Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has exploded nearly 10% in the last 24 hours to trade for $56,242 as of 1:30 a.m. EST time.

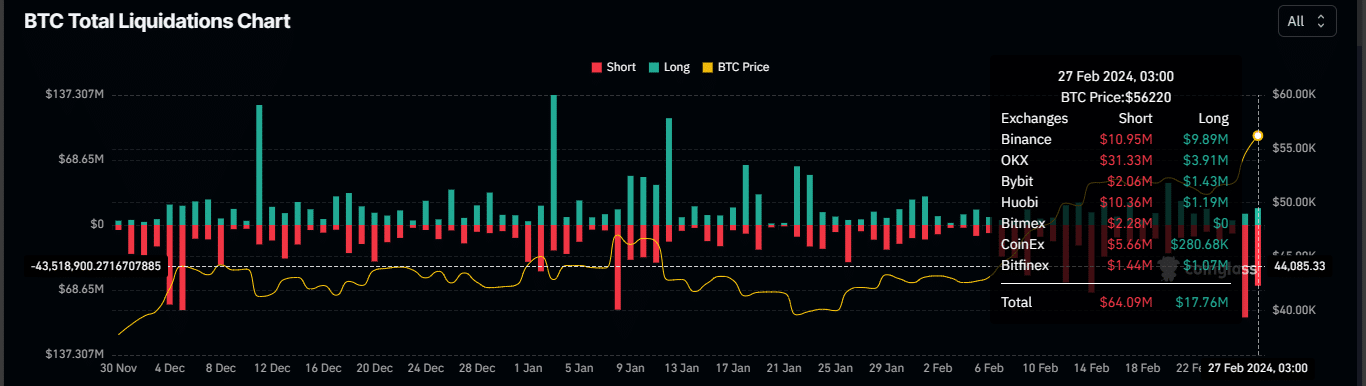

Trading volume is up 230%, signifying a remarkable surge in BTC. Amid this euphoria, the Bitcoin price blasted past the $55,000 milestone during the afternoon hours of the US session, liquidating nearly $100 million in short positions against around $12 million longs.

Latest data shows that as of publishing time, $64.09 million shorts have been liquidated, alongside $17.76 million long positions.

With it, as the shorts closed their positions (effectively buying), there has been a striking $1.41 billion increase in open interest, moving from $23.45 billion to $24.86 billion in 24 hours. For the layperson, open interest represents the sum of all open long and short positions for an asset in the market.

Why Is The Bitcoin Price On A Tear?

The surge in the Bitcoin price is inspired by two themes, with the reports coming in the order as has been detailed here.

-

MicroStrategy Inspires FOMO In Voluminous Bitcoin Purchase

First, MicroStrategy CEO Michael Saylor revealed that the business intelligence firm had added 3,000 BTC tokens to its portfolio, worth approximately $155 million.

MicroStrategy has acquired an additional 3,000 BTC for ~$155 million at an average price of $51,813 per #bitcoin. As of 2/25/24, @MicroStrategy now hodls 193,000 $BTC acquired for ~$6.09 billion at an average price of $31,544 per bitcoin. $MSTR https://t.co/micudbYf3P

— Michael Saylor⚡️ (@saylor) February 26, 2024

With an average purchase price per token in the latest investment being $51,813, this bullish move brings the firm’s total BTC bucket to 193,000 tokens, worth $9.9 billion. This is according to data from on-chain tool Lookonchain, which indicated that the average purchase price for the portfolio is $31,544.

MicroStrategy bought another 3,000 $BTC($155M) at $51,813!#MicroStrategy currently holds 193K $BTC($9.9B), and the average buying price is $31,544.

At current prices, the profit has exceeded $3.8B! pic.twitter.com/51ccSstfLv

— Lookonchain (@lookonchain) February 26, 2024

Saylor recently committed to endless BTC buying, saying, “I’m gonna be buying the top forever,” and adding that “Bitcoin is the exit strategy. It is the strongest asset.”

Sell my #Bitcoin? 🤨

"I'm gonna be buying the top forever."@saylor pic.twitter.com/2gMD0QZgav

— ⚡️ Oz ⚡️ (@imabearhunter) February 20, 2024

The latest move brings MicroStrategy closer to meriting the list of America’s largest 500 publicly traded firms, otherwise termed S&P500. The threshold for listing on the S&P 500 is a market capitalization no lower than $15.8 billion.

NASDAQ data shows the current MicroStrategy market capitalization at $13.51 billion. Other selection criteria for the S&P 500 include meeting liquidity thresholds and a consistent track record of profit-making for a minimum period of four successive quarters right before making the application.

Notably, the revelation was a bold move, coming only hours after reports that the firm’s X account had been hacked.

-

BlackRock ETF Trading Volume Hits $1.3 Billion

Another theme that has driven the surge in the Bitcoin price is a recent report by Eric Balchunas, exchange-traded funds (ETFs) specialist with Bloomberg Intelligence. In a recent post on X, Balchunas highlighted that BlackRock spot Bitcoin exchange-traded fund (ETF) the IBIT, has traded well over $1 billion on Thursday, February 26.

JUST IN: BlackRock’s #Bitcoin ETF just broke $1 Billion in trading volume for the day!

🫡 @EricBalchunas pic.twitter.com/ymg0iFvgD8

— Bitcoin Archive (@BTC_Archive) February 26, 2024

Balchunas said that the nine Bitcoin ETFs broke the all-time volume record on Feb. 26 with $2.4 billion, which just beat the first day of trading on Jan. 11. BlackRock’s IBIT attracted more than $1.3 billion in activity, according to Balchunas, who highlighted that the product has broken its record by about 30%.

It's official..the New Nine Bitcoin ETFs have broken all time volume record today with $2.4b, just barely beating Day One but about double their recent daily average. $IBIT went wild accounting for $1.3b of it, breaking its record by about 30%. pic.twitter.com/MiCs1rzttM

— Eric Balchunas (@EricBalchunas) February 26, 2024

Grayscale is second with $843.6 million for its GBTC, followed by Fidelity’s FBTC and Ark Invest’s ARKB in the third and fourth positions recording $587.3 million and $265.6 million respectively.

JUST IN: Total spot #Bitcoin ETF trading volume surpasses $3.24 billion today:

• BlackRock: $1,318,226,580

• Grayscale: $843,654,199

• Fidelity: $587,327,032

• Ark Invest: $265,647,305

• Bitwise: $83,248,930

• Invesco: $60,072,480

• WisdomTree: $37,426,253

• VanEck:…— Watcher.Guru (@WatcherGuru) February 26, 2024

Bitcoin Price Prognosis

After breaching the $55,000 milestone, the Bitcoin price is at high risk of a correction, considering the Relative Strength Index (RSI) is way above 70. If the correction happens, it could retrace to the $50,000 psychological level.

However, if the Bitcoin price closes above trhe $55,000 threshold, the upside potential could continue to abound. One factor that could sustain the uptrend is trading volumes continuing to record significant numbers towards the remaining days of the week. With such an outcome, investors’ profit appetite could remain as the countdown to the halving, around 58 days out, continues

The Spent Output Profit Ratio (SOPR) position below 1 indicates that a correction may not be due just yet. It is currently at 0.91, as a 30-day moving average (MA). For the layperson, this ratio suggests that BTC holders who are sitting on unrealized profits are not showing any intention to cash in on their gains so far.

Increased buying pressure could see Bitcoin price climb to reclaim the $57,000 threshold. In a highly bullish case, the BTC rally could extend a neck higher to $60,000. Such a move would constitute a 5% climb above current levels. It could send BTC into the supply zone between $63,329 and $67,999.

Such a move would give the Bitcoin price a chance to retake its $69,000 all-time high, levels last seen in November 2021. The first sign would be a break and close above $65,664, the mean threshold of the range.

Notice the RSI remains northbound, suggesting rising momentum. This is after it executed a buy signal, crossing above the signal line (yellow band).

TradingView: BTC/USDT 1-day chart

Conversely, a rejection from $57,000 provoked by profit-taking could send Bitcoin price to $50,000.

Meanwhile, with the Bitcoin market on a tear, investors might want to consider diversifying some of their gains into a new ICO with greater upside potential that’s called Green Bitcoin ($GBTC).

Green Bitcoin Secures $1.1 Million in Funding – Best Green Crypto To Buy

Green Bitcoin ($GBTC) is a cryptocurrency project that combines the legacy of Bitcoin with the eco-friendly attributes of Ethereum. It introduces a unique, sustainable staking model called Gamified Green Staking, which allows users to earn passive income through staking rewards.

Introducing Green Bitcoin: A Revolutionary Predict-To-Earn Token.

Join us on our Gamified Green Staking Platform, where your predictions can turn into profits!

Website: https://t.co/dG5cEeCtRs

Telegram: https://t.co/bWanoe0vHv pic.twitter.com/eXuGQBkxio— GreenBitcoin (@GreenBTCtoken) December 3, 2023

The project’s gamified staking system allows users to participate in daily and weekly BTC price prediction challenges, with the potential to earn attractive rewards.

The project has recently gained significant attention, with its ongoing $GBTC token presale surging past $1.1 million already. The presale offers a unique opportunity for early investors to get involved in the project at a low entry price of $0.492 per token. You can secure your tokens at this price now before a price hike about 10 hours.

$1 MILLION REASONS TO JOIN $GBTC

HUGE MILESTONE!

Join The Green Revolution: https://t.co/dG5cEeD1H0 pic.twitter.com/UqK09asBd5

— GreenBitcoin (@GreenBTCtoken) February 15, 2024

Stake-To-Earn 261% APY, Predict-To-Earn Rewards

Additionally, you can buy and stake $GBTC tokens to earn an impressive annual percentage yield of 261%. So far, more than 2.2 million $GBTC tokens have been staked.

Did you know you can earn HUGE, simply by staking your Green Bitcoin?

If you haven't yet, go to our website and check out the Staking feature! pic.twitter.com/6wiv99ER0O

— GreenBitcoin (@GreenBTCtoken) February 25, 2024

To further incentivize its community, Green Bitcoin also introduces a predict-to-earn feature, where users participate in daily BTC price prediction challenges. $GBTC tokens act as the stake as well as the reward, with rewards distributed every 10 minutes.

This unique approach encourages community participation and helps to maintain the stability and growth of the $GBTC network.

Crypto analyst and YouTuber, Jacob Bury, believes that $GBTC is one of the altcoins that will soar massively before the halving event in April.

To participate in the presale, you can buy $GBTC from the official Green Bitcoin website, and exchange ETH or USDT for $GBTC tokens. You can also buy directly using your bank card.

Related News

- 🚀 Dogecoin Price Prediction: Will DOGE Reach $1 in 2024? 🐶💰

- 🐕📈 SHIBA INU PRICE PREDICTION 2024: 🚀 TO THE MOON OR 📉 CRASH LANDING?

Join Our Telegram channel to stay up to date on breaking news coverage