The bull run of 2021 made sure that a majority of the investing population was somehow exposed to cryptocurrencies. The euphoric gains attracted thousands of buyers within the space. But a certain winner within the blockchain community were NFTs or Non Fungible Tokens.

The NFT market recorded phenomenal growth as the industry which was barely worth $94.9 million in 2020, saw it shoot up to around $24.9 billion in 2021.

This brand new conventional method of storing value in the form of tokenized assets has taken over the art industry since, and looks like is here to stay.

NFT Royalties and Copyright – Quick Overview

While the idea of NFTs is to make art more available, secure and better for the welfare of artists, they too pose certain obstacles. The risk of fraud and copyright issues exist even within the NFTverse. In this guide we will review:

- What are NFT royalties

- How do NFT royalties work

- Who benefits from the royalties when an NFT is sold

- Which copyright laws apply to NFTs

- Ownership of copyrights after an NFT sale

- How to invest in NFTs

What are NFT royalties?

NFTs, non-fungible tokens are units of data stored on a blockchain. They’re non-interchangeable and can be stored or traded for different values as each NFT is unique. NFTs can be in the form of images, videos, audio etc.

One of the main reasons NFTs have been praised is the recognition and money it brings to the artist. The idea is that NFTs provide artists with a platform without any middle parties to use their creativity and gain popularity based solely on their work.

In the traditional art industry, an artist earns money on the sale of their artwork. However, once sold, the increasing value of the piece doesn’t benefit the artist in any way. NFT royalties enable the creator of the art piece to get rewarded every time a sale of the same art is made.

Several famous artists whose works get sold for a meagre price benefit from the sales of their art when they reach drastic highs. This has built a nurturing environment for the welfare of creators and is one of the key benefits of tokenizing one’s art into digital format.

How do NFT royalties work

NFTs are bought and sold several times. While some have utility, some are generally flipped by traders to make a quick income. A lot of buyers look into NFTs as a medium for great profits in a short period too.

They try to get into projects by getting into whitelists or buying on launch. They then sell these projects back to others almost instantly for a fantastic return. This is possible based on the hype or popularity of the project.

Royalties can be considered as a means of passive income for the creators. When an NFT is sold for the first time by someone who bought it on launch. The sales made then and thereafter are termed to be in a “secondary market”.

Royalties are received by the creator as soon as sales occur in the secondary market. However, the question arises, what if an NFT is bought on one marketplace but put up for sale on another marketplace? Do royalties work then?

This is a barrier currently faced by many marketplaces in the industry. Many of these marketplaces are trying to induce interoperability between the marketplaces and NFTs to make this possible in the future. However, there are already a couple of Marketplaces that provide this feature. You can read about some ways to decide and buy NFTs accordingly.

When an NFT is sold, who profits from royalties?

Whenever an NFT records a sale, the creator gets a part of the pie. The whole point of the concept is to reward artists for their work whenever a transaction is made. The creator of the NFT can decide if they want to receive royalty for their work. They can also decide on the percentage for which they wish to receive royalties.

Although NFTs vary by the marketplace and are not standardized, NFT royalties are calculated based on the percentage of the sales price decided by the creator. If the royalty calculation results in a remainder, the royalty fee is rounded up.

Content creators can manually set the royalty rate during minting, which is the process of making the NFT content a part of the blockchain. To do this, the creator can make the change in specifications in the marketplace itself, which will then take care of the payouts to the artist. Thus, once the NFT is minted, the royalties occur automatically.

Royalties received from the NFTs give its creator a percentage of the selling price each time the artwork is sold on a marketplace. The average NFT royalty typically ranges from 5-10%. However, some of the marketplaces are still in the process of integrating royalties systematically.

You can read about how royalties work on Opensea, one of the top NFT marketplaces in the industry.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Which copyright laws apply to NFTs

Over the past couple of months, the presence of NFTs has been prominent on social media handles of several celebrities and other famous icons. The list is huge and includes big names within the entertainment industry like Justin Bieber, Paris Hilton, Snoop Dogg, Stephen Curry, Eminem, Mark Cuban and much more.

However, while the whole concept of owning a particular piece of art; as a means of value makes sense in physical form, the idea of owning them in digital form is still foreign to a wider audience.

An even bigger issue is the set of laws. Since the cryptocurrency market entirely itself is barely regulated, a huge number of concerns regarding copyrights laws are constantly looming over the minds of NFT buyers and sellers. To some extent, NFTs seem to pose a threat to the rights of copyright holders.

It isn’t mere speculation too, since several authors have reported about their artwork being misappropriated and minted without prior permission.

Many NFT creators in the space have reported selling their works on fraudulent websites and marketplaces; even fake NFTs. In such a case, it is important to consider the potential remedies for the protection of the NFT creators’ works.

In many countries, cryptocurrencies aren’t even recognized yet as a legal asset class. Working in a legal vacuum allows bad-faith members of the crypto community to tamper or steal the artworks created by the artists.

Since every NFT is transferred on a smart contract basis; which isn’t an actual physical contract and recognized by law, there is no such standard law or set of regulations put in place that can be a governing factor for how such issues would play out. However, with the rise of more and more NFT entities in the market, regulations, strict and concise laws can be expected shortly.

When an NFT is sold, who keeps the copyright?

As we touched on this topic above, an NFT is not essentially recognized by any centralized authority; i.e the government in this case. So, every NFT is exposed to a risk of infringement if the credentials that hold the NFT are compromised.

Owning an NFT is not to be mistaken for having an actual image or video or the actual file of the artwork. It is merely a piece of data that points to a server hosting the particular artwork. Ownership is not a sensitive issue as the NFT is nothing more than a string of data. Whoever owns the password to access the data is the owner of the NFT.

The safety and authenticity of the artwork are guaranteed by the blockchain used. For instance, duplicating or generating counterfeit artworks of a certain creator would require overpowering the entire Ethereum Network which is not feasible. Of course, the Ethereum Network isn’t the only blockchain on which NFTs can be minted.

Thus, owning an NFT doesn’t entitle the holder to copyrights over the art. So, while ownership can be considered absolute, writing it off as copyright or intellectual property isn’t supported by any law up until date.

How to invest in NFTs

Investing in NFTs has gotten extremely easier as a lot of marketplaces and several communities have formed and grown over the past couple of months.

While the crypto communities aim to educate newbies about the use case and value of NFTs, marketplaces have been aiming to get better by integrating maximum features so that the users have a seamless experience while trading NFTs.

Several websites that specialize in providing details about launch dates, and other details regarding NFTs have also taken their place as an integral part of the community. Several NFT projects have contributed to bringing about a revolution in the NFT industry. You can read our article to know about some of these top NFT projects.

To invest in NFTs, it is essential to take a look at several factors; such as the team behind it, artist, social media activity, use case if any, the blockchain used and the marketplace being launched or sold on. These factors will help one in deducing the outcome of their investment wisely.

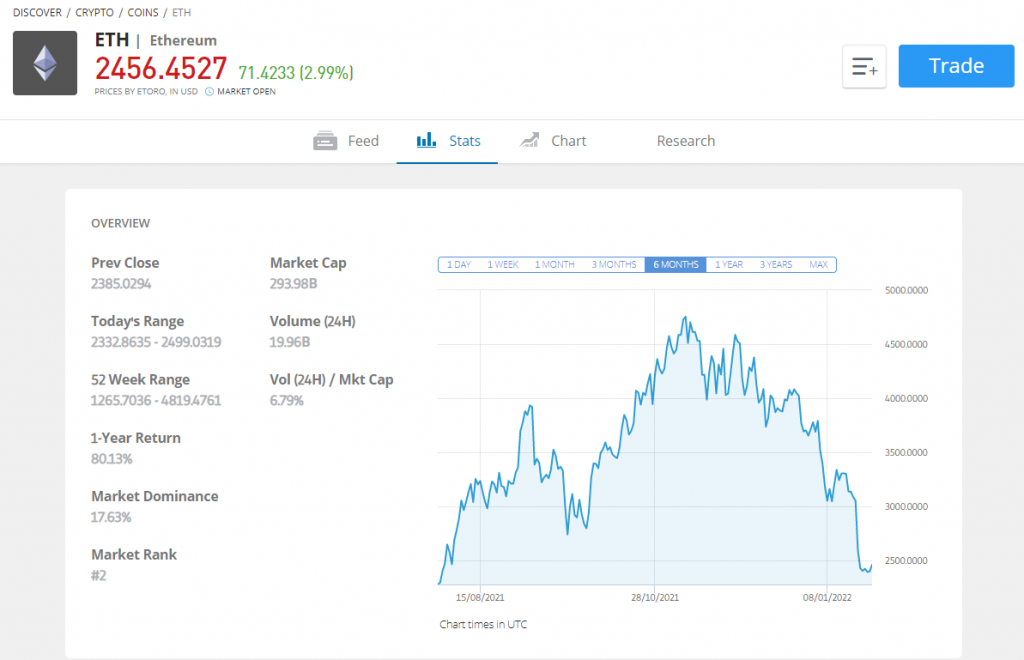

In order to buy cryptocurrency like ETH to get into NFT projects for massive profits, it is crucial to have these cryptos bought and stored in a safe exchange and wallet. One of the top picks is eToro, which is regulated by the ASIC, CySEC and FCA.

Buying NFTs can be a hassle, but there are simpler ways to get it done using exchanges like eToro. Here’s a step by step method to buy ethereum on eToro and purchase NFTs via platforms like Opensea using it.

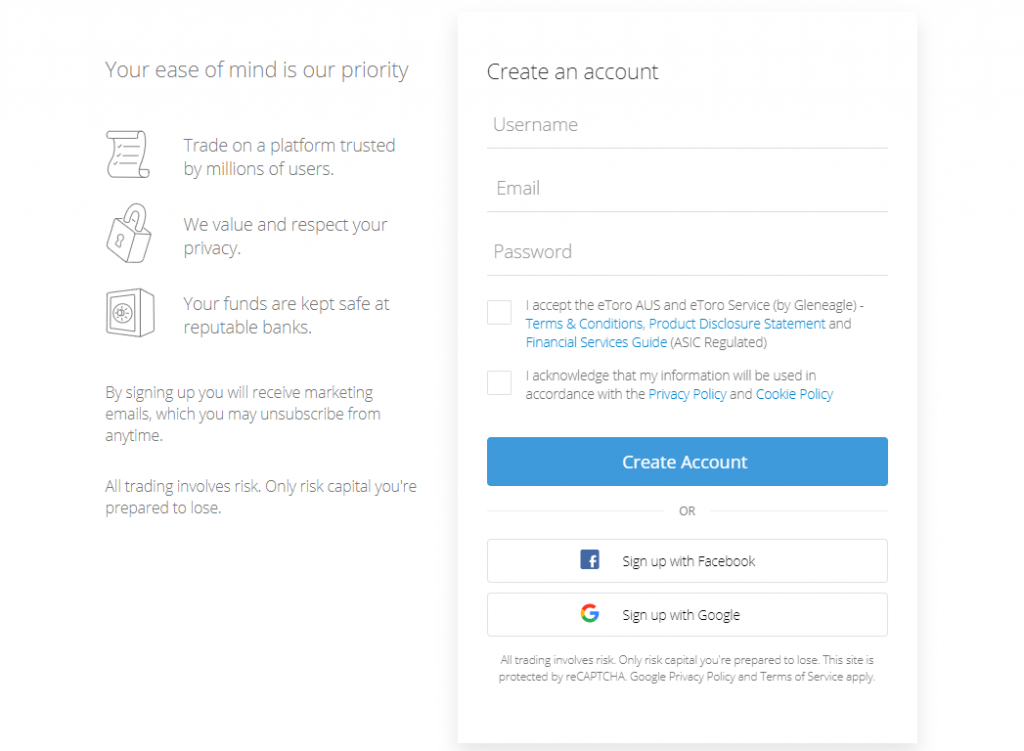

- Sign up on eToro. NO referral codes are required, no extra precautions are required. Fill in the details and you are good to go. To go to their website, click here.

- Provide documents needed for profile verification. eToro is a secure platform that prioritizes the safety of the users and makes it mandatory to comply with regulations set by the government. The verification process will begin as soon as you submit the required documents

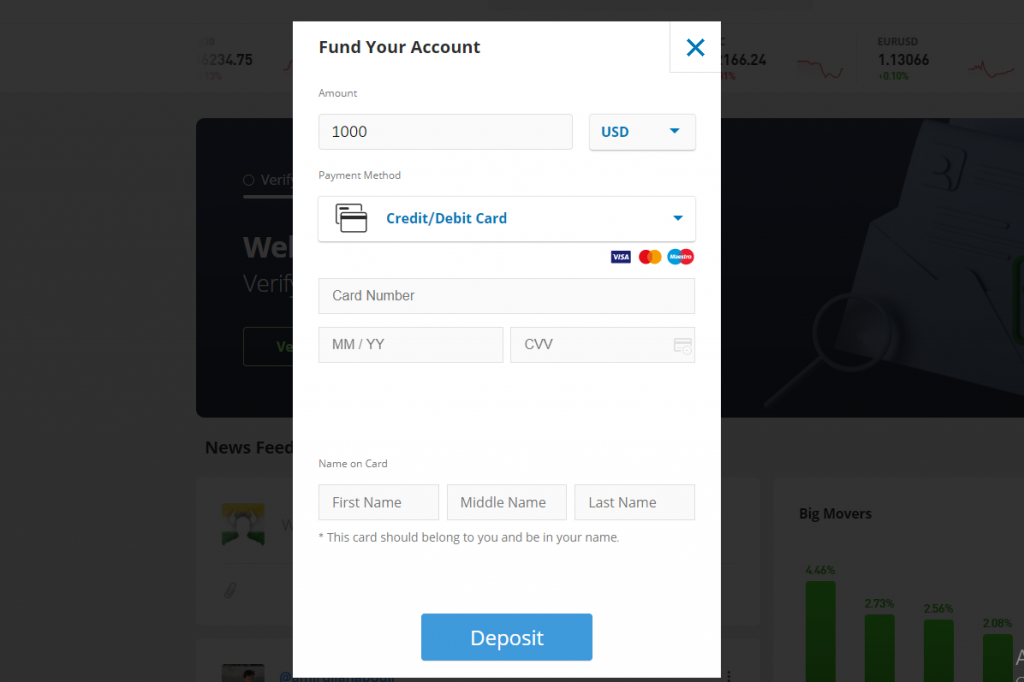

- Depositing money on eToro is as simple as it gets. You can choose to pay with Credit/Debit Cards, Bank transfers, Online transfers, Rapid transfers, Paypal, Neteller and Skrill. You can deposit a minimum amount of $50

- Ethereum can be bought from a funded wallet easily. Simply search and select ETH from the market results and click on trade.

- The eToro platform gives all the information necessary on the interface itself. Latest research material, order book, candlesticks, indicators and crypto info.

- Once you select the amount of ETH you wish to buy, click on buy and just like that, you are one of the 3.9% people who own cryptocurrency, you are indeed early enough!

- You can also stake any leftover ETH to earn passive income on eToro. Read our article to know more about buying NFTs from various marketplaces.

Another hot pick of cryptocurrency exchanges that also boasts of one of the best NFT marketplaces in the space is Crypto.com. An exchange that has garnered much attention in the past months, they claim to be the safest exchange and has shown immense growth as a cryptocurrency exchange as well as an NFT marketplace.

It boasts of several low floor price NFTs that has much potential and have a wide variety of art to choose from.

You can get started on Crypto.com by clicking here. While both the exchanges mentioned are great in terms of buying crypto, we advise users to diversify their portfolio by holding tokens like BTC, ETH and ADA in different trustable exchanges like eToro and Crypto.com.