Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – May 23, 2020

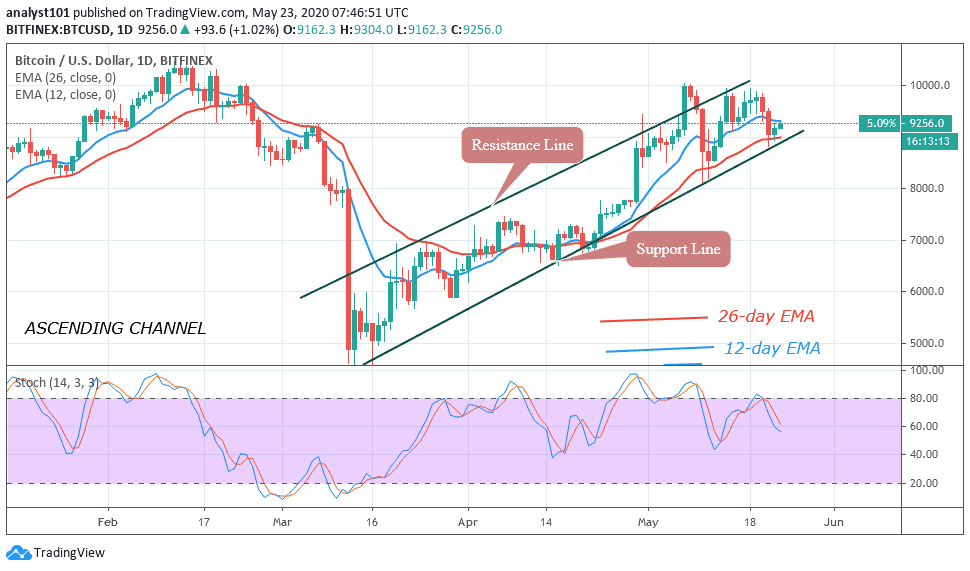

Since on May 7, buyers have made a consistent struggle to break the resistance at $10,000. The bulls have made several attempts to break the resistance but to no avail. These repeated failures have caused a bearish reaction to Bitcoin. BTC/USD pair slumped to a low of $8,800 on May 21.

Key Levels:

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

Bitcoin has been trading in the upside range between $9,000 and $10,000 since May 14. During this period the bulls made concerted efforts to breach the $10,000 resistance level. The several attempts proved abortive. Each attempt is accompanied by an equivalent selling pressure. On May 20, the selling pressure extended to the following day as price reached a low of $8,815. Nonetheless, the support at $8,800 was held as bulls made correction upward. The selling pressure would have continued if the $8,800 support failed to hold.

As the bulls recovered, the upside range is likely to continue. Bitcoin has entered the upside range between $9,000 and $10,000. A possible retest of the overhead resistance is likely. On the downside, if the selling pressure has continued below $8,800, the market will drop to $8,200. Subsequently, BTC can fall to the $8,000 low. A break below $8,000 will signal the resumption of the downtrend. Nevertheless, BTC is below the 60 % range of the daily stochastic. This indicates a bearish momentum. However, this is contrary to price action which is indicating a bullish signal.

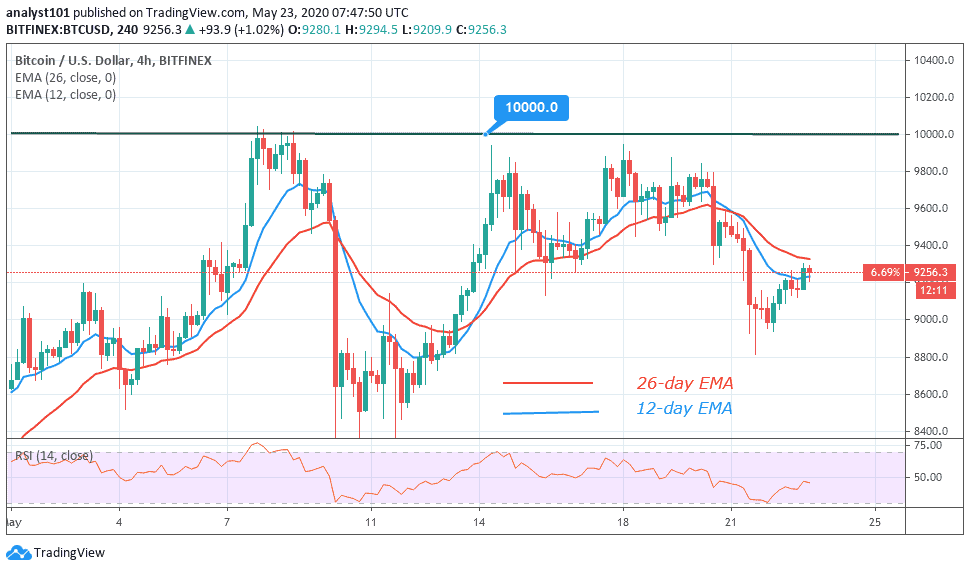

BTC/USD Medium-term Trend: Bullish (4-Hour Chart)

On the 4 hour chart, Bitcoin has been trading below $9,800 resistance. After May 7, the testing of the $10,000 resistance has been resisted below $9,800. Yesterday, as the market fell to $8,800 low, the bulls pulled back above $9,200 high. At the moment, Bitcoin is facing resistance at $9,300. However, if the upside price range fails to hold, the selling pressure is likely to resume. Meanwhile, BTC has fallen to level 44 of the Relative Strength Index period 14. It indicates that it is in the downtrend zone and below the centerline 50.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage