Join Our Telegram channel to stay up to date on breaking news coverage

XRP Price Prediction – April 10

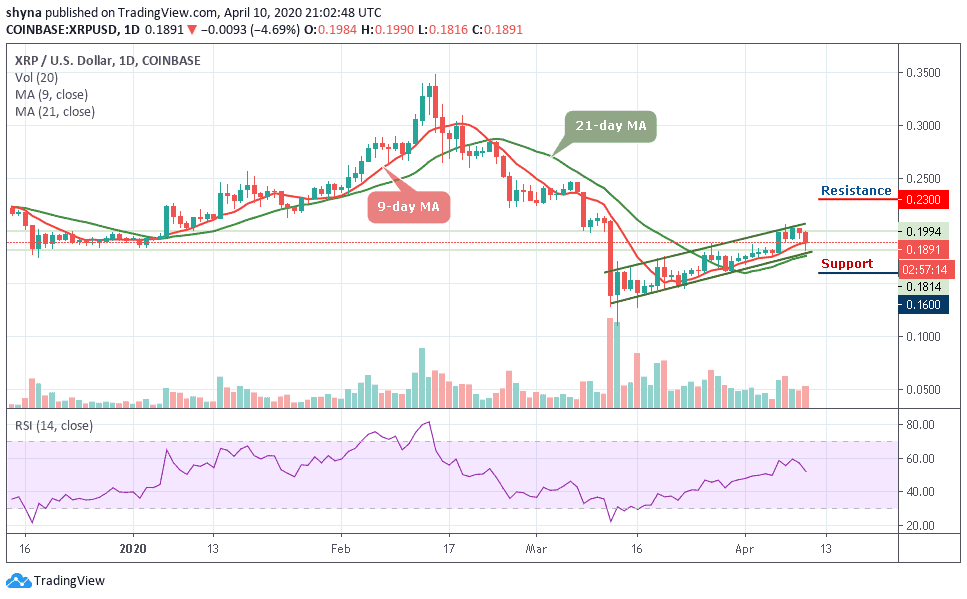

Ripple (XRP) has been down by more than 4.69% in the last 24 hours as the value gone below $0.199.

XRP/USD Market

Key Levels:

Resistance levels: $0.230, $0.240, $0.250

Support levels: $0.160, $0.150, $0.140

Having slumped beneath the $0.200, XRP/USD may continue to show weakness in price and fall at support until the market can find a stable level to reinforce bullish run. For now, a new low is yet to be ascertained as the bears remain dominant and active over the past few days. We may need to wait for the sellers to exhaust momentum before longing. However, shorting XRP might be the best position for now.

However, if the market eventually resumes sell-off now, the market may cross below the 9-day and 21-day moving averages and could find immediate support at $0.180 and $0.170 while the critical supports lie at $0.160, $0.150 and $0.140. However, the XRP/USD pair has continued to erode bearishly on the daily time frame.

In other words, a bullish rally will only confirm if the market can climb significantly back above the $0.210. Meanwhile, the technical indicator RSI (14) is moving below 53-level. If XRP manages to surge above $0.220, it may see the resistance levels at $0.230, $0.240 and $0.250.

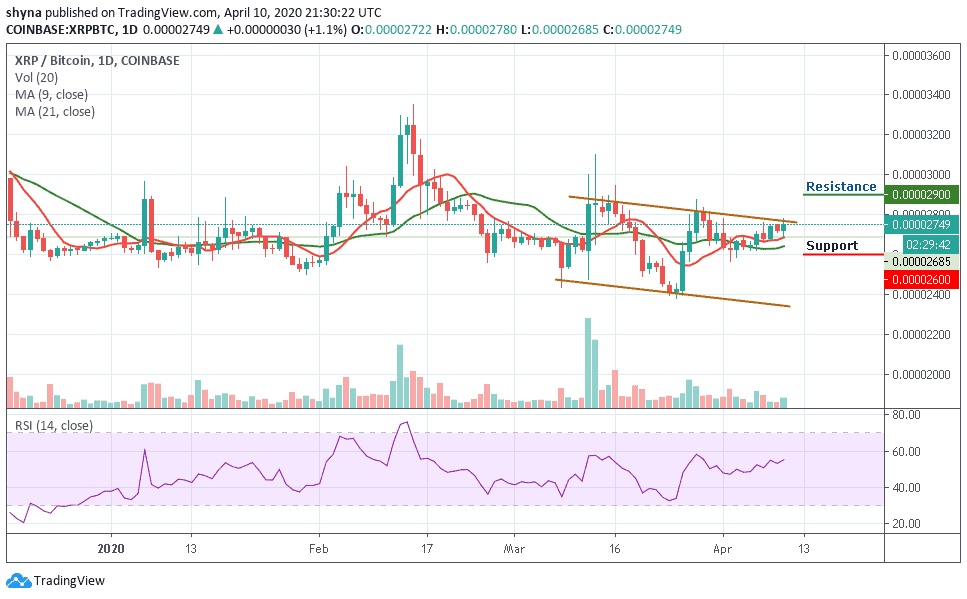

When compared with Bitcoin, the pair is consolidating within the channel and moving above the 9-day and 21-day moving averages. Meanwhile, the buyers are still making an effort to push the price above the upper boundary of the channel and the bullish continuation may bring it to the resistance levels of 2900 SAT and 3000 SAT respectively.

Meanwhile, any bearish movement may likely push the market towards the south, a possible fall could bring the market to the support levels of 2600 SAT and 2500 SAT. According to the RSI (14), the signal line is moving above 53-level, which suggests that more bullish movement may come to play.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage