Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin began the week with stability, maintaining its position above $65,800, a reassuring sign for investors amidst recent market fluctuations. Notably, transaction fees have seen a significant reduction since the halving event, providing relief for users. Medium-priority fees dropped from $146 to $8.48, while high-priority transactions have similarly decreased to $9.32 from their peak of $170.

Meanwhile, the overall crypto market continues to show strength, with its capitalization reaching an impressive $ 2.45 trillion. Bitcoin’s price reflects this positive sentiment, reaching $ 66,270 after a notable 1.69% increase in the last 24 hours. With Bitcoin currently commanding a market dominance of 53.20%, it remains the cornerstone of digital assets.

Biggest Crypto Gainers Today – Top List

Today’s cryptocurrency market presents a diverse picture, with 21% of coins showing positive movement. Leading the pack, Ontology shines as the top gainer, soaring by an impressive 26.18% in the last 24 hours. Conversely, Nervos Network faces a setback, emerging as the day’s biggest loser with a -5.67% loss. Amidst these fluctuations, let’s delve into the remarkable features and price growth of four standout gainers, each with its innovative edge.

1. Ontology (ONT)

Ontology focuses on trust, privacy, and security in Web3. It builds infrastructure for regulatory-compliant decentralized identity and data solutions. The blockchain is high-speed and low-cost, enhancing privacy and transparency. It supports three virtual machines for seamless cross-chain development. At launch, Ontology avoided ICOs, opting for community distributions. This fostered organic growth and community engagement.

This top gainer offers a diverse range of real-life use cases. It enables businesses to create customized blockchains tailored to their specific needs. This flexibility empowers finance, supply chain management, healthcare, and identity verification industries to leverage blockchain technology effectively. Its interoperability facilitates seamless integration with other blockchains, enabling cross-chain transactions across sectors.

#OntologyConsensusRound 231 has ended🖥

Summary of annualized yield, increase in stake, operation status & fee sharing ratio changes of nodes👉 https://t.co/nmAmufmOZy pic.twitter.com/RoOBbmNSy6

— Ontology #BUIDL4Web3 (@OntologyNetwork) April 19, 2024

Ontology’s current price is $ 0.452468, marking a remarkable surge of 26.43% in the last 24 hours. Despite its modest market dominance of 0.02%, Ontology has shown consistent growth, with an impressive 83% increase in price over the past year. It exhibits strong bullish momentum, trading well above the 200-day SMA at $ 0.247119. Encouragingly, 20 out of the last 30 trading days have been positive, representing 67% positivity. It has a low 30-day volatility of 8% and high liquidity and boasts a volume-to-market cap ratio of 1.8980. ONT offers investors a stable yet dynamic opportunity within the cryptocurrency market.

2. Chainlink (LINK)

Chainlink is a vital layer for smart contracts utilizing decentralized Oracle networks. Moreover, these networks securely connect blockchains with external data feeds and payment methods. This connection is crucial for the functionality of complex smart contracts. Additionally, behind Chainlink is an active open-source community. This community drives innovation and ensures decentralized participation among node operators and contributors.

In pioneering the integration of off-chain data into smart contracts, Chainlink has established partnerships. These partnerships are with trusted data providers like Brave New Coin and Alpha Vantage. This strategic collaboration broadens its data sources, enhancing reliability and accuracy for smart contract executions. Moreover, Chainlink’s decentralized structure empowers users to engage as node operators actively. They contribute to the network’s stability while earning revenue.

⬡ Chainlink Adoption Update ⬡

There were 10 integrations of 5 #Chainlink services across 8 different chains: @arbitrum, @avax, @base, @BNBCHAIN, @ethereum, @Optimism, @0xPolygon, and @WemixNetwork.

New integrations include Base, @CryptexFinance, @DinariGlobal, @HypeSaintsNFT,… pic.twitter.com/vDDkJqKGNL

— Chainlink (@chainlink) April 21, 2024

The current price of Chainlink is $ 15.84, with a 6.26% increase in the last 24 hours. Interestingly, it has seen a 122% price increase over the past year. Trading slightly above the 200-day SMA at $ 15.45, LINK shows stable performance. Additionally, it boasts high liquidity, with a volume-to-market cap ratio of 0.0865. With oversold conditions indicated by a 14-day RSI of 17.50, it presents an intriguing investment opportunity.

3. Slothana (SLOTH)

Slothana is an exciting contender in the crypto meme market, garnering attention for its roots in the Solana blockchain. Amidst a bullish trend, Solana’s sturdy infrastructure lays a fertile foundation for Slothana’s growth. This is evident from its impressive $10 million fundraising within two weeks.

https://twitter.com/SlothanaCoin/status/1782342998971302135

What sets Slothana apart is its distinct design, active community engagement, and strategic marketing efforts. Early adopters can access 10,000 $SLOTH tokens for just 1 SOL, presenting an enticing opportunity. Considering the team’s ambitious market cap target of $420 million, achieving this goal would value each $SLOTH token at approximately $0.0021. This valuation renders Slothana a compelling investment prospect.

As the countdown to its official launch ticks away, Apr 29, Slothana presents a compelling opportunity for potential investors. With just six days remaining, the window to acquire SLOTH tokens is narrowing. Analysts anticipate substantial gains, reaching up to a 10x increase upon launch. This trend mirrors recent successes in these sloth-themed meme coins. Acquiring the SLOTH token is simple, requiring only a Solana-compatible wallet. It should support SOL and SPL tokens, with popular options such as Phantom and Solflare.

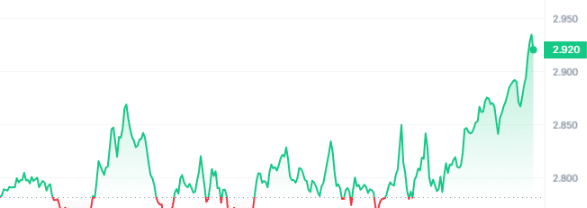

4. Stacks (STX)

Stacks, the innovative Bitcoin Layer for smart contracts, transforms transaction settlements by seamlessly integrating Bitcoin as its underlying asset. With a focus on interoperability, Stacks empowers decentralized applications. They harness the vast potential of Bitcoin’s $500B capital, utilizing the Bitcoin L1 for transaction settlements. Thanks to its unique combination of Proof of Transfer consensus and Clarity language, Stacks boasts comprehensive knowledge.

Its upcoming features, poised to enhance its functionality and security, truly set Stacks apart. Stacks aims to gain the entire hash power of Bitcoin, ensuring top-notch security and transaction finality. Additionally, the introduction of the novel 1:1 backed Bitcoin asset, sBTC, enables seamless movement between the Stacks layer and Bitcoin L1 in a decentralized manner. This opens up new avenues for Stacks smart contracts to directly engage with the Bitcoin ecosystem.

Make Bitcoin a productive asset with Bitcoin L2s 🟧

– @Cointelegraph spoke with @andrerserrano about Stacks.

Full interview available in the thread. pic.twitter.com/FPgaUfLWnt

— stacks.btc (@Stacks) April 21, 2024

Stacks is priced at $ 2.92, with a 4.76% surge in 24 hours, reflecting its potential. Despite its 0.17% market dominance, its growth soared by 311% in the past year. It maintains a stable position, trading well above the 200-day moving average at 200.60%. The 14-day Relative Strength Index indicates neutrality. It’s observed positive trading days in the last month. Also, with a 30-day volatility rate of just 14%, Stacks demonstrates high liquidity. Its volume-to-market cap ratio stands at 0.0586. Powered by these innovations and price growth, Stacks emerges as a scalable and efficient layer.

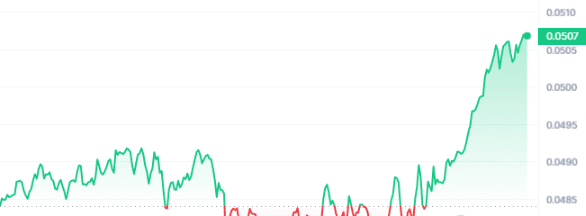

5. Ankr Network (ANKR)

Ankr Network is a decentralized blockchain infrastructure provider, facilitating global node operations across 50+ Proof-of-Stake networks. Its suite of multi-chain tools empowers Web3 users. Ankr Build provides developer solutions, Ankr Earn simplifies staking, and Ankr Learn nurtures blockchain education. This infrastructure enables seamless communication between DApps and blockchains. It also facilitates asset earnings through node delegation.

ANKR is currently valued at $ 0.050757, marking a 4.82% increase in the past day. Despite a modest market dominance of 0.02%, ANKR has seen a 57% increase over the past year. Trading 71.66% above the 200-day SMA, ANKR maintains a stable position. While the 14-day RSI is at 56.51, indicating neutrality, 57% of the last 30 trading days have been positive. With a 30-day volatility rate of 14%, ANKR exhibits high liquidity, evidenced by its volume-to-market cap ratio of 0.1592.

4/ Our collaboration with @brevis_zk is just one of the ways we are working to support the ecosystem of innovation brought about by @EigenLayer.

— Ankr (@ankr) April 15, 2024

Recently, Ankr collaborated with Brevis coChain to reshape Web3 networks by leveraging ZK coprocessing technology. This enhances smart contract functionalities securely, paving the way for a more efficient decentralized ecosystem. As the Mainnet AVS Operator, Ankr provides a robust infrastructure for Brevis coChain’s solutions. Integration with EigenLayer further improves transaction verification, fostering cross-chain compatibility and advancing decentralized finance (DeFi) adoption.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage