Join Our Telegram channel to stay up to date on breaking news coverage

USDCAD Price Analysis – August 02

The bullish movement may continue should the Bulls maintain or increase their momentum and the price may target the supply level of $1.3207.

USD/CAD Market

Key levels:

Supply levels: $1.3207, $1.3367, $1.3493

Demand levels: $1.3024, $1.2930, $1.2783

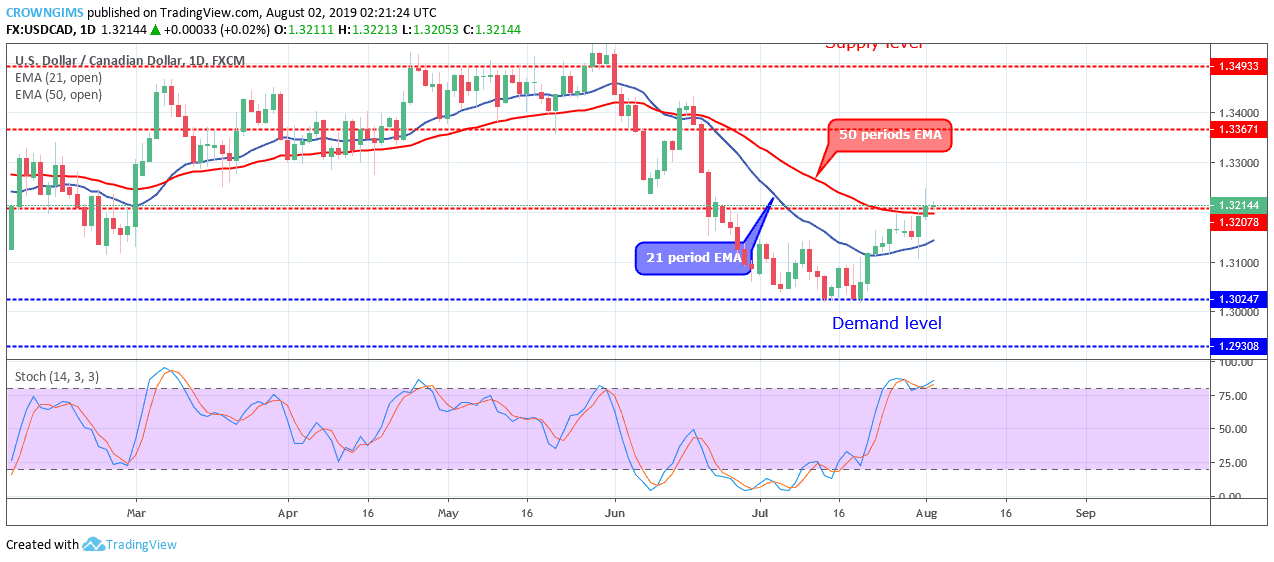

USDCAD Long-term Trend: Bullish

USDCAD is bullish in the long-term outlook. Two weeks ago, USDCAD was under the control of the Bears. The bearish momentum bottomed the currency pair at the demand level of $1.3024. The price bounced with the aid of the Bulls’ momentum, rallied towards the two EMAs and broke up the confluence at the supply level of $1.3207.

The currency pair has broken up the two EMAs and the price is trading above the 21 periods EMA and 50 periods EMA. Also, the stochastic Oscillator period 14 is above the supply level of $1.3207 (overbought level) with the signal lines pointing up which indicates buy signal. The bullish movement may continue should the Bulls maintain or increase their momentum and the price may target the supply level of $1.3207.

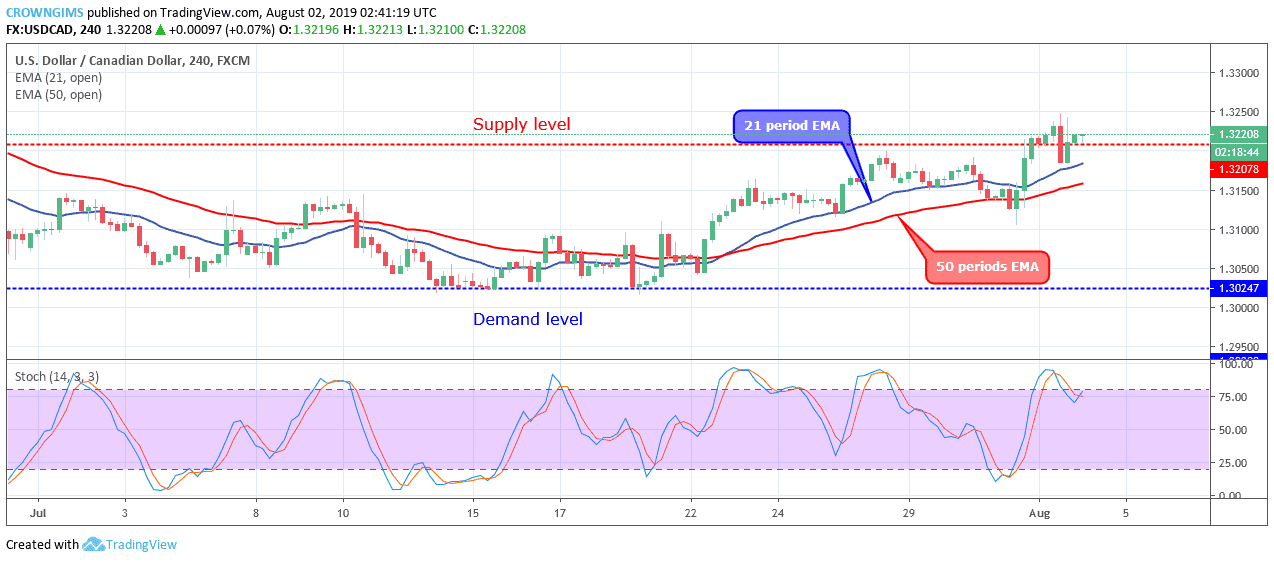

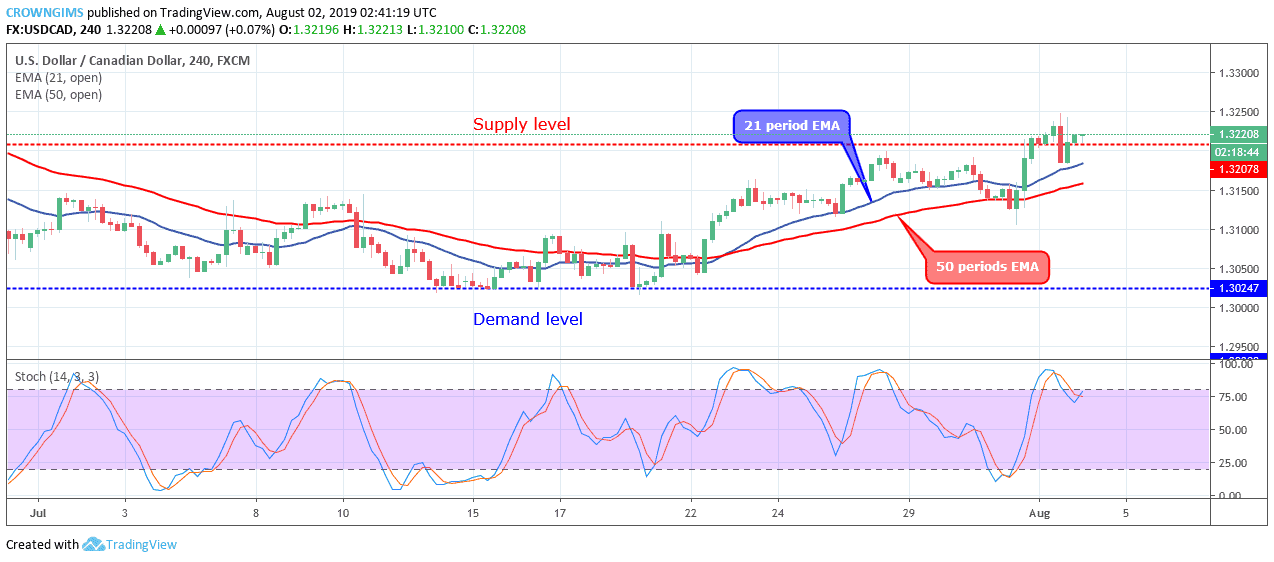

USDCAD medium-term Trend: Bullish

On the medium-term outlook, USDCAD is bullish. After the broken up of the two EMAs, the Bulls maintain their momentum and the supply level of $1.3207 was reached. The level was penetrated upside on August 01. The price pulled back to retest the broken level and the bullish movement continues.

The pair sustains its trading above the 21 periods EMA and 50 periods EMA which indicates a continuation of strong bullish momentum in the medium-term outlook. The Stochastic Oscillator period 14 is at 75 levels and the signal lines pointing up to indicate a buy signal.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Read more:

- Cardano Price: Low Bullish and Bearish Momentum

- Bitcoin Price Prediction: BTC/USD Keeps Rallying Higher; Can $9,500 Possibly be the Next Target?

Join Our Telegram channel to stay up to date on breaking news coverage