Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – November 21

The Ethereum (ETH) markets have been down. However, high volatility should help restore the uptrend. Otherwise, ETH would remain its current downtrend.

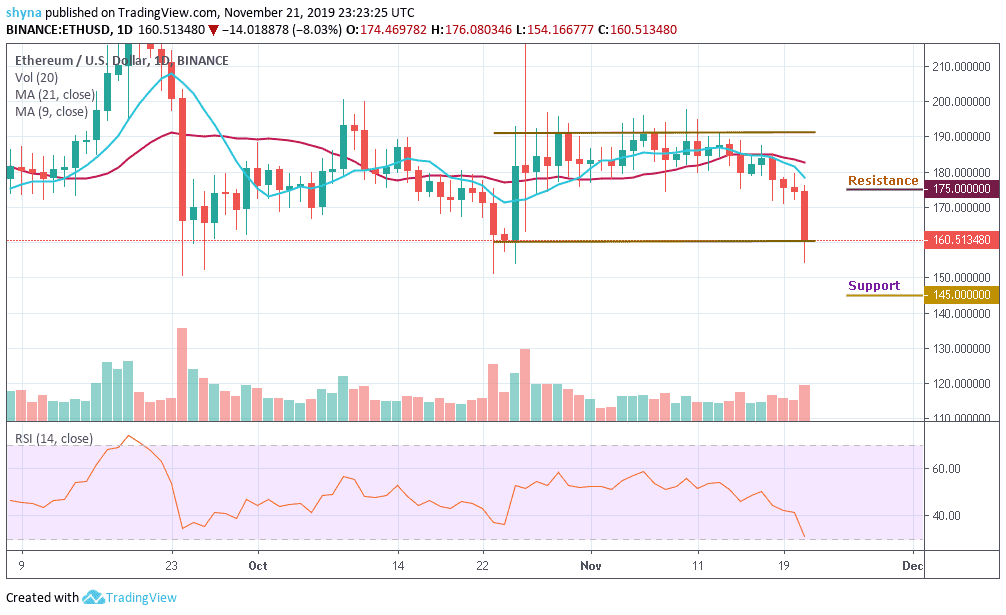

ETH/USD Market

Key Levels:

Resistance levels: $175, $185, $195

Support levels: $145, $135, $125

The ETH/USD price continues to break downwards and is recording fresh declines day after day, after having a rapid slip below $170. The trend after having hit $165 has been quite a downward race. The Bitcoin (BTC) which is the king of the cryptocurrencies also hit the fresh low below $8,000, despairing the crypto lovers and investors.

Ethereum (ETH) failed to find support at $165, as seen in the daily chart. The price brought declines to $160. With a loss of 8.03%, ETH/USD is changing hands at $160.51. The prevailing trend is strongly bearish. However, it is essential that the bulls push the price above $165 to avoid further declines.

In addition, the Ethereum bears managed to push the price well below the critical level of $165 below the 9-day and 21-day moving averages. To follow the RSI (14) signal line, a possible decline could meet support at $145, $135 and $125. On the other hand, a sustained recovery above $170 could push the coin up to $175, resistance levels of $185 and $195 are needed to ease the immediate downward pressure.

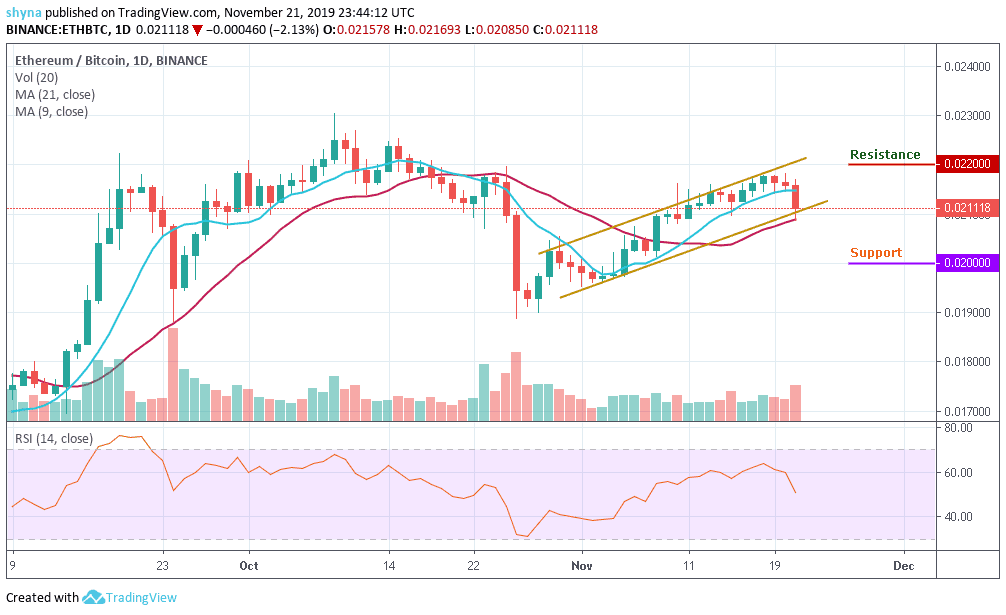

Looking at the chart, the Ethereum market has been following a downward rally against Bitcoin since the opening of the market a couple of days ago as the sellers continue to drive the market lower. Meanwhile, the bearish scenario was due to the falling of Bitcoin price over the past few days.

In addition, a careful review of the current RSI (14) indicates that Ethereum is moving below the 50-level and it is likely ready for more bearish movement. However, if the bear continues to dominate the market, it may find close support at the 0.020 BTC level and below. Meanwhile, it is possible that the buying pressure meets the resistance of 0.022 BTC if the market becomes bullish.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage