Join Our Telegram channel to stay up to date on breaking news coverage

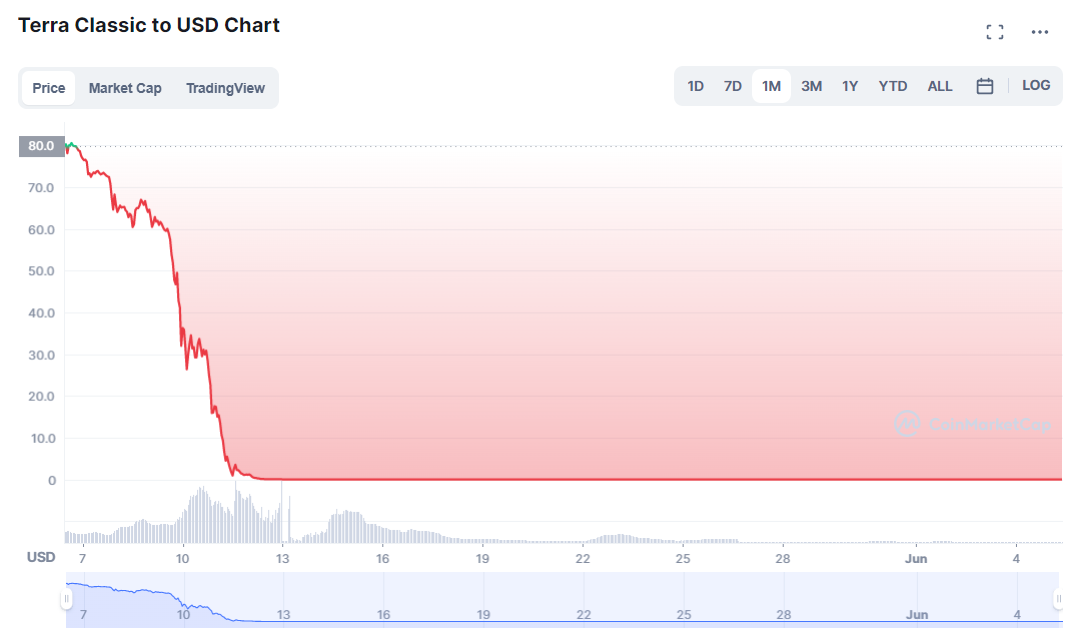

One of the most frequently traded crypto coins in the digital space, LUNA, caused chaos across the crypto world when it lost its value from about $100 to few cents in literally no time. Caused by the crash of TerraUSD, the downfall of LUNA was strong enough to bring down the value of the mightiest player in the game, Bitcoin.

LUNA, which traded in three digits around the month of April came down to a few cents, thereby prompting a rush of buying from speculators hoping for a miracle rebound, with others holding to the assumption that it is simply too big to collapse.

This entire episode of rise and fall of LUNA followed by the introduction of LUNA 2.0 is showcasing how the volatility of crypto could be influenced immensely by the activities of the speculators.

What Went Wrong for LUNA – Is LUNA Dead?

For understanding the recent price swings witnessed in LUNA, it is important to revisit the crash of TerraUSD (UST). It’s an “algorithmic” stablecoin, with a “sister” token named LUNA that runs on pre-programmed “smart contracts” to back its value. When the value of Terra falls below $1, it can be exchanged for LUNA tokens (at a low return). In principle, this should maintain both of their values steady.

But the trouble was that these complicated algorithms proved to be ineffective. LUNA and UST both crashed at the same moment, in what observers have dubbed a “death spiral.” In other words, investors hurried to sell their crypto coins before the “algorithmic” stabiliser could kick in. The “sister” token’s value dropped from around $86 at the start of this week to barely 0.003 US cents in a matter of days.

The Fall of LUNA Coin in the month of May 2022 – Currently priced at $0.00008317

In other terms, LUNA has fallen (and virtually lost all of its value) in a really short period of time. LUNA’s market value plunged from $40 billion to around $500 million, causing a sell-off and a breakdown of trust across the cryptocurrency industry.

This drop in LUNA’s value was linked by industry analysts to factors such as the “whale dumping” of tokens, which relates to individuals such as foreign institutional investors who are bulk purchasers and sellers, causing panic among ordinary investors.

The pegged price of UST reduced from roughly a dollar to 91 cents as a result of investors unstaking nearly $2 billion dollars of UST and also dumping them. At the same time, speculators attempted to profit from the situation by turning 90 cents of USTs into one dollar of LUNA coin, and resultantly, the value of the LUNA coin was even more reduced.

Understanding Terra Luna’s Price Movement

Like other cryptocurrencies, Terra Luna’s price follows Bitcoin. The Digital asset grew quickly. Late July 2019 saw LUNA’s price drop to $1.29. A market consolidation sent the utility token to $0.17.

After then, LUNA’s price rose, and it became popular in 2021. Luna rose from $0.1 to $21.4 in the second half of 2021. It went down to $5.95 in July 2021 before recovering. The Terra blockchain made a similar guarantee, and the digital currency climbed to $99.72 in late 2021.

This year, the digital asset ecosystem won and lost. By mid-February 2022, Luna’s gains were cut in half. Luna hit $119.18 on April 5. After many poor market performances, Terra Luna prices are suffering. ATH is less than $1 and it is witnessing a bearish price action.

Luna’s price drop is due to a market downtrend and de-pegging of its UST stablecoin. Recent UST withdrawals de-pegged the stablecoin, hurting Terra Luna’s bear market pricing. Project designers want to re-peg UST to the dollar.

Buy LUNA via FCA Regulated eToro Now

Your capital is at risk.

2022 Terra Luna Price Prediction

Note – In this section, a ‘LUNA price prediction’ refers to Terra Classic (LUNC), ‘the old LUNA’.

Despite its problems, Terra is still an intriguing concept. It’s the only stablecoin-facing crypto project. Investors want a more stable and less volatile digital exchange medium than pure-play crypto assets. We feel the Luna price projection will improve despite the present bearish price action.

Monthly Glimpses of its Rallies:

- June – With corrective actions in place, Luna’s market attitude should alter. This could boost the cryptocurrency’s price over $0.5.

- July – More uptrends and a $1.5 Luna crypto price projection are likely.

- August – The digital asset may lose some grip after a modest adjustment, but this should be transient. Luna coin price prediction: Above $1.9.

- September – A bull run of LUNA could treble Luna’s position and send it to $4.

- October – Now out of the crypto woods, Luna will make a strong upward push. It could hit $10.

- November – Terra Luna’s price projection is still bullish: $30.

- December – Less business over the Christmas season may slow Luna’s development. $10 to $50 would cap off a remarkable year.

Your capital is at risk.

Introduction of LUNA 2.0 – Is LUNA 2 Worth Investing In?

With the collapse of TerraUSD and LUNA, Do Kwon, the founder of Terraform Labs, has introduced LUNA 2.0 in the market without connecting it with the UST, and with the absence of any algorithmic element. They have also renamed LUNA as LUNC or LUNA Classic.

Terra LUNA 2.0 is still being scrutinised by critics, and it is currently not the most trustworthy cryptocurrency. Several issues about the LUNA Foundation Guard (LGF) and Do Kwon’s character and integrity have yet to be answered.

The coin made a lukewarm debut on the market charts on its first day. In the first half an hour of trade, the price skyrocketed from $0.30 to $30. The spike, however, was short-lived, as the price fell to barely $5.30 in the next three hours and has been seeing a downtrend since.

Some analysts are insinuating the initial volatility witnessed in the rebranded version of LUNA towards the speculative nature of this crypto. This is why a huge volatility has been witnessed in the price of LUNA 2.0 on its first day of listing. Gradually, as more and more crypto exchanges start listing LUNA 2.0 on their platform, this will go better for this coin.

Crypto.com resumed Trading of LUNA2/USDC Pair

However, the crypto community’s distrust as a result of the LUNA crash must not be overlooked. It’s obvious that not many people would trust a platform that saw an asset drop from $100 to below zero in a short space of time. Time will answer whether LUNA 2.0 will be traded on narratives or earn the trust of all its past investors who have lost millions of their fortune in the last month’s crypto crash.

As of now, the parent organization is making efforts to revive the token and Do Kwon’s LUNA recovery plan could help the LUNA price go up in 2022, both LUNA 2.0 and LUNC.

Buy LUNA 2.0 via Crypto.com Now

Your capital is at risk.

We suggest allocating only a small part of your portfolio to such coins and investing a major portion in crypto projects with good fundamentals such as Ethereum, Bitcoin, LuckyBlock and so on. At last, do follow the principle of ‘Do Your Own Research’ before investing in Crypto-assets.

Read More:

Join Our Telegram channel to stay up to date on breaking news coverage