In the past few years, the forex industry has been experiencing an increase in a new type of brokers known as the Electronic Communication Network (ECN). These brokers are allowing clients to interact with each other or with third parties.

Usually, the minimum amount required for ECN accounts is higher than regular forex accounts. By having an ECN account, you can get several benefits such as faster order executions and lower spreads.

Read on to find out what ECN brokers are, how they work, the difference between ECN and standard accounts and the best ECN brokers in the market.

[toc]What are ECN brokers?

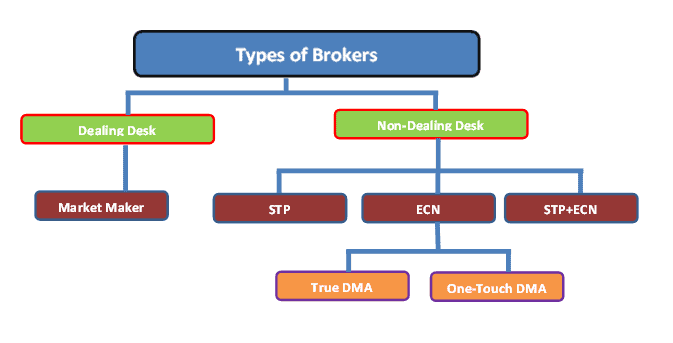

Together with Straight Through Processing (STP) and Direct Market Access (DMA) brokers, ECN brokers are classified as non-dealing desk types of brokers. They execute the clients’ trades by matching them with other clients and third parties who act as counterparties.

In contrast, dealing desk brokers serve as the counterparties on the other side of the trade. This creates an apparent conflict of interest, where the clients are disadvantaged.

In most cases, ECN brokers charge lower spreads than desk dealing brokers. On top of that, they also charge commissions on trade entries and exits made. However, the combination of both the spreads and commissions charged by ECN brokers is lower than the fees most desk dealing brokers charge. The low cost of trading and the lack of conflict of interest make ECN brokers attractive to most traders.

However, ECN brokers ask for a higher minimum deposit compared to dealing desk brokers. Most of them require a minimum trade size as high as one mini-lot rather than one micro-lot that is standard in the industry. Nonetheless, they offer excellent execution speeds.

How do ECN brokers work?

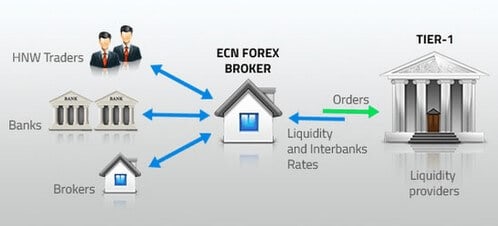

ECN brokers are a type of forex broker that get the matching orders they offer their clients from tier-1 liquidity providers such as banks, big financial institutions, hedge funds, etc. These liquidity providers offer the best currency rate. However, their minimum trading transaction and credit line requirements are very high for ordinary traders to afford. This, in turn, hinders small market players and individual traders from taking advantage of their lower rates.

This is where ECN brokers shine. They bridge the gap between tier-1 liquidity providers and small participants in the market. Since quotes come directly from liquidity providers, ECN brokers will allow you to access exclusive interbank rates.

Most ECN brokers incorporate a program that brings participants together and automatically execute orders in real-time. When orders are made, they are matched with opposite orders of the same amount and volume. This concept involves algorithms and matching engines to execute orders and perform limit checks in a matter of milliseconds. Although the spreads are flexible, they charge 1 to 2 pips on most currency pairs.

What are the advantages of ECN brokers?

The main difference between an ECN and a standard forex broker account is the execution method and the fee policy involved. This difference creates a number of advantages for retail traders, which we outlined below:

- Tighter spreads: Standard accounts have fixed spreads determined by the broker. On the other hand, one thing that has made ECN accounts popular is their tight spreads. The spread is determined by the buy and sell prices and the market itself. As a result, you can usually get spreads at very favorable points or break-even points. Because ECN brokers consolidate price quotations from several market providers (banks), they generally offer clients much tighter spreads than would otherwise be available to them

- No conflict of interest : Since an ECN broker only matche trades between traders, it cannot trade the other side of the client’s business. This eliminates any conflict of interest,

- Trading hours: ECN brokers allow you to trade outside of the traditional trading hours providing a mechanism for those who either cannot be actively involved during market hours or for those that prefer he fexibility of 24 hour a day trading.

Best True ECN brokers for 2020

Below are our most recommended true ECN brokers. They all offer robust trading platforms, tight spreads and fast order execution.

What to look for when choosing an ECN broker

Due to the increased popularity of ECN trading, more brokers are claiming to be ECN brokers or brokers that offer ECN-type accounts to ride on the wave, but not all are true ECN brokers. Below we explain what to look for in a true ECN broker.

- Credentials: Ensure that they are regulated in your country of residence and ensure they have a reputable platform with favourable reviews

- Automatic, quick process: A true ECN broker is a type of broker that put your trade orders in a network where it is automatically matched with a similar order of the same amount and volume. The whole process of matching orders is automatic and only takes a few seconds. If a broker is claiming to offer ECN trading and does not use this method of order execution, it is almost certainly not a real ECN broker.

- Execution speed: Make sure to check out the order execution speed. If it is slow, then it is not a real ECN broker.

- Transparency : ECN brokers source their orders from tier-1 liquidity providers. Fake ECN brokers usually do not indicate which liquidity provider they are using.

- Variable spreads: Ensure that the broker is offering variable spreads as this requirement must be adhered to at all times. If you encounter a broker that is offering established spreads, it’s unlikely to be a true ECN operator.

Conclusion

Due to the increasing number of available ECN brokers, it is difficult to determine which one best suits your trading needs.

When choosing an ECN broker, consider your personal circumstances and trading needs as your financial circumstances may dictate the type of broker you choose. Also, be sure to verify their credentials and that the broker is meeting the requirements of a true ECN forex broker. Also, consider reviewing their charting tools and educational material and ensure the broker offers the appropriate research tools you require.

Finally, remember that all trading carries risk, and do not risk more than you can afford to lose.

FAQs

Is there a difference between a regular forex account and an ECN account?

The only difference between an ECN and a standard forex trading account is the order execution method. In ECN trading, clients act as counterparties while in standard accounts, the broker is the counterparty.

Which broker type is better : an ECN or an STP broker?

ECN accounts are typically considered more favorable for the trader as they tend to offer tighter spreads.

How much capital do I need to open an ECN trading account?

You can create an ECN trading account by depositing between $5 to $200. You can try either Hotforex, XM, FXTM or Pepperstone.