Join Our Telegram channel to stay up to date on breaking news coverage

From a broad view of the market, the Ethereum Name Service is in an uptrend. This bullish season started on the 28th of August. There have been several pullbacks along the line, but each support level has been higher than the previous one. In October, the bullish momentum increased greatly on some of the days. On the 13th of October, the market witnessed the strongest bullish momentum so far in the month. It was after this that the bulls could not push the market upward any further again. And the bears became strong enough to put the market in a consolidation period

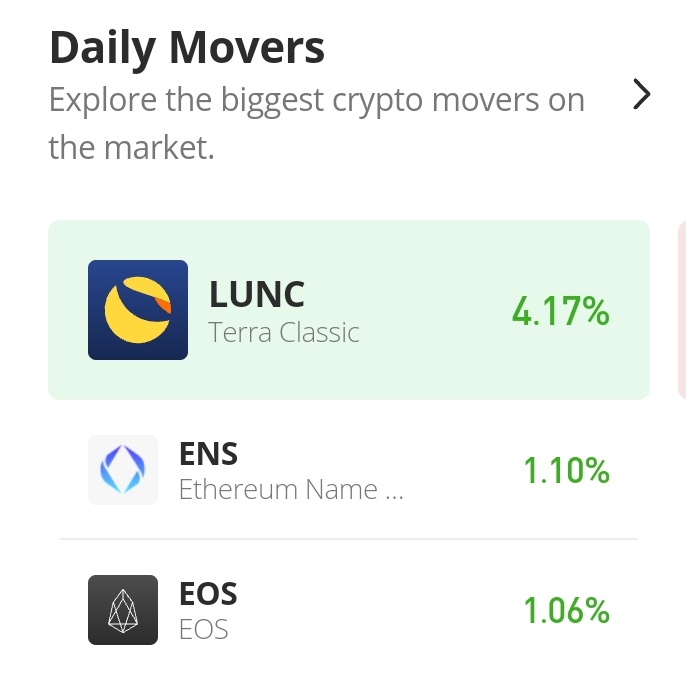

Ethereum Name Service Market Price Statistic:

- ENS/USD price now: $18.54

- ENS/USD market cap: $369,275,979

- ENS/USD circulating supply: 20,244,862.09

- ENS/USD total supply: 1,00,000,000

- ENS/USD coin market ranking: #93

Key Levels

- Resistance: $19.000, $20.000, $21.000

- Support: $17.632, $16.000, $16.500

Ethereum Name Service Market Price Analysis: The Indicators’ Point of View

At the resistance level of $20.000, the market cannot go upward anymore. At that point, bears gain strength and the price consolidates at around the resistance level for three days before the price begins to go in favour of the bears. But in today’s market, it looks like the buyers are gaining strength to prevent the selling pressure from pushing the price downward. Price remains stagnant, for now, at the current level probably because the volume of trade is low. The Relative Strength Index still measures market strength in the bullish zone of the indicator. It measures 58%. The price pullback has not crossed beyond the limit of the bullish zone.

ENS/USD 4-Hour Chart Outlook

The first session was a very rough fight between the demand and supply of Ethereum Name Service. The session opened with bulls in control but later, bears took over. As the first session was about to close, bulls became stronger again but they could not take the market. It was in the second session that the bulls reigned as kings in the market. As the bullish strength and bearish strength are becoming even with each other, the market may go into another consolidation at the current price before a decisive price break out will follow.

Related

Join Our Telegram channel to stay up to date on breaking news coverage