Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – January 3

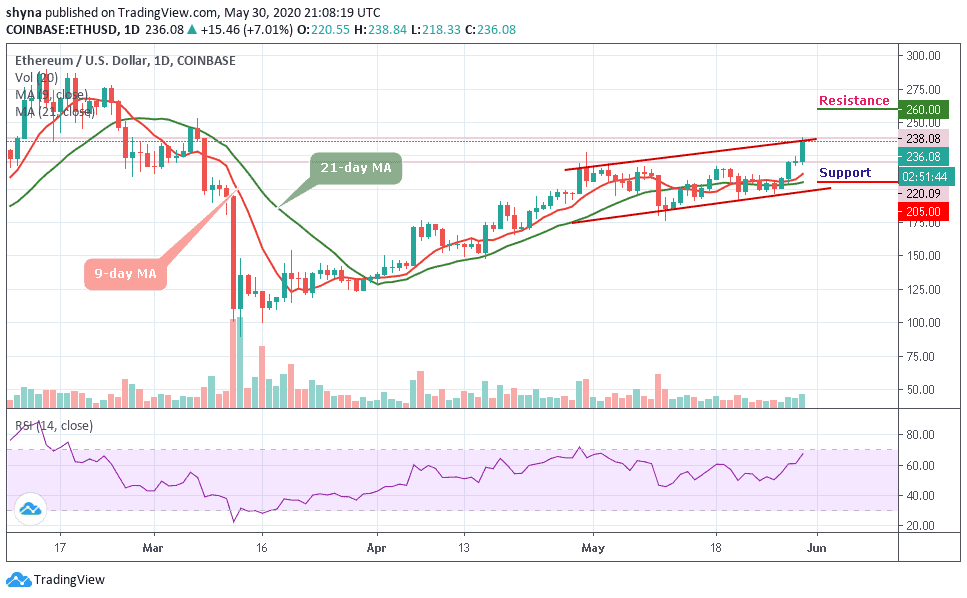

The daily chart reveals that the Ethereum (Find out more about how to buy Ethereum here) is recovering, moving in sync with the market. A sustainable move above $240 may improve the technical picture.

ETH/USD Market

Key Levels:

Resistance levels: $260, $265, $270

Support levels: $205, $200, $195

ETH/USD continues to rise further higher until it finds resistance at the expected level of $235. Looking at the daily chart, we can see that ETH/USD even spiked higher into the resistance level at $238.08 in the early hours of today. Therefore, if the buyers continue to push the market higher, the immediate resistance above the $240 level will be located. Above this, further resistance levels lie at $260, $265 and $270.

Alternatively, if the bears try to bring down the price below the 9-day and 21-day moving averages, the bears may expect immediate support to be located at $210 which is below the 9-day moving average. Below $210, further support is found at $205, $200, and $195. Meanwhile, the RSI (14) is moving above the 65-level, which indicates that more bullish signals may come to play.

Against BTC, Ethereum is still trading above the moving averages of 9-day and 21-day within the channel and the price is now hovering at 2503 SAT as the technical indicator RSI (14) moves into the overbought zone. For the fact that the bulls remain the dominant of the market, the pair seems to be moving towards the upper boundary of the channel.

At the upside, the resistance levels to be reached are 2700 SAT and 2800 SAT. Conversely, a lower sustainable move may likely cancel the bullish pattern and this could attract new sellers coming into the market with the next focus on 2200 SAT and 2000 SAT support levels.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage