Join Our Telegram channel to stay up to date on breaking news coverage

XRP Price Analysis – July 5

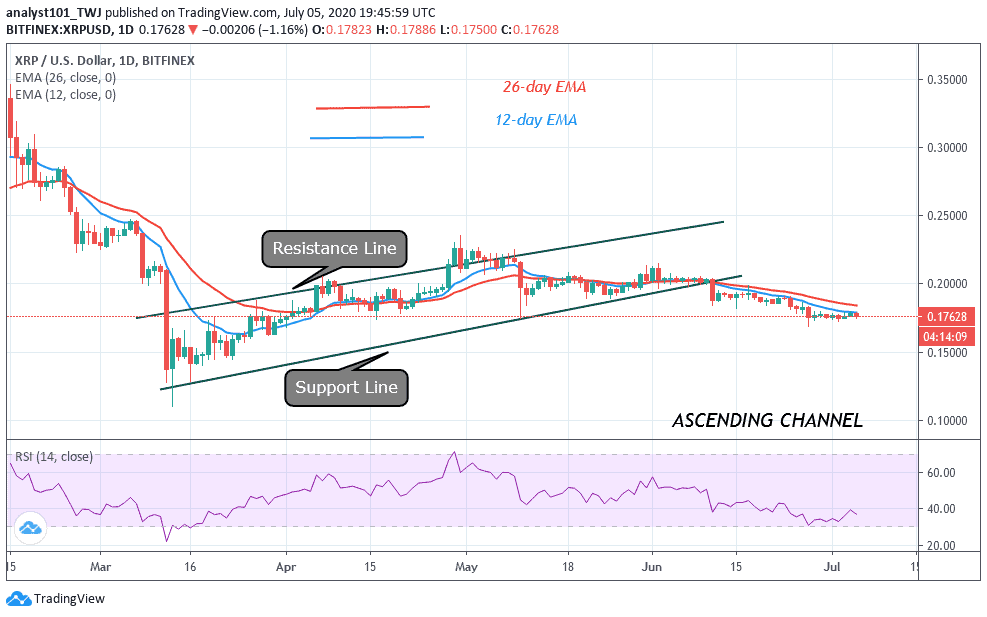

Ripple‘s bulls have successfully held the $0.17 support in the last one week. XRP/USD is trapped between $0.17 and $0.18 price levels. The bulls and bears are tussling for price possession in the range.

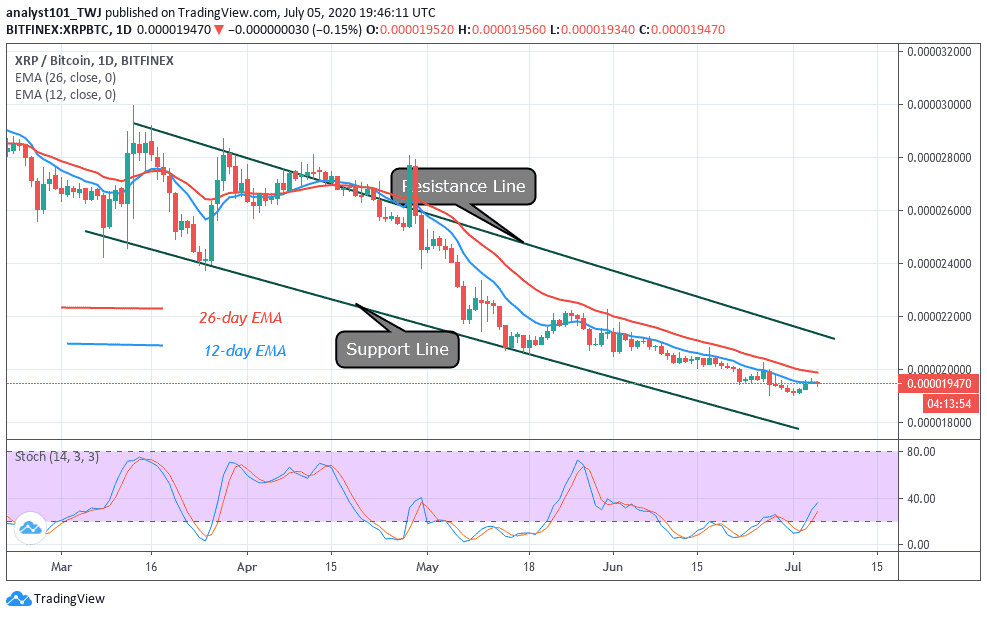

On the XRP/BTC, the coin is on a downward move as the coin reaches the oversold region.

XRP/USD Market

Key Levels:

Resistance Levels: $0.24, $0.26, $0.28

Support Levels: $0.22, $0.20, $0.18

For several weeks, Ripple has been on a downward move. Presently, The coin has been confined between $0.17 and $0.18. The crypto has been consolidating with the appearance of small body candlesticks. This suggests that the bulls and bears are undecided about the next trending move. Buyers have been retesting the $0.18 high to break above it. From the daily chart, the price bars are below the 12-day EMA and the 26-day EMA. This indicates that the coin has the tendency to fall. Nonetheless, if the bulls succeed in breaking above the EMAs, Ripple will resume an upward move.

In the meantime, the price action is in favor of the bears. Nevertheless, if the price tussle continues in the range, the bears may have the upper hand. Ripple, will reach the low of $0.14 if the current support is breached. Meanwhile, the pair is at level 36 of the Relative Strength Index. It indicates that the market is approaching the oversold region. In the oversold region, buyers will emerge to push the prices upward.

Similarly, on the XRP/BTC chart, the market has continued to descend to the lower region of the descending channel. This indicates that the bears have the upper hand.

The price bars are closer to the support line of the ascending channel. On the downside, if the bears break below the support line, the coin will further depreciate. However, if the bulls break above the resistance line and price closes above it, XRP/BTC will resume an upward move. However, this is not feasible for now. Presently, Ripple is above 25% range of the daily stochastic. This explains that the market is in a bullish momentum but the momentum is weak.

Join Our Telegram channel to stay up to date on breaking news coverage