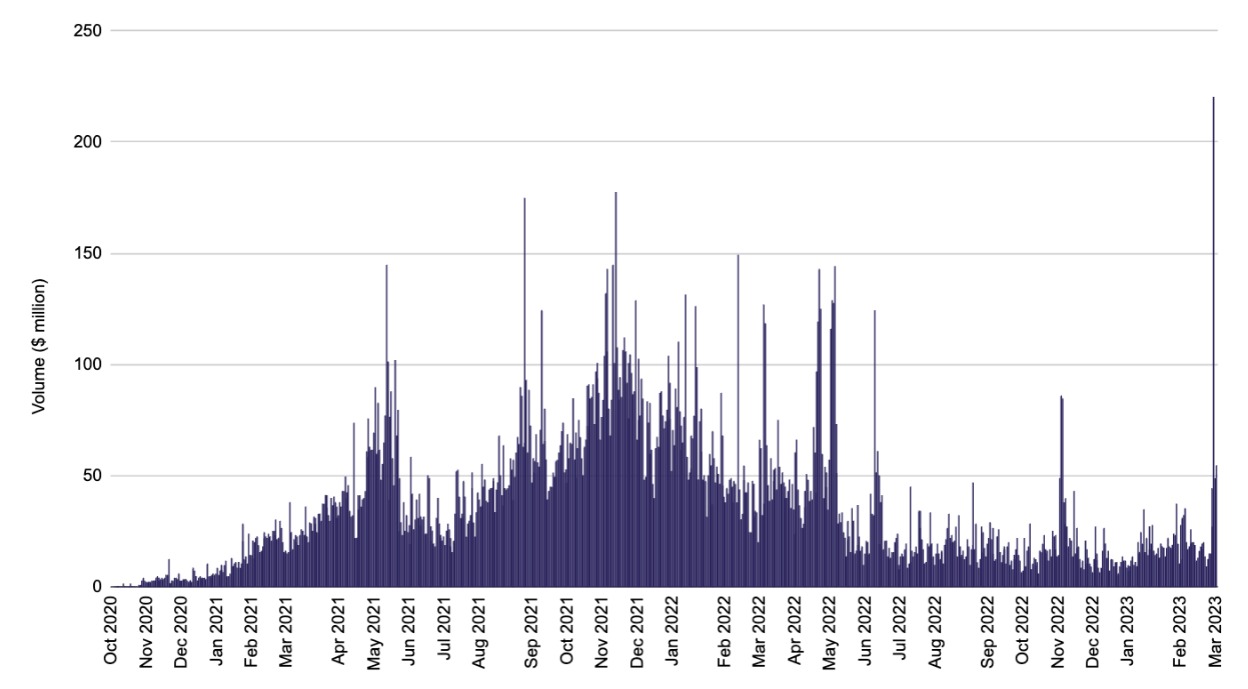

Metamask, a popular web3 wallet provider, witnessed a surge in swap volume over the weekend, attributed to the collapse of major crypto-friendly banks Silvergate and Signature.

The uncertainty surrounding the bank closures caused speculative panic among investors, leading to significant transactions as people searched for stability. According to Dan Finlay, Metamask group manager, people responded by making substantial moves, unsure of what they could trust. Finlay’s remarks were made during an upcoming episode of The Scoop podcast with Frank Chaparro.

Circle, the issuer of USDC stablecoin, announced on Friday that it had $3.3 billion in reserves held at Silicon Valley Bank, which state regulators shut down on the same day. As a result, many people became concerned that their stablecoins might lose value, causing a drop in prices. The value of DAI also dropped since it relies heavily on USDC as its backing. However, regulators confirmed on Sunday that any deposits would be complete.

According to Finlay, the CEO of Metamask, the company made approximately $1.5 million in swap fees because of the recent spike in volume. He also noted that as people are onboarding and fleeing to crypto in various situations, this is a positive trend for the industry. Even during systemic shocks, people look at cryptocurrencies and realize their potential.

Thus, while some systemic risks may be involved, the current situation could also be seen as “extremely good” for the crypto market. It’s a strangely mixed blessing.

Crypto and Financial Markets Surge in the Wake of Bank Crisis

Following the recent collapse of two major banks, the prices of cryptocurrencies have surged. Bitcoin and Ethereum experienced significant gains in response to growing concerns about the banking system’s stability. On Tuesday, Bitcoin soared to an impressive $26,400, marking a remarkable 34% increase from its pre-SVB collapse level on Friday. Similarly, Ethereum saw a surge in value, reaching $1,780 earlier in the day, representing a 29% increase from its low point on Friday.

The financial markets responded positively to these recent developments, as seen in the surge of futures tied to The Dow Jones Industrial Average that ended the trading day at 31,819.14, down 0.28% or 90.50 points. After a tumultuous trading day, the S&P 500 index concluded at 3,855.76, declining 0.15% following a drop of 1.37% at one stage. Meanwhile, the Nasdaq Composite finished 0.45% higher, reaching 11,188.84 points.

On Friday, regulators took over Silicon Valley Bank (SVB), a startup lending institution, in the most significant U.S. bank failure since the 2008 financial crisis. SVB had suffered significant losses because of the Federal Reserve’s interest rate hikes and a surge of depositors attempting to withdraw their funds.

In response, SVB was forced to sell investments at a significant loss, which triggered panic among other depositors who also began withdrawing their money. This panic resulted in the closure of another institution, Signature Bank, and a drop in regional bank stocks on Monday morning. Despite this, the Federal Deposit Insurance Corporation (FDIC) reassured depositors that their funds were secure.

Over the weekend, banking regulators developed a plan to protect depositors with funds in Silicon Valley Bank (SVB), which was on the brink of collapse. This move was crucial in preventing a potential panic in the financial system. Depositors at Signature Bank in New York, which was also shut down because of concerns about systemic contagion, will have complete access to their funds. Signature Bank was a significant funding source for cryptocurrency firms. These actions were among several measures approved by officials to address the situation.

More News:

Shareholders Sue Silicon Valley Bank For Fraud

How Binance CEO Changpeng Zhao Is Picking Winners And Losers In Stablecoins Like BUSD, TUSD

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage