Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin has caught a bug and it might be the coronavirus, but in an indirect sort of way.

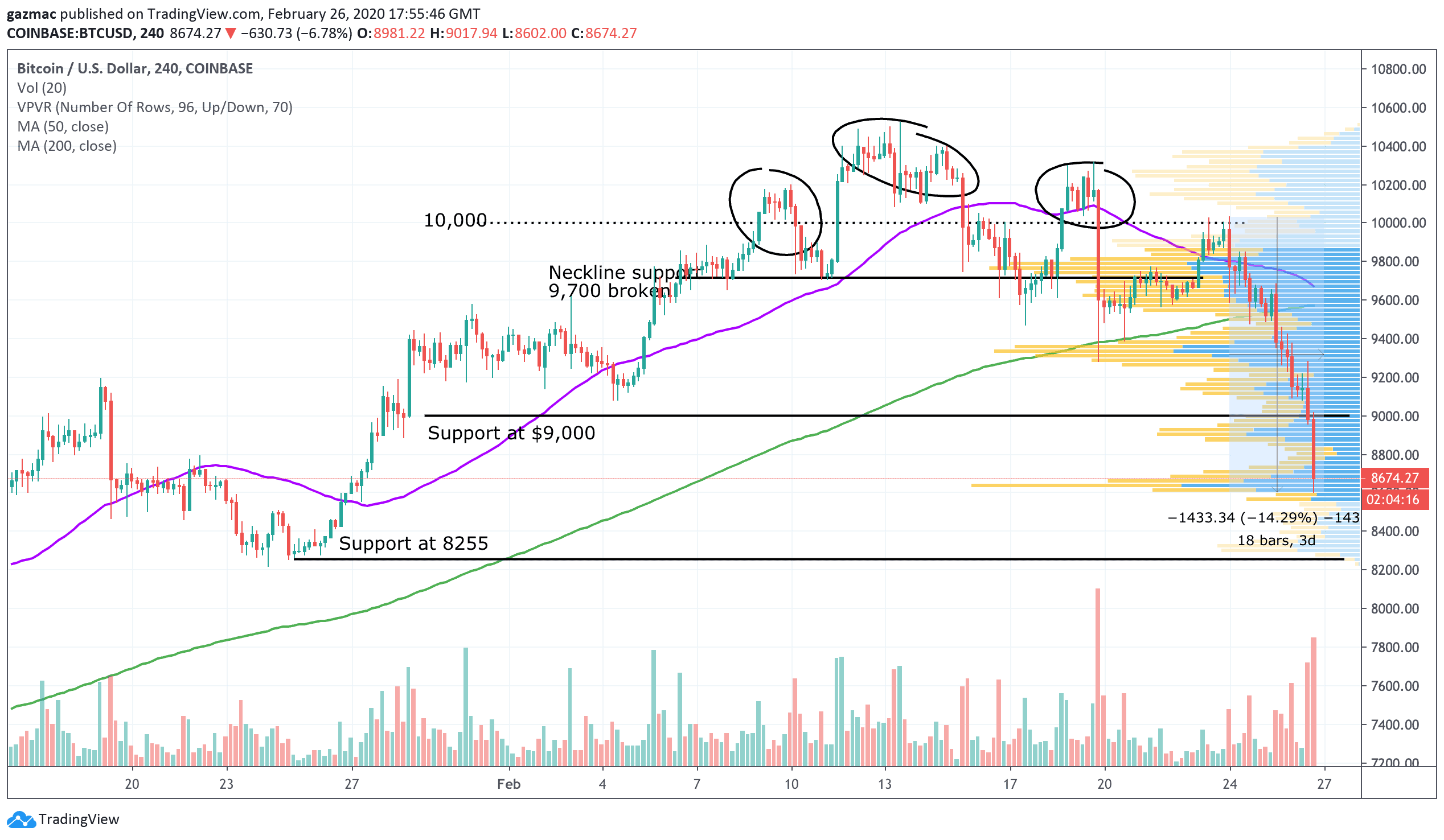

Aside from technical weakness brought on by failed attempts to hold above $10,000, those scratching their heads to explain the ferocity of the price collapse might do well to look to Wall Street.

The hammering of the stock markets as the prospect of a pandemic builds has pierced the bubble of complacency that had enveloped markets.

Two 1,000 point drops for the Dow has certainly got everyone’s attention, crypto holders included.

Blame it on the Dow?

With equity markets in free-fall, those market participants with a foot in the crypto space may have decided this was the time to unload. If that was the case, far from bitcoin being a safe haven, it was deemed to be a riskier asset, which in turn meant it was first out of the door.

If that is part of the story of the energetic pullback in crypto markets, then the converse may turn out to be true – when the equity markets stop bleeding then bitcoin might catch a bid too.

As I write, the Dow is trading 0.5% higher having given up its day high, so it is way too earlier to call the bottom on stocks. President Trump is due to do a presser on coronavirus at 6pm EST which may not provide the soothing balm some hope for.

But maybe the equity sell-off was a catalytic trigger as opposed to the fundamental driver so the correlation with equities is a fleeting affair?

Stocks-Bitcoin crossover

The connection between the equity markets is seen organically in the crossover between tech investors and bitcoin, as FundStrat’s Tom Lee shows in a tweet on 21 February focusing on millennials. Lee is making the case for the investing future featuring bitcoin, big time, but it is the crossover we are interested in:

#bitcoin a #millennial thing. @CharlesSchwab top 10 holdings:

Boomer + GenX + Millennials:$FB$BABA$AMZN$MSFT$BRKB

Millennial:$GBTC

Millennials inherit $68T next 20 years!!

see the future?@Yogita_Khatri5

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) February 21, 2020

Admittedly, that tweet was before the big sell-off in both equities and crypto.

But Lee’s tweet today further draws out the relationship between equities and bitcoin. He sees the back-to-back 3% drops in US equities as the set up for an improved risk/reward return but says this is also positive for crypto and bitcoin.

The short term not clear, but the back to back -3% days is setting up for very good risk/reward for equities in the next 3M, 6M and 12M out

This is also positive for #crypto #bitcoin#Coronavirus #COVID19 #BTFD$SPY $QQQ https://t.co/o2h2zlebbi

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) February 26, 2020

The risk/reward potential is in fact probably better for bitcoin at this juncture, but where is the BTC/USD bottom you ask – when to buy the dip?

Accumulate BTC

With bitcoin losing support at $9,000 and currently trading at $8,723, the next stop south is $8,250, which I expect bitcoin to hold. Indeed, accumulating at these levels with halving a little more than two months away should be profitable.

What happens to bitcoin if the stock markets continue to slide as coronavirus spreads?

Who knows, but the correlation of the past few days with equities should de-couple as buyers return for the halving. There’s a school of thought that has it that any price under $10,000 is good – it just depends on your investment horizon.

With $108 million worth of long positions liquidated on BitMex in the decline below $9,000, we may have further to fall before the bounce.

BTCUSD lost the 200-day moving average (green line, blue 50MA) on the 4-hour chart yesterday, so this downdraft has strong gravitational force.

That means bulls are in a weaker position now so should bear in mind that the BTCUSD market could be in for a dead cat bounce near-term.

Price target for week’s end $9,000

Support at $8,225

Join Our Telegram channel to stay up to date on breaking news coverage