Join Our Telegram channel to stay up to date on breaking news coverage

InsideBitcoins regularly provides a rundown of the best cryptocurrencies to buy now, taking into account their recent price performance.

Altcoins have started capitalizing on the bullish trend in March. These digital assets are riding the wave of optimism. Still, they are also experiencing substantial price escalations daily, much to the delight of their investors, who are witnessing profitable returns. This article outlines several of these tokens and examines the factors contributing to their notable surge in value.

Best Crypto to Buy Now

Among these tokens are Stacks, Toncoin, and Maker, each demonstrating the potential for significant growth. These digital assets have captured the attention of investors who are closely monitoring their progress, driven by the strong indications of future growth and sustainability within the crypto market.

1. Stacks (STX)

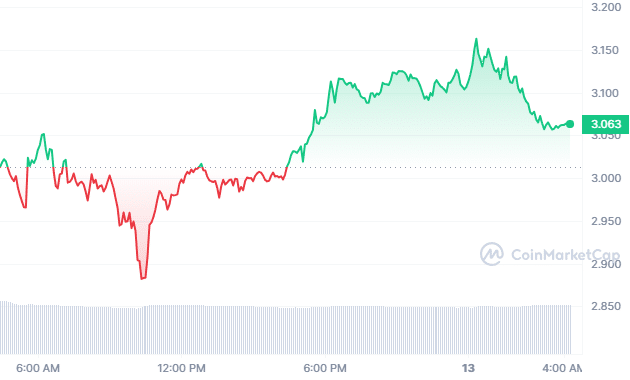

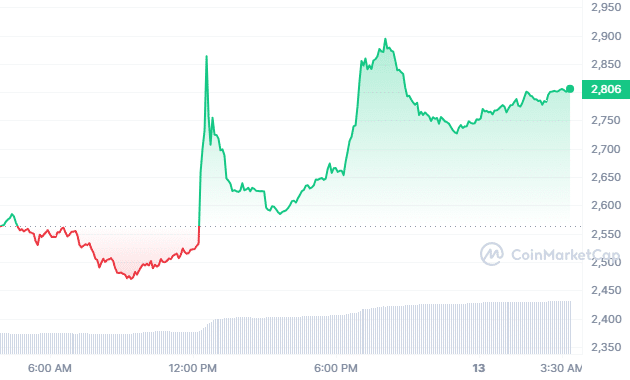

The recent performance of STX reflects a 1.82% increase in its price over the last 24 hours. This uptrend aligns with a bullish sentiment in the Stacks price prediction, while the Fear & Greed Index stands at 81, indicating extreme greed among investors.

Moreover, STX saw significant growth last year, with its price surging by 275%. The token successfully outperformed 78% of the top 100 crypto assets simultaneously. Technically, the $2.77 mark and the 20-day Exponential Moving Average (EMA) have served as strong support levels, suggesting a consistent trend of buyers stepping in during price declines.

Furthermore, STX is currently trading above its 200-day Simple Moving Average (SMA). Additionally, Stacks has experienced 19 green days out of the last 30, translating to a 63% positive performance rate. This indicates favorable market conditions and investor sentiment towards the project.

This week, eight new signers announced support for the Stacks 🟧

With billions of dollars in assets collectively, their support speaks volumes about the leading layer 2’s potential to revolutionize Bitcoin scalability.

Read the full newsletter by @CoinDesk in the thread below. pic.twitter.com/zt6WCfVNQx

— stacks.btc (@Stacks) March 10, 2024

In summary, Stacks demonstrates a positive trajectory in price performance and market sentiment, with technical indicators suggesting continued bullish momentum. However, as with any investment, conducting thorough research and considering the inherent risks before making any decisions is essential.

2. Toncoin (TON)

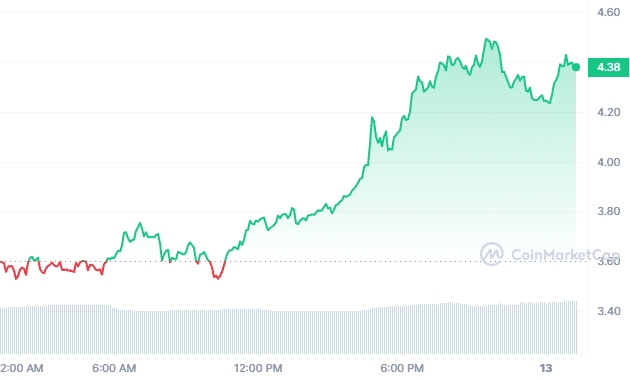

Toncoin has been on a consistent upward trend in the current market rally, showing gains of 46.82% in the past month alone and 99.26% over the last three months. This indicates a bullish performance in the medium term. Over the past year, Toncoin has seen an 83% increase in price, suggesting sustained growth.

Investor interest remains high, with a Fear & Greed Index at 81, indicating increased transactions. Furthermore, the growth of Toncoin is supported by projects within the TON blockchain ecosystem, notably within The Open League. TON Raffles, one such project, has seen significant user engagement and a rise in Total Value Locked (TVL).

This has prompted the TON Foundation to announce an airdrop initiative for TON Raffles token holders. Moreover, Telegram’s potential distribution of 50% of revenue to channel owners utilizing Toncoin Blockchain has further fueled investor interest.

🎉 @tapfantasy2021 $MC holders, get ready!

1 $TON airdrop coming 🔜 as a reward for showcasing the power of coordinated community action leading to impressive market cap growth – even outperforming TON!

A snapshot was taken on March 12, 2024, 9 AM GMT. Were you holding $MC?… pic.twitter.com/rvEndq2P9R

— TON 💎 (@ton_blockchain) March 12, 2024

Despite recent volatility, Toncoin has maintained an upward trajectory, supported by significant partnerships. On December 25, 2021, the token reached its all-time high of $4.91. It experienced a cycle high of $3.32, with a low point at $0.757304.

3. Smog (SMOG)

Smog has become one of the best tokens in the cryptocurrency market with its unique launch approach. Unlike many other projects, Smog avoided presales, ensuring a level playing field for all participants. Instead, it relies on a fair launch model, emphasizing airdrops and community rewards.

Leveraging the Solana blockchain, Smog strategically entered the market amidst the meme coin frenzy. Its differentiation lies in prioritizing airdrop campaigns over presales, which fosters a strong community foundation deemed vital for sustainable growth. Introduced in early February, SMOG boasts innovative tokenomics aimed at incentivizing its holders.

Picture a world without ever burning other #Memecoins with #SMOG! 🔥

Would be way too boring… 😴

— SMOG (@SMOGToken) February 27, 2024

Furthermore, a significant portion of Smog’s total supply, 50%, is allocated to marketing efforts, while 35% is set aside for airdrop rewards. Currently, the project executes “the Greatest Airdrop in History,” distributing substantial amounts of SMOG to holders of other popular meme coins such as Samoyedcoin (SAMO).

Apart from airdrop initiatives, Smog offers staking opportunities, enabling token holders to earn yields. The token’s annual yields are 42%, with approximately 17 million SMOG tokens already locked in staking. With Smog gaining momentum on social media and extending its reach through integration with Ethereum, it seems poised for further growth and adoption.

4. Maker (MKR)

In the recent month, Maker demonstrated positive growth on 60% of days, indicating a favorable trend. Historical data analysis suggests that investing in Maker has yielded profits. Last year, Maker’s price surged impressively by 142.72%, showcasing strong performance.

However, its performance over three years experienced a slight decline of -8.97%. Maker has recently transitioned into an uptrend following a prolonged consolidation phase. Notably, it exhibited one of the market’s best performances in the third and fourth quarters of the previous year, witnessing nearly a 100% price increase.

Despite encountering significant price fluctuations as bulls and bears contested its value, Maker continued to thrive in the current bull market. It added over $200 to its price. Furthermore, Maker DAO co-founder Rune Christen decided to exchange substantial SHIB and LDO tokens for MKR. This move likely bolstered investor confidence in the token, further propelling its price upward.

Due to the recent market volatility conditions, an Accelerated Proposal has been put forth for an Executive Vote to prepare the Maker Protocol for a potential excessive Dai demand shock caused by further bullish sentiment.

The Maker Protocol is working as expected, maintaining…

— Maker (@MakerDAO) March 8, 2024

Also, the recent uptrend in Maker’s price was sparked by a community-executed vote. This vote permits the platform to reassess stability fees charged on different collateral assets, potentially resulting in increases of up to 15% or 17.25% in the fees applied within the Maker Protocol.

5. Stellar (XLM)

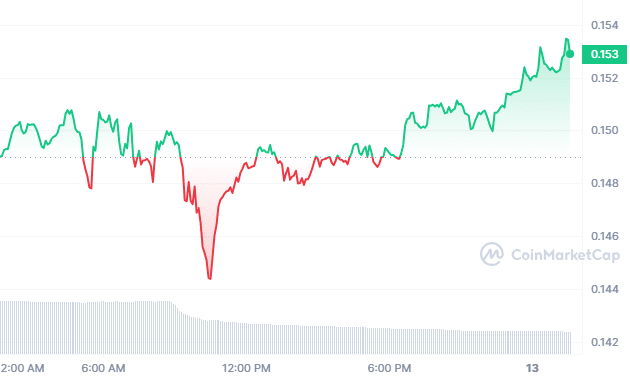

Stellar (XLM) has shown resilience in the cryptocurrency market since the beginning of this year. It witnessed a surge in value, with a remarkable 74.19% increase in 2023, reaching its peak in August.

Over the past month, the price of XLM has risen by 2.70% to $0.15, which is a significant development for its holders. This positive momentum continued over the past week, with XLM experiencing an 11.24% gain, climbing from $0.13 to $0.16. Moreover, the trading volume for XLM surged by 48.0% during the same period.

The circulating supply of XLM has slightly increased by 0.16% to over 28.63 billion tokens. This represents approximately 57.27% of its maximum supply of 50.00 billion tokens. In addition to its price performance, Stellar made headlines with its integration with Band Protocol.

A huge milestone for smart contracts on Stellar. @BandProtocol's integration allows developers to access real-time data and build innovative DeFi solutions on the #Stellar network 💪 https://t.co/iyIJCYKWo2

— Stellar (@StellarOrg) March 7, 2024

Band Protocol successfully deployed its Oracle service on Soroban’s testnet, Stellar’s smart contracts platform. This integration marks a significant milestone, enabling the development of decentralized applications (dApps) on the Stellar network by leveraging Band Protocol’s Oracle solutions. This collaboration aims to enhance the functionality and utility of the Stellar ecosystem, providing developers with more tools to build innovative applications on the platform.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage