Join Our Telegram channel to stay up to date on breaking news coverage

Altcoins are flat lining as bulls accumulate in lower time frames. As we can see from the charts, XLM/USD is bullish and that might spill over to today while LTC/USD, ADA/USD and EOS/USD range above important support lines. If anything, this is a waiting game and once we see rapid gains in the direction of Oct 15 bulls, then we shall recommend buying on dips.

Let’s have a look at these charts:

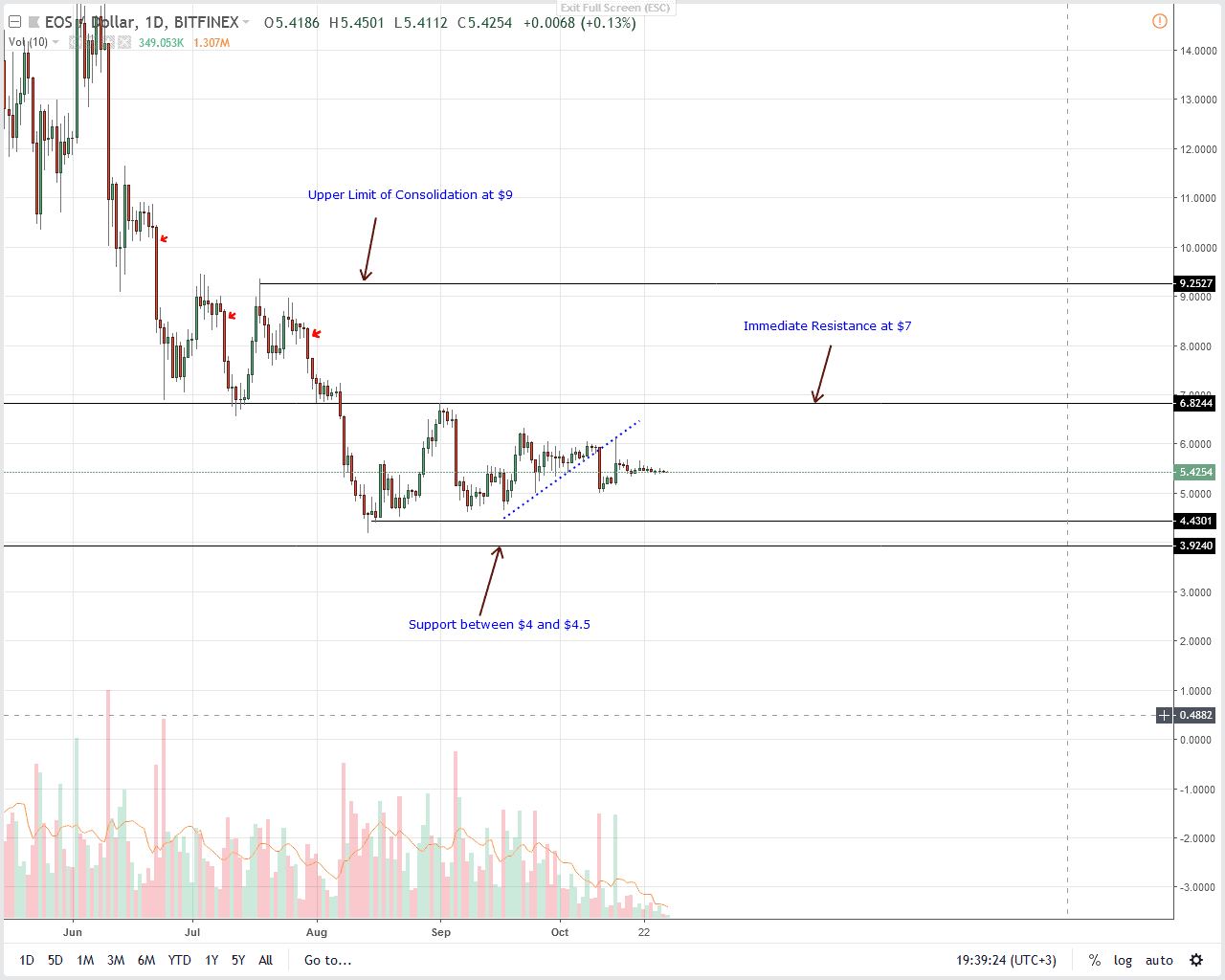

EOS/USD EOS Price Analysis

On average, the EOSIO blockchain attracts 60,000 unique daily users thanks to a 500 percent surge in user activity taking their accounts to 450,000 as the platform popularity balloon. Coincidentally, this come at a time when the platform is facing issues around it’s block producer centralization, governance issues and later accusation of block producer collusion.

Back to price and EOS/USD is stable at the weekly and daily time frame. In the last week it is down 0.6 percent and up 0.3 percent in the last day meaning volatility is low as prices range. Therefore, considering how price action is laid out, our last EOS/USD trade plan is valid. Regardless of the ranging market, we hold a bullish outlook because of Oct 15 bulls from where current prices are moving inside of and the simple fact that prices are down +90 percent from 2017 peaks. Any breakout above $7 ignites bulls aiming at $9 while dips below $4.5-$4 support cancel this bull projection.

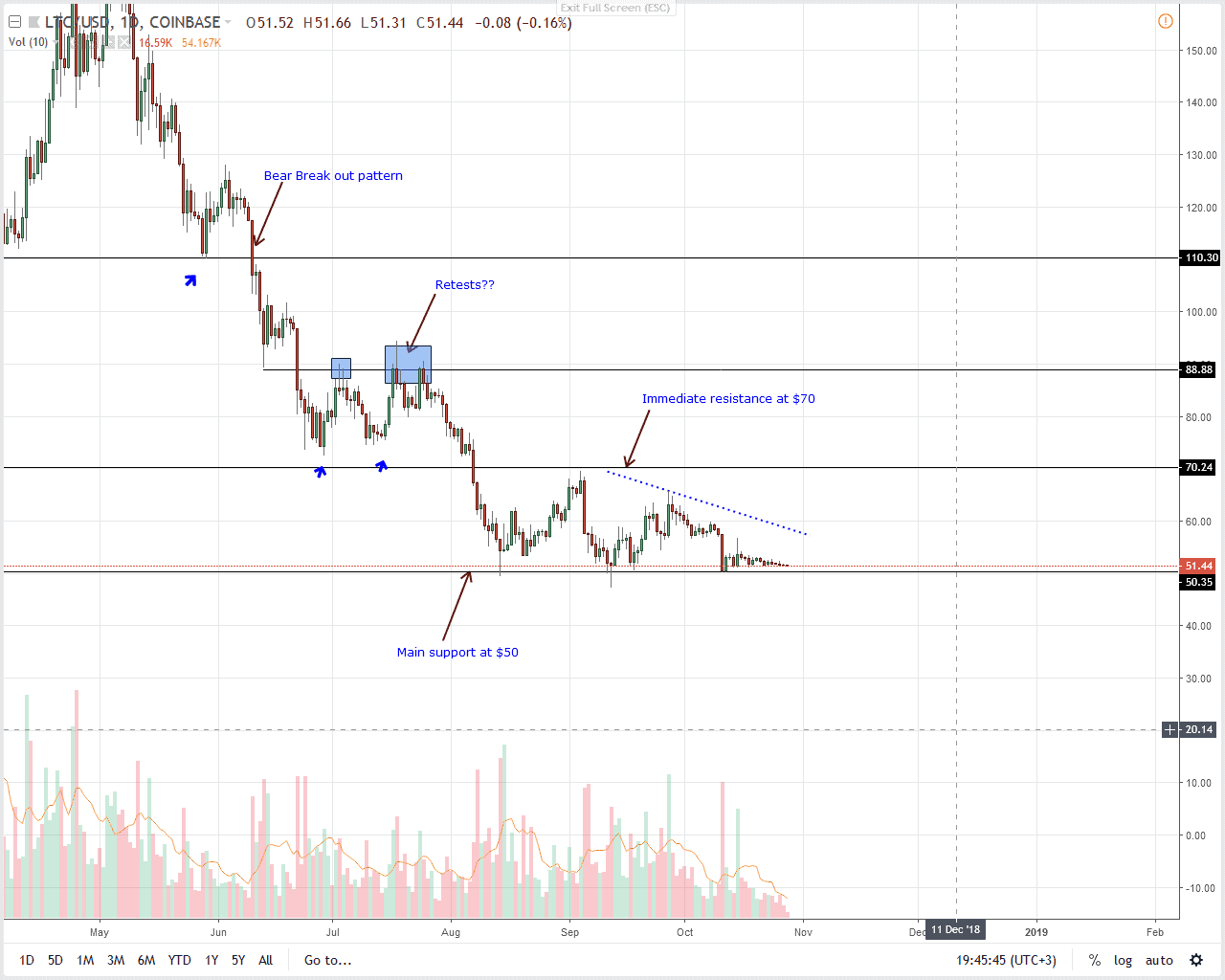

LTC/USD Litecoin Price Analysis

Overly, we remain neutral on LTC/USD partly because of the momentum shaping ranging market and secondly because of the price action proximity of $50. Like in all our LTC/USD price analysis, our trade plan relies mostly on price will react at $50 where by movements below support might end up pushing prices towards $30. On the flip side, should this accumulation lead to breaks above $55 or $60 then odds are Litecoin will be bottoming out. In that case prices would easily expand igniting aggressive traders aiming at $70 and later $90.

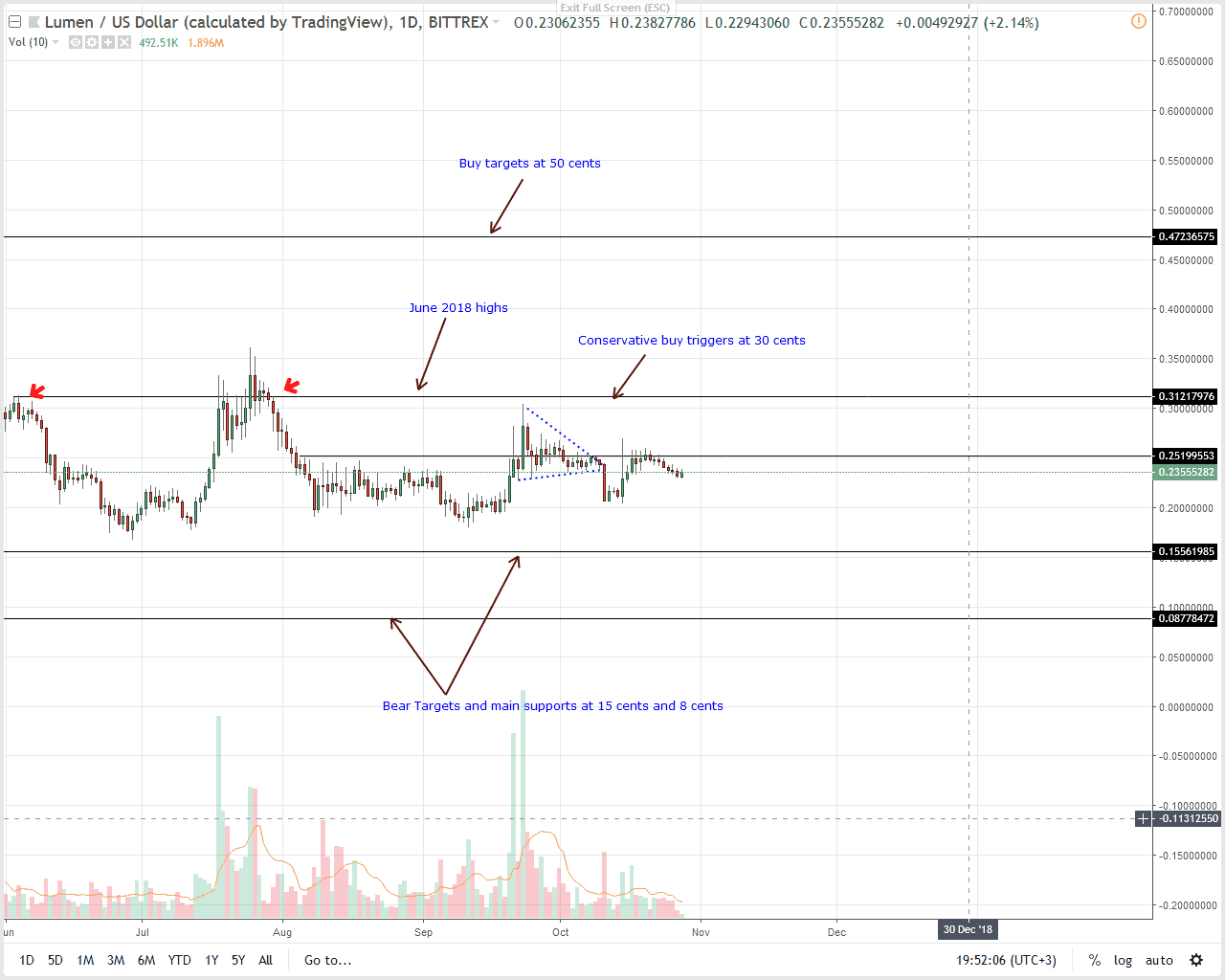

XLM/USD Stellar Lumens Price Analysis

Yesterday’s bulls could be the launching pad that drives Stellar Lumens prices above 25 cents and later 30 cements validating our last XLM/USD trade plan. Like we keep on saying, at the back of dropping trade volumes, XLM slide provides an opportunity for savvy traders as long as prices are trading above Oct 15 high lows. It’s an effort versus result scenario and the realization that prices need to recover after this year’s deep correction. Therefore, if anything, we remain bullish and once XLM cross then 25 cents mark, traders can pick up the asset on dips with first targets at 30 cents. Any declines below the main support at 15 cents-20 cents cancel this projection.

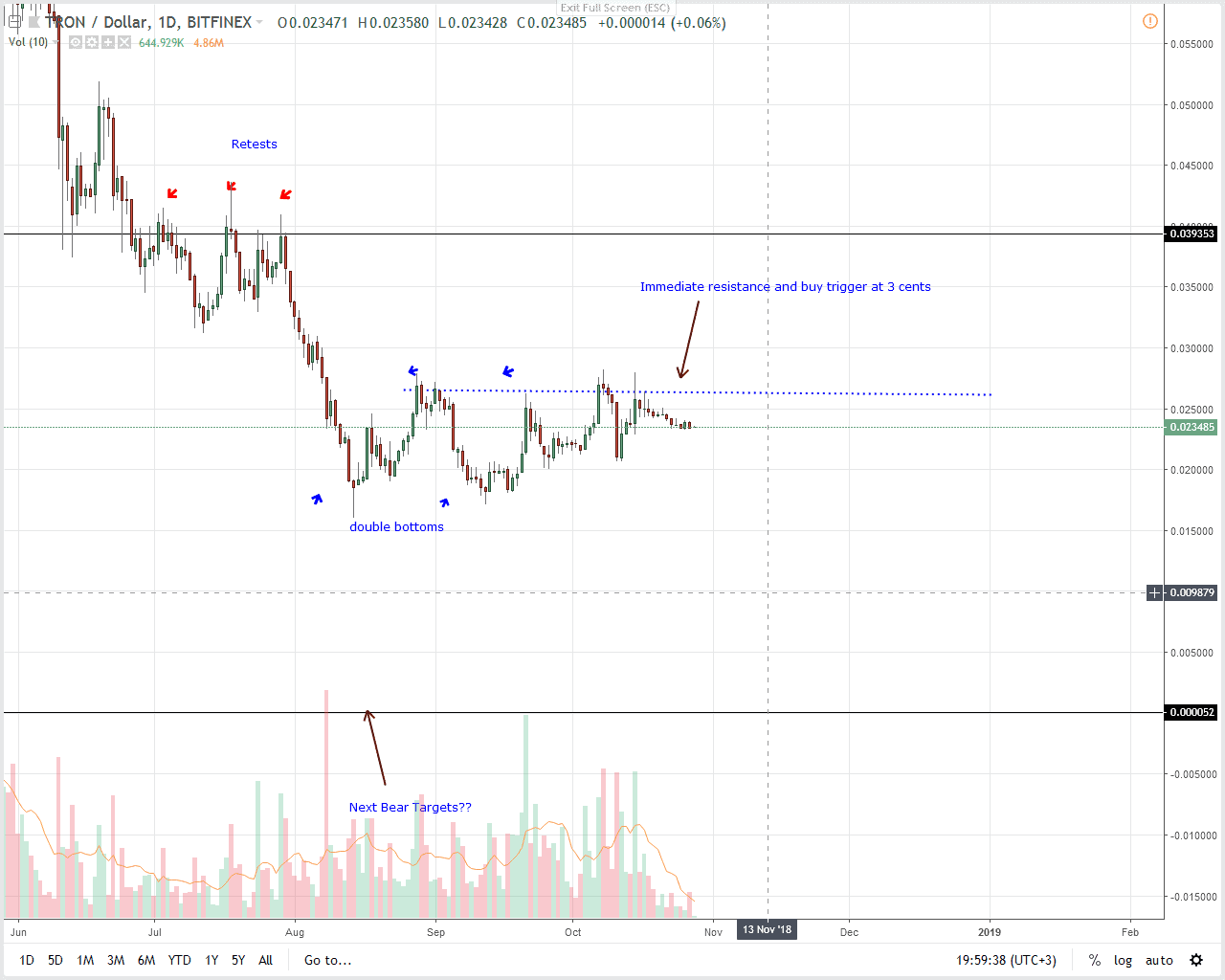

TRX/USD Tron Price Analysis

Technically TRX/USD prices are everywhere. However, what we can observe is that as prices drop so are volumes. In fact we cannot compare the volumes of the last 10 days with that of Oct 15 meaning bulls have an upper hand as Oct 15 bull bar reflect. As such, the bar’s high low is important in our analysis. In that line therefore, surges above Sep highs at 2.5 cents-3 cents level validates our bullish projection and bulls should aim at 4 cents. However, if bears confirm their presence like they have been doing in the last 10 months and cause prices to dip below 2 cents then we shall recommend sells on pullbacks.

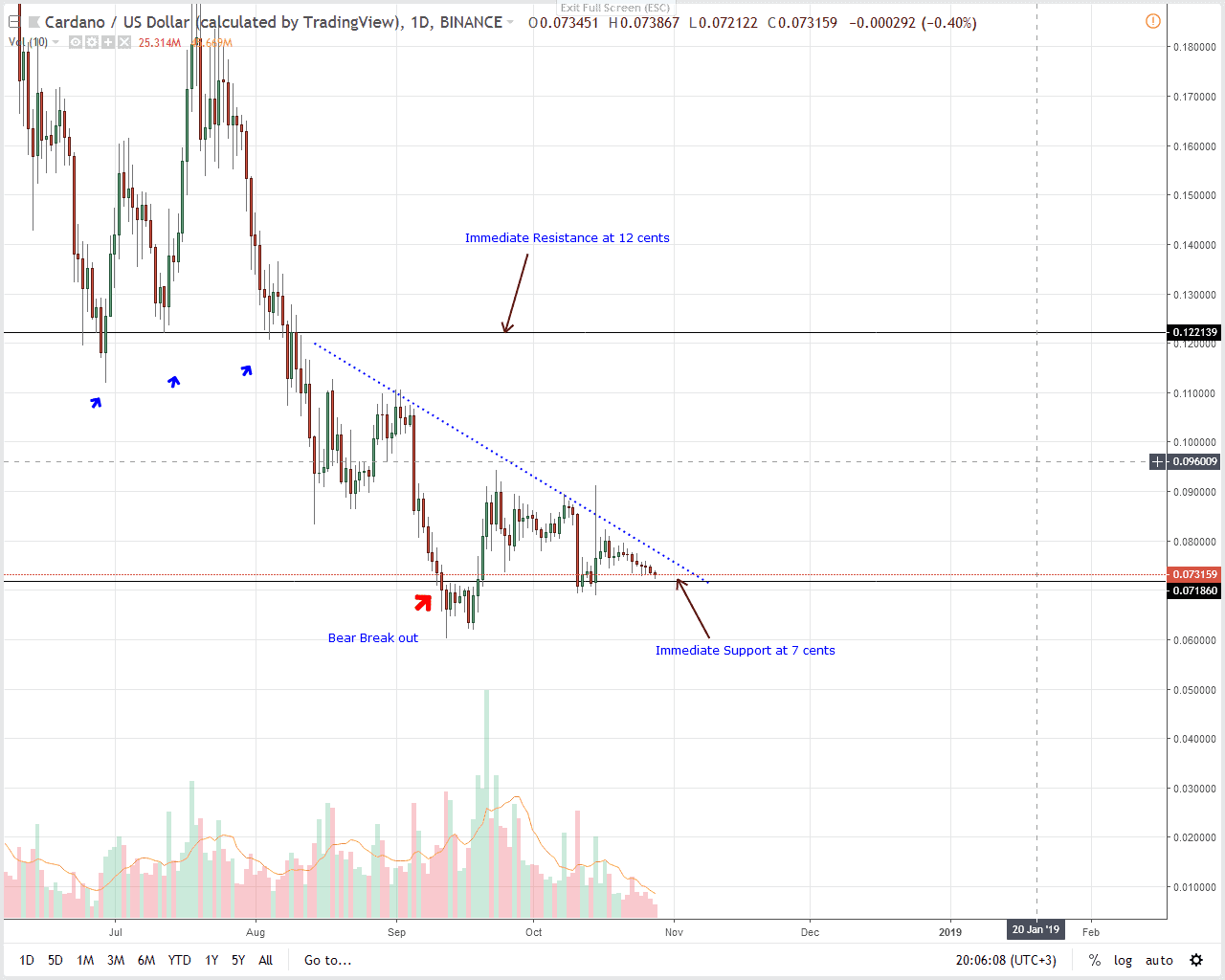

ADA/USD Cardano Price Analysis

All things constant, a dip in ADA/USD should provide an opportunity for traders to buy on dips in line with our iterations. Even though sellers are in control from a top down approach, losses below 7 cents will quash out bullish ambitions as bears would have been successful in reversing Oct 15 losses. The high volume bull bar anchors our analysis and as long as prices are within its high low, risk-off traders can buy on dips with stops at 6.8 cents—Oct 14 lows with first targets at 12 cents—our main resistance and buy trigger line.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

The post TRX/USD Price Analysis: Altcoin Rally Inevitable in Q4 2018 appeared first on NewsBTC.

Join Our Telegram channel to stay up to date on breaking news coverage