Join Our Telegram channel to stay up to date on breaking news coverage

SkyBridge Capital boss and former White House communications director Anthony Scaramucci believes bitcoin’s value proposition has grown over the years. There are several reasons for this, chief of which is the entrance of institutions and government regulations.

Bitcoin the Perfect Hedge

Scaramucci made his thoughts known in an op-ed published on CNN along with SkyBridge’s COO Brett Messing. Scaramucci believes Bitcoin has become the perfect hedge against inflation.

As the government prints more money to stimulate the economy, there’s a massive fear of inflation. This is driving many investors into Bitcoin purchases. Scaramucci’s findings are not unfounded. The recent Global Fund Manager Survey revealed that Bitcoin had beaten golds and bonds and was now third in rankings of “most crowded trade.”

Bitcoin still has a long way to go to flip gold. Analysis from on-chain analytics resource CryptoQuant revealed that Bitcoin’s all-time high of $42,000 only took 2% of gold’s market cap, which stands at $10 trillion.

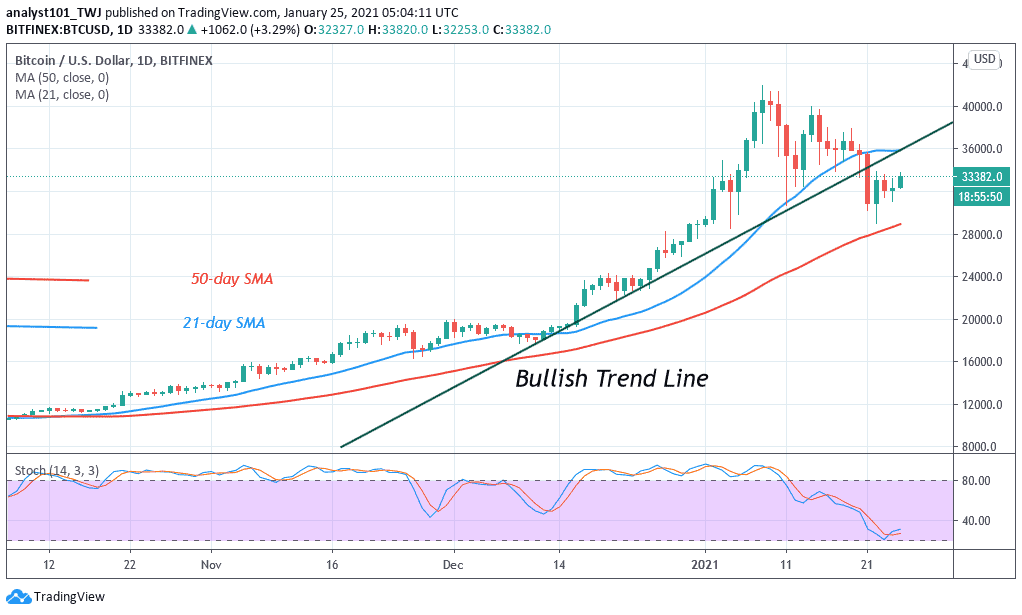

These numbers might seem low, but it shows progress. BTC’s market cap topped $1 trillion as the price eclipsed $410,000, before it settled to around $33,000 with a market cap north of $600 billion. As asset managers lose confidence in the dollar, they’re shifting their investment priorities to cryptocurrencies.

“At the same time, increased regulations, improved infrastructure and access to financial institutions — like Fidelity — that hold investors’ money have made bitcoin investments as safe as owning bonds and commodities like gold, which are also used to balance portfolios,” he notes.

Investors are now flocking to the cryptocurrency due to its infrastructure’s maturity coupled with increased regulations from the government.

Scaramucci referred to the forward-thinking decision of the Office of the Comptroller of Currency, which saw the bureau authorize banks in a milestone move to provide crypto custody services in July 2020. Major wall street veterans and large companies are also moving their treasuries into Bitcoin. Some popular examples include MicroStrategy, MassMutual, investment manager Ruffer, and Jack Dorsey’s Square.

Race to Bitcoin Mountain

Scaramucci’s SkyBridge is also not left out. The investment manager launched a Bitcoin Hedge Fund in December with $25 million of its funds. The Fund’s filing with the Securities and Exchange Commission (SEC) shows it was filed under the SEC’s Reg. D exemption. The agency’s Reg. D exemption opens up the investment only to accredited investors. The firm announced that its Bitcoin exposure was valued at $310 million at the time of launch.

The Fund charges a management fee of 75-basis point, but no incentive fee. Fidelity serves as the custodians for the assets, while Ernst & Young handles the audit. SkyBridge Capital joins a flurry of companies looking to help investors procure Bitcoin in North America. Other companies like Morgan Creek Capital and Mike Novogratz’s Galaxy Digital are also working on several bitcoin-related products targeted at institutional investors.

Join Our Telegram channel to stay up to date on breaking news coverage