Join Our Telegram channel to stay up to date on breaking news coverage

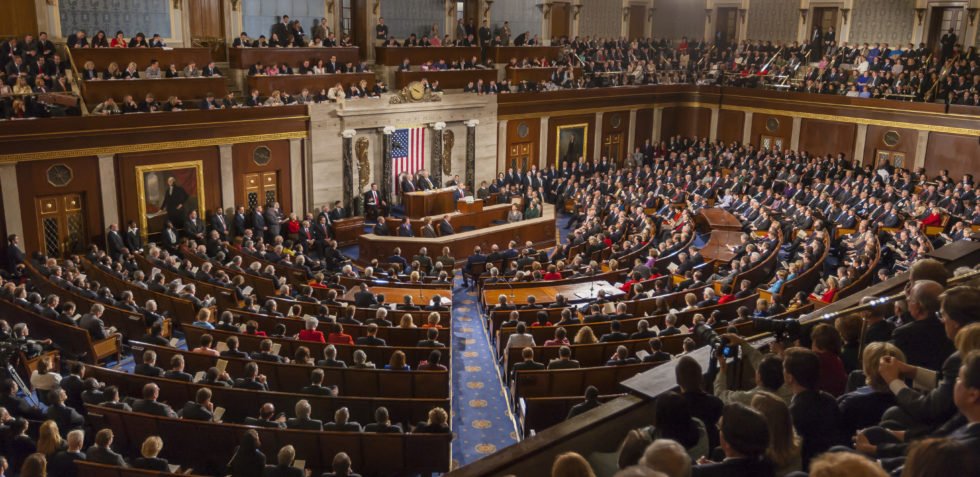

Brian Brooks stands as the leader of the US Office of the Comptroller of Currency, or OCC, and was a former executive from the Coinbase exchange. Recently, the OCC has received a letter sent by multiple congress members, who have come to express concerts regarding his leadership and its heavy focus on crypto.

Multiple Congresspeople Holding Reservations

The letter was sent by Stephen Lynch, congress member from Massachusetts, as well as Rashida Tlaib, congress member from Michigan. The letter itself holds signatures of other members of Congress as well: Jesús García from Illinois, Deb Haaland from New Mexico, Barbara Lee From California, as well as Ayanna Pressley from Massachusetts.

The letter itself detailed the recent “unilateral” actions in the digital financial activities space that the OCC has done. This includes announcing plans to offer special-purpose “payments” charters as well as interpretive letters on crypto custody. This comes by way of a media statement Tlaib had made yesterday.

Several Key Moves From OCC

A number of key regulatory clarity decisions were made within the crypto industry throughout the year, partly thanks to the OCC under Brooks’ leadership. Back in July, regulatory approval was given to federally chartered banks to allow for crypto custodianship. In September, approval was ushered in for such banks to start stablecoin reserve custody.

The letter highlighted the limited statutory authority that the OCC holds, urging the Comptroller to reconsider the implications of this unilateral approach to crypto legislation. Instead, the letter suggests that the OCC should rather collaborate with other regulators, including Congress, when it comes to these issues.

Stepping on A Few Toes

In the statement, it’s claimed that the clarity the OCC had issued out in September only hurt innovation, all the while facilitating a new class of institutions that primarily benefits established and large fintech firms. As such, the letter highlighted that large tech firms like Facebook would be able to get the go-ahead to enter the payments arena, which raises several red flags when it comes to legislators.

The world at large has seen its respective regulators go deeper in their involvement regarding the crypto space this year, especially in regard to clarity and criminal charges.

As it stands now, Brian Brooks’ press team has yet to give out a statement about the matter, but it seems the man has stepped on a few toes. Granted, the US needs to significantly jumpstart its crypto legislation if it wants to keep up with China, who’s already at the cusp of making its CBDC widely available.

Join Our Telegram channel to stay up to date on breaking news coverage