Join Our Telegram channel to stay up to date on breaking news coverage

The Bittensor price has plunged 23% in the last 24 hours to trade at $192 as of 12:30 a.m. EST on a 54% surge in trading volume to $81 million.

That made it the biggest loser among major cryptos as the industry’s overall market capitalization plummeted 13.4% to $1.85 trillion after a rate cut by Japan spooked investors, triggering panic selling amid fears of a recession after the US Fed held rates steady last week instead of cutting them.

Bittensor Price Analysis: TAO Dipens Further, Can Bulls Regain Momentum?

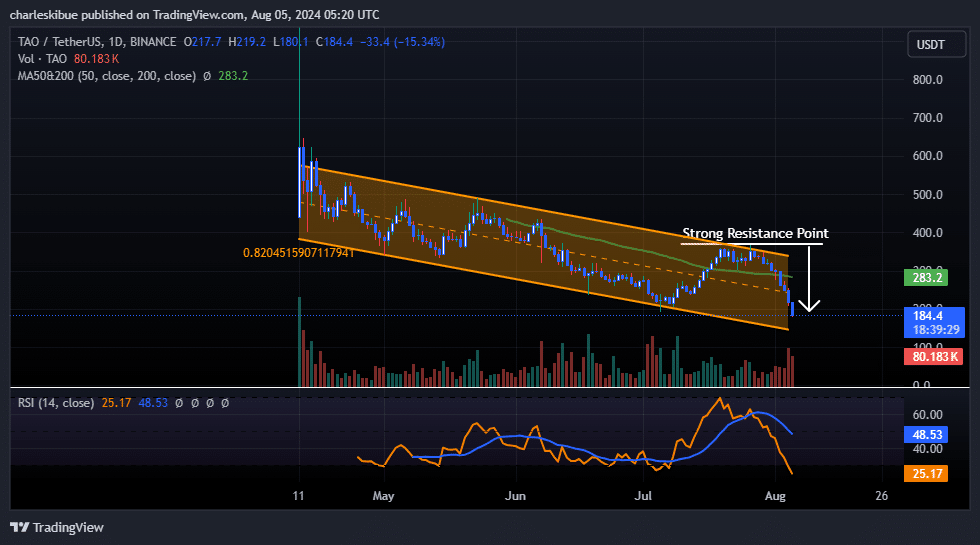

Bittensor (TAO) delivered massive returns to its investors, surpassing 1600%, reaching an all-time high of $755.01 between October 2023 and March 2024. However, it hit a supply zone and couldn’t push beyond that peak.

This led to profit-taking, which eroded over 70% of the gains that had been achieved. However, the bulls seem to have staged support at $215, pushing the price to the upper boundary of the bearish channel.

The resistance level at $358 has driven the price down by nearly 20% this week, pushing it towards the crucial support at $200. The decline accelerated after breaking below the previous swing low of $300 and the 50-day SMA support level. Other indicators also showed a bearish crossover, with the RSI at 43.82.

TAOUSDT Analysis (Source: Tradingview)

Bittensor Price: Bulls Still Have Hope

The price is also trading below the 50 simple moving average as bears continue to push the price down. However, it remains above the 200 SMA, which allows the bulls to drive the price back up.

Furthermore, the Relative Strength Index (RSI) indicates a downtrend from the 70 overbought regions falling below the 50 midline level to the oversold region. At his level, the bulls have a chance to drive the price up again, thereby pushing the RSI back to the overbought 70

Bittensor Price Prediction

The current situation suggests a short-term decline and a breakdown of the falling wedge pattern. As a result, bears might target support levels at $180 and $155. However, if a sudden uptick in support boosts the price, resistance could be found at $330 and $358.

Final Call To Buy WienerAI Now Before Launch In Hours

With the TAO price plunging, investors are flocking to buy the blockbuster WienerAI (WAI) presale before it’s too late. The token has raised more than $9 million and is offering investors a last chance to buy before it lists in a few hours at 12p.m. UTC.

12 hours left!

The final countdown to the WienerAI launch has begun! 🌭 pic.twitter.com/PJ2xvEkeeT

— WienerAI (@WienerDogAI) August 4, 2024

WienerAI blends a playful dog theme, a quirky sausage meat twist, and advanced AI capabilities.

Its standout feature is a powerful trading bot, designed to be a crypto trader’s ideal partner. If you’re unsure whether to buy or sell a cryptocurrency, ask the bot.

Within seconds, you’ll receive a comprehensive analysis of the current price, potential buy or sell signals, and even some price predictions.

WienerAI is launching Monday! 🌭

Check out our timeline of major events so you don't miss any action! pic.twitter.com/i7Wib8lUOr

— WienerAI (@WienerDogAI) August 2, 2024

WienerAI also offers a staking protocol with an impressive annual return of 122%.

ClayBro, an influential YouTuber with 130k subscribers, says WAI could explode 20X after launch.

There is a less than 4 hours left for interested investors to participate in what has been one of the hottest presales of the year.

Buy WAI tokens here for $0.00075 each using ETH, BNB, USDT, or a bank card.

Related Articles

- Upcoming Crypto Presales: Unlock Early Investment Opportunities!

- Bonk Price Prediction: BONK Tops Gainers With 24% Leap, But Experts Say This AI Meme Coin Rival Might 10X

- Pepe Price Prediction: PEPE Surges 15%, But Analysts Say This Layer-2 PEPE Derivative Might Be The Best Meme Coin To Buy Now

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage