Join Our Telegram channel to stay up to date on breaking news coverage

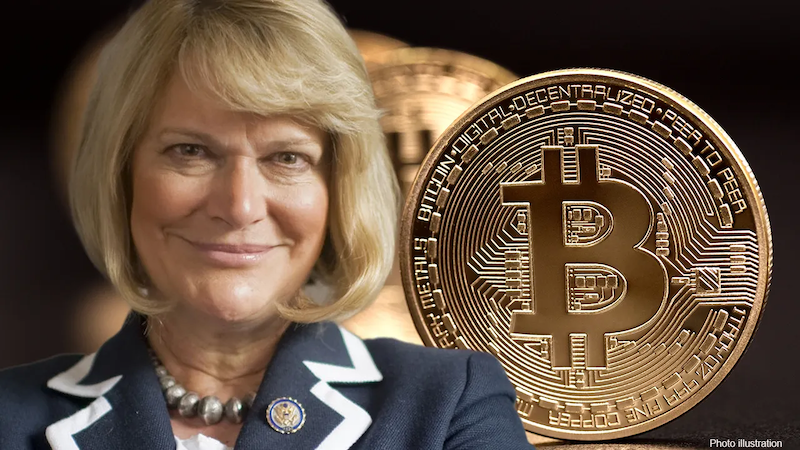

Two prominent U.S. Senators, Cynthia Lummis (R-WY) and Kirsten Gilibrand (D-NY), are making a renewed effort to create a legislative framework to oversee the evolving digital asset sector. The pair’s latest initiative to pass an updated version of a cryptocurrency regulation bill they jointly proposed last year was revealed on CNBC’s Squawk Box. This comes amid a digital currency industry that’s simultaneously experiencing favorable conditions and significant hurdles.

Highlighting the legal issues facing the industry, the Securities and Exchange Commission launched legal actions against the two leading cryptocurrency exchanges, Binance and Coinbase, in June. This move, designating nearly a dozen tokens as securities, unexpectedly threw the industry into turmoil and triggered concerns about the future trajectory of digital currencies in America.

On the brighter side, the industry saw several firms, including BlackRock, Invesco, Valkyrie, and Ark Invest, following BlackRock’s lead by filing applications for exchange-traded funds in Bitcoin spot markets on June 15. This trend significantly drove Bitcoin prices, pushing them to a level unseen since the previous year.

Hopeful About a Better Bill

Despite these challenges and opportunities, Lummis and Gilibrand are hopeful about the new version of their bill – an updated form of last year’s Responsible Financial Innovation Act. The original version aimed to clarify some of the trickiest aspects of crypto regulation, including categorizing a token as either a security or a commodity, which in turn would determine whether the SEC or the Commodity Futures Trading Commission (CFTC) would be the responsible regulator.

Bipartisan legislation is the most effective path towards regulatory clarity, consumer protection, and market reform in the digital asset ecosystem.

Addressing the SEC’s current approach to crypto regulation, Lummis noted that both the SEC and Congress share blame for the current unclear regulatory environment. She stated, “The current erratic regulatory framework is the result of both Congress’s hesitation to pass a bill and the SEC’s failure to provide proactive guidance to companies.” She assured that the streamlined version of the draft will reflect feedback from both regulators and industry stakeholders.

The crypto community reacted positively to the updated RFIA. Georgia Quinn, general counsel for Anchorage Digital, said in an email that it represents a “significant step forward from the Senate.” She highlighted that “bipartisan legislation is the most effective path towards regulatory clarity, consumer protection, and market reform in the digital asset ecosystem.”

However, the updated legislation drew a more reserved response from Gabriel Shapiro, general counsel for Delphi Labs. He warned about potential confusion due to the bill appearing “too deferential” to existing securities laws and expressed reservations over other aspects that could cause misunderstanding.

While the bill is still in progress, having been maneuvered through two GOP-led House committees, its proponents are seeking to make it a bipartisan effort. Rep. Patrick McHenry, the chair of the House Financial Services Committee and one of the leading supporters of the bill, expressed his intention to make the final bill bipartisan. House Democrats, though not ruling out the bill, have voiced reservations over aspects they believe could protect wrongdoers and weaken the SEC.

Related News

- Mark Cuban Criticizes U.S. SEC’s Ineffective Approach to Crypto Regulation

- Most Secure Bitcoin Wallets

- The SEC and Their Showdown with Crypto

- AI Crypto Projects

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage