Join Our Telegram channel to stay up to date on breaking news coverage

Gauntlet recently raised concerns about Aave’s huge $176 million CRV (Curve) position, citing risks associated with its size and exposure. The report emphasizes risk management and proactive measures to protect Aave’s ecosystem from any adverse consequences. Decentralized finance (DeFi) is evolving, so thorough risk assessments and continuous monitoring are important.

DeFi Community Buzz: Michael Egorov’s CRV Debt Sparks Speculation

People have been talking about CRV token investments through popular DeFi lending platforms. In the crypto community, this has gotten a lot of attention.

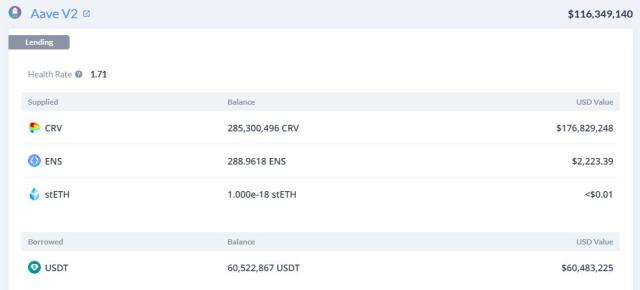

On June 16, Michael Egorov, co-founder of Curve Finance, owed $60 million in stablecoins. CRV tokens worth $176 million secure this debt.

Egorov has used his CRV tokens as collateral on Aave, a popular decentralized finance (DeFi) lending platform. Despite Egorov’s strong position, Gauntlet, a risk management firm, advises Aave to halt the CRV market on Aave V2.

CRV can’t be added as collateral on the platform by Egorov and others.

Along with other altcoins, CRV, a cryptocurrency, has dropped almost 30% in the past month. CRV’s decline might have sparked renewed worries about a long-held position.

Gauntlet Works to Reduce Aave’s Bad Debt Risk Amid CRV Liquidity Challenges

The Gauntlet team is working on reducing Aave’s bad debt risk. CRV is at risk if its price drops to the point where Aave has to sell, but the position is too big. Aave might have trouble liquidating the position if it loses.

With AAVE, people can close positions by repaying USDT and receiving CRV as collateral.

Egorov’s Aave V2 collateral represents over 33% of all CRV tokens.

Liquidators couldn’t sell the whole position profitably since CRV isn’t available on the blockchain. CRV’s price would drop by 70% if Egorov sold 100 million CRV on the mainnet.

Due to the scarcity of liquidity for CRVs, Gauntlet warned of disorderly liquidations.

Andrew Thurman, former communications director at Nansen, says it’s unlikely Egorov won’t repay his debt, contrary to some speculation on Gauntlet’s forum.

Thurman said.via Telegram,

Michael has actively managed that position in the past, including at times paying down portions of the debt.

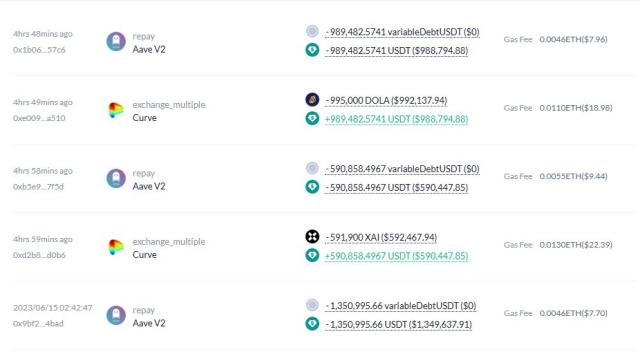

On-chain data shows that Egorov has repaid nearly $3 million in the past day but hasn’t responded.

Jaabari shares a different perspective on bad debt and Aave from Silo Finance’s Aiham Jaabari. Gauntlet’s post aims to minimize Aave V2’s risk exposure, so he thinks the worries are exaggerated.

Some traders have used the narrative to drive down CRV’s price. The popular Twitter account says DeFiMoon, Binance has increased funding rates for shorting CRV.

Silo works differently than Aave V2 because it groups smaller sets of assets. Silo doesn’t have enough USDT liquidity to accommodate Egorov’s entire Aave V2 position transfer.

Egorov has collateralized borrowing positions with CRV on other platforms like Frax Finance and Abracadabra, totaling over $10 million, according to DeBank.

Gauntlet’s concerns about Aave’s bad debt were possibly influenced by Avraham Eisenberg’s similar trading strategy. Because Eisenberg borrowed CRV against collateralized USDC, CRV’s price dropped.

Egorov’s position wasn’t liquidated by Eisenberg bringing CRV’s price down, Jaabari said. “After they saw what happened to Avi, no one is doing this,” Jaabari said.

Eisenberg was charged with market manipulation by the SEC in January of this year. A guilty plea has been entered by him, and he has agreed to pay a penalty of $2 million. According to the SEC, he had caused more than $27 million in losses to investors as a result of his actions. Jaabari commented that as a result of this, other traders were more cautious about using similar tactics in the future.

Join Our Telegram channel to stay up to date on breaking news coverage