Join Our Telegram channel to stay up to date on breaking news coverage

Although the Bitcoin community can sometimes generalize the entire banking industry as one technologically-inept entity, the reality is that each bank comes to their own conclusions on various fintech innovations. While some financial institutions are mainly interested in generalized blockchain technology, others are looking specifically at the Bitcoin blockchain due to its decentralized and permissionless nature.

[Read More: Barclays: We’re Experimenting with Both Permissioned and Permissionless Blockchains]

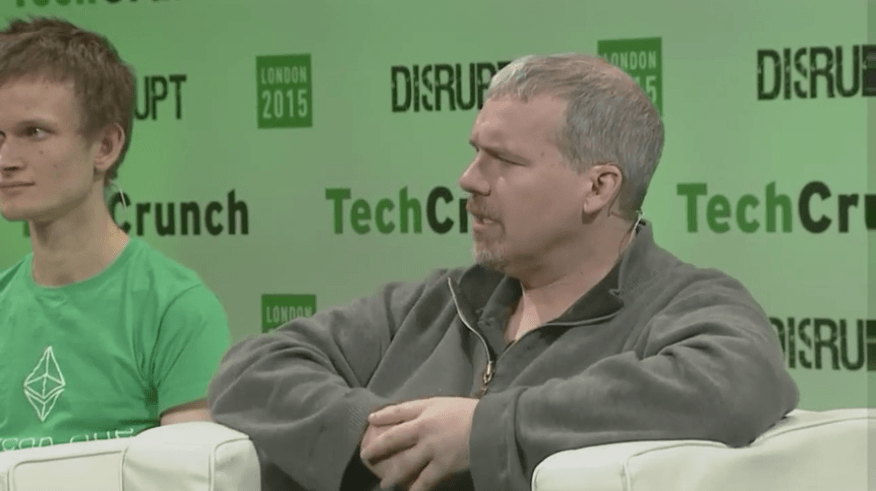

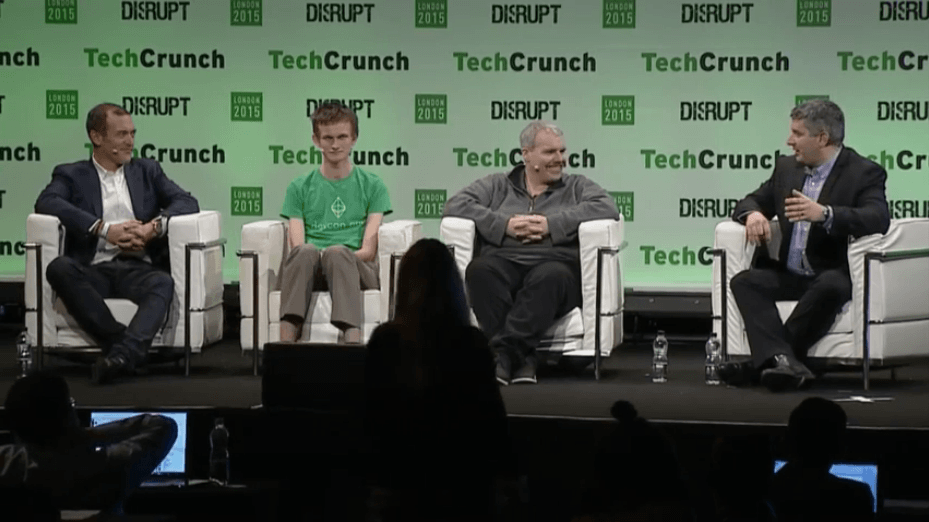

Blockstream Chief Instigator Austin Hill was recently featured on the blockchain panel at TechCrunch Disrupt London 2015, and he shared some thoughts on why it may make sense to bring some banking activities onto the Bitcoin blockchain.

Some Banks are Working on More Blockchain Projects Than Others

When speaking on the banking industry’s view on the Bitcoin blockchain, Austin Hill noted that not all banks are looking at this new technology with the same mindset. While some financial institutions are simply building prototypes to showcase internally, other banks are building more mature platforms that could be available to consumers in the near future. Hill explained:

“There are certain financial institutions that I think are just doing this at the innovation group where they want to learn and they build some prototypes then they go showcase it internally to different divisions in the bank, but there are some that are way more mature in their development cycle.”

There is a meme in the fintech space that most bank-funded blockchain projects are nothing more than two guys in an office browsing Bitcoin subreddits, but Hill explained that this isn’t necessarily the case 100 percent of the time. The Blockstream leader noted that some banks are putting serious manpower behind some sort of integration of blockchain technology:

“I know of a couple banks that have more than 150 people working on blockchain technologies that are much farther along in terms of business units defining real problems that they’re working on blockchains to solve.”

The Permissionless Bitcoin Blockchain Will Be the Preferred Option

At one point during the panel discussion, the topic of Goldman Sachs’s SETLcoin was brought into the conversation. This is the world’s largest investment bank’s attempt at building more efficient stock trade settlement on top of their own proprietary blockchain, but Austin Hill indicated that Bitcoin’s decentralized and permissionless platform will be a better option for this sort of use case in the long run:

“They’re not alone. There are a number of other players working on that. We see a bunch of interesting stuff coming out of fintech, but one of the powers of open-source platforms and open-source software is it does lower the barrier for permissionless innovation.”

[Read More: Why Last Week May Have Been Bitcoin’s Best Yet]

Bitcoin’s Open-Source Nature Makes It More Secure

One of the main reasons the Bitcoin blockchain may be preferred over private or closed models is that the platform has been operating in the wild for nearly seven years. The amount of money held on the Bitcoin blockchain combined with its open-source nature has made it a clear target for hackers, but the technology has been able to hold its own up to this point. Austin Hill explained:

“Frankly, one of the best things Bitcoin has done is it painted a 1 to 10 billion [dollar] security bounty on the protocol that’s been out there available to be stolen. Over the last six years, I don’t think there’s a system that’s gone under more peer review or stress testing than Bitcoin, and that gives people a lot of confidence to then build on that as a platform.”

Third Key Solutions CTO Andreas Antonopoulos recently made a presentation on the topic of private, permissioned blockchains where he compared them to a bubble boy. Private blockchains may have some niche use cases in the future, but it’s clear that Austin Hill is betting on the Bitcoin blockchain at Blockstream.

Featured image via TechCrunch.

Kyle Torpey is a freelance journalist who has been following Bitcoin since 2011. His work has been featured on VICE Motherboard, Business Insider, RT’s Keiser Report, and many other media outlets. You can follow @kyletorpey on Twitter.

Join Our Telegram channel to stay up to date on breaking news coverage