Join Our Telegram channel to stay up to date on breaking news coverage

Since buying a reported 21,454 BTC in August 2020 worth $250 million, MicroStrategy has not looked back. Its CEO Michael J. Saylor has become somewhat of a crypto evangelist and has been touting Bitcoin as the best hedge against inflation.

The company has gone on to make further investments in the crypto space, focusing primarily on Bitcoin.

MicroStrategy’s BTC Holdings Shoots To 90,859

Michael Saylor has become somewhat of a Bitcoin fanatic, and his love seems to propel him to buy more Bitcoin by the day.

In a recent acquisition round, the American intelligence company has reportedly made another investment in Bitcoin.

The investment said to be worth $15 million will give them 328 BTC in return at an average price of $45,710.

This new investment in the highly-regarded crypto asset will see MicroStrategy having a whopping 90,859 Bitcoins valued at $4.3 billion.

There’s a growing trend of publicly-traded companies adding Bitcoin to their balance sheet. Besides MicroStrategy, other notable names include Tesla and Square.

Square has 5% of their balance sheet in bitcoin.

Tesla has 8% of their balance sheet in bitcoin.

Microstrategy has 95%+ of their balance sheet in bitcoin.

Who is next?

— Pomp 🌪 (@APompliano) February 24, 2021

MicroStrategy has been converting most of its cash to Bitcoin in recent years. In a press release, Saylor said this move was part of the company’s new capital allocation strategy with the intent to bring long-term value for its stakeholders who want a stake in cryptocurrencies.

Their convincing and open embrace of crypto assets has seen prominent industrialists also come into the burgeoning industry. Notable among them being Tesla and Space X owner Elon Musk.

To Musk, cryptocurrencies have the potential to become the earth’s next currency in the nearest future.

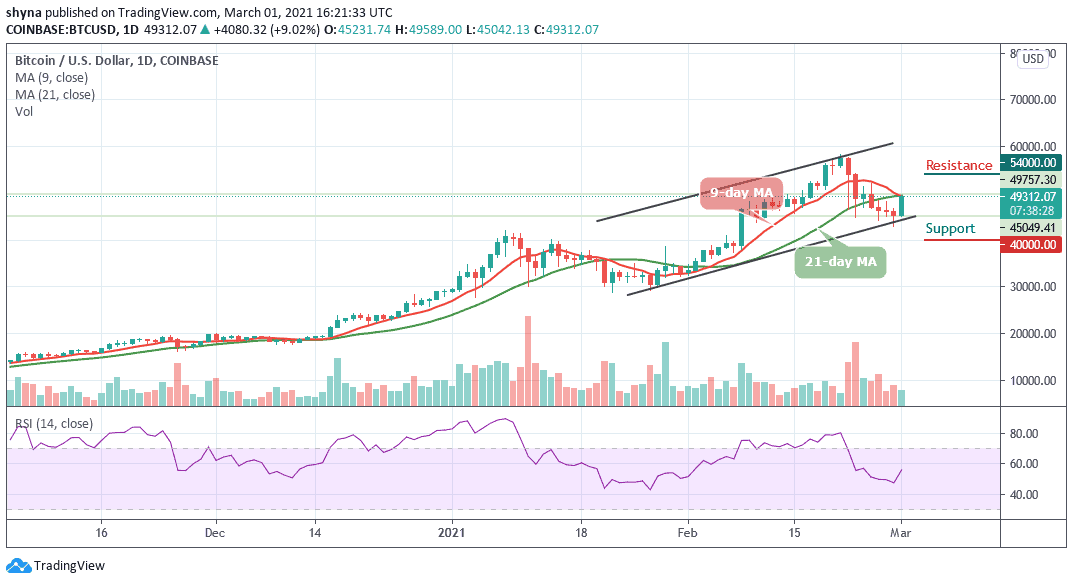

MicroStrategy’s $15 million BTC acquisition saw BTC climb close to the $50K mark and is trading at $49,200 at press time.

The firm says it is far from ending its BTC acquisitions. Saylor has confirmed MicroStrategy will continue adding Bitcoin to its balance sheet.

Crypto Gaining Mainstream Traction

Although MicroStrategy has been making the rounds with their BTC investments, Grayscale Bitcoin Trust Fund (GBTC) – one of the largest digital asset managers in the industry – is also going all-in for crypto-assets.

Operating Trust Funds for digital assets, Grayscale allows institutional investors to gain indirect exposure to volatile assets like Bitcoin without holding the assets. This way, they can profit without going through the hassles and tax liabilities of holding cryptocurrencies.

In previous funding round, MicroStrategy reportedly made a $1.026 billion investment acquiring 19,452 BTC at an average price of $52,765 per coin at the time. The company has only 9,141 BTC standing between it and a 100,000 BTC mark.

Join Our Telegram channel to stay up to date on breaking news coverage