Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price tumbled almost 3% in the past 24 hours to trade for $67,637 as of 01:00 a.m. EST on trading volume that surged 98%.

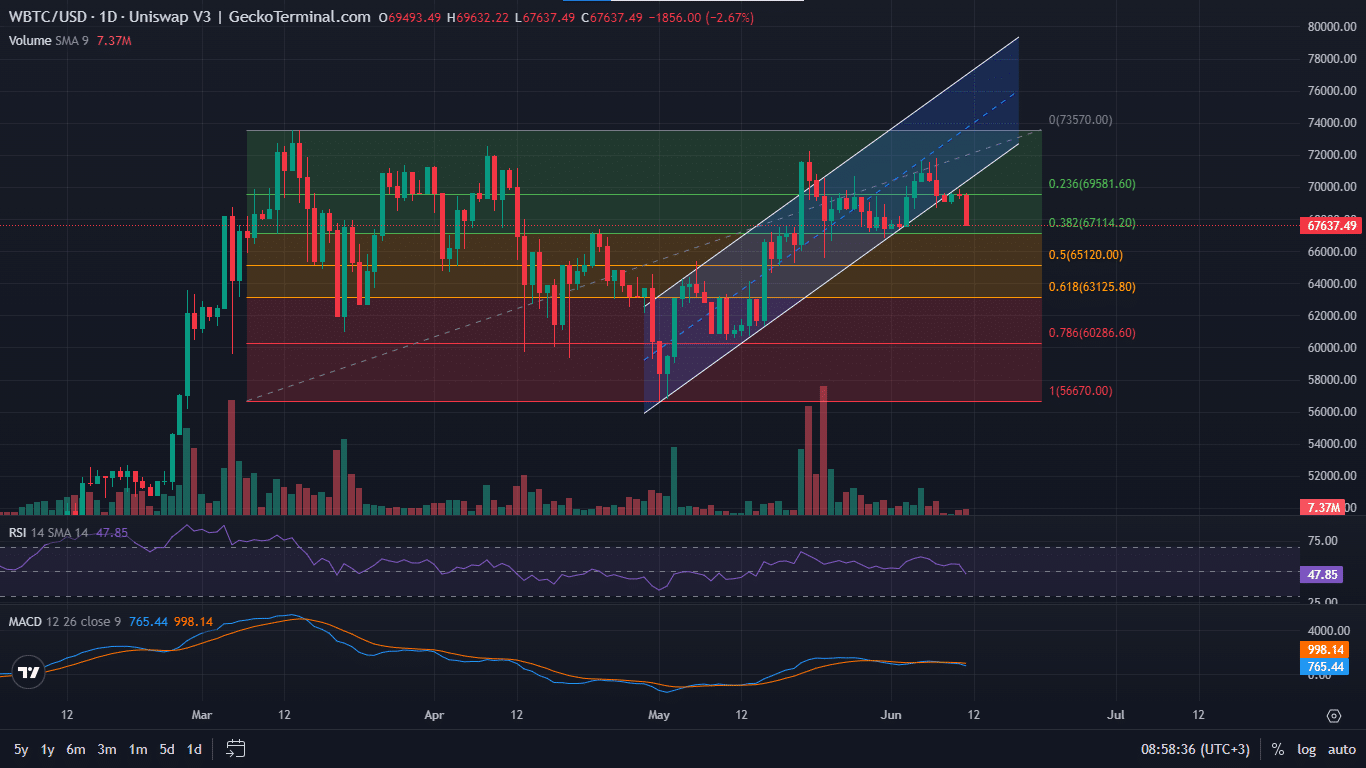

With this dump, the Bitcoin price has broken the three-day consolidation, with the strong leg down solidifying the break below the ascending parallel channel. Accordingly, BTC is edging toward a more bearish status, which could be worse if the 38.2% Fibonacci level of $67,114 breaks.

Meanwhile, renowned BTC veteran Samson Mow predicts an explosive rally for the Bitcoin price. He attributes this to “some entities shorting [BTC] massively on futures,” adding that they are likely going to get annihilated soon, as BTC explodes to the north.

This matches with my analysis too. With so many left bell curve traders popping up to confidently explain “the short interest increase is just a cash and carry trade,” it’s no wonder why we constantly see so many liquidations. Like the carry trade didn’t exist before this week.… https://t.co/lDIxALdLPI

— Samson Mow (@Excellion) June 9, 2024

“Bitcoin being kept at sub $0.07M is like compressing a coil. It’s going to be explosive to the upside soon,” Mow notes.

His assertions align with what Bitcoin investor Quinten said on May 9, that the Bitcoin price is suppressed despite crazy ETF stacking. Like Mow, Quinten attributed this to hedge funds shorting BTC at record highs.

Why is #Bitcoin price suppressed while ETFs are stacking like crazy?

Because hedge funds are shorting $BTC at record highs pic.twitter.com/3W19hyBWBv

— Quinten | 048.eth (@QuintenFrancois) June 9, 2024

When hedge funds take short positions on Bitcoin, they are betting that the price will decrease. This can create downward pressure on the price as these funds sell off their holdings or engage in derivative contracts to profit from a decline in the asset’s value.

Notably, such moves are often calculated by the same hedge funds or smart money to accumulate at lower prices in anticipation of a short squeeze.

How Bitcoin Price Could Explode On A Short Squeeze

A short squeeze in Bitcoin trading occurs when the price of Bitcoin sharply rises, forcing traders who had short positions (betting on the price going down) to cover their positions by buying Bitcoin.

This sudden surge in buying activity can amplify the price increase and create a self-reinforcing cycle. Here, more short sellers are forced to buy back their positions at higher prices, further driving up the price. It results in significant price spikes and volatility in the market.

Bitcoin Price Prediction

The Bitcoin price has broken below the 23.6% Fibonacci retracement level of $69,581. As it teases with a foray into the Fibonacci Golden Zone between the 38.2% and 61.8% Fibonacci retracement levels, investor should exercise caution.

There is a chance that the Bitcoin price could recover as the Relative Strength Index (RSI) is yet to confirm a continued move south with a lower low. With this, BTC could bounce atop the 38.2% Fibonacci retracement level, providing another buying opportunity at $67,114.

Supporting this thesis is the position of the Moving Average Convergence Divergence (MACD) in positive territory. In the case of a recovery, only a candlestick close above $72,000 would confirm the continuation of the uptrend. This could see the BTC price extend a neck higher to reclaim the $73,570 peak.

GeckoTerminal: BTC/USD 1-day chart

Conversely, if the RSI produces a lower high, the downtrend could extend for the Bitcoin price. A slip below the 50% Fibonacci placeholder of $65,120 would provoke panic selling. However, only a candlestick close below the 61.8% Fibonacci retracement level of $63,125 would negate the big-picture bullish outlook for BTC.

Meanwhile, investors are flocking to 99BTC, a learn-to-earn crypto that has surpassed $2.1 million in funds raised in its presale. YouTuber Today Trader says it has ”huge potential.”

Promising Alternative To Bitcoin

99BTC is the powering token for the 99Bitcoins ecosystem, a long-established educational platform that is pioneering a new Learn-to-Earn rewards model.

Boasting best-in-class educational resources and visual learning courses for crypto beginners, this project has earned a place among the most trusted names in crypto circles.

The project traces back to 2013. Starting out as BitcoinWithPayPal.com, what was once a simple domain has since transcended to a true Web2 fashion. Transitioning to Web3 with its $99BTC token, 99Bitcoins promises a groundbreaking earn-as-you-learn experience for users of the website.

Since 2014, $99BTC has been at the forefront of #Crypto education.💡

🧠 Experienced Guidance: Decades of combined knowledge.

⚡ Wide Range: Covers multiple #Cryptocurrencies.

📖 #LearnToEarn: Reap rewards while you learn!

Get started: https://t.co/NXD7DAamqr#Bitcoin $BTC pic.twitter.com/lJjLgkgVI2

— 99Bitcoins (@99BitcoinsHQ) May 5, 2024

99Bitcoins incentivizes learning through a unique mix of gamification and a leaderboard reward system. This ensures users feel like their learning is producing tangible benefits. Put simply, you earn crypto while learning about crypto.

You can also stake your 99BTC holdings for rewards as high as 788% annually. So far, upwards of 1.3 billion tokens have been staked.

Short on time? Simply stake your $99BTC tokens on our website and earn passive rewards effortlessly!

Join now! 👉 https://t.co/nA4Lw89WA0#99Bitcoins #Crypto #Presale #Alts pic.twitter.com/av0mkMvIbR

— 99Bitcoins (@99BitcoinsHQ) April 19, 2024

99BTC tokens are currently priced at $0.00108 each. But that will change in less than a week so don’t wait too long to secure the best deal.

Visit and buy 99Bitcoins here.

Also Read:

- 99Bitcoins Price Prediction – $99BTC Profit Potential in 2024

- 99Bitcoins Launches New Learn-to-Earn Airdrop Presale – TodayTrader Video Review

- Best Penny Crypto Investments: Top Picks for Explosive Growth in 2024!

Join Our Telegram channel to stay up to date on breaking news coverage