Join Our Telegram channel to stay up to date on breaking news coverage

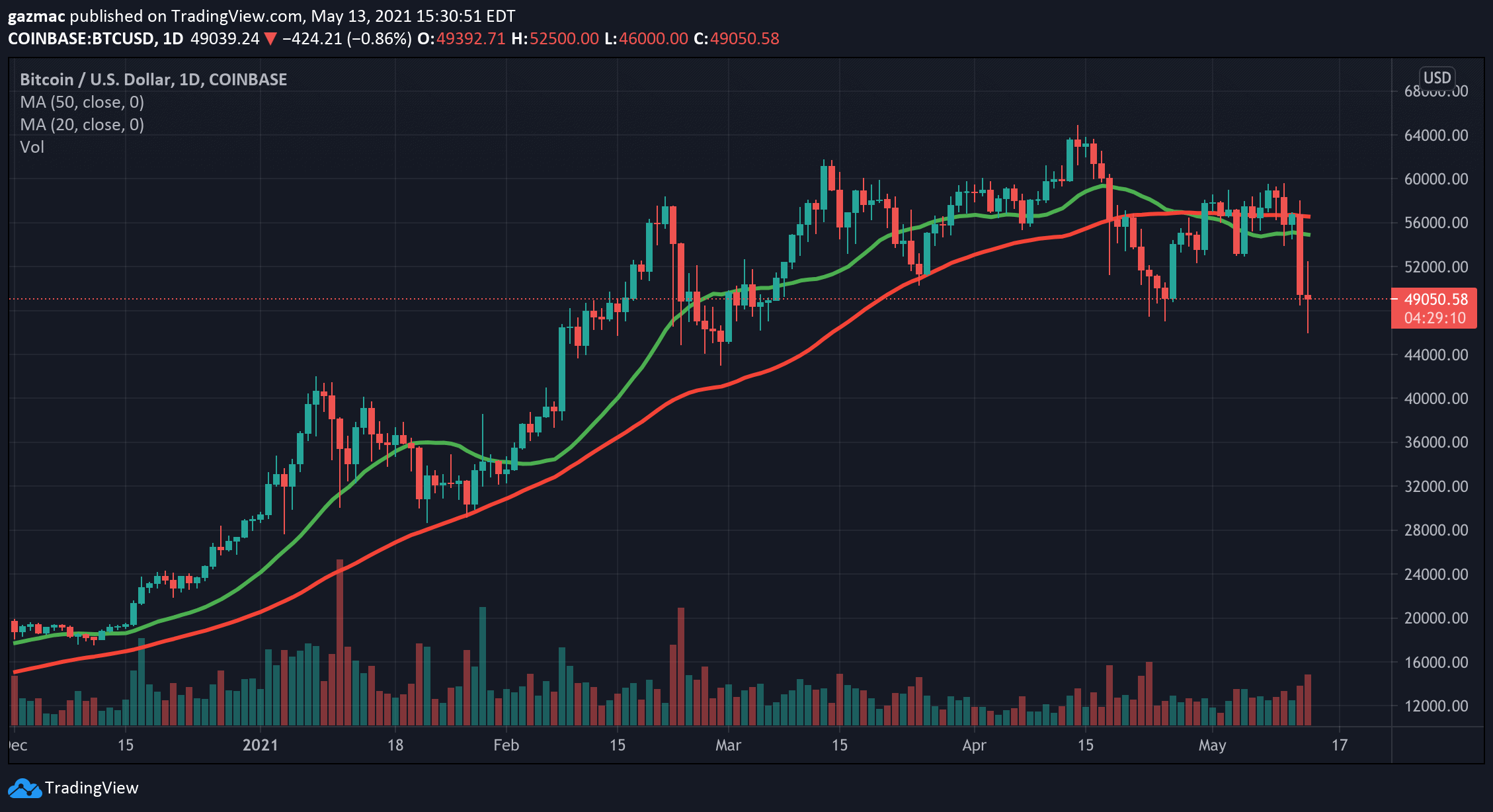

The Bitcoin Elon Musk negativity effect continues to weigh on bitcoin, but the investigation of Binance by US regulators is adding to the bearish woes, with the virtual currency failing to find a bottom.

The selling pressure was set in motion by the shock revelation that Tesla will no longer be accepting the digital currency in payment for its cars.

Bitcoin is currently trading at $48,417, according to Coinmarketcap. The reaction to Musk’s tweet last night was immediate.

European-based crypto-asset platform Currency.com saw a surge in trading volume on its USD.cx/BTC market, jumping 479%. USD.cx is Currency.com’s tokenised version of the US dollar. Within the six-minute window, clients trading the pair mushroomed 400%, while trades executed rose 240%.

Mikhail Karkhalev, financial analyst at Currency.com, commented: “Elon Musk’s statement certainly put a lot of pressure on Bitcoin. There was an immediate reaction to the news across Currency.com with heightened trading activity within just a few minutes of the announcement. However, it’s important to note that the announcement was not the only factor contributing to BTC’s recent decline.”

Inflation fears hurt stocks and bitcoin too

Yesterday’s US consumer inflation rate for the year to end April clocking in at 4.2% also played a part in spurring on bitcoin’s reversal. Equity markets fell heavily as investors sort out safer havens and fled risk assets, adding to selling pressure in crypto, even though the latter is seen as having inflation-hedging properties.

The S&P 500 fell 2.2% and the Nasdaq by an eye-watering 2.7%, with big tech high fliers leading the descent.

Yields on US Treasuries also spiked. Higher inflation will eat into the future earnings of tech companies valued on the size of those future earnings, hence the sell-off in tech. The crossover between tech investors and crypto means there is a positive correlation between the two.

But the other issue that hasn’t previously been fully factored in is the prospect that central bankers – and the US Federal Reserve in particular – will have to tighten monetary policy by ending asset purchases and increasing interest rates .

However, there are other market participants who think that any sharp rise in inflation will be transitory and would merely reflect the bounce back from the pandemic in economic activity.

Binance probe: US Justice Dept and IRS investigating

Strengthening the negative turn in sentiment, today is the news reported by Bloomberg that top crypto exchange Binance is under investigation by the US Inland Revenue Service (IRS) and US Justice Department, as the authorities look to crackdown on the suspected proliferation on crypto exchanges of illicit activity such as money laundering and tax evasion.

As far as the Musk’s stick in the spokes of the crypto wheels goes, Karkhalev believes that it could mark the end of the near-term “dynamic growth cycle for BTC”.

Responding to the probes into its business, Jessica Jung from Binance said: “We have worked hard to build a robust compliance program that incorporates anti-money laundering principles and tools used by financial institutions to detect and address suspicious activity.”

ByBit CEO: “Bitcoin will come back more resilient”

Ben Zhou, CEO of crypto derivatives exchange Bybit told insidebitcoins that bitcoin would come back stronger. “Bitcoin will lick its wounds and return [to] being Bitcoin. For something that has set its goal on being the ultimate asset class, it needs to prove its strength against such attacks. “

Zhou continued: “Every time Bitcoin survives an assault or a character assassination like this, it will come back more resilient. A future attack from Musk, should there be more, will have less sting.”

The Currency.com analyst also thinks the decline will be temporary.

“We believe that this panic is temporary. The number of institutional investors is growing, and interest in cryptocurrencies is not decreasing, but increasing. It is likely that BTC’s decline will fall to $44,000, but eventually rise again,” says Karkhalev.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider

Join Our Telegram channel to stay up to date on breaking news coverage