Join Our Telegram channel to stay up to date on breaking news coverage

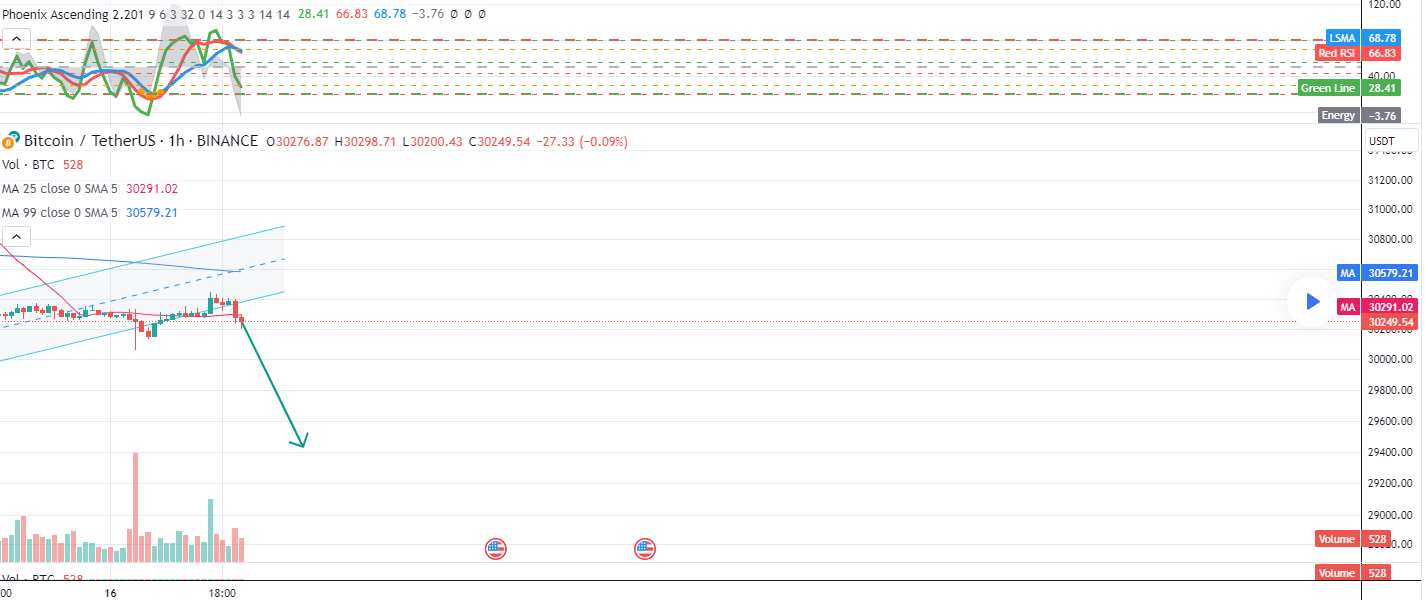

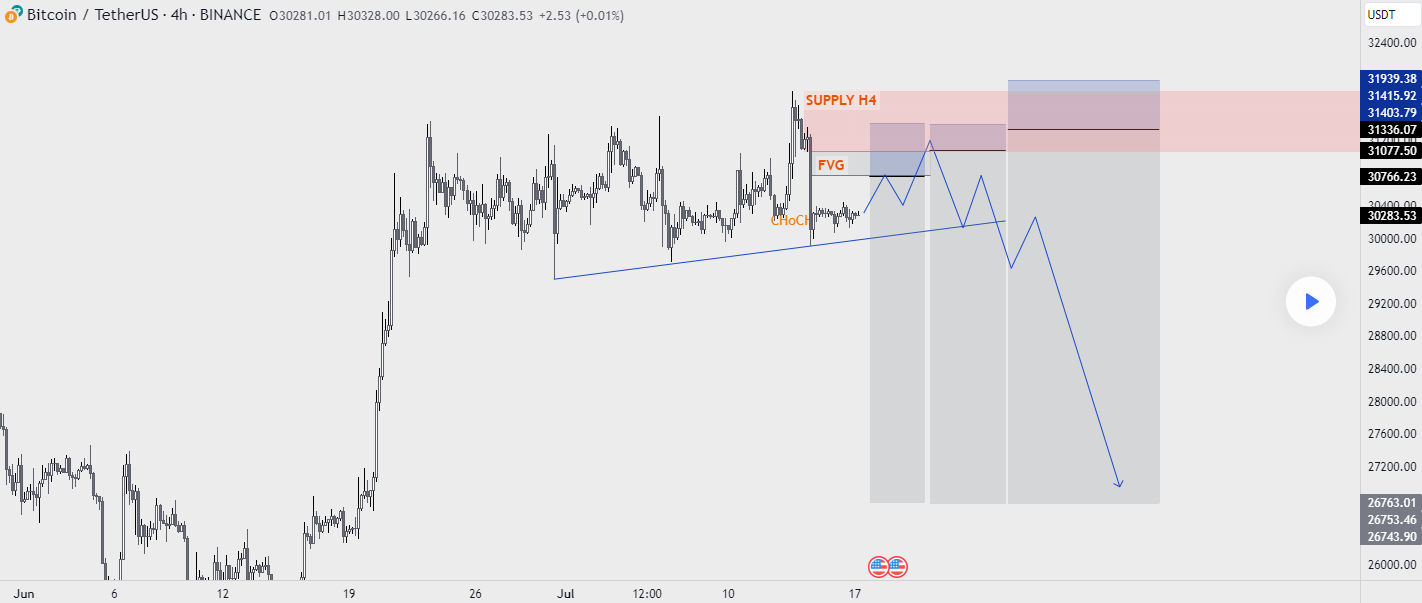

Bitcoin price crashed from above $31.2k on late Friday, sinking back to a support level at $30.2k in a matter of hours. The coin has been quite stable over the next two and a half days, with only minor fluctuations between $30,200 and $30,400.

For BTC, fluctuations of $200 are some of the smallest that the coin has seen in years. The situation finally started changing mere minutes ago, and at the time of writing, BTC price broke the support at $30,200, sinking to $30,000. The price is now seemingly reacting to a strong pressure from the sellers, and at the time of writing, it sits at $30,061, and dropping.

However, Bitcoin’s recent negative price action does come as a surprise, given that the coin has seen several positive news over the last few days.

Binance integrates the Bitcoin lightning network (LN)

Binance, the world’s largest crypto exchange by market cap, recently announced a successful integration of Bitcoin Lightning Network. The LN integration will enable faster and cheaper BTC transfers, according to the exchange.

The integration came after the exchange had to suspend BTC trading twice, as the network congestion and high transaction fees made it impractical to use the coin. Binance then saw Bitcoin LN as the only alternative.

Lightning Labs also decided to release new tools to support the incorporation of LN with AI applications.

In its announcement, Binance said that deposits and withdrawals for BTC are now open on the Lightning Network. It advised users to find their assigned BTC deposit address on the LN, within the Deposit Crypto page.

As mentioned, the integration of the LN will bring several advantages to Binance’s users. It will address the issue of scalability, and as a result, it will reduce congestion. This will also reduce transaction cost, as transactions will be processed off-chain. Transactions wil be conducted nearly instantly, and users will not be required to wait for a confirmation by miners.

SEC decided to review BlackRock’s BTC ETF application

A big development regarding Bitcoin also happened when the US SEC accepted to review BlackRock’s Bitcoin ETF application. Blackrock’s initial application was filed over a month ago, but after two weeks, the SEC rejected it.

BlackRock reacted swiftly, fixing the problems that the regulator pointed out, and refiled its application within a week. Now, the regulator announced that it will review the application, as it no longer has the option to say no.

This was taken by many in the crypto industry as a major step, and a signal that the US might finally get its own Bitcoin ETF, after 10 years of applying for it. After the SEC initially rejected the filing, mentioning the lack of surveillance as the biggest problem, BlackRock entered into a surveillance-sharing agreement with Coinbase.

Many were unsure what to make of the decision, given that the SEC sued Coinbase in early June for allegedly offering unregistered securities. For now, it remains to be seen what conclusions the regulator might reach, and whether or not it will finally approve the ETF, or if this will simply be another rejection.

BlackRock CEO: Demand for Bitcoin, Ethereum skyrockets among gold investors

BlackRock’s CEO, Larry Fink, stated recently that demand for Bitcoin and Ethereum is surging rapidly among gold investors. Ever since it became evident that Bitcoin is not scalable enough to be a currency, many in the crypto industry started viewing it as digital gold — a perfect asset to act as the future store of value.

Bitcoin has a limited supply, it is easy to store and transfer, it is transparent, and more, all of which give it an advantage over gold. It appears that traditional gold investors are coming to the same conclusion, as demand for BTC among them is climbing.

In a recent interview, Fin said that the number of gold investors who enquire about crypto’s role has increased significantly in the past five years. This is one of the reasons why the company is fighting for a Bitcoin ETF, expecting to democratize access to both gold and crypto with them.

Wall Street Memes raises over $15m, now targets $15.5m

As Bitcoin price continues to keep traders and investors at the edge of their seats, one of the most popular meme coin projects of the year continues to blow up. Wall Street Memes (WSM), a project inspired by a subreddit WallStreetBets and memes culture, managed to raise over $15.2 million in its presale as of the time of writing.

The token is growing in popularity and value, currently selling at a price of $0.0316. However, its price will jump to $0.0319 in mere hours as the project’s presale is scheduled to enter the next phase. Those interested in joining the presale can buy WSM in exchange for ETH, USDT, or BNB, or pay via credit card.

As mentioned, the project was inspired by WallStreetBets — a subreddit that consists of amateur investors who came under the spotlight in early 2021 when they started a mass purchase of shares of companies whose stocks were shorted by institutional investors. While institutions sought profit, not caring about what they might do to the targeted firms, Redditors came to the companies’ rescue by pumping their stock prices.

Related

- 10+ Best Bitcoin Live Casinos to Play At 2023

- In Attempt to Satisfy SEC, Bitcoin ETF Refilings Spearheaded by Fidelity

- Venture Capital ICO Gambits Left Bitcoin Ecosystem Underfunded, Says Adam Back

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage