Amid intensified competition in the rapidly evolving crypto trading landscape, Uphold is effortlessly making its mark, retaining the trust of over 10 million users across more than 180 countries worldwide. This is no fluke, considering how the global crypto exchange combines the latest and industry-standard solutions to deliver a simple, secure, and one-step trading experience.

Beyond its advanced trading tools, spanning take profit, trailing stop, repeat transaction, and limit orders, Uphold is also turning heads with its self-custody solution – Vault, first-class crypto card, and high-rewarding USD savings program. The combination of the aforementioned features has strategically positioned the exchange for global acceptance.

In this detailed review, we will walk you through everything you need to know about Uphold and why it might be the perfect pick for your everyday trading endeavors.

Key Features – Quick review

Before we step into the full review of all the available components on Uphold, here is a highlight of all features that users will find while using the app:

- Uphold offers buying, selling, and swapping of over 300 cryptocurrencies like Bitcoin, Ethereum, USDT, USDC, Binance Coin, Solana, and Dogecoin among many others.

- Another core feature of the exchange is its crypto card that allows investors to spend their digital assets in different online and physical stores across the globe.

- There is a self-custody Vault on Uphold that give users a security control over their investment portfolio while enjoying centralized convenience.

- Uphold supports various market options so that investors can grow their wealth. Users can take advantage of its staking, referral, and USD interest account feature on the exchange to make more returns.

- Thanks to its user-friendly interface, Uphold is easy to use, making it an ideal option for newbies.

- Uphold is integrated with more than 30 underlying cryptocurrency exchanges to provide traders with better liquidity and advanced investment possibilites.

- The exchange appeals to both individual and institutional investors with its host of industry-grade offerings.

- Users can enjoy various trading tools like take profit, trailing stop, and limit orders.

- The exchange is registered with leading regulators like FinCen, FCA, OFAC, and many others.

- Uphold has a good security setup that helps ensure full protection of users’ assets.

- The cryptocurrency exchange comes with an app that’s accessible through mobile and desktop devices.

Overview

The establishment of Bitreserve in 2014 by Halsey Minor laid the foundation for the market debut of Uphold. Initially, the platform served as a Bitcoin storage platform with an evolving API.

However, in 2015, the firm rebranded to Uphold, taking a more robust posture as a multi-asset online trading platform. Since its debut almost a decade ago, the platform has established itself as a household name in the global crypto landscape, gaining the confidence of more than 10 million users and reputable regulators across various jurisdictions.

Central to its appeal is its consistency in delivering a transparent and secure platform for all kinds of users – both retail and institutional investors – to buy, trade, swap, and hold a huge array of assets, ranging from cryptocurrency to fiat currencies and precious metals. In terms of crypto support, Uphold allows selling, buying, sending, receiving, and trading of Bitcoin and other popular altcoins like ETH, USDT, USDC, SOL, BNB, XRP, XDC, ADS, ALT, SEI, DAG, and many others.

Uphold also extends its support to new, promising and low-cap cryptos. In fact, the exchange presents one of the best avenues for savvy investors to discover and gain early exposure to some of the newly-launched cryptos so that they can compound their gains.

With that being said, investors on Uphold can easily keep a large and diversified portfolio due to its extensive support for more than 27 national currencies, tokenized carbon credits, smart routing orders, gold, silver, platinum, and palladium.

Furthermore, Uphold has a deep liquidity book, thanks to its integration with a host of external sources including CEXs, DEXs, and layer 2 networks. Through this strategic approach, the exchange helps users find the best token prices while also exposing them to valuable market opportunities.

While offering a wide range of assets, Uphold has an effective portfolio diversification system that allows investors to segment their holdings in line with their trading goals. Likewise, this standout feature simplifies the process of monitoring one’s investment portfolio for timely decisions.

In addition to this, Uphold has a self-custody option that gives investors full control over their crypto holdings – all within one app, ensuring maximum protection of their funds.

Meanwhile, apart from the array of investment opportunities embedded in Uphold, the online digital assets trading platform is also home to numerous interest-bearing passive programs like staking, USD interest accounts, and a referral system, catering to those who do not necessarly want to engage in active trading or those seeking an additional source to boost their gains.

Another core attribute of Uphold is its ability to process up to 50 simultaneous limit orders irrespective of users’ trading account balance. As part of its users’ first policy, the cryptocurrency exchange removes funds from connected accounts only when the custom price has been reached.

More so, all offerings on Uphold are in compliance with highest regulatory standards, making the platform a legitimate and credible crypto spot for all users. As part of its compliance standards, the exchange has a separate reserve where it stores users’ assets away from the business capital of the online trading platform.

To avoid insolvency issues, Uphold ensures that all deposited funds on its platform are intact, and the exchange doesn’t lend out users’ funds. Therefore, Uphold, through its numerous market opportunities appeals to both individual and institutional investors.

Features – Full Review

In this section, we will fully review some of the core features of Uphold.

Supports Multiple Asset Classes, Including Over 300 Cryptocurrencies

Uphold is strategically positioned to cater to investors seeking to diversify into multiple asset classes, including cryptocurrency, fiat currencies, and precious metals. At its core, Uphold supports various blockchain networks to provide investors with a wide range of cryptocurrencies to pick from.

Also, the exchange has a flexible listing policy, giving investors an edge over their counterparts in discovering new tokens early. Overall, as mentioned earlier, it supports more than 300 cryptocurrencies on its platform.

Within the platform, investors can access popular cryptocurrencies like BTC, ETH, USDT, USDC, SOL, LTC, ADA, XRP, DOGE, DAG, QNT, BNB, AVAX, TON, and many others.

In addition, Uphold has a smart routing algorithm that scouts for the various market opportunities across different 30 sources including CEXs, DEXs, and a handful of layer 2 networks. Through this pathway, investors can enjoy low trading fees, helping them maximize their profit.

The lineup of available investment opportunities on Uphold goes beyond digital assets. Uphold supports tokenized carbon credits and smart routing orders. Also, investors can invest in precious metals like gold, platinum, and silver.

Thanks to this vast support, investors can easily swap their assets for cryptocurrencies and vice versa with just a tap.

Easy Diversification Of Users’ Portfolio

Proper organization of an investment portfolio is critical to ensuring easy monitoring and management. It helps investors stay ahead of market trends, take advantage of opportunities, and mitigate the risk of any potential price downturn.

Uphold understands the relevance of this strategy to contemporary traders and has taken a big move to meet such needs through its Basket feature. This incredible aspect of the exchange offers an ample solution to strategic portfolio diversification.

Introducing #UpholdBaskets!

Your one-click solution for #crypto diversification!

Launching with:

3⃣ Big Three: $BTC $ETH $XRP

🌉 Infrastructure: $ETH $AVAX $ATOM $DOT $LINK $QNT

🔮 Future of Blockchain: $KAS $DAG $SOL $AZERO $NEARMore coming soon!https://t.co/WTsCzqxA9T

— Uphold (@UpholdInc) February 22, 2024

Investors can craft a strong, diverse portfolio that cuts across multiple crypto markets using the Uphold Basket, regardless of their starting point or investment experience.

Self-Custody Option

Uphold has a self-custody solution – UpHODL – that gives users full control over their wallet’s private keys. With the increasing hacks on cryptocurrency exchanges, there’s no better time for investors to embrace self-custody solutions than now.

As part of its vast offerings, Uphold, through the Uphold Vault, eliminates users’ reliance on third parties to manage their digital assets. One major downside of having assets in self-custody wallets is limited market opportunities as these assets are mostly kept away from external sources including crypto exchanges.

However, the Uphold Vault is directly connected to the cryptocurrency exchange, ensuring users enjoy investment opportunities while having their assets in custody. Also addressing some of the deficiencies of a self-custody wallet, the Uphold Vault has an easy and reliable keyphrase recovery system.

Hence, investors using the wallet should be confident that their cryptocurrencies are within reach even if they misplace their seed phrase.

USD Interest Account

Uphold is integrated with an FDIC-insured brokerage account that provides investors with up to 4.9% APY on their USD Interest account. Meanwhile, the return rate can vary based on users’ balance. For instance, Uphold pays 2% USD interest on USD balances between $1 to $999 while accounts with more than $1,000 will receive up to 4.9%.

🗣️ With the USD Interest Account on Uphold, it's the customer who gets the interest, NOT the bank.

💸 4.9% APY on dollars instantly tradable into #crypto

🪙 2% APY on balances under 1K

🚫 No subscription. No lock up

🏦 FDIC insured up to $2.5M on participating funds🇺🇸 US only.

— Uphold (@UpholdInc) October 10, 2024

Unlike other interest-bearing services offered by other platforms, Uphold’s USD Interest Account has no lockup period, adding an extra layer of dynamism to it. Investors can withdraw their funds at any time they want while still having their yields intact.

This powerful initiative doesn’t have a designated cap as users can deposit as little as $1, making it a good avenue for even casual investors to make returns.

Uphold Crypto Card

With a strong focus on pushing cryptocurrency to the mainstream and ensuring that holders can maximize their holdings in the real-world, Uphold has designed a crypto card that’s usable anywhere in the world. The card caters to those seeking to increase their crypto spending power for their day-to-day operations without incurring any foreign transaction fee.

In essence, Uphold’s card solution helps users enjoy the flexibility of spending their assets seamlessly, earning cashback bonuses in GBP, and great exchange rates.

The virtual version of the card is entirely free for users and it can be activated within the platform at all times. Likewise, the crypto virtual card allows users to make web payments with ease.

On the flip side, users can request the physical version of the card on the platform, however, they must pay £9.95 as a shipping fee. The delivery time is between 7-10 working days.

Vast Trading Tools

Adding a feather to Uphold’s cap is its variety of trading tools that support investors to optimize their initial investments. These solutions are designed with the interest of traders at heart, ensuring their convenience while they maximize potential possibilities in the volatile market.

On the exchange, investors can find different trading tools like take profit, trailing stop, and limit orders. Further, Uphold supports Dollar-Cost Averaging strategy that helps investors to divide their investment over recurring periodic purchases.

This feature is effective in protecting investors and helping them mitigate the risks of entering markets at the peak of a cycle. More so, the DCA strategy ensures that investors get into the market at a lower entry point.

How Does Uphold Work?

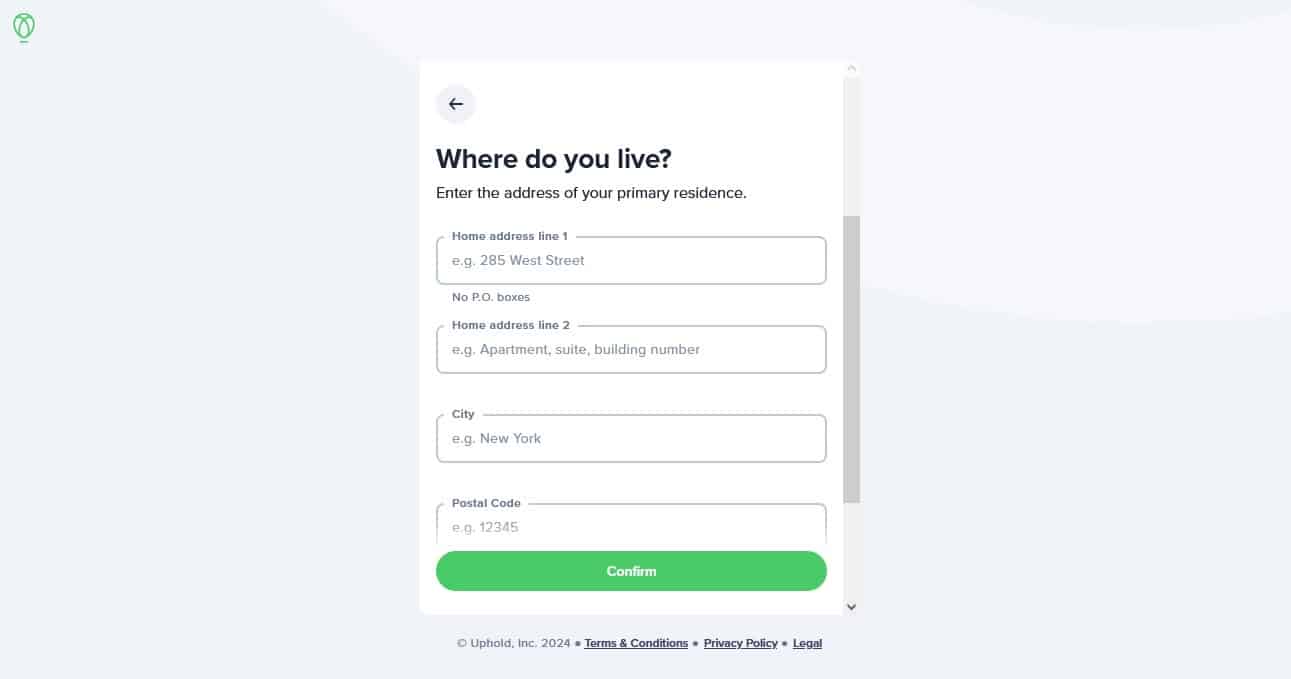

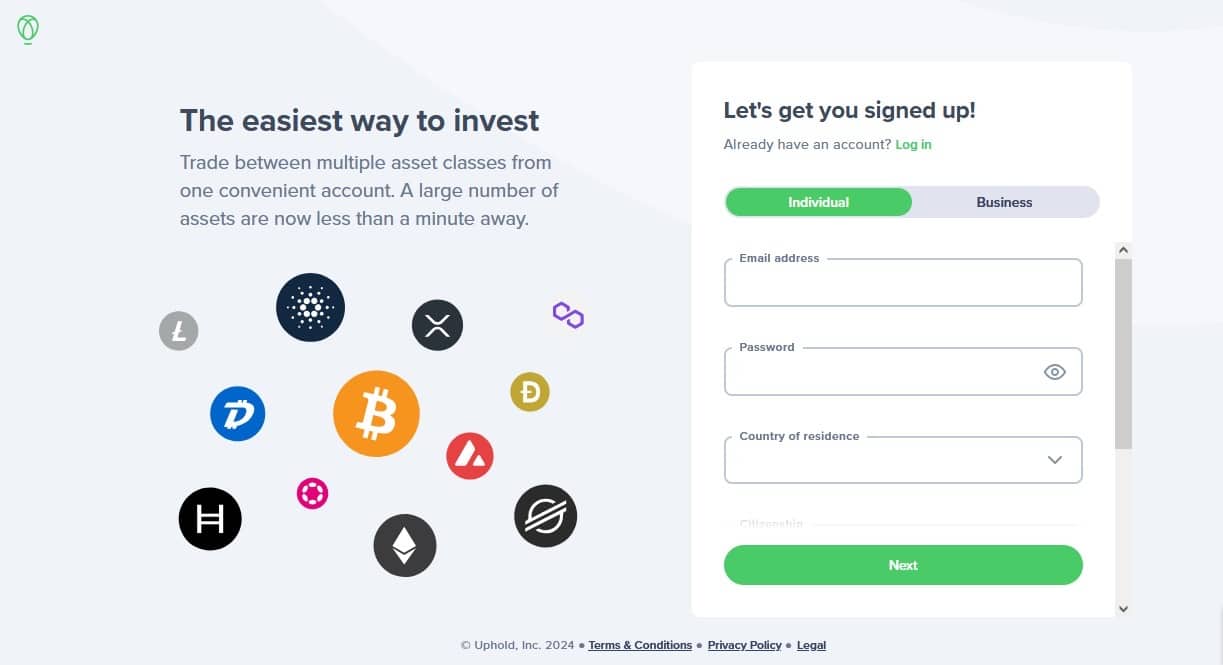

Uphold is a regulated global cryptocurrency exchange that supports traders to buy, store, send, receive, and invest in digital assets. To explore the broader crypto market through Uphold, it is essential for new users to set up an account on the platform.

Due to its compliance with global regulatory standards, Uphold requires new customers to provide their details which include their email address, phone number, physical address, country of residence, and citizenship.

Furthermore, the exchange also has a user verification system that requires a government-issued ID to confirm the identity of new intakes.

Among the outstanding features that the site highlights is its access to seven blockchain networks and 1,000+ trading pairs. It also allows users to link their wallets on the site to their debit card or bank account.

As an exchange platform, it allows for instant conversions between fiat and cryptocurrencies, fiat, and a variety of other exchanges. Users can also send funds to other users at no cost and without any limitations.

Uphold Fees

Signing up at Uphold and creating a wallet is free of charge. However, some deposits and withdrawals on the site attract charges. Let us consider the fees and limits on Uphold:

Deposits

| Deposit Method | Fee | Limit |

| Debit/Credit Card | 3.99% | Daily Minimum: $15,000 Weekly: $15,000 Monthly: $50,000 |

| ACH (Microdeposits) | Free | (ACH) Daily Minimum: $2,000

(ACH) Maximum: $8,000 |

| Cryptocurrencies | Free | None |

Withdrawals

| Withdrawal Method | Fee | Limit |

| Debit/Credit Card | 1.75% (min $1) | $700,000 monthly |

| ACH (Microdeposits) | Free |

$700,000 monthly |

| SEPA (one to three business days) | Free | £700,000 monthly |

| FPS | Free | £700,000 monthly |

| Cryptocurrency | Free | $700,000 monthly |

Why Should I Choose Uphold?

In this section, we will discuss some of the reasons why every trader should consider Uphold for their day-to-day endeavor in the bustling cryptocurrency market.

Various Streams Of Passive Income

Having the opportunity to earn more aside from trading profit is a dream standard for traders. As a result of its extensive offerings, Uphold has put in place various means of earning passive income for users.

Traders can take advantage of the staking option on the platform that allows them to earn passively by committing their idle assets to the protocol. Uphold has a USD interest account that allows users to earn APY on their USD-available balance.

Users of the exchange’s cryptocurrency card are also entitled to cashback rewards on every purchase they make. Meanwhile, influencers and community managers can make extra funds through the affiliate program of the exchange.

Early Access To New Trending Cryptocurrencies

One of the popular trading strategies among enthusiasts is jumping on a project early to net massive gains once it goes mainstream. With Uphold, users have an advantage ahead of other traders since they have access to a broad range of early tokens that can be purchased at low costs.

Meanwhile, the cryptocurrency exchange relies on the support of more than 30 different trading pathways which include centralized exchanges, decentralized exchanges, and layer 2 networks. With this, users have more than enough new tokens to capitalize on.

Flexible Payment Options

As a result of its users-first policy, Uphold incorporated a flexible payment system that supports cryptocurrencies and fiat. Uphold allows users to fund their trading accounts using their debit/credit cards, while it supports direct deposit from bank accounts.

The cryptocurrency exchange also permits users to fund their accounts using Apple Pay and Google Pay. Similarly, both fiat deposit and withdrawal transactions can be executed in international currencies like EUR, GBP, and USD.

📢 Introducing Apple Pay for deposits and withdrawals!

📱 Withdraw directly to your bank account with Apple Pay on Uphold.

💳 Tap and go—No need card details needed.

⚡ Withdraw up to $25,000 daily.

⏰ Get your funds in seconds.⚠️ Credit transfers not supported.

— Uphold (@UpholdInc) October 10, 2024

Furthermore, Uphold allows users to receive cryptocurrencies from external wallets and exchanges. There is also a P2P option where traders can interact with one another and trade digital assets between themselves without the interference of the exchange.

In another innovative dimension, Uphold has a feature that allows users to send funds through emails. Likewise, it has an easy crypto-to-fiat conversion feature so that users can easily convert their digital assets to USD, GBP, or EUR.

Due to these vast options, Uphold is a good pick for traders seeking an exchange with a versatile payment setup.

Mobile App

Uphold serves as an all-around hub for all traders to explore the cryptocurrency market conveniently from every corner of the world. It has an application that’s fully optimized for both mobile and desktop users. While both versions are easy to use, those who prefer to enjoy on-the-go trading experience should consider the mobile app.

Good Security Setup

Only a few crypto exchanges come close to Uphold when it comes to providing high-standard security. Therefore, traders seeking a platform that they can trust with their personal data and assets can try out Uphold.

The exchange uses advanced encryption technology to conceal users’ credentials, keeping them away from the claws of hackers. Similarly, in a bid to mitigate the risks of cyber attacks, Uphold utilizes a multi-layer security setup and the expertise of professionals to identify every loophole.

Due to that, the cryptocurrency exchange often carries out a regular security audit and maintains 24/7 security surveillance. Supporting its security system is the regular bug bounty program organized to reward white hat hackers for discovering potential risks.

Is Uphold Regulated And Secure?

Uphold is one of the most reliable and legit cryptocurrency exchanges available on the market. The digital assets trading platform is well-known among regulators in crucial crypto hubs like the United States of America and the United Kingdom.

The cryptocurrency exchange is regulated in the U.S. by the Financial Crimes Enforcement Network (FinCEN) and various state regulators in the country. All operations on the cryptocurrency trading platform are in full compliance with regulatory stipulations of the U.S. Office of Foreign Assets Control (OFAC). Outside the United States, Uphold is licensed in the United Kingdom by the Financial Conduct Authority (FCA).

Meanwhile, as part of its commitment to expanding its market presence in Europe, the cryptocurrency exchange received a regulatory license from the Financial Crime Investigation Service through The Ministry of Interior of the Republic of Lithuania. It also adheres to the laws of the People’s Republic of China and E.U. on users’ data protection.

Uphold’s compliance with major local, state, federal, and international guidelines solidifies its market position as a credible crypto exchange and enhances investors’ trust in its vast offerings.

Complementing its strong regulatory posture is a host of security measures that have been incorporated to ensure a safe trading experience. The exchange aligns with the Payment Card Industry Data Security Standards (PCI-DSS) to reduce credit card fraud and deliver maximum security for users and their funds.

Pros & Cons

In this segment, our review team will highlight both the upsides and downsides of Uphold to help potential users make informed decisions.

Pros

- Wide range of global cryptocurrencies.

- Simple UI and app experience.

- Transparent and reserved.

- Multiple advanced trading tools.

- Early exposure to highly potential crypto assets.

- Supports multiple asset classes, including fiat currencies and precious metals.

- Maximum security.

Cons

- Basic charts.

Available Countries

With headquarters in the UK and US, Uphold opens its doors to millions of crypto enthusiasts from more than 180 countries across the globe. Some of the supported countries include Canada, the UK, the US, Japan, Iceland, Hungary, Ireland, Sweden, Spain, Switzerland, Romania, Greece, Poland, Brazil, Australia, and many more, solidifying its global reach.

Meanwhile, unlike most of its peers, Uphold has a strong compliance mechanism that aligns with regulations in each jurisdiction where it operates. However, users from the likes of Iran, Mali, North Korea, Sudan, and Central African Republic amongst others may not be able to create trading accounts and access Uphold exclusive services due to the regulation uncertainty in their respective regions.

Customer Support

Uphold checks all the right boxes to ensure customer satisfaction. One such way through which the exchange has been living up to this focus is by integrating a 24/7 customer support service, with multiple channels available.

In fact, users can get their issues resolved without having to consult the support team, thanks to its self-service feature. Leveraging this standout option, users will be able to seamlessly reset their passwords, freeze accounts, download tax reports, and even customize their accounts. There is also a user-friendly help center, equipped with cutting edge articles on topics of interest.

In the event that none of the provided articles or FAQ sessions cater to your urgent issues, you can now proceed to submit a support request to the team. Through this channel, Uphold provides both swift and quality assistance to users’ complaints, issues, and inquiries.

More so, like other top crypto exchanges, Uphold is also active on several social media platforms, especially X where it consistently engages its user base and announces its listings, partnerships, product launches, and many more.

User Experience

Described as investors’ surest gateway to crypto trading and asset management, Uphold is strategically built with users’ convenience in mind, offering a streamlined way for buying, trading, and holding a diverse range of assets. It integrates a vast array of innovative technologies, products, and tools to position traders ahead of the curve, ensuring that they can capitalize on all potential market opportunities anytime anywhere.

One core aspect of Uphold that has received much accolades from users is its all-in-one app, that’s tailored for mobile and desktop users alike. While the mobile version of the app is compatible with iOS and Android devices, its desktop counterpart supports Mac, Windows, and Linux operating systems. Both users can easily connect the app to their bank accounts and cards and gain direct access to a huge assortment of financial instruments, ranging from cryptocurrencies to traditional assets.

Featuring notable trading and investment management tools, Uphold’s app facilitates a seamless experience, empowering users with everything they need in one spot. Those with multiple accounts, especially for trading, savings, and everyday transactions can easily manage their funds for constant earnings without necessarily leaving the app.

Upon opening the app, users will find a different section, dedicated to the USD savings account, separate from their crypto holdings for enhanced asset management.

Given the relevance of its offerings to all categories of modern traders, including first-timers and experienced investors, it is no surprise that Uphold’s beginner-friendly app has garnered widespread acceptance within the broader crypto trading landscape.

At the time of writing, the app boasts more than 30k downloads on the Google Play Store alongside an impressive star rating of 4.6/5, reflecting its level of adoption among traders.

Contributing to its viral appeal is its ease of use. It is equipped with a fashionable and straightforward UI to enhance the overall experience of those wanting to simply engage in one-click trading between multiple asset classes and expand their earning streams. The account setup process is relatively simple, ensuring that users can immerse themselves in the bustling trading realm, transfer popular assets, and earn constant earnings with just an email.

More so, all the icons, labels, and bars on the app are well-positioned for almost instant access. It has a tiled interface that can be customized to suit users’ trading needs and objectives. Overall, the platform’s layout design is clean, easy on the eyes, and attractive, making navigation a breeze.

Meanwhile, to gain deep insights into what real users are saying about the market performance of Uphold, our team of experts examined various review platforms, especially Trustpilot. In most of the reviews, users commended the exchange for its strong emphasis on simplicity, transparency, and security, emphasizing how the presence of these elements on Uphold has significantly improved their trading experience.

How To Set Up An Account With Uphold

Uphold has taken a relatively simple posture so that newcomers can get started, make deposits, and explore its groundbreaking earning options in less than five minutes. Users can create their accounts with Uphold either through its mobile or desktop app. Irrespective of the choice made, users can rest assured that the registration process will be fast, seamless, and straight to the point.

For those interested, this aspect of our review will highlight all the guidelines that can be followed to create a trading account with Uphold.

Step One: Download and open the Uphold app.

Step Two: Tap the “Sign Up” button and fill in your personal details, including email address, phone number, physical address, and country of residence and citizenship.

Step Three: Take a moment to read the terms of use before using the “Agree” button.

Step Four: Provide answers on your employment status, income, and intended use of the platform.

Step Five: Provide any of your government-issued identifications for verification. Unlike other platforms, the KYC procedure on Uphold is very quick and can be completed within the twinkle of an eye.

Step Six: If accepted, you can now start exploring the platform and its all-around trading and earning offerings.

Uphold Review – Our Verdict

Uphold has emerged as a refreshing one-time solution for those who love to manage and store multiple asset classes under one roof. Alongside its trading functionalities, the prominent crypto exchange is gaining monumental attention for its interest-bearing account feature, empowering users to maximize their earnings without incurring any extra cost.

Other vital attractions for the Uphold app include a multichain self-custody Web3 wallet for both cryptos and NFTs, staking pools with an APY that’s as high as 4.9%, unique debit card with intricate functionality, strong security systems, intuitive interface for beginners and intermediate traders, and a transparent fee structure that may not be found elsewhere.

By merging all the aforementioned elements in one place, Uphold establishes itself as one of the most versatile trading platforms to use this year.

FAQs

Is the Uphold app available for desktop users?

Yes, the Uphold standard app supports popular operating systems, including Mac, Windows, and Linux, ensuring that all levels of desktop users can access its offerings conveniently.

Is Uphold accessible to both UK and US users?

Thanks to its compliance with regulatory standards, Uphold is open to all categories of users in the United Kingdom and the United States of America.

What classes of assets are supported by Uphold?

Uphold supports multiple asset classes, ranging from cryptocurrencies to traditional currencies and metals, helping investors gain enough exposure to the broader investing market.