Join Our Telegram channel to stay up to date on breaking news coverage

USDCAD Price Analysis – June 27

In case the $1.3111 demand level holds and the bulls gain enough pressure, the USDCAD price may reverse at the level and return to the previous high of $1.3367.

USD/CAD Market

Key levels:

Supply levels: $1.3207, $1.3367, $1.3493

Demand levels: $1.3111, $1.2977, $1.2783

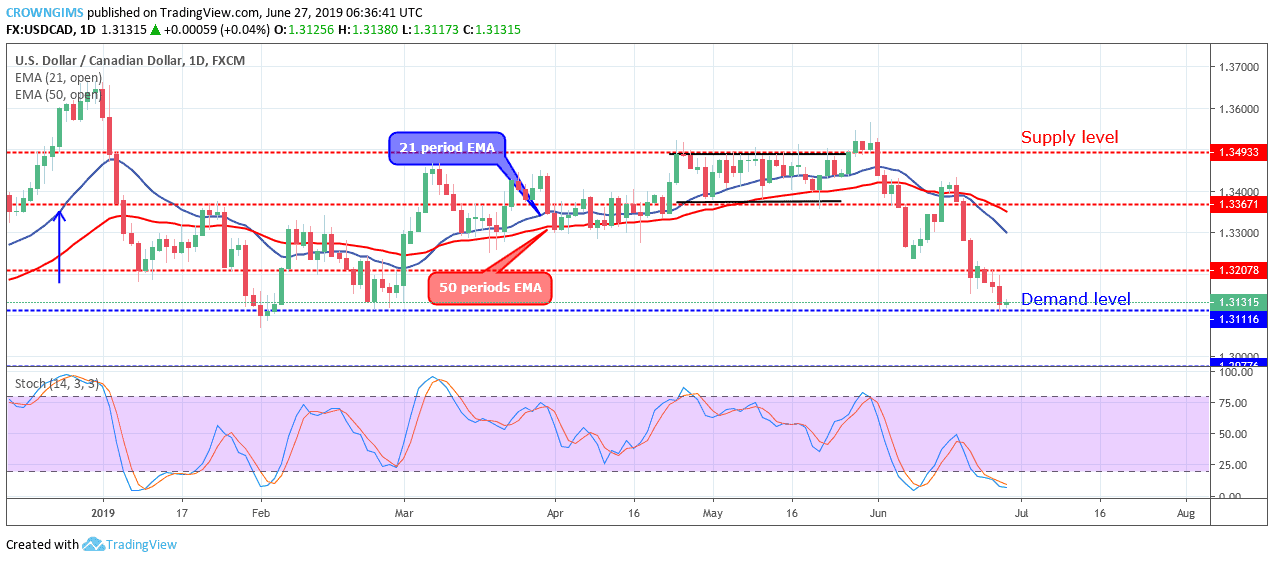

USDCAD Long-term trend: Bearish

On the long-term outlook, USDCAD continues the bearish movement. The Bears dominated the USDCAD market last week. The bearish pressure broke down the former demand level of $1.3207 and the currency pair found support at $1.3111 price level. The price may reverse or pullback at the level.

In case the $1.3111 demand level holds and the bulls gain enough pressure, the USDCAD price may reverse at the level and return to the previous high of $1.3367. On the other hand, should the Bears exert pressure and the $1.3111 breaks down, the price may target $1.2977 level. Meanwhile, the Stochastic Oscillator period 14 is below 20 levels and the signal lines point down to indicate a further decrease in USDCAD price.

The USDCAD price retains its trading below 21 periods EMA and 50 periods EMA at a farther distance from each other.

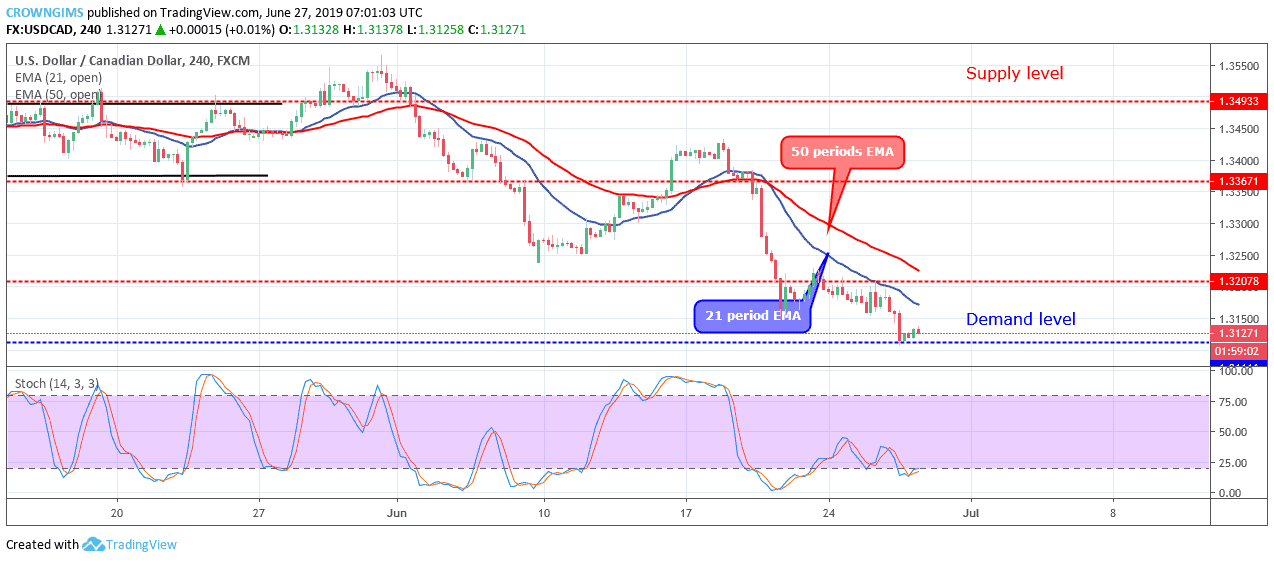

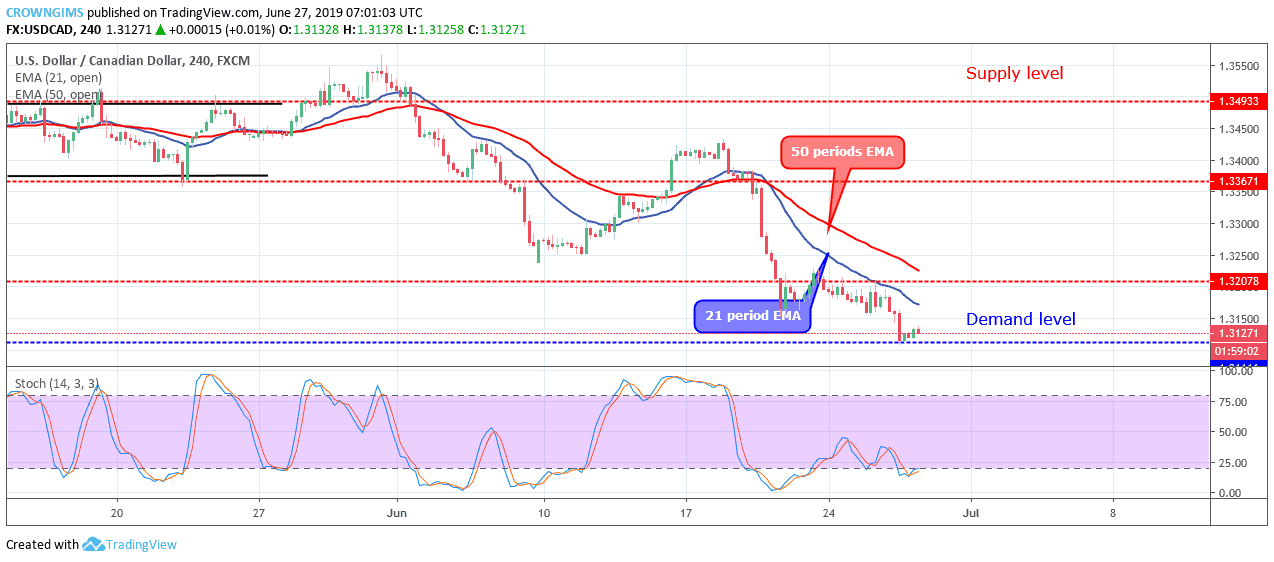

USDCAD medium-term Trend: Bearish

USDCAD is bearish in the medium-term outlook. The bears are yet to give chances to the Bulls. However, the Bears reached the demand level of $1.3111 yesterday. The bearish momentum is getting weak as the Bulls are gradually coming up with the formation of bullish candles at the $1.3111 demand level.

The 21 periods EMA remain below 50 periods EMA with wider distance from each other as a sign of an increase in bearish momentum. The Stochastic Oscillator period 14 is at 25 levels and the signal lines pointing up to indicate a buy signal.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage