NSBroker is a Malta-regulated CFD broker that offers a range of financial instruments to trade on covering forex, indices, commodities, and cryptocurrencies. It is best suited for experienced forex traders looking to trade in higher volumes and get access to the popular MetaTrader 5. But is it the right broker for you? Is NSBroker the best choice in the market?

In this review, we explore the pros and cons of NSBroker and cover the most important factors to consider before opening an account with this broker. This includes the platform’s tradable assets, fees, spreads, regulatory standing, supported payment methods, and much more.

On this Page:

What is NS Broker?

NSBroker is a subsidiary brand of NSFX Ltd, a company that is based in Malta under the registration number IS/56519. It was founded in 2011 by a team of experts in the financial sphere, and is licensed by the Malta Financial Services Authority (MFSA) and the Financial Conduct Authority (FCA). Further, the broker also complies with the regulation of European Markets in Financial Instruments Directive (MiFID).

NSBroker is a subsidiary brand of NSFX Ltd, a company that is based in Malta under the registration number IS/56519. It was founded in 2011 by a team of experts in the financial sphere, and is licensed by the Malta Financial Services Authority (MFSA) and the Financial Conduct Authority (FCA). Further, the broker also complies with the regulation of European Markets in Financial Instruments Directive (MiFID).

Since its foundation, it has has been constantly growing due to the high-security level it offers and the solid selection of trading tools. As of 2020, NSBroker has more than 33,000 clients in over 150 countries. It supports around 100 tradable assets and instruments across four markets, which is a very limited range of products compared to other brokers in the industry.

NS Broker Pros and Cons

Pros:

- Supports MT5

- Highly regulated

- Competitive spreads

- ECN trading account

Cons:

- Limited range of assets and instruments

- Only supports one account type

- High minimum deposit requirement

- Does not support web trading platform

- Limited trading tools

- Only one trading platform (MT5) is available

- Does not offer a social trading experience

- Complicated withdrawal process

Regulation and Trust

When it comes to regulation and the safety of your funds, NSBroker efforts to take all measures in order to protect investors’ money and data. First and foremost, the broker was launched in 2011 and holds licenses from the Malta Financial Services Authority (MFSA), Financial Conduct Authority (FCA), Federal Financial Supervisory Authority (BaFin), French Prudential Supervisory Authority (ACP), National Securities Market Commission (CNMV), and the Danish FSA. On top of that. the broker also complies with the regulation of European Markets in Financial Instruments Directive (MiFID). This means that investors’ funds are completely isolated from the organization’s funds and are held in segregated accounts.

Clients’ funds are also protected by the Maltese Investor Compensation Scheme, which serves as a limited safety net for certain classes of investors in the event of insolvency.

Products and Markets

NSBroker falls behind competitors in the industry in terms of the range of products and markets it offers. On this platform, you will get access to 100 financial instruments across four markets: Forex, commodities, shares indices, and cryptocurrencies. This is extremely limited if compared to other brokers such as eToro that offers more than 2000 tradable assets.

Nevertheless, the variety of instruments available on NSBroker’s platform includes:

- Forex: Over 40 currency pairs with a leverage ratio of up to 30:1 for retail clients and 100:1 for professional traders.

- Indices: You will also get access to four share indices. These include the Australia 200 (ASX200), France40 (CAC40), JPN225 (Nikkei 225), and UK100 (FTSE 100).

- Cryptocurrencies: You will be able to trade on the following digital assets: Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ripple.

- Commodities: Finally, NSBroker supports Gold, Silver, Brent Oil, and Crude oil.

Bonus

Under the Malta Financial Services Authority laws and regulations, NSBroker is not authorized to offer any bonuses and promotions to clients.

Leverage

NSBroker offers a leverage ratio of up to 30:1 for retail clients, which means you’ll be able to trade with a margin requirements of up to 3.33%. Professional traders, however, are able to trade with a leverage of up to 100:1. This is relatively low compared to other brokers in the market.

The margin requirements provided by NSBroker are based on the new restrictions on CFDs imposed by the European Securities and Markets Authority (ESMA). Below we have listed the leverage limits for retail clients offered by NSBroker.

- Forex: 30:1 (margin requirement 3.33%)

- Indices: 20:1 (margin requirement 5%)

- Cryptocurrencies: 2:1 (margin requirement 50%)

- Commodities: Gold – up to 20:1, Silver, Brent/Crude oil – up to 10:1.

Education and Trading Tools

Overall, NSBroker offers very limited educational resources and trading tools with the majority of the educational material is mostly suited for beginner investors. On its education center, the broker provides a basic glossary, video lessons, collection of forex & CFDs ebooks, and guides. Further, it also supports a free demo account for investors that wish to test the platform before risking real money.

NSBroker also offers a number of trading tools that include financial news articles, technical analysis forecasts, and an economic calendar. However, we must inform you that NSBroker financial news feed is out of date so you may have to consider using a third party market news provider. The technical analysis section provides you with an insight into the forex market for the coming week and updated on a weekly basis.

While NSBroker does not offer many advanced useful trading tools and education material for professional traders, it does support automated trading solutions via the MetaTrader5. This is one of the great features offered by NSBroker and allows investors to set up your own algorithms on the MetaTrader 5 platform.

Account Types

One of the biggest disadvantages of this platform is that NSBroker offers only one type of account to its traders, the Live Account. That will limit investors who want greater liquidity and tighter spreads. Further, it means there’s no option to get access to a premium trading account that comes with a dedicated account manager and many benefits for the user.

NSBrokers offers a real live account through an Electronic Communications Network (ECN) execution method with spreads starting from 0.4 pips, which is lower than the industry average. However, you must take into consideration that ECN trading accounts are typically susceptible to heavy slippages.

The deposit requirement for the real live account starts at $250. In addition, you can sign up for a free demo account with $20,000 of virtual money.

Fees

In terms of trading fees and commissions, NSBroker charges spreads and overnight interest rates. As an ECN broker, it charges relatively low spreads that starts from 0.4 for the EUR/USD. To view the overnight rates, you need to log in to the MetaTrader 5 and navigate to the contract specifications.

It appears that the broker also charges an inactivity fee though the information has not been provided on NSBroker’s website. In general, there is no mention of any trading fees on the NSBroker’s site. There are no fees on deposits and withdrawals.

Banking

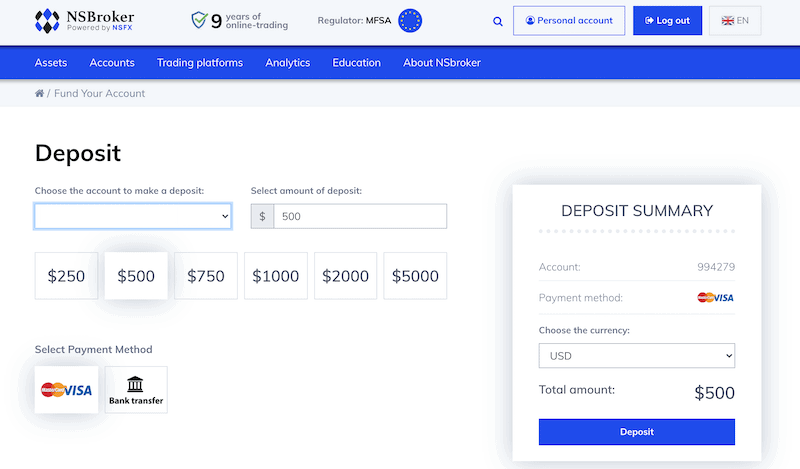

NSBroker offers limited payment method options, which is not enough to cover all preferences of investors who like to have more payment options: The broker allows traders to fund the account via bank wire transfer or credit card (Visa and MasterCard).

The minimum deposit at NSBroker is $250. According to NSBroker, it does not charge any fees on deposits, however, you will have to pay a fee for the credit card provider or your bank. The processing time for funds transfers varies depending on the type of transaction:

Deposit:

- Credit Card – Instant

- Bank Transfer – Between 2-3 Days

Withdrawals:

- Credit Card – Up to 1 business day

- Bank Transfer – Up to 2 Business days

Another disadvantage of NSBroker is that in order to withdraw funds, you’ll have to complete NSBroker’s verification process that includes uploading proof of identity and proof of residence documentation.

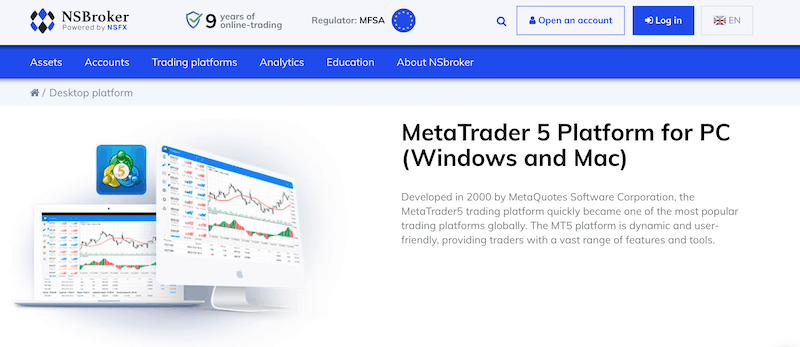

Trading Platform

NSBroker offers only one platform type – the MetaTrader 5 (MT5). The platform is available to download to your desktop (Windows and Mac) or mobile, however, you will not be able to trade on the platform from your web browser. The mobile trading platform is available on both iOS and Android.

Overall, the MetaTrader5 platform is a powerful trading platform that grants you access to a wide range of technical analysis indicators and tools including but not limited to automated trading strategies. These include more than 50 technical indicators, 40+ graphical objects, 17 display styles for indicators, 21 time-frames, and 100 open charts simultaneously.

NSBroker Tutorial: How to Sign Up & Trade

Like all other online trading platforms, you’ll have to sign up and create a trading account before you can start trading. Below, we are going to show you how you can get started in three simple steps.

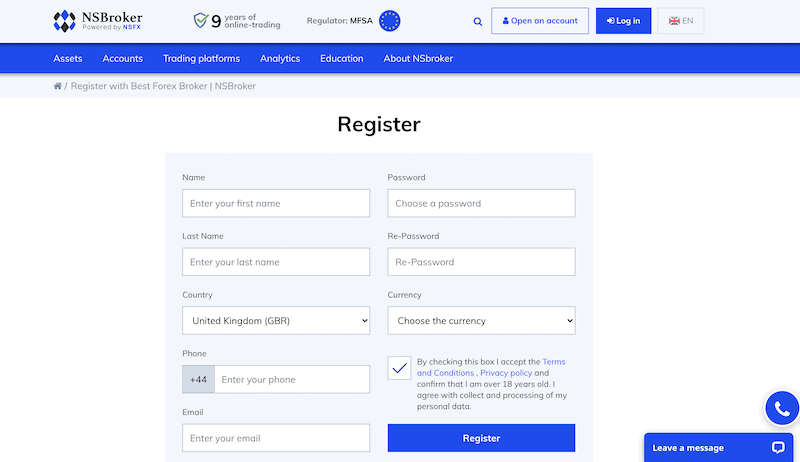

Step 1: Open an Account

First, you’ll need to create a trading account. Once you visit NSBroker’s website, click on the ‘Open Account’ button and fill in your personal details on the registration form.

You will then be asked to provide your full name, home address, nationality, date of birth, and contact details.

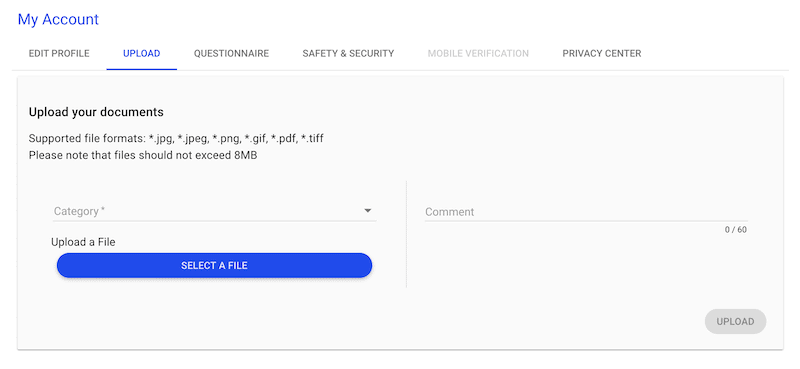

Step 2: Verify Your Identity

Next, you’ll be transferred to your trading account’s dashboard where you must upload documents to verify your identity and complete a questionnaire about your occupation and trading experience. On the ‘upload’ tab, upload the following documents:

- Government-Issued ID, such as a photo of your passport or any national identity card

- Proof of residential address, such as any utility bill issued within the last three months

- If depositing with a credit/debit card, you’ll need to provide a photo of both sides of the credit/debit card used for the payment

Step 3: Deposit Funds

Once your account has been approved, you will then need to fund your account. Click on the Personal Account button and navigate to the deposit button on the dropdown menu. If you wish to start off with the minimum amount, you can make a deposit of $250.

Step 4: Start Trading

That’s it – As the funds have been deposited in your account, you should now be able to download the MetaTrader5 desktop platform and start trading. Yet, before you decide to trade the live account it’s highly recommended that you use the demonstration account in order to get familiar with the platform and the provided trading tools.

Customer Service

NSBroker offers customer support via phone from 8 am to 8 pm (GMT+3) Monday to Friday. There’s a customer support number for calling within the UK as well as international phone numbers in Austria, and Malta.

Alternatively, you can contact the support team by filling in an online submit request as well by email and live chat.

Supported Countries and Regions

NSBrokers mainly serves clients from the European Union, however, it appears that this broker accepts investors from most countries with a few exceptions. This includes traders from the United States, Japan, Canada, and Australia.

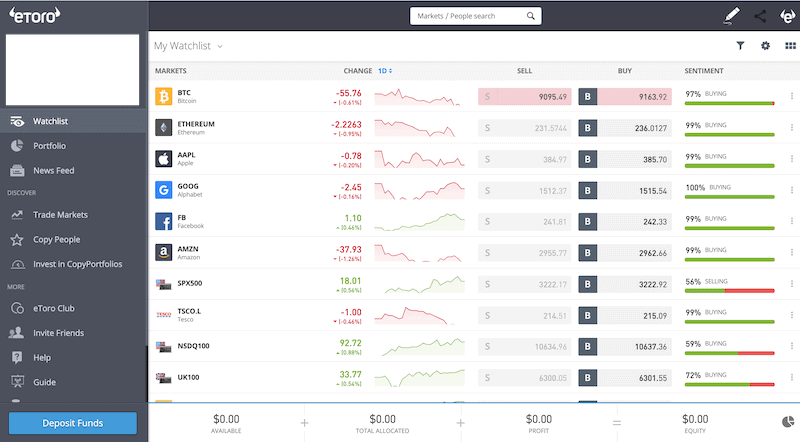

NS Broker vs eToro

NSBroker is a well-reputed and regulated CFD broker, though it falls short in some crucial aspects when compared to other brokers in the industry such as eToro.

While NSBroker offers tight spreads and the popular MetaTrader5, the selection of products and markets is very limited with only 100 tradable assets available on its platform. eToro, on the other hand, gives investors access to more than 2000 assets including a built-in CopyPortfolios that enable investors to invest in analyst-curated strategies. eToro also offers a no-commission policy for buying shares, cryptocurrencies, and other CFDs.

Another feature that stands out about eToro is its social trading platform and copy trading tools. On eToro’s platform, investors can interact with other users and can even copy traders of other top-performing traders by using its CopyTrader tool. This is a great tool for beginners as well as those who wish to let others make the research work.

In summary, NSBroker does not come close to eToro. eToro offers a social trading experience, a wide range of financial products and payment methods, and a user-friendly trading platform. The registration process at eToro is not only safe and secure but also requires a lower minimum deposit requirement which can be funded through a range of payment methods, including bank cards, bank transfer, and PayPal.

Read our comprehensive eToro review to learn more about this platform.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Conclusion

The big issue that traders may face with NSBroker is the limited range of products and trading tools. The fact that this broker operates through the MT5 platform may suit experienced traders, but beginners are best off opting for a more user-friendly platform.

Consequently, if you’re looking for the best trading platform on the market, we recommend eToro over NSBroker. With the ability to trade on more than 2000 CFDs without having to pay trading commission, the range of payment methods, and the social trading experience, you’ll get much more from eToro.

Read more:

FAQs

Can I transfer my NSBroker portfolio to another broker?

No. NSBroker is an FX and CFD broker, which means you do not own the underlying asset when you buy financial instruments on its platform. Therefore, if you wish to transfer your portfolio to another broker, you will need to sell your positions, and then withdraw the funds that are available on your trading account.

Can NSBroker run my IRA or other retirement accounts?

No, NSBroker has no authorization to manage retirement accounts. It is a CFD and Forex broker, hence, this broker cannot manage any funds including IRAs.

Is NSBroker available in my country?

NSBroker accepts investors from most countries, except the United States, Canada, Australia, and Japan.

Can I access the same account through my phone and computer?

Absolutely, once you have opened a trading account you will be able to log in to the MetaTrader5 platform from your desktop and mobile trading app.