Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market is a bit on edge right now, as it appears that not even the Bitcoin halving can push the top asset’s price past the $10,000 threshold. However, a new report is showing that investors might be in for a possible slump once more.

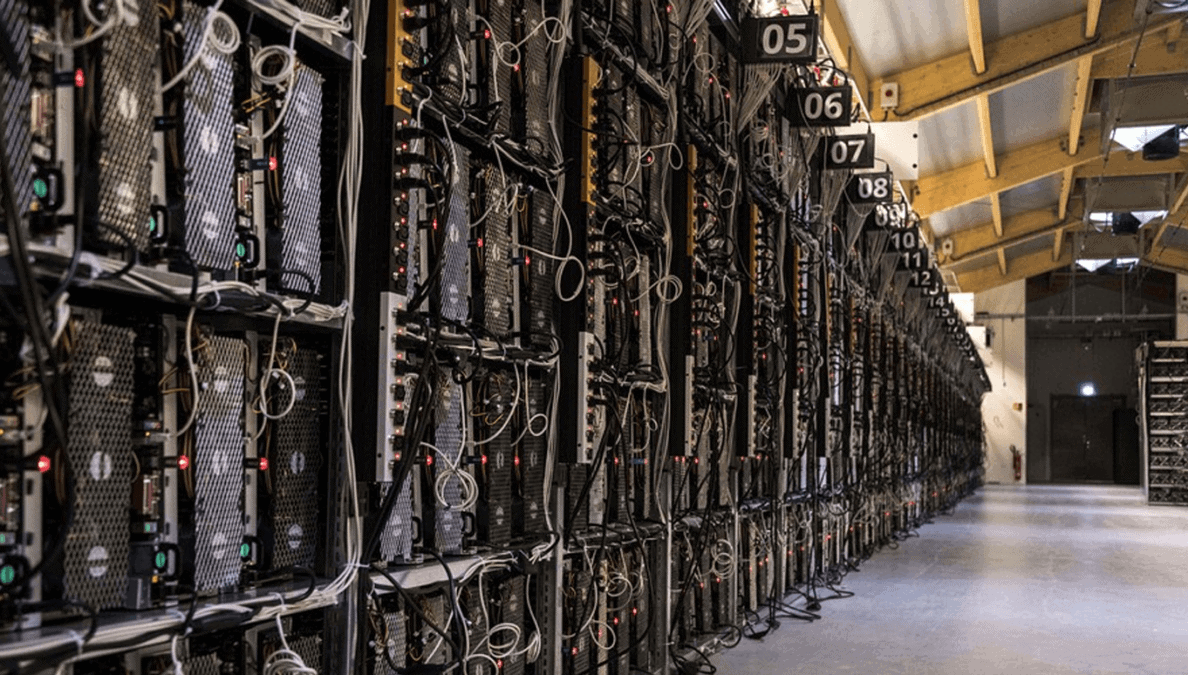

Mining Difficulty and Hashrate Show Disparities

Famous crypto analyst and YouTuber The Moon pointed out that there’s a widening gap between the difficulty of mining and the Bitcoin hashrate. According to an analysis video, this phenomenon could lead to a miners’ capitulation and end up in Bitcoin taking a nosedive.

https://www.youtube.com/watch?v=aB80RioPY14

Part of The Moon’s report drew on past occurrences, which showed that there had been a massive exodus of miners as a result of discrepancies in hashrate and mining difficulty. The reduction in block rewards also usually forces most small miners out of the network.

A similar trend occurred in 2016 – the last time Bitcoin’s block rewards halved. At the time, Bitcoin’s price plunged by about 21 percent, moving from $654 to $517. If the same trends hold, Bitcoin could drop to as low as $6,750 once more – from the $8,500 price that Bitcoin held when it halved last week. According to data from Bitinfocharts, the Bitcoin hashrate has fallen by about 38 percent since the halving. At the same time, historical data from BTC.com shows that the mining difficulty slumped by only 6 percent in the same period. While there’s hope for a return of miners in the next few days, the chances of this drop spurring a massive influx of miners are quite low.

Surging Costs Disincentivize Miners

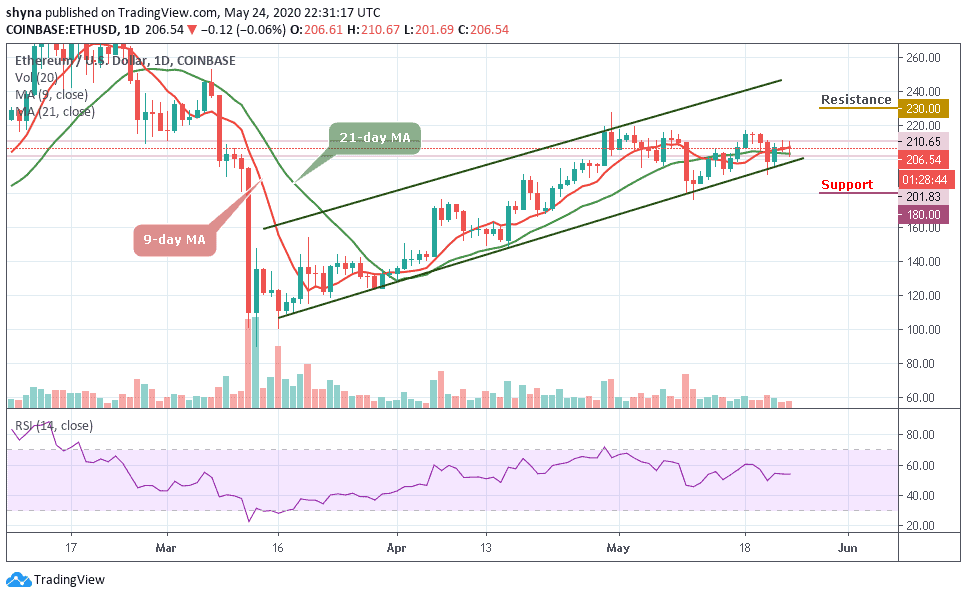

Whether or not this will hold remains to be seen. However, what appears to be evident is that Bitcoin is already slipping. The asset is trading at $8,761 per token at press time – down 4.39 percent on the day. The drop marked six consecutive lower highs since 2019. The lower highs show that buyers aren’t establishing a new bull cycle. Whenever an asset touches a lower peak, it signifies that the market is facing a significant amount of selling pressure, and the asset is having difficulties breaking out.

The miners are also feeling an immense amount of pressure. According to reports, the breakeven cost of mining Bitcoin has stayed steadily above the $12,000 mark since the halving occurred. So, miners have more of an incentive to sell more Bitcoin than they’re currently mining.

Bitcoin’s price is nowhere near the $12,000 breakeven cost, and smaller miners will need to sell more to keep operating costs under control. In a tweet, noted cryptocurrency investor Willy Woo explained that miners and exchanges are the two unmatched sellers in the current market.

Post this 2020 halvening miners will cease to be the biggest sellers of Bitcoin. It'll be the dawn of the crypto exchange as the leading seller.

The biggest sell pressure on Bitcoin will soon be from exchanges selling their BTC fees collected into fiat.

— Willy Woo (@woonomic) May 9, 2020

“There’s only two unmatched sell pressures on the market. (1) Miners who dilute the supply and sell onto the market, this is the hidden tax via monetary inflation. And (2) the exchanges who tax the traders and sell onto the market.”

Join Our Telegram channel to stay up to date on breaking news coverage