Join Our Telegram channel to stay up to date on breaking news coverage

Are you looking for Graph crypto price predictions for the upcoming weeks? Your search ends here. This article will cover the best GRT price predictions and forecasts. Find out what experts think about this digital coin’s future performance and value for the foreseeable future.

As the DeFi market evolved, the Graph (GRT) became one of the most crucial tools. Currently, it’s one of the top cryptocurrencies. How far is The Graph expected to go? As a sought-after cryptocurrency, here’s Graph’s price prediction.

Price Prediction Data for the GRT

In the last 24 hours, Graph has traded $3.029M at $0.156. Over the previous 24 hours, the Graph has dropped 8.51%. With a live market cap of $1,395,903,063, Graph (GRT) is currently ranked #40 on CoinMarketCap. The circulating supply is 8,784,171,248 GRT coins, and the maximum supply is 8,784,171,248 GRT coins.

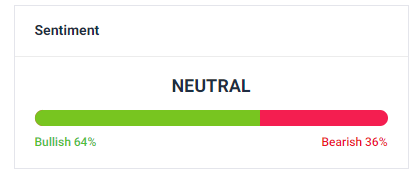

By February 15, 2023, we expect the value of The Graph to rise by 22.97% and reach $0.195. The Fear & Greed Index currently shows 48 (Neutral), showing a Neutral sentiment according to our technical indicators.

According to crypto experts, the average GRT rate in February 2023 might be $0.189 based on the price fluctuations of The Graph at the beginning of 2023. Prices are expected to be $0.179 at the minimum and $0.199 at the maximum, respectively.

Trading costs in March might be as low as $0.189, while they might reach as high as $0.209. According to average estimates, The Graph may be valued at $0.199. A total of 18 technical analysis indicators signal bullish signals from February 10, 2023, and 10 bearish signals.

How Do You Use the Graph?

With The Graph indexing all blockchain data, you can see what’s happening in the crypto market. The network’s expansion will make it a more helpful tool for market analysis.

DeFi protocols require the Graph to index cryptocurrencies as part of their services. Cryptocurrency price tracking is the most common requirement.

Graph’s method is supposedly quicker and safer because of its decentralized nature. This means that it validates its data across multiple sources and that attackers cannot modify its APIs.

Graph Network users play four primary roles:

- Indexers: Stakeholders/node operators.

- Curators: Members who suggest APIs for indexing to Indexers.

- Delegators: They can delegate their GRT tokens to Indexers to earn fees.

- Consumers: Query subgraphs by paying GRT fees to Curators and Delegators.

How does The Graph gain trust?

The Graph focuses on speed as its primary benefit. Ultimately, a decentralized platform adds up to the scientific algorithm of safety combined with speed, resulting in the masses trusting it.

Before investing, you might want to check the previous month’s performance or the security features of the Graph on its official website.

GRT Tokens: Where Can I Trade Them?

Several major exchanges, including Huobi Global, Coinbase, Binance, Kraken, and many more, support GRT tokens. Based on ongoing developments, investors can also access The Graph’s block rewards program in the cryptocurrency market, which is easily accessible.

It is essential to do your research before making an investment decision.

In the end, you must determine this for yourself. Research is essential before you invest because prices can go up or down, so you should never risk more than you can afford to lose.

Related News

Kraken Exchange Review – Coins, Fees & Features

Binance Alternatives – 9 Better Platforms

10+ Best DeFi Coins to Buy 2023 – Top List

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage