Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price plummeted by 8% in the last 24 hours to trade for $3,168 as of 00:11 a.m. EST on trading volume that dipped 15%.

The slump came as outflows from spot ETH ETF (exchange-traded fund) products launched on July 23 hit $113.3 million, led by an $810 million hit for Grayscale’s Ethereum Trust (ETHE).

The outflows recorded by Grayscale’s ETHE overshadowed the net inflows of seven other funds. Leading the pack were the Fidelity Ethereum Fund (FETH) with $75.4 million in inflows and the Bitwise Ethereum ETF (BITW) with $29.6 million.

Ethereum’s price slump also followed the broader digital asset dump, with global market capitalization tumbling nearly 4% to $2.31 trillion.

It also came despite digital asset management firm Hashdex’s move to file for a multi-crypto ETFs featuring Bitcoin (BTC) and Ethereum (ETH). If the US Securities and Exchange Commission (SEC) approves the application, the Hashdex Nasdaq Crypto Index US ETF could see other cryptocurrencies added down the track.

Hashdex files S-1 for combined spot btc & eth ETF… https://t.co/XurKX448Ab pic.twitter.com/je3PRiszPJ

— Nate Geraci (@NateGeraci) July 24, 2024

In its filing to the SEC, Hashdex wrote, “If any crypto asset other than bitcoin and ether becomes eligible for inclusion in the Index, the Sponsor will transition to a sample replication strategy. Only bitcoin and ether in the same proportions determined by the Index.”

Update: @hashdex has filed an S-1 for their Crypto Index ETF. Will start with just #Bitcoin & #Ethereum but can add other assets if and when approved by the SEC. https://t.co/W3uHyv9MYn pic.twitter.com/DFXouwu4IK

— James Seyffart (@JSeyff) July 24, 2024

The offering is intended to track certain digital assets in the Nasdaq Crypto US Settlement Price Index, which is the daily closing value of the Nasdaq Crypto Index. It measures the performance of a significant portion of the digital asset market. Hashdex did not propose to include Ether staking in its combined spot cryptocurrency ETF.

Elsewhere, a report by Coingecko indicates that Ethereum became inflationary in the second quarter, adding 120,000 ETH tokens to its circulating supply. This is after 107,725 ETH were burned, while 228,543 were emitted during the period.

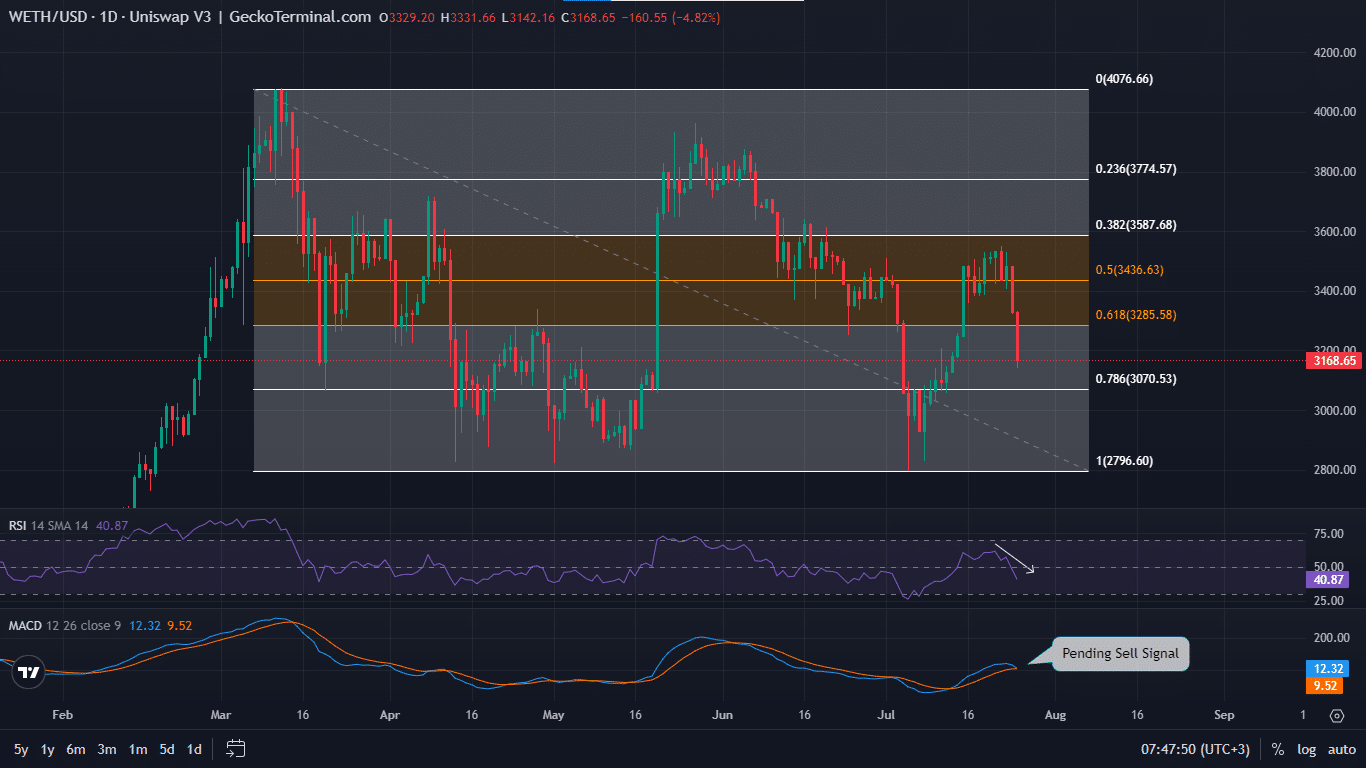

Ethereum Price Prediction

The Ethereum price is trading with a bearish bias, which threatens the big-picture bullish outlook after a nearly 30% climb achieved this month. The odds lean in favor of the downside amid waning momentum and selling pressure almost exceeding that of buyers.

The Relative Strength Index (RSI), an indicator that measures momentum, shows that this metric is falling. Its move slipping below the threshold of 50 shows the bears could be having their way. This is accentuated by the pending sell signal on the Moving Average Convergence Divergence (MACD), which suggests sellers have overpowered the buyers.

Increased selling pressure below current levels could see the Ethereum price extend the fall to the $3,070 support or, worse, roll over to $2,796, effectively revisiting the July lows.

GeckoTerminal: ETH/USD 1-day chart

On the other hand, if Ether bulls recover, the Ethereum price could climb. Nevertheless, only a stable close above the $3,587 threshold would render ETH attractive to buy. In a highly bullish case, the gains could see the Proof-of-Stake (PoS) token reclaim the $3,774 level, paving the way for a further upside.

With the Ethereum price risking further losses, traders might consider a new presale that influential YouTuber Jacob Bury says has the potential to 100x after launch.

Promising Alternative To Ethereum

The project is called Base Dawgz (DAWGZ) and while it calls the Base chain home it will operate on five different chains once it launches: Ethereum, Avalanche, BSC, Solana and Base.

Thanks to Portal Bridge and Wormhole technologies, the project will enable quick and easy funds transfers between these chains. This will allow users to move their money to whichever chain they wish.

They will be able to access Ethereum’s decentralized exchanges (DEXes), Solana’s low fees and high speeds, Binance’s own DeFi, and more.

Users can also benefit from staking DAWGZ tokens, with an annual yield of 1,148% on offer.

So far, about 23.7% of DAWGZ tokens have been staked. As the number of staked tokens increases, the returns diminish, so investors should consider staking tokens while it is still early and with rewards still high.

YouTube channel Cryptonews says DAWGZ “is going to explode“ after launch.

If you would like to join investors who have already pumped over $2.7 million into DAWGZ, you can buy its tokens for $0.006725 using ETH, USDT, USDC, BNB, BUSD, AVAX, or SOL.

🪂 2.6 MILLION 🚀

Well done big $DAWGZ! pic.twitter.com/DZQ3unZS8K

— Base Dawgz (@BaseDawgz) July 20, 2024

The price will increase in a little more than five days, so do not wait too long if you plan to add it to your portfolio.

Visit the official DAWGZ website here.

Also Read:

- How to Buy Base Dawgz Token – $DAWGZ Presale Review

- Base Dawgz Price Prediction – DAWGZ Price Potential in 2024

- Best Base Chain Meme Coins To Buy – 2024 Guide

- Upcoming Crypto Presales: Unlock Early Investment Opportunities!

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage