Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – March 29

Finally, the Bitcoin price is making a dramatic move and dropping to the much-anticipated point.

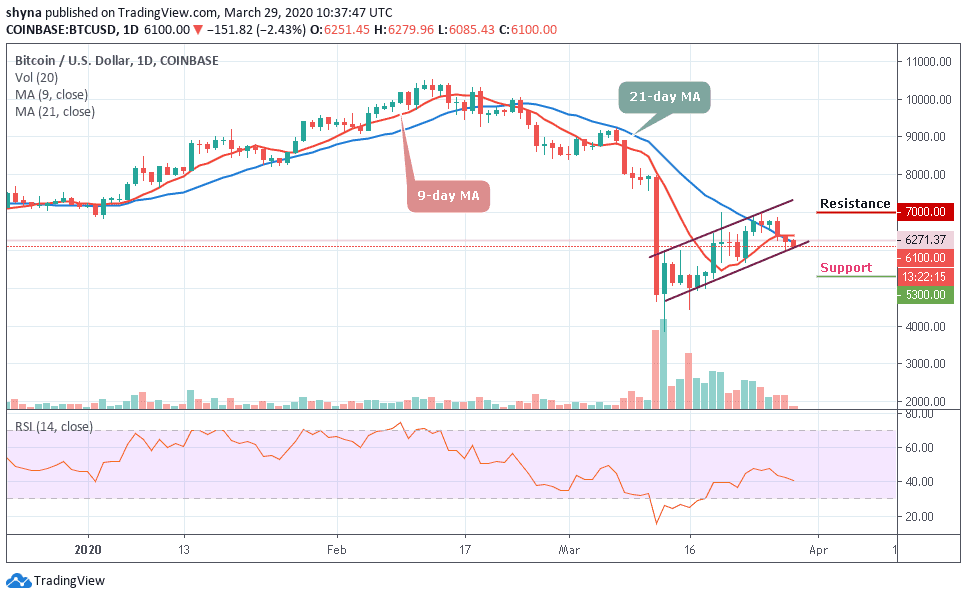

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $7,000, $7,200, $7,400

Support Levels: $5,300, $5,100, $4,900

At the moment, BTC/USD is relatively stable and would remain to be stable if it continues to stay above the level of $6,000. Meanwhile, going below this level could create panic and may promote panic selling, which could ultimately bring the price of Bitcoin to a $5,000 support level. However, a bullish trend could also prevail, in case BTC/USD bounces higher and climbs back to the range above $6,500.

Moreover, the Bitcoin price has shed about 2.43 percent, falling from the highs of $6,271, testing the $6,100 support. This recent drop indicates that the Bitcoin price is on the lookout for more support below the key levels. More so, this development could attract more buyers, but it will put BTC at risk of sinking. In the case of bulls losing control, the retest of $5,000 long-term support could be witnessed after the drop from $6,000 range.

Presently, BTC/USD is currently trading below the 9-day and 21-day moving averages. Meanwhile, a breakout out from this pattern may likely continue in the direction of the previous trend. In this case, any movement above the moving averages may push the price above $6,500 resistance before moving to the potential resistance levels at $7,000, $7,200 and $7,400.

However, should Bitcoin price failed to move above the moving averages; it could drop to $5,500 vital support. A further low drive may send the price to $5,300, $5,100 and $4,900 support. The RSI (14) has recently revealed a sign of trend reversal, which shows a possible more bearish momentum in the market.

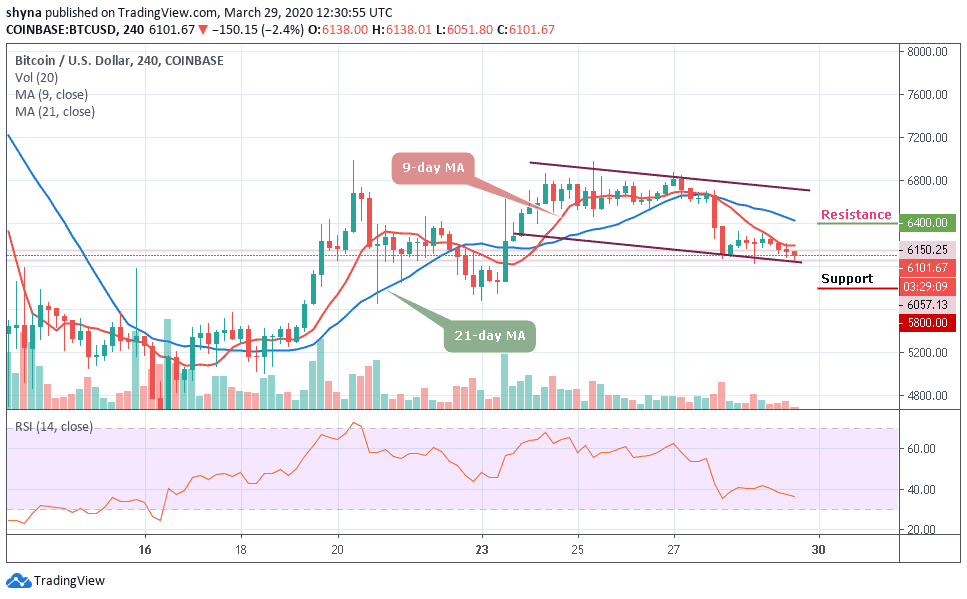

BTC/USD Medium-Term Trend: Bearish (4H Chart)

According to the 4-hour chart, the bears have dominated the market and the price has dropped far from the 9-day and 21-day moving averages heading towards the south. However, if the price breaks below the trend line of the descending channel and continues to fall, the support levels of $5,800 and below may come into play.

Meanwhile, the technical indicator RSI (14) is moving below 37-level, if the buyers could energize and after gathering enough momentum to fuel the market, they may push the price above the moving average where it could hit the targeted resistance levels of $6,400 and above.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage