Join Our Telegram channel to stay up to date on breaking news coverage

Last week has brought another series of corrections and recoveries for Bitcoin, culminating with the coin’s rise to the 12-month high on July 6th.

Bitcoin climbed up to $31,334, stunning investors who assumed that the coin would drop to the mid-$20k range prior to the price surge.

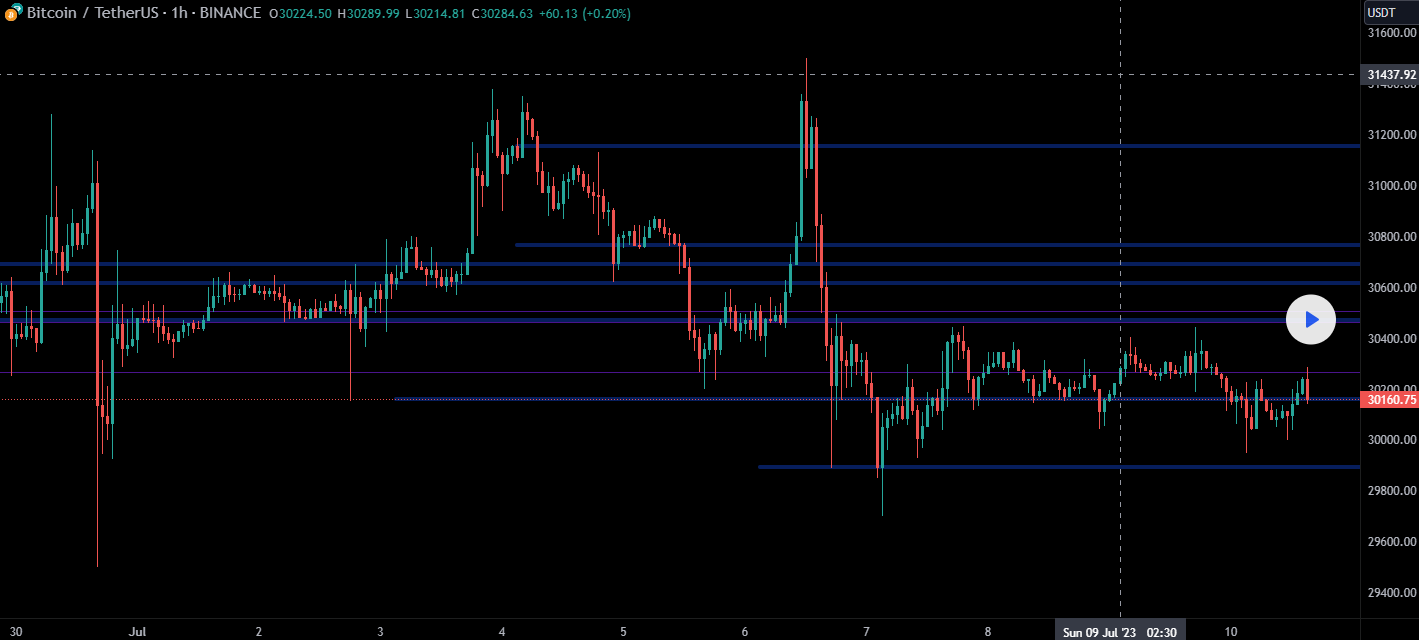

The correction did follow, however, and by the end of the day, Bitcoin found itself just above its support at $30k.

On Friday, July 7th, as well as over the weekend, many expected Bitcoin to finally break the support at $30k. However, this did not happen, and the coin started trading sideways ever since.

Bitcoin’s support at $30k managed to hold for the past four days, but the price was also limited by a resistance at $30.4k.

The coin stabilized in the sense that it was trapped between these two levels, neither of which broke since Thursday evening. On July 10th, the Bitcoin price sits at $30,157 after dropping by 1.57% compared to its price 24 hours ago.

Assessing the current situation, analysts noted that the situation is suitable for scalping as long as traders who engage in this type of trading keep a watchful eye on the price action.

The Bitcoin price kept going up and down between the two levels throughout the weekend, and it continues to do so even with the start of the new week. In the last four days, Bitcoin was rejected by its resistance and bounced back up from its support over a dozen times.

Attempting to decipher the signs and predict which level would break first, analysts used AI software, predicting that the support would likely give in first. If true, the AI predicted that the coin might drop to $29,200. However, this level could act as another support that might allow BTC to recover from there.

US investors are accumulating Bitcoin

Bitcoin started growing nearly a month ago because of BlackRock’s Bitcoin spot ETF filing with the US SEC. Prior to the filing, crypto whales started buying BTC in massive quantities. US investors started joining massively, especially after the SEC rejected BlackRock’s application, only for the asset manager to re-file it.

On-chain analyst William Clemente spoke about the situation, stating that it is quite clear that BlackRock inspired investors to start buying Bitcoin en masse.

Young wizard @WClementeIII explains why hash-rate is at an all-time high, US markets are putting a premium on bitcoin, and a few surprising metrics that occurred over the last 90 days. pic.twitter.com/S8vbtVMgOe

— Pomp 🌪 (@APompliano) July 8, 2023

Standard Chartered predicts massive gains for BTC in 2024

With the crypto world craving Bitcoin predictions, Standard Chartered analyzed the market, revealing its thoughts. According to the company, the top cryptocurrency could reach anywhere between $50,000 and $120,000 by the end of 2024.

BREAKING 🚨 #BITCOIN

$800 billion Standard Chartered Bank now forecasting $120,000 #Bitcoin price by 2024 pic.twitter.com/qjb3DuVbBv

— BITCOINLFG® (@bitcoinlfgo) July 10, 2023

The prediction is not outlandish, considering that Bitcoin is scheduled to see another halving in mid-2024, which is an event where Bitcoin block rewards get cut in half. The event happens after every 210,000 blocks, and this will mark the 4th halving event in Bitcoin’s history.

Interestingly, Bitcoin’s price skyrockets to reach new heights never seen before after every halving. However, the surge doesn’t happen immediately, and it typically takes 6-12 months for the surge to begin.

It is quite possible that Bitcoin might even surpass Standard Chartered’s expectations, given that its last ATH took it to $69,000.

Wall Street Memes presale closing in on $14 million raised

While Bitcoin seems to be the hottest topic in the crypto industry right now, it is worth noting that the biggest and most popular presale is still drawing investors in.

The new meme coin, Wall Street Memes (WSM), is still holding its presale which continues to advance. The meme coin might even steal the spotlight from the world’s largest cryptocurrency.

At the time of writing, Wall Street Memes has already raised over $13.8 million, and it is still not stopping. The token is currently being sold at the price of $0.0313 per WSM, and in a little over a day, its price will increase to $0.0316.

WSM can be purchased with ETH, BNB, USDT, or via credit/debit card. It emerged as a way of remembering a group of amateur investors from Reddit, known as WallStreetBets.

The subreddit rose against institutional investors when they attempted to short stocks of several companies to make a profit, not caring that their actions were leading the companies to financial ruin.

WallStreetBets responded by organizing a mass purchase of stocks belonging to the targeted firms, pushing their value and causing institutions to lose money.

Related

- As Halving Looms, Bitcoin Miners Are Weighing Up Their Options

- Bitcoin Price Holds Steady At $30,300. What Can Take It Back To $32,000 Today?

- Bitcoin Ordinals Launchpad Luminex’s New Collection Standard Cuts Inscription Costs By 90%

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage