Polygon, previously known as the Matic Network, is a scaling solution that provides various tools to improve the speed, lower cost, and simplify transactions on blockchain networks. At the core of Polygon’s idea is Ethereum, a platform that houses a variety of decentralized applications, including those that allow you to join virtual worlds, play games, buy art, and participate in various financial activities.

However, Ethereum’s blockchain activity has rendered it nearly unworkable, as transmission costs are growing and traffic is becoming choked. Polygon bills itself as a layer-2 network, an add-on coating to ETH that does not change the original blockchain layer.

Like its geometric namesake, Polygon has numerous sizes, shapes, and applications, and it promises a more straightforward structure for developing interconnected networks.

Polygon aims to assist ETH in growing in size, security, efficiency, and utility and encourage developers to bring appealing products to market faster. After the rebranding, Polygon kept its MATIC cryptocurrency, the digital coin that powers the network. MATIC is utilized as a payment and settlement unit amongst network participants.

On this Page:

How to Buy Polygon Crypto – Quick Guide

- Select a Polygon exchange – we recommend Binance as the top cryptocurrency exchange.

- Create a new trading account on Binance and authenticate it.

- Deposit funds using one of the available payment methods.

- Select ‘Polygon’ from the drop-down menu to start the order creation process.

- Enter the amount of tokens you wish to purchase and confirm the transaction.

Where to Buy Polygon Crypto – Best Platforms

Polygon (MATIC) is an Ethereum protocol that aspired to “creating, issuing, and managing digital assets on the blockchain.” Polymath aims to “tokenize and trade old and new kinds of assets” by developing a compliance-focused standard (ST-20) for issuing and managing security tokens.

Before we go into how to buy MATIC in the UK, you must first locate the appropriate broker or exchange. Below, you can compare the finest cryptocurrency brokers and exchanges and their features, fees, and payment options in 2024. You may even modify your investment amount and cryptocurrency to check how much each broker costs!

Best Brokers to Buy Polygon

1 – MEXC

MEXC stands as one of the few crypto brokers that has experienced significant growth over the past few years. Founded in 2018, the exchange has swiftly risen among the top 20 options according to Coinmarketcap. Its user base exceeds 10 million globally, spanning across 170 countries and regions. Notably, MEXC’s support for a diverse range of cryptocurrencies stands out as one of its key strengths, encompassing not only popular altcoins like MATIC but also over 1700 lesser-known options.

Based in Seychelles, MEXC distinguishes itself as one of the fastest exchanges, capable of executing 1.4 million transactions per second. This impressive speed is attributed to its trading engine crafted by professionals from the banking industry. Moreover, MEXC’s user interface caters to investors of all types, simplifying the process of purchasing cryptocurrencies like MATIC.

With its robust security measures, dedicated customer support, and various other enticing features, MEXC unequivocally positions itself as an excellent platform for acquiring MATIC tokens.

Fees: The fee structure at MEXC prioritizes the convenience and benefits of regular traders. For spot trading, both maker and taker fees are fixed at 0.2%. However, VIP customers, typically larger investors, have the opportunity to access discounted rates based on their invested or traded amounts on MEXC.

Deposits are free, while withdrawal fees vary depending on the cryptocurrency, chosen payment methods, and associated transaction costs. Additionally, users may have the chance to obtain better discounts during promotional events frequently hosted by the platform, offering reduced rates for investments or trades.

Pros & Cons of the MEXC platform:

- Supports more than 1700 cryptocurrencies

- Is among the top 20 crypto brokers in the industry

- Has a high speed trading engine

- Caters to a wide variety of users

- Offers exciting promotional events

- Competitive fee structure

- Restricted in multiple countries

2 – KuCoin

KuCoin Exchange is based in Seychelles and launched cryptocurrency trading in September 2017. Based on a research department that scours the blockchain industry for quality projects, the KuCoin Exchange emphasizes the quality of the projects listed.

KuCoin offers an exchange service that allows customers to perform digital asset trades securely and fast. KuCoin’s long-term goal is to deliver long-term, increasing value to its more than 20 million registered users in over 200 countries. ‘The People’s Exchange’ formally collaborated with IDG Capital and Matrix Partners in November 2018.

KuCoin claims to offer the highest level of security and a massive cryptocurrency selection. Despite its considerable features, it is a user-friendly exchange with a basic layout. Furthermore, the exchange boasts some of the lowest costs in the Bitcoin industry. KuCoin claims that one of every four cryptocurrency holders uses its service globally. The main benefit of such a large customer base is that it increases market liquidity; you’re more likely to make the deals you want because more individuals are trading.

It offers bank-level security, a sleek interface, a user-friendly UX, and a wide range of crypto services, such as margin and futures trading, a built-in P2P exchange, the ability to purchase crypto with a credit or debit card, instant-exchange benefits, the ability to earn crypto by lending or staking via its Pool-X.

Deposits – Only cryptocurrency deposits and withdrawals are accepted.

Trading Fees – The platform charges 0.1% to both makers and takers, making it one of the cheapest cryptocurrency exchanges online. KuCoin listed Polygon (MATIC) on May 21, 2021, and supported trading on MATIC/USDT and MATIC/BTC.

Pros & Cons of the KuCoin Platform:

- Low fees

- Strong user base

- Wide range of coins

- Earn interest in your crypto

- Advanced trading features

- Good customer service

- Not licensed in the U.S.

- Limited payment methods

- Not for new traders

- Limited educational resources

3 – Coinbase

Coinbase exchange was founded in 2012 as a platform for sending and receiving Bitcoin. The company has expanded to accommodate dozens of unique cryptocurrencies and now employs over 2,700 people worldwide.

Coinbase is a decentralized organization with no central offices. Coinbase has users in over 100 nations, and clients trade about $327 billion per quarter. In addition, Coinbase oversees a thriving Bitcoin ecosystem that serves 9,000 financial institutions.

Coinbase operates two distinct trading platforms and a standalone cryptocurrency wallet service. As previously stated, the company operates two platforms: Coinbase and Coinbase Pro. Each allows you to purchase, sell, and exchange cryptocurrencies, but each has its features.

Coinbase – Coinbase trading is beginner-friendly and straightforward for anyone with basic computer abilities. Coinbase is accessible via the web and mobile devices running Android and iOS. You’ll have a similar experience if you’ve ever traded stocks through an online brokerage.

Coinbase Pro – Coinbase Pro appears to be designed specifically for professional traders, yet anyone with a Coinbase account can access and utilize the pro version. In addition, it provides a variety of trade types, such as limits and stop orders, which are not available on the main Coinbase platform.

Mobile App: Coinbase has an easy-to-use and highly functional mobile software that allows users to buy, sell, and manage bitcoins from anywhere. It has 4.7 ratings in the Apple App Store and 4.4 stars in the Google Play Store.

A platform for advanced trading: For most people who want to buy, sell, and spend cryptocurrency, Coinbase’s ordinary desktop site is sufficient. On the other hand, advanced traders access the Coinbase Pro desktop trading interface. Customers can browse real-time order books, use graphing tools, and place orders quickly on that website.

Creating a Coinbase account is as simple as opening a new bank or brokerage account online. To create a fully verified account, you must include your contact information, particularly your Social Security number. To show they are who they claim they are, new account holders must present a photo of a government ID.

After you’ve opened an account and verified your information, you can buy and sell cryptocurrencies up to the limits of your Coinbase account.

Fees: Coinbase presents its fee on the trade screen before you make a transaction, so you know exactly how much you spend before entering a deal. The following are the fees you should expect to pay on the main Coinbase platform:

Trade Size Coinbase Fee

$10 or less $0.99

$10 to $25 $1.49

$25 to $50 $1.99

$50 to $200 $2.99

Trades above $200 have a percentage-based fee rather than a flat fee.

Coinbase listed the Polygon (MATIC) token on March 09, 2021, and it offers to trade on Polygon (MATIC). Moreover, Coinbase has opened trading for MATIC/USD, MATIC/BTC, MATIC/EUR, and MATIC/GBP.

Pros & Cons of the Coinbase Platform:

- The best mobile app

- Advanced trading platform

- Provides free cryptocurrency in exchange for learning about new digital tokens.

- Provides a Coinbase debit card that may be used to spend cryptocurrency anywhere. Visa cards are accepted.

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

4 – Binance

Binance, founded in 2017 by software developer Changpeng Zhao, is a decentralized cryptocurrency exchange based in China.

While Binance is currently the world’s largest cryptocurrency exchange by trading volume, it also deals with regulatory concerns in various nations. Binance provides global users with access to hundreds of cryptocurrencies. The worldwide Binance platform differs from its US version, Binance.us, with only about 60 cryptocurrencies.

Although experienced traders may appreciate the variety Binance provides, new users may find this platform confusing due to its numerous features. Furthermore, its continuous investigations and growing regulatory difficulties cause concern.

Binance’s platform supports the trading of over 365 coins. 1 It also accepts fiat currencies such as USD, EUR, AUD, GBP, HKD, and INR. Binance provides various trading tools, including real-time charting with moving averages and exponential moving averages. Users can execute transactions using the Binance app, the Binance website, or the Binance desktop app.

Traders can also utilize the Binance platform to check their order book and price charts and access their portfolios and transaction history. Binance also offers a variety of order types, including stop orders, limit orders, stop-limit orders, stop-market orders, and trailing stop orders. You can also select from various trading perspectives, from classic to margin and OTC.

Binance uses two-factor authentication (2FA) verification and FDIC-insured deposits in US currencies (USD). Binance also uses device management in the United States, IP whitelisting, and cold storage to protect its customers.

Fees: When it comes to commission structure, Binance stands out. Fees usually start modest and only become lower from there. Binance employs a volume-based pricing approach and offers further discounts using its proprietary coin. However, if you’re used to the uncomplicated world of typical brokerage prices, you’ll have to say goodbye to such fantasies here.

In general, you’ll pay a 0.1 percent commission when you trade. However, the exchange’s volume-based pricing approach, based on your 30-day trading activity, can help you save money. Binance has 11 price levels, denoted as VIP 0 through 10, based on your 30-day volume. Furthermore, Binance employs a maker-taker mechanism, which rewards those who add liquidity to the market (makers) and penalizes those who diminish liquidity (at greater trading volumes) (takers).

Binance listed the Polygon (MATIC) token on July 28, 2021, and it offers to trade on Polygon (MATIC). Moreover, Binance has opened trading for MATIC/BTC, MATIC/USDT

Pros & Cons of the Binance platform:

- All of the chart indicators used by professional traders are available to them.

- Margin trading – long or short on leverage

- Over 500 coins are available for trading.

- A broader selection of cryptocurrencies

- More staking options – Binance Earn feature

- A wide range of transaction types is available.

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited

- Credit card deposits fees are high

- Binance doesn’t offer copy-trading

5 – Bitfinex

Bitfinex is a well-known cryptocurrency exchange. iFinex Inc, its parent firm, is in Hong Kong and registered in the British Virgin Islands. The site has been online since 2012 and has a sizable fan base, but as many Bitfinex reviews will point out, there have been some teething issues along the road.

Bitfinex is a premier destination for seasoned traders worldwide and is one of the top exchanges in terms of recognition and trading volume. Except for a few countries, it serves the entire world and supports fiat-to-crypto and crypto-to-crypto exchanges.

It offers margin trading, limit and stop orders, over-the-counter (OTC) trades, and other notable features. While there are numerous options, everything is laid out intuitively, with simple dashboards and menus.

Fees – Bitfinex charges a 0.1% fee on deposits and withdrawals via bank transfer. If you require funds within 24 hours, you can pay a 1% expedited fee. Alternatively, bitcoin withdrawal costs differ by coin. Bitfinex listed Polygon (MATIC) on Oct 21, 2021, and enabled trading against USD and USDt.

Pros & Cons of the Bitfinex Platform:

- Established in 2012.

- Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

- Suitable for experienced traders.

-

There is no regulation.

-

US citizens are not accepted.

- Support team only available via email

-

Expensive trading fees

- Hacked on more than one occasion

6 – Bybit

It provides excellent security and a zero-downtime commitment, though it is currently unavailable in the United States.

Bybit is a trading platform for cryptocurrency derivatives situated in Singapore. These contracts offer you the right to buy or sell crypto assets at specific prices in the future. But before we get any further, there are a few things we need to clarify. The Financial Conduct Authority has not authorized Bybit.

Founders – Ben Zhou co-founded Bybit in 2018 after seeing the immense potential of cryptocurrency trading two years prior. Zhou was the general manager for Greater China at forex brokerage business XM before becoming the exchange’s CEO.

He assembled an A-team of investment banking and fintech professionals who previously worked for Alibaba, Tencent, Morgan Stanley, and other well-known companies to build the platform. The Bybit exchange also consists of blockchain experts and veteran forex talents.

Bitcoin, Ethereum, and USDT, as well as 45 fiat currencies, are accepted by the Fiat Gateway. Market takers pay 0.075 percent, while market makers pay -0.025 percent.

Pros & Cons of the Bybit Platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the U.S.

- Crypto derivatives are extremely risky

- Not suited to spot trading

What is Polygon (MATIC)?

Polygon SDK is a modular, adaptable framework that facilitates the creation of various sorts of apps. MATIC, Polygon’s native token, is an ERC-20 token based on the Ethereum platform. Furthermore, the tokens are used for payment services on Polygon and as a settlement currency between Polygon marketplace members.

Polygon (formerly Matic Network) is the first well-structured, user-friendly Ether scaling and infrastructure development platform. Check out our in-depth look into Polygon Matic to discover more about it. Polygon can generate optimistic aggregate functions chains, ZK rollup chains, stand-alone chains, or any other type of infra the developer requires.

Polygon successfully converts Ethereum into a complete multi-chain ecosystem (Internet of Blockchains). This multi-chain system is identical to Polkadot (DOT), Cosmos (ATOM), Avalanche, and others, but it benefits from Ethereum’s security, active ecosystem, and openness. The $MATIC token will continue to exist and play a growing role in protecting the system and allowing governance.

Polygon is a Layer 2 scaling mechanism. The project aims to increase cryptocurrency acceptance by addressing scalability issues on several blockchains. Polygon is a blockchain architecture that combines the Plasma Framework and proof-of-stake. As Ethereum co-founder Vitalik Buterin suggested, Polygon’s Plasma framework enables the simple execution of scalable and autonomous smart contracts.

The existing ecosystem based on the Plasma-POS chain will remain unchanged. Polygon is expanding its capacity to cater to the needs of developers and build new features around current established technology. In addition, Polygon will continue improving its fundamental technology to scale to a bigger ecosystem.

Polygon can process up to 65,000 transactions per second on a single side chain and has a block confirmation time of fewer than two seconds. On top of that, the architecture enables the development of globally accessible decentralized financial apps on a single underlying blockchain.

Polygon can host infinite decentralized applications on its infrastructure thanks to the Plasma framework, which eliminates the usual limitations associated with proof-of-work blockchains. In addition, Polygon has attracted over 50 DApps to its PoS-secured Ethereum sidechain so far. MATIC, Polygon’s native token, is an ERC-20 token on the Ethereum blockchain.

The tokens are used for payment services on Polygon and as a settlement currency amongst Polygon ecosystem users. On Polygon sidechains, transaction fees are likewise paid in MATIC tokens.

What Is the Process of Polygon?

Polygon is a multi-level platform that tries to grow Ethereum through several sidechains, all striving to unclog the main platform efficiently and cost-effectively. If you’re unfamiliar, sidechains are distinct blockchains linked to the main Ethereum blockchain and can implement many Ethereum Decentralized Finance (DeFi) protocols. Polygon has a proof-of-stake consensus technique to generate new MATIC and protect the network, which implies that staking is one way to earn money on MATIC you own.

Validators undertake the heavy labor, verifying new transactions and adding them to the blockchain. In exchange, they may obtain a charge reduction and freshly developed MATIC. Becoming a validator entails operating a full-time node (or computer) and staking your private MATIC. If you make a mistake or act deliberately (or even if your internet connection is unstable), you may lose some of your staked MATIC.

Delegators stake their MATIC indirectly through a trusted validator. This is a significantly lower-risk variation of staking. However, the investigation is still required since if the validator you choose acts maliciously or makes errors, you may lose some or all of your staked MATIC.

Is it Worth Buying Polygon in 2023?

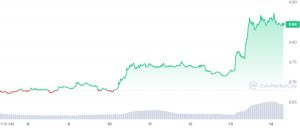

Polygon is an exciting cryptocurrency project with innovative solutions that address the scalability of the blockchain network. Its native token – MATIC, entered the market in 2019 and has survived multiple market crashes. Over the first two years, MATIC was traded below $0.02, but it gained popularity soon and reached new heights in 2021.

Eventually, it hit its all-time high of $2.92 in December 2021 and was never traded below $0.3. MATIC followed the ups and downs of the whole crypto market, but the coin recovered significantly from the “crypto winter” and has a nearly 60% YTD return rate.

But what will happen to MATIC in 2023? Polygon has recently encountered significant challenges. It was accused by the United States Securities and Exchange Commission of operating as an unregistered security, which raised regulatory concerns.

Moreover, the famous American financial services company, Robinhood, has announced its plan to delist MATIC from its trading platform. Consequently, these developments have led to a noticeable decrease in the price of MATIC.

Despite this downturn, Polygon manages to recover. Moreover, a proposal has been put forward by a collective of Polygon founders and researchers to enhance the network by replacing the MATIC token with POL. This upgrade would enable POL to be a unified token across all networks built on Polygon.

1/ Today, the next technical proposal of Polygon 2.0 is unveiled:

POL, the upgraded token of the Polygon protocol! 💫

POL is the next generation native token, designed to secure, align and grow the Polygon ecosystem.

Watch the video to get an idea how cool it is, then 🧵 pic.twitter.com/Gn7KcHpWEY

— Polygon (※,※) (@0xPolygon) July 13, 2023

These networks comprise the primary Polygon blockchain, the Polygon zkEVM network, and multiple supernets, application-specific blockchains operating on the main Polygon network. Based on price analysis, Polygon is currently on bullish momentum with a 25% rally in the weekly chart.

However, Polygon seems to be a valuable project in the crypto space, and MATIC is a must-have if you use Polygon’s network. So, MATIC has a lot of room for growth and can increase its value once the crypto market recovers.

Will the Price of Polygon Go Up in 2023?

Polygon aims to contribute to adopting blockchain technology and works on scalability issues. So, the project’s success depends on the popularity of the decentralized apps and the successful adoption of its innovative solutions. After witnessing substantial dApp adoption in 2021, the price of MATIC skyrocketed.

As its network is capable of handling 65,000 transactions per second and with this ratePolygon managed to attract several projects. The fundamental analyses of the project indicate that it can be one of the most successful and well-established projects in the DeFi space. So, let’s look at the technical indicators to determine how much they expect Polygon to grow.

Wallet Investors – Based on our forecasts, a long-term increase is expected, and the expected price for MATIC is $1.495 in 5 years. The revenue is expected to be around +22.34% with a 5-year investment.

Price Predictions – According to this popular AI-based platform, MATIC is expected to have an average price of $10.76 in 5 years. The maximum price of the coin can reach $12.39, and the minimum price can drop as low as $10.46.

Coin Codex – Based on our tech sector growth prediction, in 2026, the estimated price for Polygon would be between $ 2.45-$ 22.12. This means that in the best-case scenario, the MATIC price is expected to rise by 1,713.32% in the best case scenario by 2027.

Digital Coin Price – It is estimated that Polygon’s value and growth will be astronomical because it is so powerful and has tremendous potential. According to the current market situation, the price could be a maximum of $3.88 by 2025 and the minimum price down to $3.55. That being said, the average MATIC price could anchor at $3.69.

GOV Capital – Polygon has been declining, so we believe similar market segments were unpopular in the period. Our prediction system predicts the asset’s future price at $3.1846858375887 (158.078% ) after a year. The five-year forecast for MATIC is $7.930.

When you’re considering an investment, follow these things:

Do you want to buy MATIC but aren’t sure how cryptocurrencies work? Put an end to it!

Cryptocurrencies can be an exciting investment opportunity, but novice investors risk losing money if they are deceived by scammers or back a new coin with no track record. This section will cover what you should know before investing in the Bitcoin market.

1. Do Not Put all of Your Eggs in a Single Basket

If you put your entire deposit into one cryptocurrency and it suddenly dropped by 50%, you’d lose half of your money. But, if you had ten assets and MATIC was just 10% of your total deposit, your loss would be less severe. Therefore, never overlook risk diversification!

Instead, always conduct market research and invest in several cryptocurrencies.

2. Calculate the Size of The Transaction

Traders are frequently led by emotions rather than logic or serious calculations. This behavior is also described with a specific word. It’s referred to as FOMO or fear of missing out. Beginner traders are influenced by the buzz and put 30–40% of their deposit into a single transaction, resulting in significant losses if it fails. As a result, don’t overlook the 6 percent and 2 percent rules.

According to the latter, you should open a position with no more than 2% of your total investment. Some even advise investing no more than 1% of the total amount. However, you will never lose your entire deposit if you use this strategy.

According to the 6 percent rule, if you continue to lose money in crypto trading and cannot stop a string of bad trades, you should stop trading if you lose more than 6% of your investment. In this instance, taking a 1.5–2 week sabbatical from trading is advised to recover and avoid making rash decisions psychologically.

This principle is intertwined with the stop-loss order. When you open a trade, ensure the overall risk for all orders is less than 25%. This ensures that you will retain at least 75% of your deposit even if your transactions are unprofitable.

3. Calculate the Transaction’s Profitability

Just keep in mind that not every trade will be profitable. Professional traders also lose money. Loss is an unavoidable element of trading; you have to accept it. The profit/loss ratio is the most crucial factor to consider and should ideally be 3 to 1, or at least 2 to 1.

How to Buy Polygon (MATIC) as a CFD Product

Contracts for difference trading, often called CFD trading, is a strategy that allows investors to trade and engage in an asset by engaging in an agreement with an exchange or a broker instead of opening a trade directly on a specific market.

When the position closes, the trader and the broker agree to mimic market circumstances and settle the difference between themselves. CFD trading has several advantages that direct trading does not, such as exposure to international markets, leveraged/margin trading, short selling an asset that does not typically offer that option, and more.

How Do Classic CFDs Function?

Traders select an asset offered by the broker as a CFD. For instance, it might be a stock, an index, a cryptocurrency, or any other investment in the broker’s portfolio.

Traders open the position and specify characteristics such as a long or short position, leverage, amount invested, and other criteria specific to the broker. The two sign a contract in which they agree on the opening price for the position and whether or not any additional expenses (such as overnight fees) are involved.

The position is executed and remains open until the trader decides to close it or closes automatically, such as when a stop loss or take profit point is reached, or the contract expires. If the trader’s position closes in profit, the broker compensates him. The broker deducts the difference from the trader’s account if it matures at a loss.

Lately, CFD trading has made its way into the cryptocurrency market. Having said that, MATIC is also accessible as a CFD product. So if you’re having trouble tracking bitcoin trading with the exchange where you keep your crypto assets, you can profit from MATIC using CFDs.

We recommend using Binance or CryptoRocket to trade cryptocurrencies with leverage. More cryptocurrencies, including MATIC, are supported by Binance. CryptoRocket, on the other hand, supports fewer altcoins – currently 40. Cryptorocket does not allow leveraged trading on MATIC, but they are constantly launching new coins.

We also recommend the derivatives broker Capital.com, which has a MATIC/USD trading pair. You have more flexibility when you trade with CFDs because you are not tied to the asset; you have bought or sold the underlying contract. CFDs are a more established and regulated financial product.

However, it is worth noting that when coupled with leveraged trading, the increased volatility of cryptocurrency might result in exaggerated gains and losses. Instead, use stringent risk management measures and stop and limit orders.

Taxation on Polygon Earnings

Crypto traders and enthusiasts may have severe tax concerns as the value of various cryptocurrencies, such as Bitcoin and Ethereum, has skyrocketed. However, with the Internal Revenue Service (IRS) ratcheting up enforcement operations, even people holding the currency instead of trading it must be careful not to break the law. Given how the IRS views cryptocurrency, this may be easier than you think.

The Internal Revenue Service (IRS) has also attempted to establish a cryptocurrency taxing framework. Currently, the agency treats digital assets as real estate, putting them in the capital gains tax category. Furthermore, there are some instances where virtual currencies are recognized as income, resulting in the imposition of income tax by the taxation authority.

1. You Will be Asked if You Own or Utilize Cryptocurrencies

You must indicate whether you have dealt with cryptocurrencies on your 2022 tax return. For example, form 1040 asks, “Did you receive, sell, send, swap, or otherwise acquire any financial interest in any digital currency at any time during 2022?”

As a result, you’re on the hook to answer definitively whether you’ve transacted in cryptocurrencies, perhaps placing you in a position to lie to the IRS. If you do not answer truthfully, you may face additional legal consequences.

There is, however, a footnote. The IRS recently clarified that taxpayers who solely acquired virtual currency with actual currency were not required to answer “yes” to the question.

2. You are Not Exempt From Taxation Simply Because You Did Not Receive 1099

You (and the IRS) will typically receive a Form 1099 from a bank or brokerage reflecting your income throughout the year. Nonetheless, It may not be the case with cryptocurrencies.

Harris explains:

There isn’t the same amount of reporting for cryptocurrency yet, compared to standard 1099 forms for stocks, interest, and other payments. Coinbase and other exchanges don’t provide the IRS with good reporting.

However, beginning on January 1, 2023, a law passed in November 2021 will demand higher tax reporting for those in the industry. Anyone transacting digital assets for another must report such information to the IRS on a 1099 or similar form.

3. Simply Using Cryptocurrency Exposes You to Potential Tax Obligations

You may believe you are not subject to taxation if you merely use – but do not trade – cryptocurrencies. That is not necessarily the case.

You may be exposed to a tax penalty when you sell virtual currency for real currency, products, or services, which is a part of trading alongside buying and holding – those are not usually taxed.

4. Crypto Trading Profits are Taxed in the Same Way as Normal Capital Gains

So you made a profit on a profitable transaction or purchase? The IRS treats bitcoin gains the same way it considers any other type of financial gain. For assets held less than a year, you will pay conventional tax rates on short-term capital gains (up to 37 percent in 2021 and 2022, depending on your income). However, if you hold assets for over a year, you will be subject to long-term capital gains tax, most likely at a lower rate (0, 15, and 20 percent).

5. Crypto Miners May Face Different Treatment Than Others

Do you mine cryptocurrencies for a living? Then you may be able to deduct your expenses in the same way that a conventional firm would. Your income is the monetary value of your output.

“If you mine cryptocurrencies, you earn income at fair market value, so that’s your basis in cryptocurrency,” Harris explains. “Your expenses may be deductible if this is a trade or enterprise.”

But that last bit is important: you must be in the trades or manage a business to qualify. For instance, you cannot operate your mining rig as a hobby and claim the same tax benefits as a legitimate business.

6. A Crypto Gift is Handled the Same as Any Other Gift

If you give Bitcoin to someone, say a younger relative, to pique their interest, your present will be treated the same as any other such gift. As a result, it may be subject to gift tax if it exceeds $15,000 in 2021 (or $16,000 in 2022). However, if the recipient decides to sell the present, the cost basis stays the same as the giver’s cost basis. However, even if you exceed the annual level, there are specific ways to avoid the gift tax, such as using the lifetime exemption.

7. Inherited Cryptocurrency is Treated the Same Way as other Inherited Assets

Inherited cryptocurrency is regarded similarly to other capital assets passed down from generation to generation. For example, if the estate exceeds specified levels ($11.7 million and $12.06 million in 2021 and 2022, respectively), they may be subject to estate taxes. Cryptocurrency, like stock, has a stepped-up cost basis to the fair value on the day of death. According to Harris, most people widely regard Bitcoin as a capital asset.

Risk Reduction in Polygon (MATIC) Investment

Every investor should look out for strategies to protect oneself from significant losses. If you wish to limit your risks, follow these guidelines:

By using a firm stop loss, you can avoid mental stops.

One of the best tactics for traders to reduce their risk exposure in the markets is to use a hard stop loss with each transaction. Don’t just consider a stop-loss; execute the order to prevent a minor loss from becoming a long-term losing position.

Higher leverage

A high-leverage strategy can help a trader make a lot of money in a short period of time. However, if the market moves against your trade, it can result in considerable losses that wipe out your trading cash.

Volatility in the market

To begin with, some volatility is advantageous since it helps traders profit from little price swings. For example, if a market does not move, no one will trade it. As a result, trading in a market with little volatility might occasionally result in losses. Not only from the market but also from the high transaction costs.

Determine your level of risk tolerance

The amount of money at stake in each transaction is a personal preference that involves placing a stop-loss order. However, we favor a rigorous 1% or 2% standard. We believe that a trader should examine the size of his trading capital and how much money he is willing to risk and then compute the percentage of the trading account.

Polygon Price Predictions: Where Does MATIC Go From Here?

MATIC is a precious asset for traders who may profit from these price swings by taking a long or short position. It is currently ranked the 10th largest cryptocurrency by CoinMarketCap, with a live market cap of $10,639,481,036. Here is what industry experts predict for investment over the next five years:

Polygon Price Prediction 2023

According to the Digital Coin Price, MATIC’s maximum value can be $2.68, and the minimum value can drop to $1.10 in 2023. The average price for MATIC is expected to be $2.61 during 2023. Price Prediction foresees a maximum price of $1.99 and a minimum price of $1.65 for MATIC. According to the platform, the average price of the coin will be $1.71.

Polygon Price Prediction 2024

With partnerships, alliances, and community investment, the market expects MATIC to perform, reaching an average price of $3.10, which is pretty optimistic but undoubtedly achievable. The maximum and minimum price for the MATIC is expected to be $3.16 and $2.63, according to the Digital Coin Price. Price Prediction is less optimistic and indicates an average price of $2.51 for the coin with a $2.44 maximum and a $2.82 minimum price.

MATIC Price Prediction 2025 – 2028

The polygon may experience foggy days if government laws and regulations shift. However, platforms have different views about the Polygon growth in 5 years. Price Prediction indicates that Polgyon’s value will eventually hit $10 in 5 years and have an average price of $10.76 in 2028.

While Digital Coin Price is less optimistic about MATIC’s performance in the long term, according to it, MATIC’s average price will be $6.41 in 5 years. GOV Capital’s 5-year MATIC forecast predicts a price of $7.930 for the MATIC coin.

Should I Buy Polygon Crypto?

MATIC’s bullish forecast expects the coin to continue developing in the next few years and experience several inbound innovations and alliances. This may contribute to its expansion and bring growth for the coin. From this perspective, MATIC is an excellent coin to invest in during the bear market. However, you also need to consider the crypto market’s risks and the volatility of the whole market. So, always make reasonable investments and don’t risk the capital if you can’t afford to lose it.

Summary

Polygon (MATIC) is an Ethereum protocol used to ‘produce, issue, and manage digital securities on the blockchain.’ Polygon SDK, a platform that allows individuals to construct various types of blockchain applications and decentralized finance (DeFi) services, lies at the heart of the protocol.

Utilizing the Polygon framework makes gaining access to the Ethereum blockchain feasible while avoiding some of its existing drawbacks, such as high transaction fees and limited processing capacity. This means that Polygon effectively converts Ethereum into a multi-chain system known as the ‘Internet of Blockchains.’ The platform can theoretically process up to 65,000 transactions per second on one side-chain, and it takes less than two seconds to create a new block.

Our recommended regulated broker, Binance, can assist you if you’re ready to invest. It only takes a few minutes to get started with Binance.

FAQs

Any risks in buying Polygon now?

All trading carries risk. However, cryptocurrencies are showing signs of recovery in mid-2023, led by Bitcoin bouncing 100% to start the year amid the global banking crisis.

Should I buy Polygon?

Polygon (MATIC) has debatably stood the test of time, being a top 20 coin for some years with a wide range of applications.

Where can I spend my Polygon?

MATIC can be used to buy and sell products and services via e-commerce or retail, but unlike credit or debit cards, the payment is actually instant. As a buyer, the crypto-currency (MATIC) exits your wallet and is instantly transferred to the seller's wallet at absolutely no cost.

Is it safe to buy Polygon?

The Polygon ecosystem is quite popular, with several projects built on it; if improvements continue, we may expect the MATIC price to reach $2.40.

Will Polygon ever hit $10?

In the next five years, if the network can continue to work on TPS, it may eventually benefit ETH holders, causing the price to rise to around $10.