Join Our Telegram channel to stay up to date on breaking news coverage

GMX price has had a drabish start to the year trading in a sideways price action since January 1. However, the decentralized exchange (DEX) token has displayed strength over the last couple of days rising as much as 14% from $40 to hit highs of $45.67 on Tuesday. So, what is the forecast for GMX in the near term?

GMX Multi-Asset Pool Hits the $1M Deposit Capacity

GMX is a DEX supporting spot and perpetual exchange services with low fees and zero price impact trades. Trading on the protocol is supported by a unique Multi-asset pool (GLP) that earns liquidity providers fees from market making, leverage trading, swap fees, and asset rebasing.

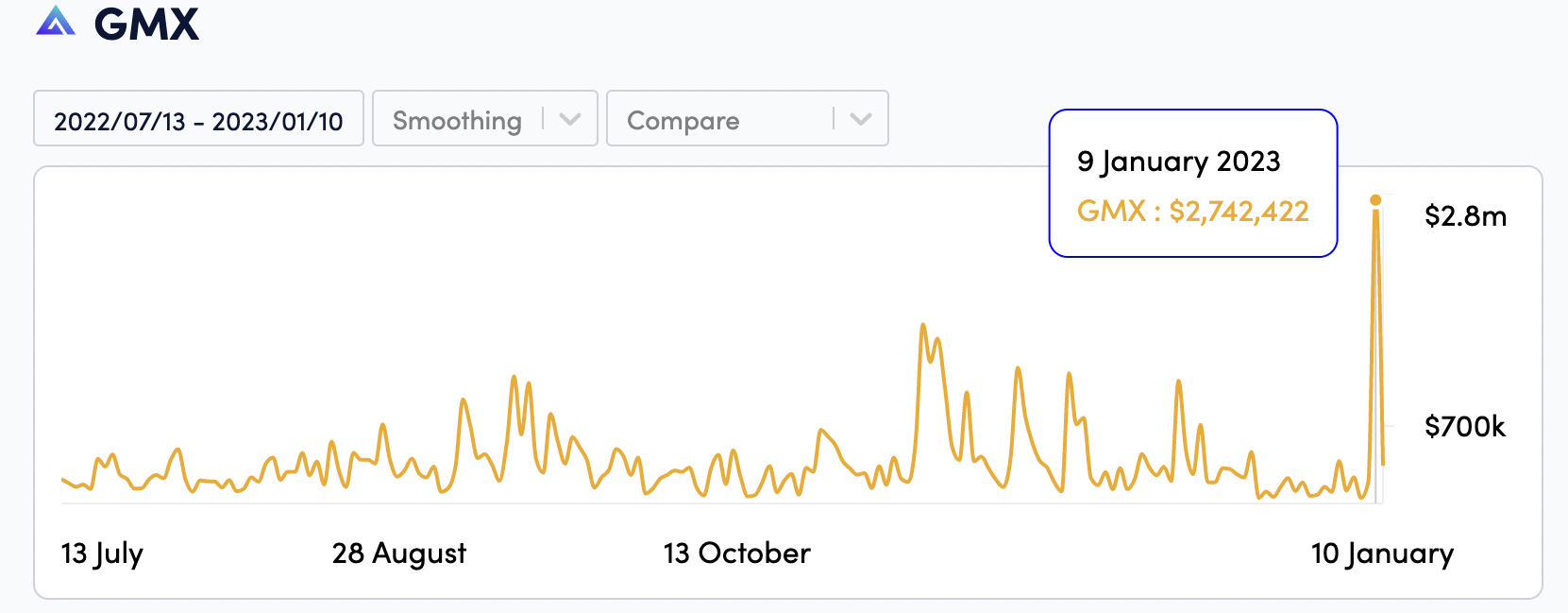

GMX has sparked user interest which has caused fees in the ecosystem to spike. Data from CoinFees shows that the GMX protocol generated about $2.7 million in fees on January 9. That was more than 10 times the amount of fees generated the day before. This is the highest level the GMX price has reached since November last year.

GMX Trading Fees

Also note that the total fees generated on the GMX dex has surpassed $100 million, affirming the growing popularity of the DEX in the recent past.

Congratulations to @GMX_IO for surpassing $100M on total fees! 🥳🥳🎉 pic.twitter.com/hnKzsI3TBR

— Arbitrum Core (💙,🧡) (@arbitrumcore) January 6, 2023

A careful analysis of the GMX ecosystem gives reasons why there has been a spike in the protocol’s fees. For example, the data shows that the total deposits by Yeti Finance on GMX’s GLP pool have hit the $1 million mark.

@GMX_IO GLP has hit the $1M deposit capacity 🔺

Yeti Finance remains one of the best protocols to borrow against high demand and diverse collaterals (BTC.B, Aave/BENQI supplied assets, JOE) on #Avalanche. pic.twitter.com/2MjrT6OYMD

— Yeti Finance 🔺 (@YetiFinance) January 9, 2023

This points to increasing user interest in the network. More investors are choosing to use DEXs for their trades particularly, after the collapse of the giant crypto exchange FTX led to reduced investor confidence in centralized exchanges.

As such, as more people turn to GMX, revenues in terms of fees will continue to increase, in turn increasing the value of the GMX token.

GMX Price Bulls Face A Difficult Task Ahead

At the time of writing, GMX teetered at $44 and was trading within a significant supply zone. This is the resistance area stretching from $48 to $43.9. Note that supplier congestion from this area saw the DEX token drop 20% between December 26 and January 3. Similarly, supply pressure from the same region occasioned a sell-off that saw the price drop 15% between November 26 and 29.

As such, bulls have to overcome headwinds from this area in order to secure an uptrend. For this to happen, the GMX price must rise above the 50-day Simple Moving Average (SMA) at $46.5 to confront resistance from the upper limit of the supply zone at $48.

Breaching this zone will open the way for the bulls to collect the liquidity above it as GMX makes a run for the $60 range high. Such a move would represent a 36.4% uptick from the current price.

GMX/USD Daily Chart

Supporting GMX’s positive outlook was the Parabolic SAR which was still positive after turning bullish and moving below the price on January 7. Two days later, the moving average convergence divergence (MACD) indicator sent a call to buy GMX when the 12-day exponential moving average (EMA) crossed above the 26-day EMA suggesting the market had flipped in favor of the upside.

In addition, the RSI was positioned at 51 in the positive region. This suggested that there were slightly more buyers than sellers in the market. These indicators added credence to GMX’s bullish thesis.

On the downside, if the price turns away from the current levels to produce a daily candlestick close below the lower limit of the supply zone at 43, the bullish narrative will be invalidated. As such, the GMX price may retrace lower first toward the $40 psychological level and later the $37.72 swing low.

At the moment, GMX is still in a dicey position. However, as investors continue to look for gains, Fightout (FGHT) is a new coin presenting massive profitability opportunities.

Fight Out is a reliable move-to-earn platform that allows users to earn as they keep fit. It encourages users to lead fit and healthy lifestyles through a platform that tracks all users’ vitals and pays them for keeping fit. They can also access fitness sessions and enter a metaverse where they can work out, display their gains, and earn.

https://twitter.com/FightOut_/status/1612887151988903938?s=20&t=rCsfwPXCxnk767v0IcLYqA

FGHT is currently available on presale and has raised over $2.8 million so far.

Related News:

- These Crypto Coins are Expected to Pump 55x by 2024

- Biggest Crypto Gainers Today January 10 – APT, GALA, D2T, RIA, FGHT, TARO

- FightOut Presale Hits $2.5M, Announces Athlete Ambassadors – New Crypto Giveaway

- How to Buy Bitcoin

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage