Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) trading volume tumbled almost 20% to $8 billion today and its price continued to move sideways as boosts from BlackRock’s spot Bitcoin ETF application and Ripple’s landmark court victory fade.

With those developments priced in, investors are watching to see what comes next as they strive to anticipate Bitcoin’s future trajectory. Regulatory uncertainty remains a drag as the SEC has hinted it may appeal the Ripple ruling and the approval of BlackRock’s spot Bitcoin ETF is far from certain.

Bitcoin Moves Within a Range as BlackRock Spot ETF and XRP Ruling Fade

#Bitcoin is hanging on to 30k support. We've had it underperforming traditional markets for the past few days as the Blackrock ETF and Ripple news fade. However, If 29.7k support gets taken out I'm looking to buy that dip down to 28k. $BTC #crypto pic.twitter.com/ZaKaahiFIl

— CoinRaptor (@TheCoinRaptor) July 19, 2023

The recent developments have not provided a conclusive answer on whether XRP and other tokens are securities. This adds to the regulatory confusion surrounding token classifications. As per data from bitcoinity.org, trading volume tumbled 84% from the previous month.

Trading Volume Trends: Up in Emerging Markets, Down in Developed Markets

According to a long-term analysis, trading volume has surged in emerging markets and Japan this year, indicating a bullish trend. In developed markets such as the U.S. and Europe, Bitcoin trading has fallen.

🚨In 2023, the #trading volume of #Bitcoin has witnessed an upward trend in emerging markets and #Japan🚀

🔥However, in more developed markets like US and Europe, #BTC trading experienced a decline 📉#Crypto #Cryptocurrency pic.twitter.com/i4YWKKImkO

— Satoshi Talks (@Satoshi_Talks) May 18, 2023

The divergence in trading volume trends suggests varying interest levels and adoption of Bitcoin in different regions. Emerging markets are displaying stronger demand and growth potential. Meanwhile, the more established markets seem to be experiencing a period of reduced activity or investor caution.

The reason behind emerging markets embracing Bitcoin more might be due to favorable crypto regulations and greater need for alternatives. These encourage higher adoption and trading.

Regulation through enforcement doesn’t work , that’s what the SEC been doing, other countries actually doing the work and having simple regulation for crypto like Japan Singapore , just a name a few , Best believe! @POTUS @SenateDems @SenateGOP FOX News. pic.twitter.com/2o21n1y9LH

— XRP- Flare-Coreum-Solo – United (@FarshadRouhani5) March 4, 2023

The decline in Bitcoin’s trading volume in more established markets may be attributed to the impact of their crypto regulatory frameworks, especially given the US Securities and Exchange Commission’s crackdown on crypto. Stricter regulations or uncertainty surrounding cryptocurrency laws in these regions could create a less favourable environment for investors and traders.

Bitcoin Price Analysis

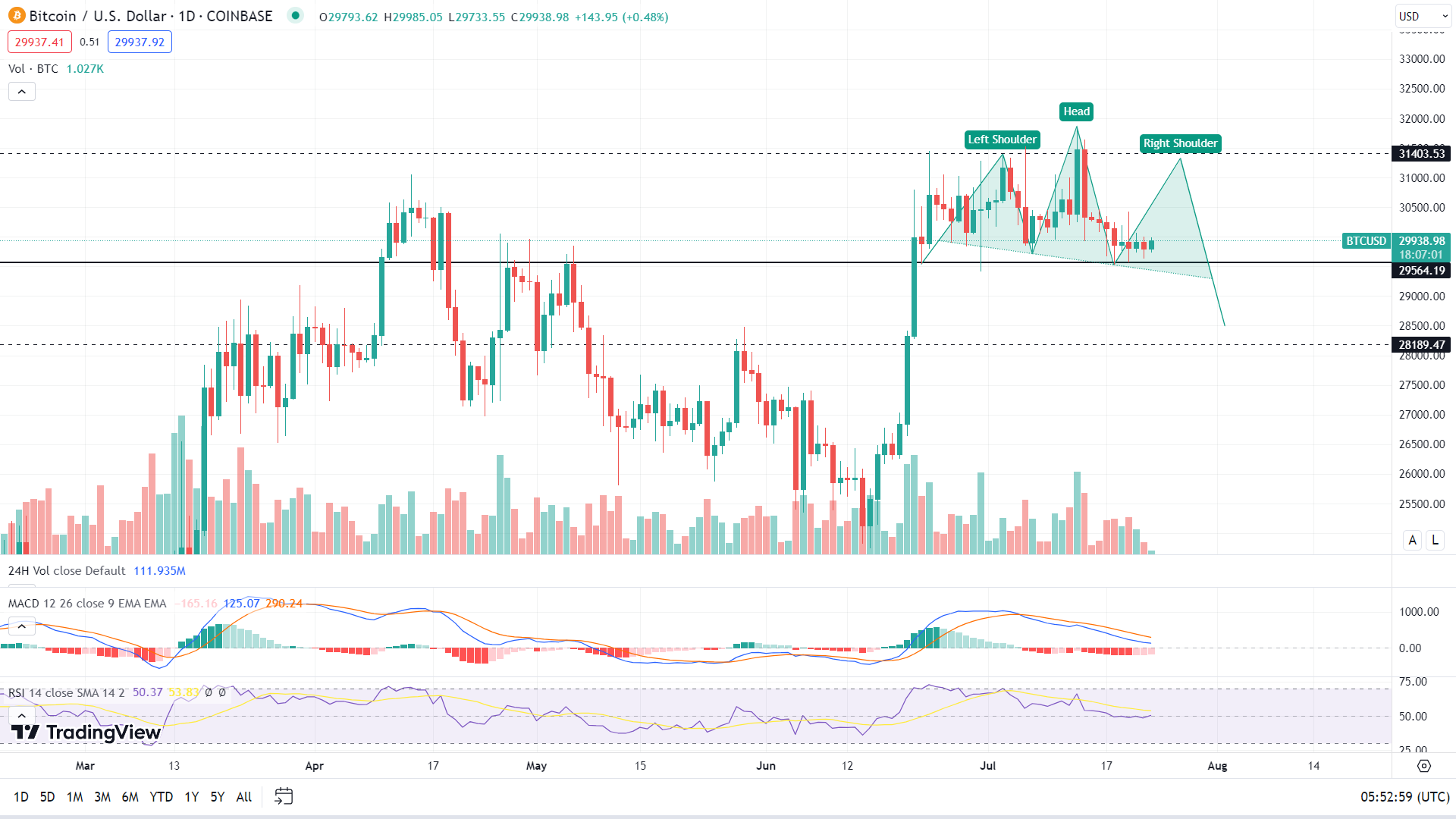

On the daily chart of BTC/USD, the price has been fluctuating between the range of $29,500 and $31,400 since June 22. A head and shoulders pattern has been emerging during this period, with the left Shoulder and head forming. The potential formation of the right shoulder at the resistance level of $31,400 poses a risk of pushing the prices downwards. This exerts considerable pressure on the neckline at $29,500.

Should the price break below and close below the neckline, it would likely result in a further decline toward the next support level at $28,000. It is worth noting that trading volume has been notably low in the past week, which increases the likelihood of the right shoulder formation. Such an outcome presents an opportunity for traders to initiate a short position near the $31,400 resistance.

The negative Moving Average Convergence Divergence (MACD) histograms are currently signaling bearish momentum. This adds to the overall cautious sentiment. However, the Relative Strength Index (RSI) is hovering near the middle line, suggesting a range-bound movement at this point in time.

Based on the daily price chart analysis, a short-term price pump seems unlikely. This is unless the neckline holds prices and trading volume rises to break the right shoulder formation.

Given the current range-bound nature of Bitcoin price, it may be worth considering other crypto investments at this time.

Promising Alternative To Bitcoin

Burn Kenny token is based on the lovable and unfortunate Kenny character from the hit show South Park. It’s designed to embody the qualities of resilience and perseverance that Kenny symbolizes. The meme token provides a fun and engaging investment opportunity for believers in its mission.

With its distinctive approach and unique concept, Burn Kenny has captured the attention of investors. The meme coin has a 0% tax system and impressive total supply of 420,000,000,000,000 tokens.

Missed $PEPE, $DOGE, $SIMPSONSINU, $PAPI, or $SPONGE? Don't worry, $KENNY's on the way to the moon. pic.twitter.com/F934NQXfmR

— $KENNY (@kenny_token) May 28, 2023

Frenzy at Launch: $KENNY Raises $250,000 in Just One Hour

Burn Kenny Coin, widely touted as one of 2023’s top meme coin investment opportunities, just sold out its $500,000 presale in less than 48 hours.

The stunning pace at which the presale was gobbled up by meme coin degens suggests that significant pent-up demand and FOMO will be carried into the token’s launch on Decentralized Exchanges (DEXs) on Monday.

The token is to be listed on the Uniswap decentralized exchange (DEX) and will include a deflationary burn mechanism as well as locked liquidity that further highlights its commitment to long-term growth.

🚀🎢 Meme coin frenzy! Burn Kenny ($KENNY) token, inspired by South Park character, raises $250,000 in just 1 hour! 🤑💰 Presale set to reach $500,000 cap, gearing up for Uniswap DEX debut. With a deflationary burn mechanism and locked liquidity, $KENNY aims for long-term growth.… pic.twitter.com/orypqxtG7u

— CryptoEth (@CryptoEth22) July 21, 2023

$KENNY trading will go live at 18:00 CET on Monday on Uniswap, with the team having already locked in 30% of the token’s supply as liquidity for three months, as shown on DEXTools and Team Finance.

Liquidity locks are a rare move in the meme coin market, underscoring the project’s legitimacy and guarding against the possibility of a rug pull.

Massive token burns are also rare in the meme coin world, but Burn Kenny Coin says it will live up to its name with a 30% token burn designed to deliver value to investors.

The social media buzz surrounding Burn Kenny has contributed significantly to its widespread enthusiasm and interest. To buy $KENNY tokens, investors are encouraged to set up a wallet and acquire $ETH or $USDT. Next, connect the wallet to the Burn Kenny website for a seamless purchase experience.

With the community rallying behind Burn Kenny, its journey in the cryptocurrency market is poised to be both captivating and potentially rewarding.

Also Read:

- Bitcoin Victory Review – Genuine Trading Platform?

- Should I Buy Bitcoin Now? Is This BTC Alternative The Next Altcoin To Explode

- Man Who Claims He’s Bitcoin Inventor Satoshi Nakamoto Wins Appeal in UK Copyright Lawsuit

- Act Fast: Burn Kenny Coin Presale Almost Sold Out – Less Than $100k Remaining for 2023’s Hottest Meme Coin Before Takeoff

- New Deflationary Crypto Presale $KENNY Raises $300,000 Within Hours – 60% Sold Out

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage