Join Our Telegram channel to stay up to date on breaking news coverage

News of the commencement of Ether spot ETH trading has generated optimism within the cryptocurrency market. Accordingly, cryptocurrencies, particularly altcoins, are printing significant price rises. This price climb has trickled into new cryptocurrency releases, listings, & presales today due to their current attractiveness within shrewd market participants.

Their potential for significant upsides and large returns, coupled with their low entry positions, have made these tokens worthy of consideration within the market. InsideBitcoins assists in this pursuit by curating tokens that fit this description, thus providing details on their features, utilities, and market outlook.

New Cryptocurrency Releases, Listings, and Presales Today

Music Protocol is bringing groundbreaking changes to the industry by revolutionizing how music intellectual property (IP) is managed and licensed in the digital era. Furthermore, the Qoda Ecosystem includes partner applications that aim to enhance the accessibility of financial services.

Additionally, Q is an EVM-compatible Layer 1 blockchain that utilizes delegated proof-of-stake and prioritizes decentralized governance. In a related development, WienerAI’s ($WAI) project has sparked significant market interest, successfully raising over $7 million, with each token priced at $0.00073. Meanwhile, spot ether ETFs have commenced trading on US exchanges.

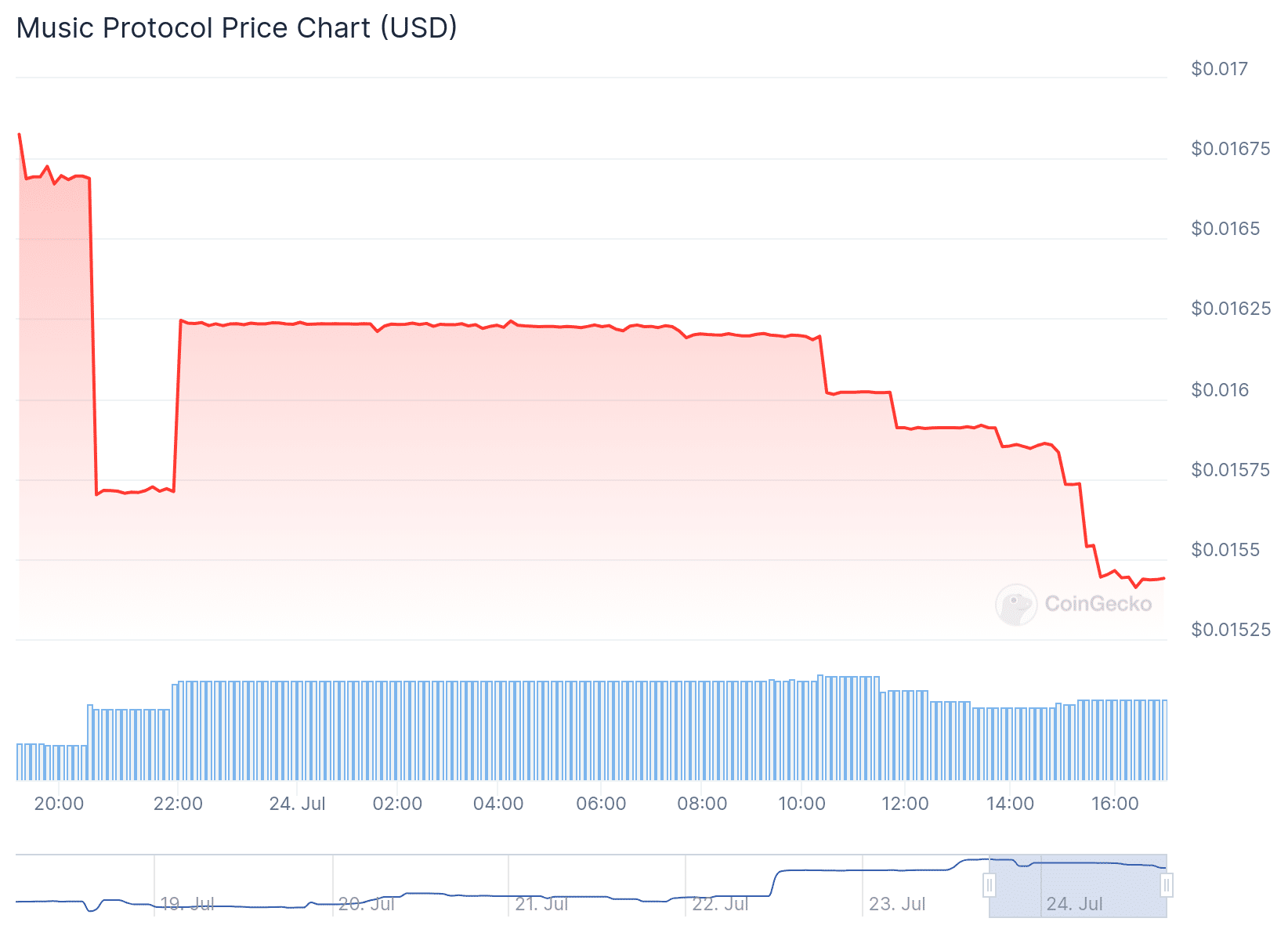

1. Music Protocol (RECORD)

Music Protocol is introducing significant innovations in the music industry by redefining the management and licensing of music intellectual property (IP) in the digital age. Developed through a three-year collaboration involving the legal, music business, and technology sectors, it offers a transformative infrastructure to facilitate digital evolution within the music industry.

Music Protocol offers a blockchain-based solution designed to handle the complex management of music IP. Its modular architecture allows IP owners to manage their rights in digital and analog formats if needed. This system effectively integrates digital and optional analog IP rights management, allowing it to adapt to the industry’s evolving needs.

Additionally, the protocol is open and decentralized, supporting the development of new licensing standards and applications. It fosters community collaboration to connect the protocol with real-world applications. This adaptability could lead to new business models, licensing frameworks, and IP exploitation methods.

Moreover, Music Protocol has formed several strategic partnerships to further its goals. For instance, one notable partnership is with MusicProtocolX, a Layer 1 platform that converts music royalties into blockchain-based digital assets, facilitating easier investment and management. This collaboration is expected to bring $1 billion worth of music catalogs on-chain, potentially opening new opportunities for both parties.

$RECORD is now live on the @base network on @Uniswap.

CA – 0xE642657E4F43e6DcF0bd73Ef24008394574Dee28

This is the official link: https://t.co/KLPPtdCsFG

Please be vigilant and only trust links provided on our official communication channels. pic.twitter.com/eVoJKlH0X9

— Music Protocol | $RECORD (@MusicProtocolX) July 15, 2024

Another significant partnership is with TomCoinBNB, a resource management and strategy game with over 700,000 players. This partnership allows players to win prizes through $TOM, integrating music into the gaming experience.

Finally, a partnership with zkCrossNetwork, a leader in DeFi infrastructure for chain abstraction, aims to enhance the protocol’s focus on Real World Assets (RWA) by ensuring seamless liquidity transfers and efficient asset management across Web3.

These partnerships highlight Music Protocol’s commitment to integrating music IP management into various digital and gaming ecosystems, potentially paving the way for new business models and opportunities within the industry.

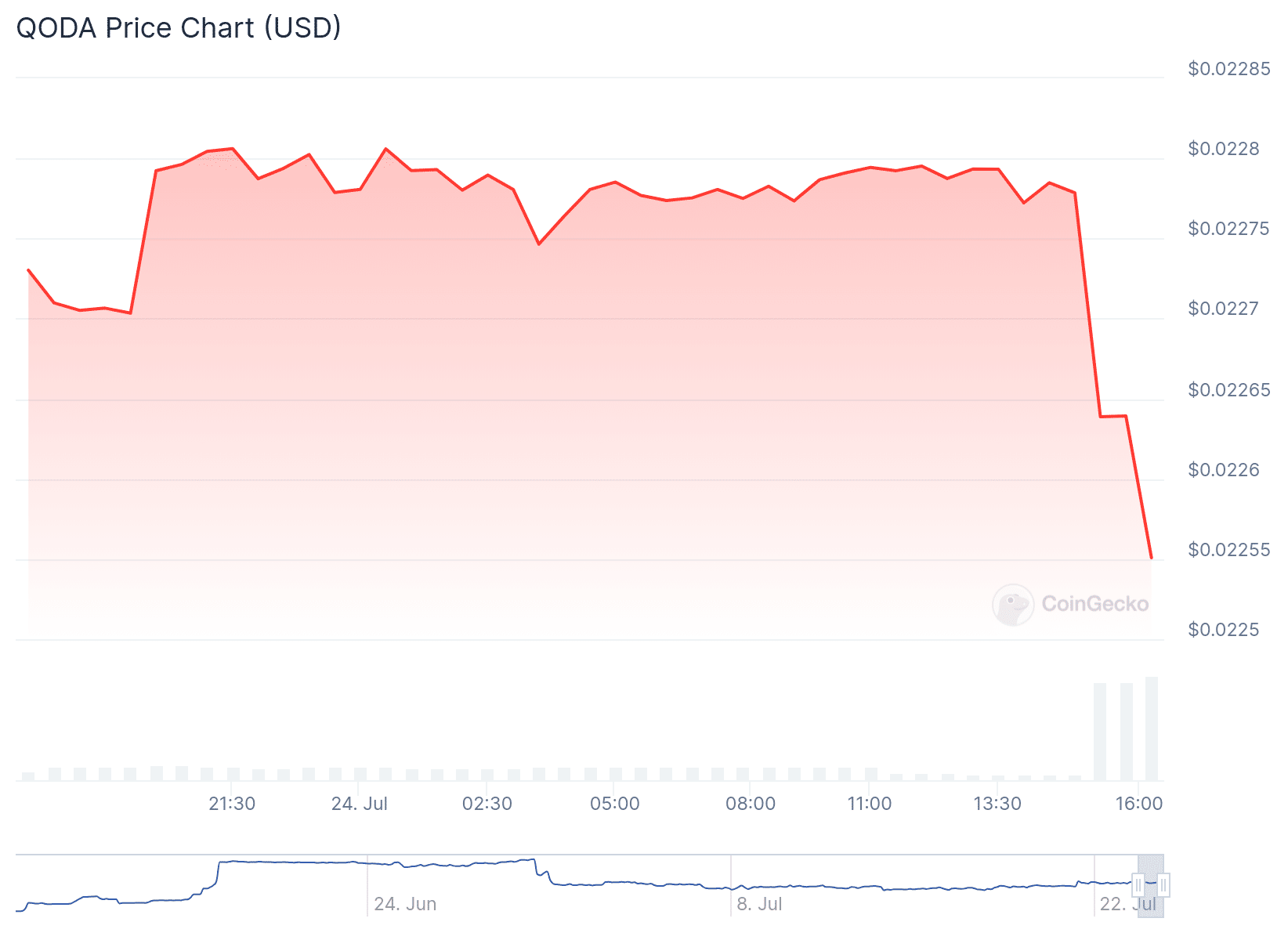

2. Qoda Finance (QODEX)

The Qoda Ecosystem comprises partner applications designed to make financial services more accessible. These applications operate across various blockchain networks, providing flexibility and inclusivity.

The Qoda Ecosystem includes two primary applications. First is Threebalance, a portfolio management tool that facilitates rebalancing crypto portfolios using on-chain liquidity sources. Steadily Consulting Inc. manages this application. Additionally, Qonstant operates as an order book-style exchange on Arbitrum One, offering fixed-rate lending and borrowing. This, too, is managed by Steadily Consulting Inc.

Partners within the Qoda Ecosystem have the option to purchase $QODA tokens. They may burn these tokens permanently or distribute them as rewards to Qoda DAO Members. The specific amounts of tokens purchased, burned, and distributed depend on the agreements made with each partner.

🔥 $QODA Listing on Uniswap 🔥

$QODA is now available for trading and adding liquidity on @Uniswap.

Get $QODA: https://t.co/j65RwLsq40

Learn more about the $QODA token: https://t.co/wcmL4SEnq2

Staking $QODA is the only way to earn $veQODA and participate in the Qoda DAO.…

— Qoda Finance (@QodaFinance) June 6, 2024

In terms of partnerships, Qoda has engaged in several notable collaborations. For instance, a partnership with RociFi aims to enhance DeFi lending by utilizing blockchain credit assessments, thus addressing the issue of high collateral requirements. Moreover, Qoda is working with the 1inch Network through the Threebalance app to enable efficient swaps, which helps users achieve optimal on-chain rates while minimizing gas fees.

Additionally, security is a key focus for Qoda. Its partnership with Halborn, a prominent blockchain security company, highlights this. Furthermore, Qoda has joined forces with DIA to broaden the range of crypto assets available for lending and borrowing. This collaboration is crucial for integrating reliable price oracles for a wider variety of assets beyond the commonly used ones, such as USDC, ETH, and BTC.

3. Q Protocol (QGOV)

Q is an EVM-compatible Layer 1 delegated proof-of-stake blockchain focusing on decentralized governance. It provides a framework that supports various Web3 entities, including DAOs, DeFi applications, and metaverse platforms. By doing so, Q ensures secure and fair processes for decision-making, rule enforcement, and dispute resolution.

Q’s governance model integrates smart contracts with a private-law-based legal framework. The Q constitution outlines the system’s rules, which are enforced through a combination of on-chain and off-chain elements. Additionally, a dispute resolution mechanism addresses potential conflicts. One of Q’s key offerings is its Governance Security layer, which is permissionless and decentralized.

This feature aims to enhance existing governance frameworks in the Web3 space. By offering governance-as-a-service, Q enables developers to create more sophisticated products. Consequently, this infrastructure supports a variety of use cases, solving current crypto ecosystem problems and enabling new business models on-chain.

Q Development AG, the company behind Q Blockchain, has formed several strategic partnerships. For instance, the collaboration with Kleros integrates Kleros’s decentralized dispute resolution procedures with Q’s ability to enforce off-chain decisions on-chain. This partnership seeks to improve safety, accountability, and transparency for DAOs. Similarly, Dmany’s partnership involves deploying its DAO on the Q Blockchain, enhancing community participation with decentralized decision-making capabilities.

Become a Q Patron by committing your QGOV tokens to the Q Vault and receive additional rewards for supporting the security of @Qblockchain!

Commit your QGOV tokens today and get a total APR of up to 81%. Under the Q Patron Program, you can commit your QGOV tokens for 6, 12, or… pic.twitter.com/5v0fpMyS6q

— Q Blockchain (@QBlockchain) July 23, 2024

Moreover, by combining Q’s governance expertise with DeSciWorld’s ethical standards framework, their partnership showcases secure and community-controlled governance within the DeSci community. Meta Pool deployed its liquid staking platform on the Q Blockchain in another partnership.

This allows stakeholders to use an accessible staking system that delegates Q tokens to top validators and collects staking rewards. This partnership supports blockchain decentralization and leverages Q’s governance mechanism. Finally, the collaboration with Orally Network utilizes innovative on-chain oracles powered by the Internet Computer from Dfinity, further enhancing Q Blockchain’s capabilities.

4. WienerAI (WAI)

WienerAI’s ($WAI) market entry seeks to simplify trading for beginners by blending artificial intelligence, AI tokens, and a trading bot. The project has generated market hype, raising over $7 million, with each token priced at $0.00073. Despite the bearish market conditions, the demand for WAI tokens suggests growing interest in the project. This interest is supported by a well-structured tokenomics plan that incentivizes early investors and promotes sustainable growth.

A major draw for investors is the staking rewards offered by WienerAI. During the presale, the platform provided an Annual Percentage Yield (APY) of over 143% for staked WAI tokens. This has resulted in over 7.3 billion WAI tokens being staked, indicating strong investor confidence in the project’s future.

A distinguished gentleman, WienerAI, will make his grand entrance soon 🌭🤖 pic.twitter.com/iF01b9Hhh3

— WienerAI (@WienerDogAI) July 23, 2024

Wiener is earning trust within the investor community by emphasizing security and transparency. The project’s strategic tokenomics and attractive staking rewards further enhance this trust. WienerAI’s technology also contributes to its attractiveness. The AI-driven trading interface predicts market movements and offers straightforward analyses.

Additionally, the platform allows seamless swaps across decentralized exchanges without fees, aligning with its decentralized ethos. WienerAI protects users against MEV (Miner Extractable Value) bots, ensuring interference-free trading. With the presale ending in 7 days, investors can purchase tokens at the current presale price for potential future returns.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage