Join Our Telegram channel to stay up to date on breaking news coverage

Straight from Fidelity Investment creation of a new crypto subsidiary to yesterday’s altcoins revival, odds are ETH are likely to edge higher today. Though it is down six percent in the last week, the three percent gain in the last 24 hours at the back of high trading volumes could be the impetus bulls need to rally above $300.

Latest Ethereum News

There is a sweeping tide in traditional Wall Street corporations and Fidelity Investment is the latest to see opportunity in crypto and ancillary services. The fund management firm with more than $7.2 trillion of assets under management is forming a new subsidiary, the Fidelity Digital Asset Services. This branch will specifically cater for the needs of institutional level investors.

The Fidelity Digital Asset Services will be a platform where investors of all caliber would trade across different exchanges that meet Fidelity Investment standards thanks to their in-house internal crossing engine and smart order routing platform feature. Although the firm didn’t mention any partnering exchange, Fidelity approval procedures are stringent. The firm considers among other things the financial strength and regulatory compliance that syncs well with the firm’s third-party framework.

Besides trading, Fidelity entry in a space that many consider risky, is a stamp of approval. Initially, the risky tag was one of the many reasons why high liquid investors were shying away from cryptocurrency investment. Now, through an offline, cold storage custodial services, Fidelity Investment is acting like a missing link satisfying investor’s needs.

Already, the subsidiary’s head has said they are working with 13,000 institutional investors. This confirm comments from Fidelity Investment CEO Abigail Johnson that their aim is to make digital assets as Ethereum more accessible to investors.

Ethereum Price Analysis

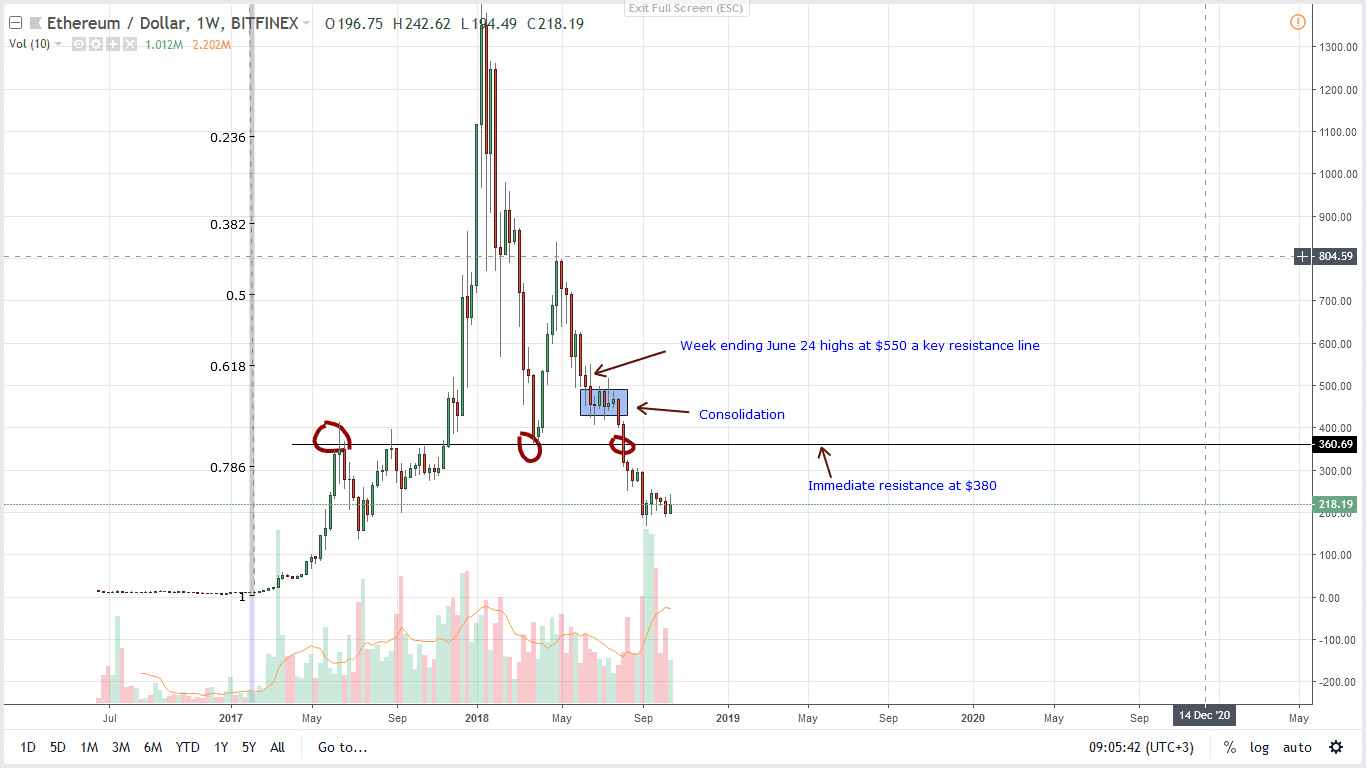

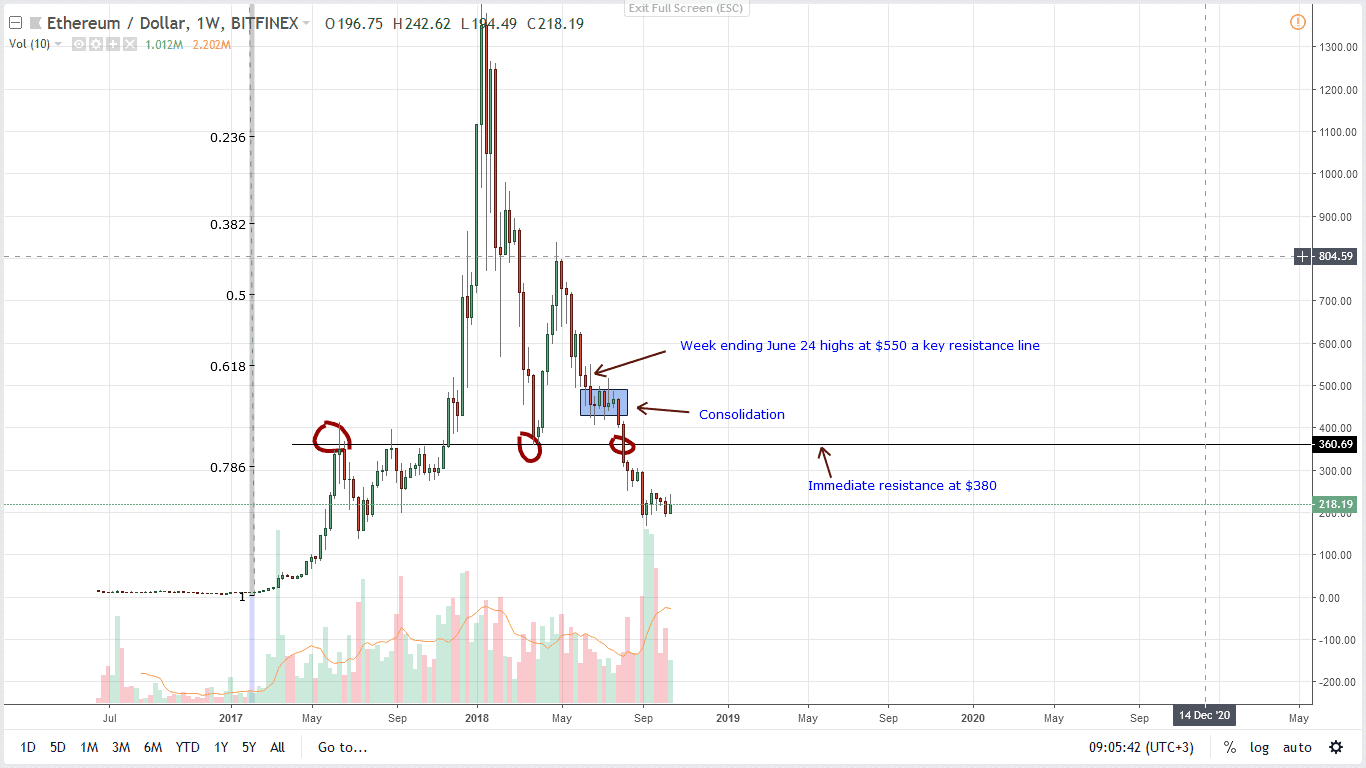

Weekly Chart

Overly, ETH is stable and has so far bulls have been successful in rejecting lower lows. Though there is this wave of excitement across the market, our previous Ethereum trade plan is valid since none of our trade conditions are live.

From the chart, it’s clear that week ending Sep 9 bar is still influential. It’s lows at $190 act as the first level of support. Because of our last recommendations, we shall only initiate trades upon break outs above $250 or $160.

Therefore, that means once bulls muster enough momentum to rally above $250 and $300 on the upper side reversing week ending Sep 9 losses then we shall suggest buys on dips with first targets at $400.

On the reverse side, losses below $160 or 2018 lows shall open doors for further losses towards $75.

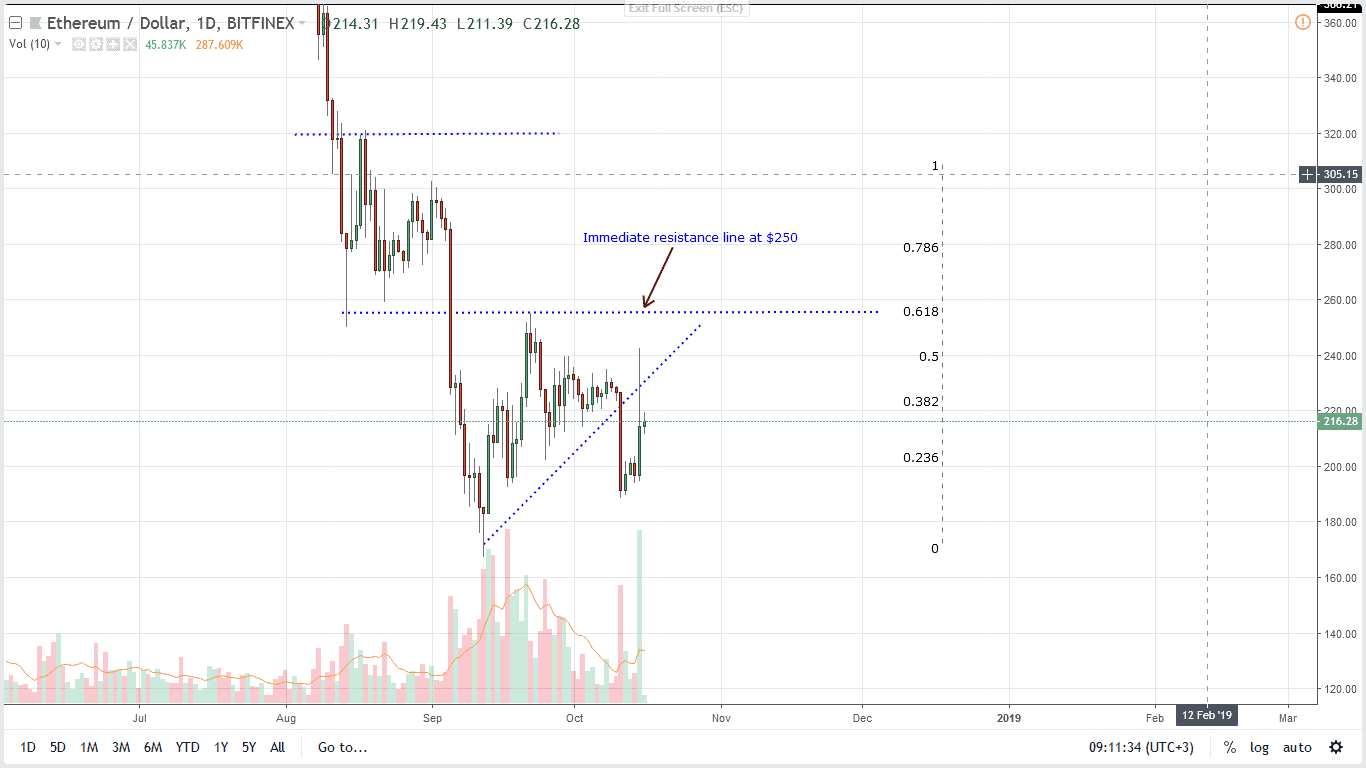

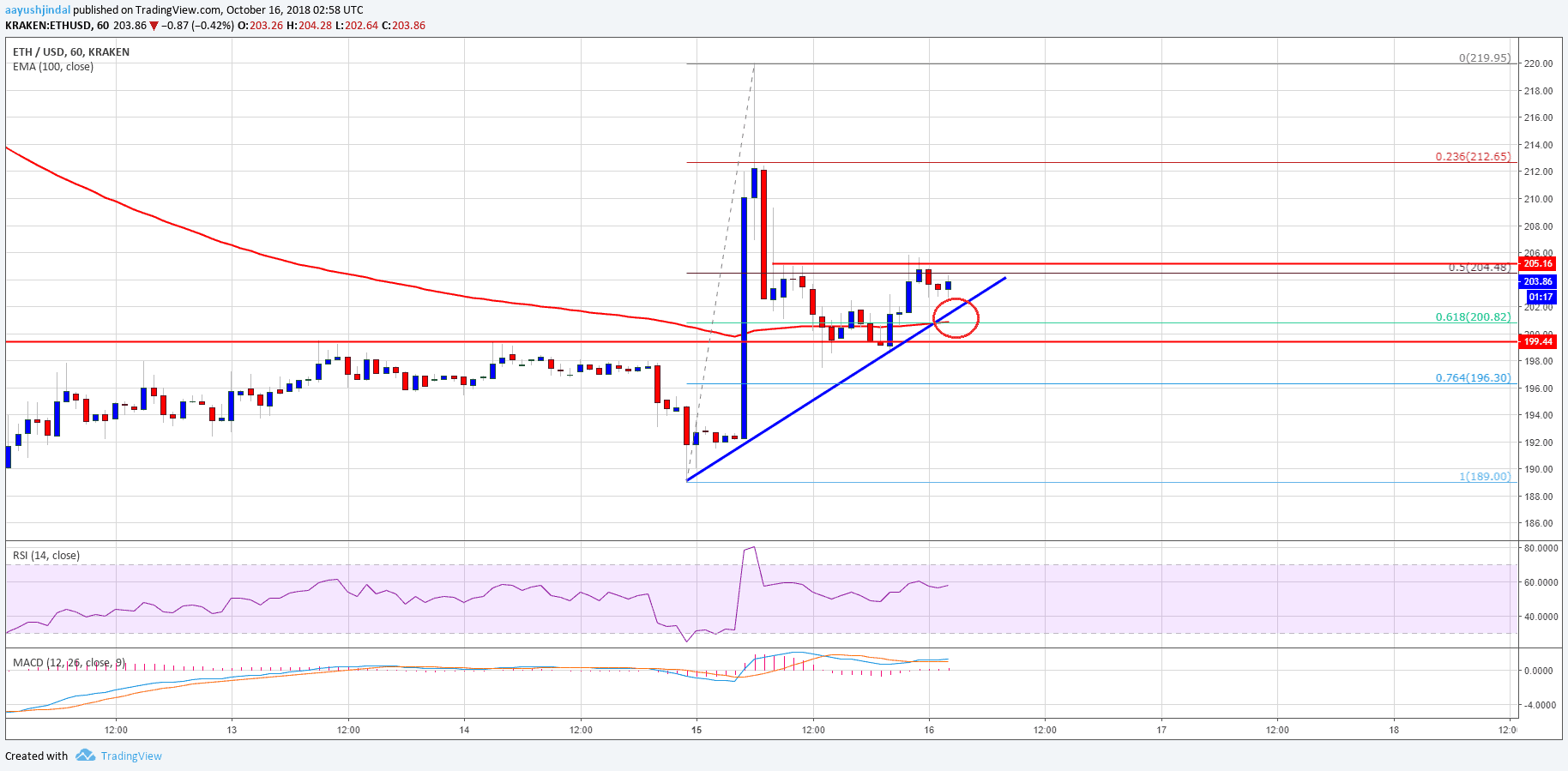

Daily Chart

In the daily chart, it’s clear that yesterday’s price rally happened at the back of high trading volumes. Even though prices are still trading within Oct 11 bears, it’s better to trade from a top down approach. In that case we recommend taking longs once there is a solid close above $250 as aforementioned.

Overly, the market is vibrant. But since our shorts are not valid, risk off traders can load at spot with first targets at $250.

Fitting stops should be at Oct 15 lows at $190.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

The post Ethereum Price Analysis: Entry of Fidelity a Game Changer, ETH up 2% appeared first on NewsBTC.

Join Our Telegram channel to stay up to date on breaking news coverage